Multifamily Rent Decline

According to the most recent Yardi Matrix National Multifamily Report, the expected slowdown in the U.S. multifamily market began following a year of unprecedented performance in November 2022. The average asking rent decreased in November to $1,719, and year-over-year growth fell to seven percent, the lowest level in 17 months. Rent growth is anticipated to continue declining throughout 2023, and several data sources report that rents are falling weekly.

2023 Market Outlook

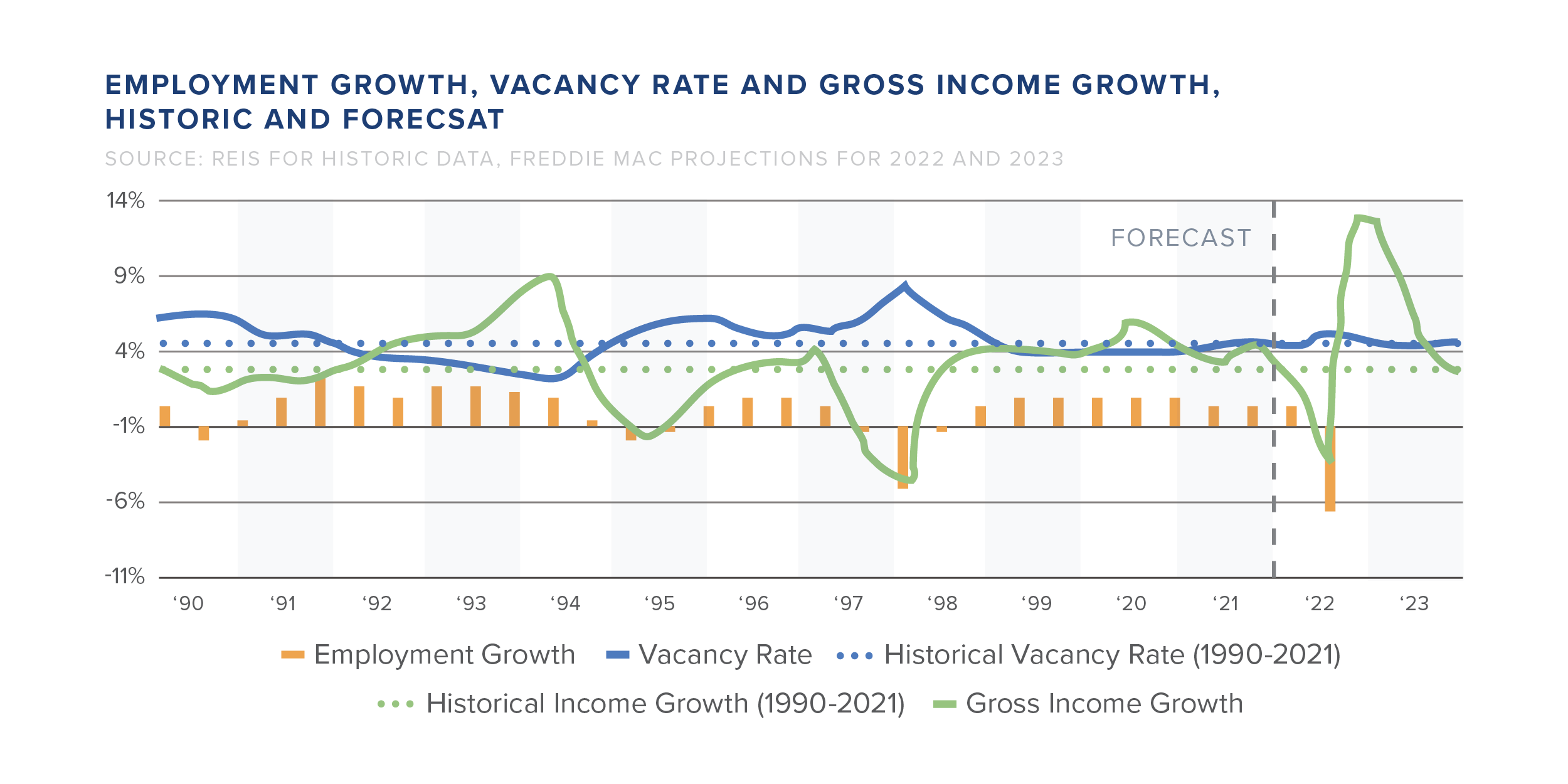

This year’s multifamily market is already being impacted by slower rent growth. According to Multifamily Research Center, market fundamentals will slow down at the start of 2023 before picking up steam in the year’s second half. These fundamentals include a 3.5 percent gain in gross income and a slight increase in vacancy rate, reaching 5.1 percent. Multifamily is in a period of price discovery, heavily contributed by the swift rise in interest rates. The difficult lending environment has forced sellers and buyers to adjust sale price expectations. The longer interest rates rise, cap rates will follow suit, negatively impacting the real estate’s value. Nonetheless, multifamily is still positioned as an investor’s favorite asset class, thanks to favorable demographics and a strong job market that encourages household formation. In addition, the need for housing is ever present, making it a secure choice for investors in an economic downturn.

In 2023, the predicted best-performing markets are predominately smaller southwestern markets, primarily in Florida. On the other hand, a geographically broad mix of small and major areas anticipate significant levels of new supply and will likely make up for the bottom-performing markets.

Despite the economic headwinds and decreased rent growth, data indicates that the multifamily market will see healthy growth by the end of 2023.

Inflation and Falling Rents

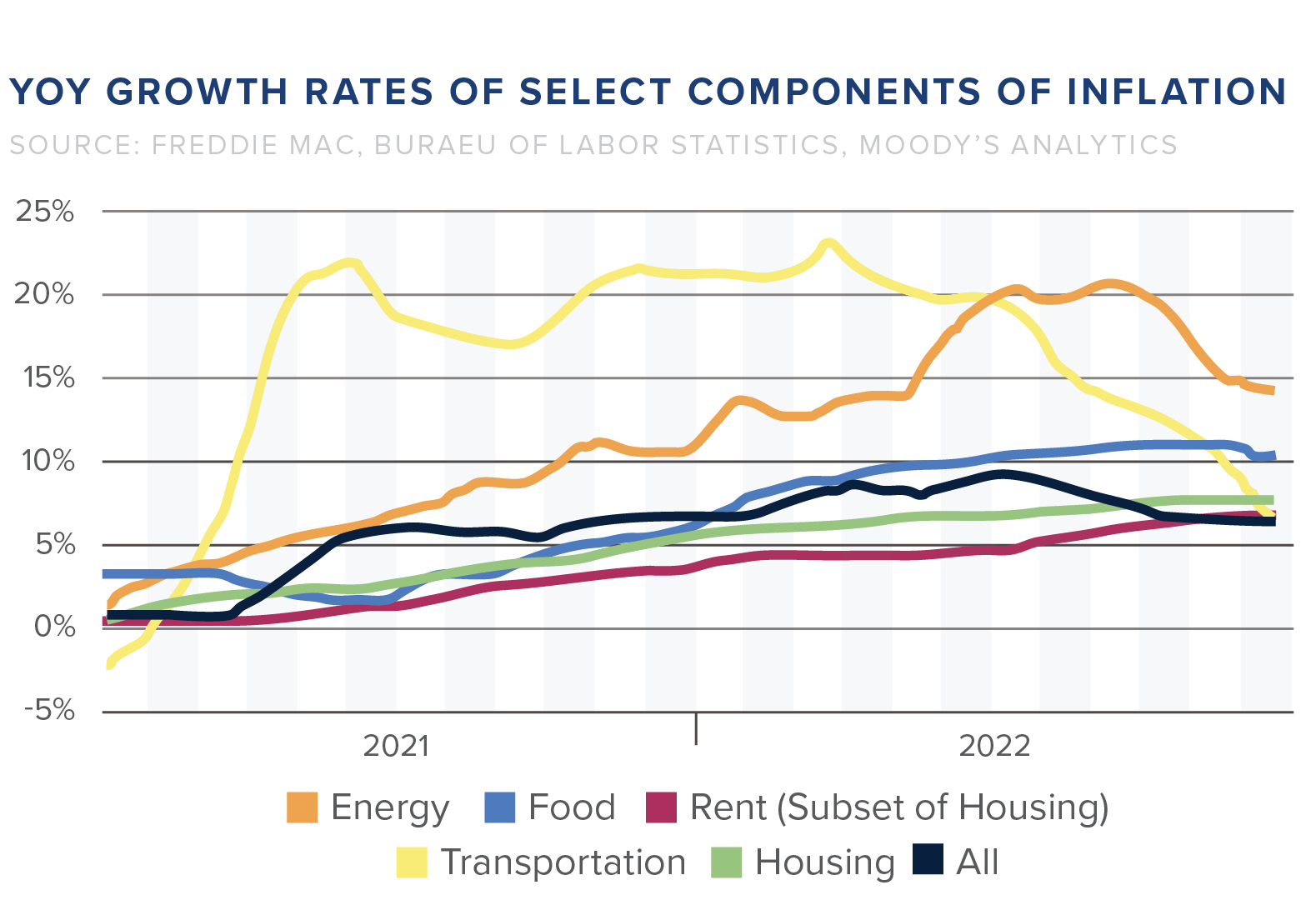

Year-over-year inflation rates are slowly trickling back down after their historical peak in 2022. However, inflation remains at its highest since the 1980s, and demand for several goods continues to outpace supply.

The graph displays that the overall inflation rate is dropping, which is caused by flattening food inflation rates and sharp drops in energy and transportation growth rates. According to Multifamily Research Center, the growth rate of housing units has flattened to just below eight percent year-over-year as of October 2022, while the rent growth rate is still increasing and is currently at 7.2 percent year-over-year compared to 4.4 percent in January of 2022. Since rent growth, as measured by the CPI, typically takes six to twelve months to reflect in the index fully, experts anticipate this trend continuing well into 2023.

What We Can Expect This Year

Multifamily fundamentals are expected to decelerate during the first quarter of 2023. However, demand for multifamily is expected to return in later quarters as long as the labor market doesn’t fall into recessionary territory. According to Moody’s Analytics, the baseline forecasts show an increase in vacancy rates, up to 5.1 percent, by the end of 2023. Multifamily forecasted demand growth in 2023 may be pivotal in supporting rent growth and vacancy rates.

Market experts are hoping that the rental market adjustment in 2023 will be orderly; renters will receive lower rent rates, investors will suffer some losses, the market will rebalance, and things will resume as usual in 2024.