Why Invest in Dallas-Fort Worth?

Dallas-Fort Worth (DFW) is the fifth-largest metro area in the U.S. and consistently ranks among the country’s top metros for job growth. Many experts deem DFW as the sixth-best market for overall real estate prospects and the second-best city in the Texas real estate market. Before COVID-19, the U.S. economy was experiencing the longest expansion on record, and DFW was at the top of the list. Overall, the DFW economy has faced short-term disruption from the pandemic and is expected to continue its growth trajectory.

Top Reasons to Invest

DFW stands out as a frontrunner in economic and population expansion, ranking number one in the country for job recovery post-pandemic, according to the Dallas Regional Chamber. In addition, according to the U.S. Census Bureau’s report, the DFW-Arlington metro area experienced the highest net employment growth among all U.S. metros from November 2022 to November 2023. The Dallas Morning News also recognized 201 companies and organizations through the DFW market as Top Workplaces for 2023.

Over eight million individuals call the market home, with 453 newcomers recorded between 2020-2023. Because of the market’s affordable business environment and skilled workforce, businesses have either moved or expanded operations. The financial services sector, in particular, has had a significant influence, as evidenced by Goldman Sachs and Wells Fargo’s plans to build regional campuses employing a total of 9,000 workers. Furthermore, in 2019, Charles Schwab announced the acquisition of TD Ameritrade for $26 billion, relocating its headquarters from San Francisco to Tarrant County.

Over the past year, the metro area saw an increase of approximately 134,000 jobs, expanding the local workforce by 3.2%, surpassing the national average of 2.0%. This notable growth comes as employment growth rates are moderating compared to the rapid rebound observed in the years following the pandemic.

DFW is not just growing; it’s booming. With more people, businesses, and jobs, the metroplex is experiencing significant development. New projects are springing up throughout the area, from downtown to uptown, the Art District, and North Dallas. This rapid growth and development are clear indicators of the market’s resilience and potential for future growth, making it an attractive investment opportunity.

State of the Dallas CRE Market: Capital Markets and Investment Update

DFW has led the nation in commercial property transactions over the last three years, with approximately $90 billion changing hands. The region’s rapid population growth is generating opportunities in the healthcare sector, where existing structures are being repurposed for higher and better use. These conversions honor the original structures while also promoting sustainable urban development.

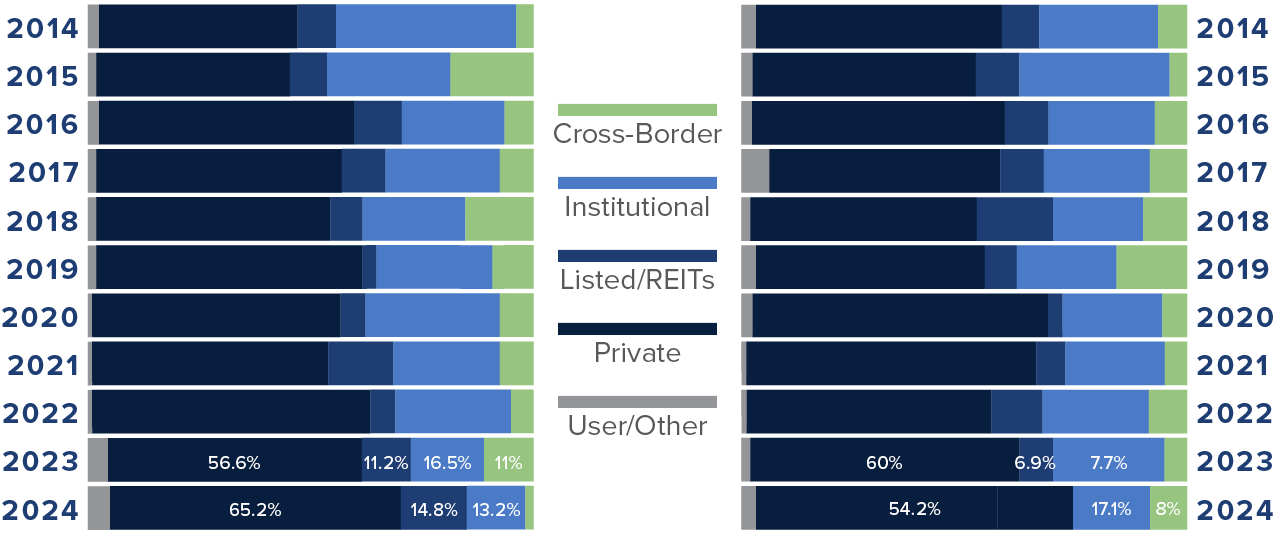

Higher interest rates have altered the market’s buyer profile, with private investors gaining more favor. Institutional investors and Real Estate Investment Trusts (REITs), which rely more on debt, have reduced their acquisitions.

Buyer vs Seller Capital Composition

Source: RCA

Source: RCA

Multifamily Market Update | How are Developers and Investors Keeping Up with the Demand?

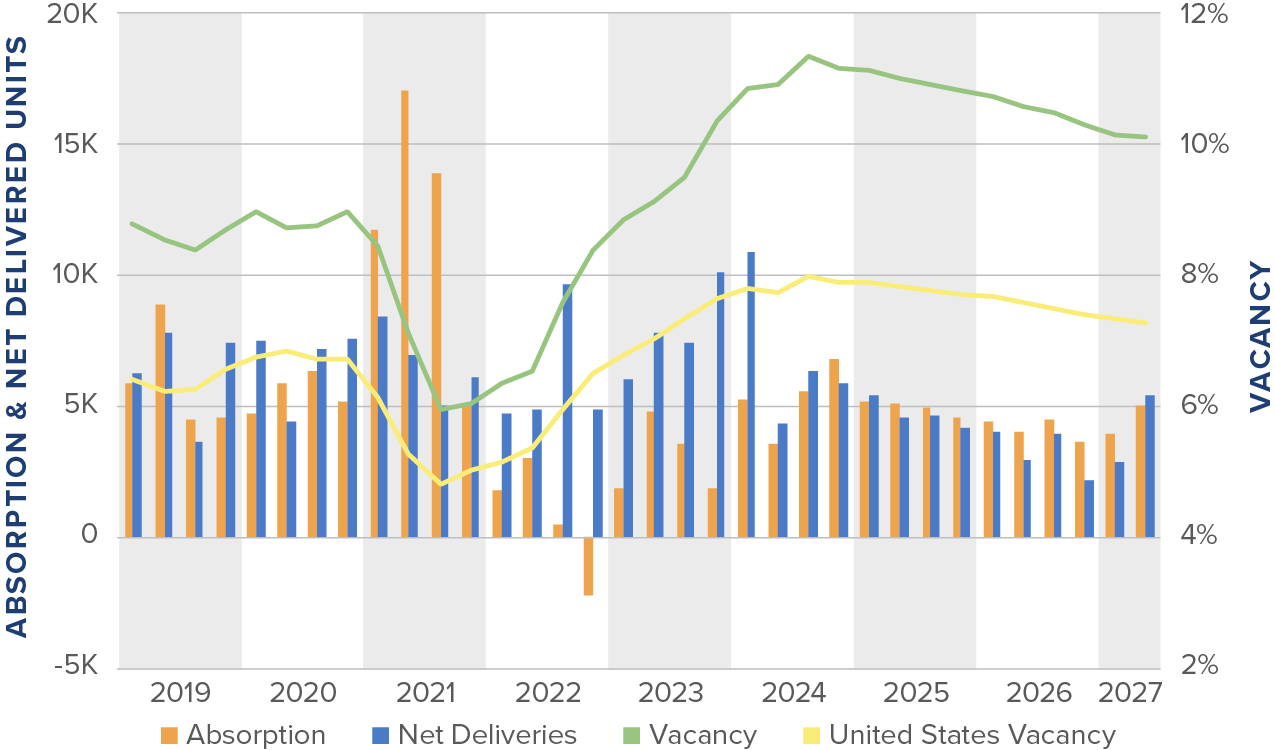

The demand for multifamily has increased significantly, with approximately 14,000 units absorbed in the past year. However, the supply exceeds this demand, as over 32,000 units were delivered within the same timeframe. This imbalance has led to an average vacancy rate of 10.4% as of Q2 2024.

In Q2 2024, rent growth declined dropping from 4.4% at year end 2023 to -1.5%. This is down from 2.5% from the same time last year. The rent decline is attributed to the pressure from increased supply, particularly in suburban areas undergoing heavy construction activities, including Frisco/Prosper, Denton, and Allen/McKinney.

The sales volume stands at $6 billion, a decrease from the peak of $28 billion recorded in 2021, and the average price per unit stands at $191,000. Higher interest rates have increased the expense of borrowing, making it more challenging for those interested in higher levels of debt. Consequently, the value of assets is decreasing, and cap rates are rising. In Texas, where sales prices are not publicly disclosed, some brokers suggest that cap rates for Class A properties hover around 4.5%, while Class B assets tend to have rates closer to 5.5%.

Absorption, Net Deliveries & Vacancy

Source: CoStar Group

Source: CoStar Group

Retail Market Update | Rise of Mixed-Use

DFW retail leasing is in high demand, driven by tenants from across the country eager to establish a presence throughout the metro.

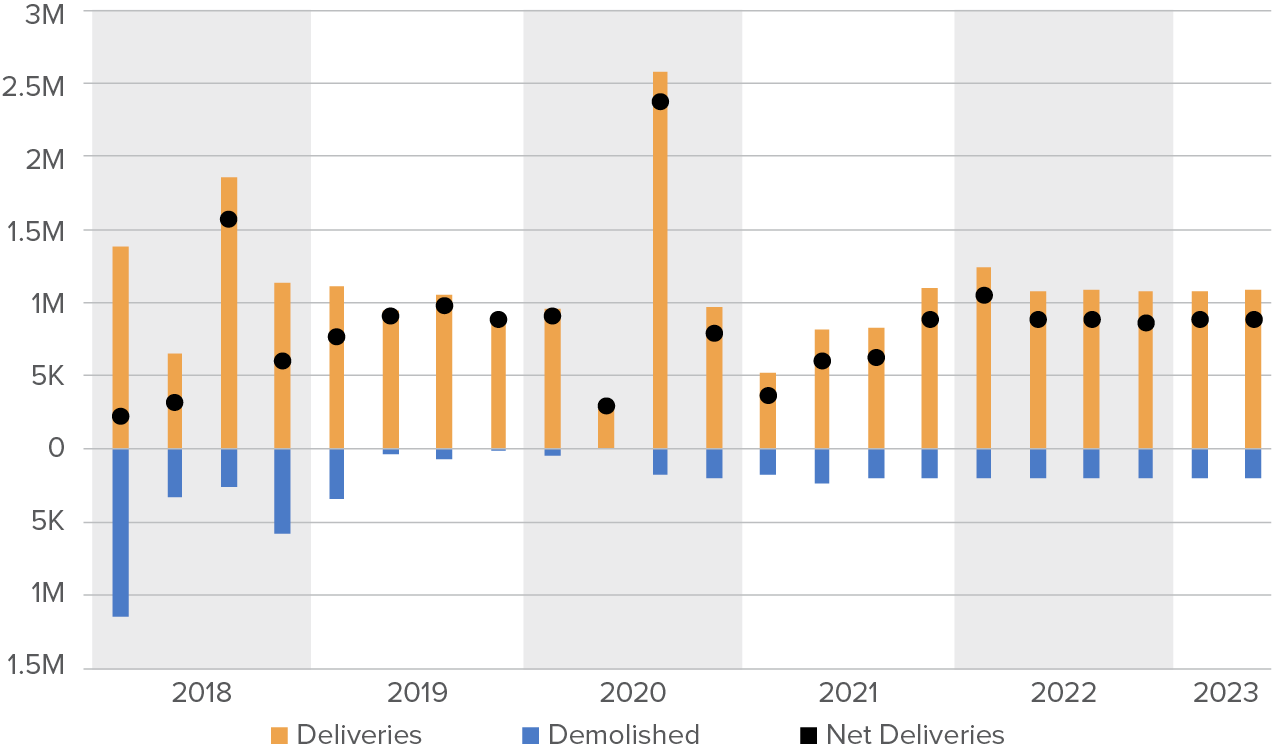

The retail market in DFW remains strong due to steady demand and minimal store closures. In the last 12 months, 3.5 million square feet of space have been delivered, while 3.1 million square feet have been absorbed. Demand is primarily fueled by major retailers, national and local grocery chains, discount stores, and food and beverage establishments.

The majority of recent retail developments with larger footprints have been incorporated into more significant mixed-use initiatives, which helps reduce the potential for excess supply. For instance, projects like CityLine in Richardson, Legacy West in Plano, Water Street, the Music Factory in Las Colinas, and major mixed-use projects in Frisco all feature significant retail elements.

Increased competition for space and robust retail performance has contributed to the growth in rental rates. Rental rates have increased by 5% over the last year, surpassing the national performance in the United States.

Sales activity continues to be subdued, with an estimated $3.5 billion in sales in 2023, a decrease from the peak of $7.1 billion reported in mid-2021. The majority of transactions involve single-tenant net leased assets or centers anchored by grocery stores, discount retailers, or fitness centers.

Deliveries & Demolitions

Source: CoStar Group

Source: CoStar Group

Industrial Market Update | Exploring the Influx of Logistics, E-Commerce, and Manufacturing Firms to the DFW Market

The industrial sector remains robust, benefiting from the area’s central location and excellent logistics infrastructure.

Larger DFW logistics facilities have been driving up leasing activity in the market, with buildings measuring 500,000 square feet or more representing 29% of the lease volume in 2023.

Year-over-year, market rent growth has reached 9%, showing a decline from the peak of 12.6% in mid-2022. Future rent growth is expected to slow as more space becomes available in the market over the next year.

High-tech manufacturing is shifting northward along I-45, evidenced by GlobiTech’s commencement of construction on a $5 billion plant in Sherman, according to CoStar Group. Once fully operational, the facility will create 1,500 jobs.

North Fort Worth, particularly the Alliance area, contributed 18% of deliveries in 2023. The region benefits from excellent multimodal connectivity and is a major port of entry, including Alliance Airport and the BNSF Alliance Intermodal Facility. Leading e-commerce companies like Amazon, third-party logistics providers (3PLs), traditional retailers, and manufacturing firms have capitalized on Alliance’s efficient supply chain. While speculative development has been a critical driver, buildings in this industrial hub are leasing up faster, with an availability rate of 11%.

As of Q2 2024, the DFW industrial market has reported an estimated sales volume of $7.8 billion over the past year. Regarding inventory turnover, approximately 0.9% of Dallas-Fort Worth’s inventory was sold in 2023, a decrease from the peak of 3.3% recorded at the end of 2022.

Availability Rate

Source: CoStar Group

Source: CoStar Group

Capitalizing on Dallas’ Growing Demand for Healthcare Services

According to Bisnow, rapid population growth and evolving demographics have increased demand for healthcare services across the Lone Star state, particularly in DFW. Hospital systems are expanding current campuses, constructing new properties, and intensifying efforts to recruit staff.

In conjunction with a rising DFW population, the percentage of individuals aged 60 years or older is expanding state-wide. As stated by the U.S. Census Bureau, it is projected that over 20% of the state’s population will fall into the 60+ age group by 2039, marking a 25% rise since 2012.

DFW Healthcare By The Numbers | Last 12 Months | Source: CoStar Group

- Cap Rate: 6.8%

- Sale Price/SF: $399

- Average Sale Price: $21.4M

- Sales Volume: $171M

- Sale vs Asking Price: -2.9%

- Average SF: 74.9K

These metrics on the DFW area provide a snapshot of the market’s performance. At 6.8%, the DFW market is in the ideal risk-reward zone. The 2023 sales volume was the highest in the last three years, with a high of $153,090,000 in Q3 2023. Performance metrics indicate that 2024 will continue this growth period.

Takeaways

Markets like DFW will only continue to attract talent and companies, so the capital pursuing deals in this city will follow. In the face of an unsteady market impacting society, the economy, and, by extension, CRE, Matthews™ is here as your resource. Please contact a Matthews™ specialized agent for more information on the DFW market.