CLICK HERE TO DOWNLOAD THE ARTICLE

Commonly associated in the same group are two retail industries, auto parts and auto services, that share fundamental similarities but vary in offerings. Auto part and auto service retailers greatly benefit from the fact that the average length of car ownership has increased over the last ten years, and car owners are spending more to prolong their vehicle’s lifetime as opposed to buying a new one. According to IHS Markit, an information provider, although U.S. auto sales declined nearly 27 percent year-over-year from 2019 to 2020, auto part and service retailers both remained open during the peak of the pandemic.

Fundamental Similarities

- Recession, E-Commerce, & Pandemic-Resilient: Customers will continue to favor personal and customized service appointments during an economic downturn over purchasing a new vehicle entirely to save money. While e-commerce continues to boom, customers still need to come in-store to drop-off their vehicle or pick up parts.

- Strong Credit Leases: Both auto retailers come with strong guarantees, especially for auto service businesses.

- Leases: Both retailers oftentimes sign 15-year fee simple leases and 20-year ground leases, with the occasional exception of new auto parts retailers signing fee simple leases with an initial 20-year lease term.

Fundamental Differences

- Location

- Auto Part: It’s more common to find auto part retailers in tertiary markets, just outside main retail corridors, where the rents are more affordable.

- Auto Service: Auto service retailers rely on nearby shops for foot traffic and customers but are typically found behind big-box retailers with no storefront.

- Increases in Initial Term of Lease

- Auto Part: A majority of auto part leases start flat for most of the initial term or no increase in the first ten years.

- Auto Service: A typical auto service lease term increases every five years, anywhere between five to 6.5 percent to ten percent. It’s also common to see two percent annual increases.

- Demographics

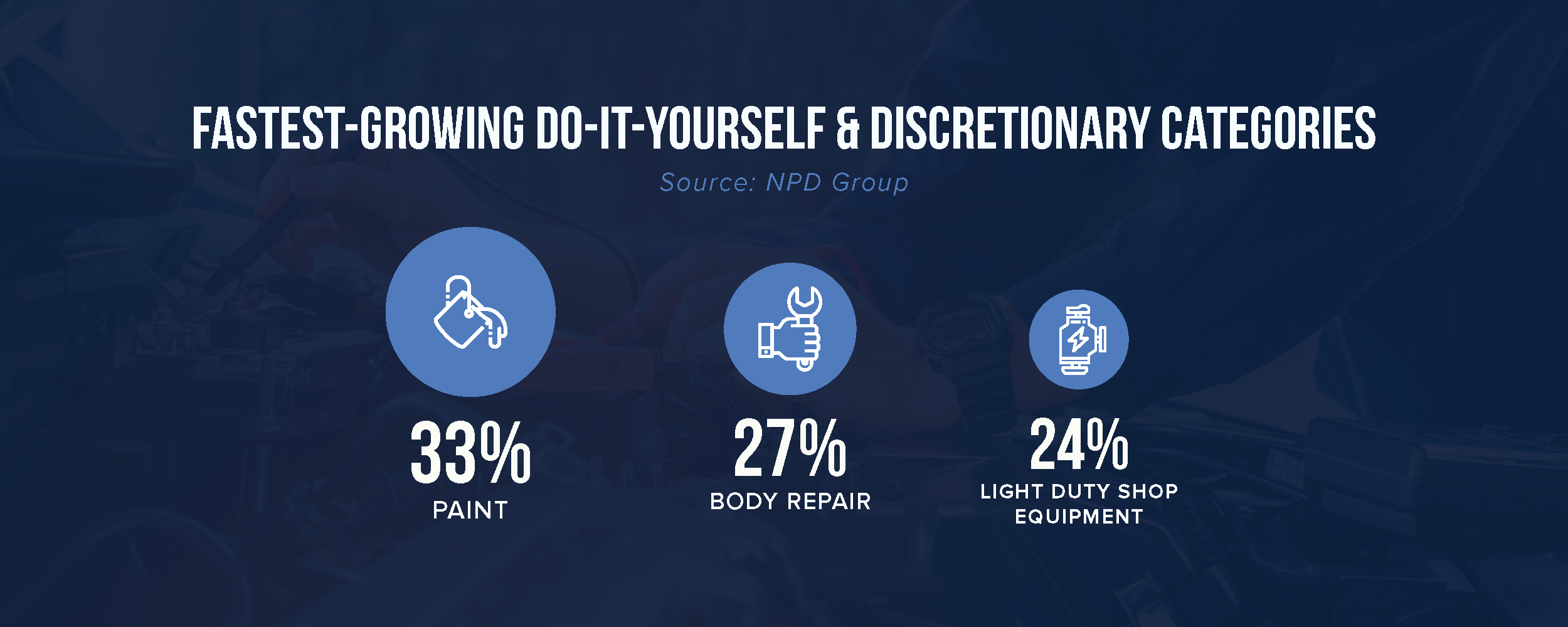

- Auto Part: Comprising of two primary clienteles, the Do-It-Yourself and the Do-It-For-Me customers, auto part retailers live in tertiary markets with below-average income, foot traffic, and population.

- Auto Service: Auto service retailers appeal more to the mid-to-high-income earners that pay for car repairs and usually have above average traffic count. With cars evolving to become more sophisticated, auto service retailers see these car owners more frequently as the repairs are too difficult for an average person.

- Building Type

- Auto Part: Often in a standard building with minimal tenant improvements, auto part landlords avoid costly renovations and lengthy tenant transitions. These basic building types are on the market for lease approximately three months less than properties that need extensive improvements, like auto service buildings.

- Auto Service: Traditionally, auto service retailers dedicate 1,500 square feet for office space and 5,000 square feet for service bays. Due to the large service bay area, paired with these spaces going without insulation or electrical wiring, heating, or air conditioning, auto service assets are less versatile and more difficult to convert for another use. Despite this, good locations allow for creative opportunities among restaurants and general retailers.

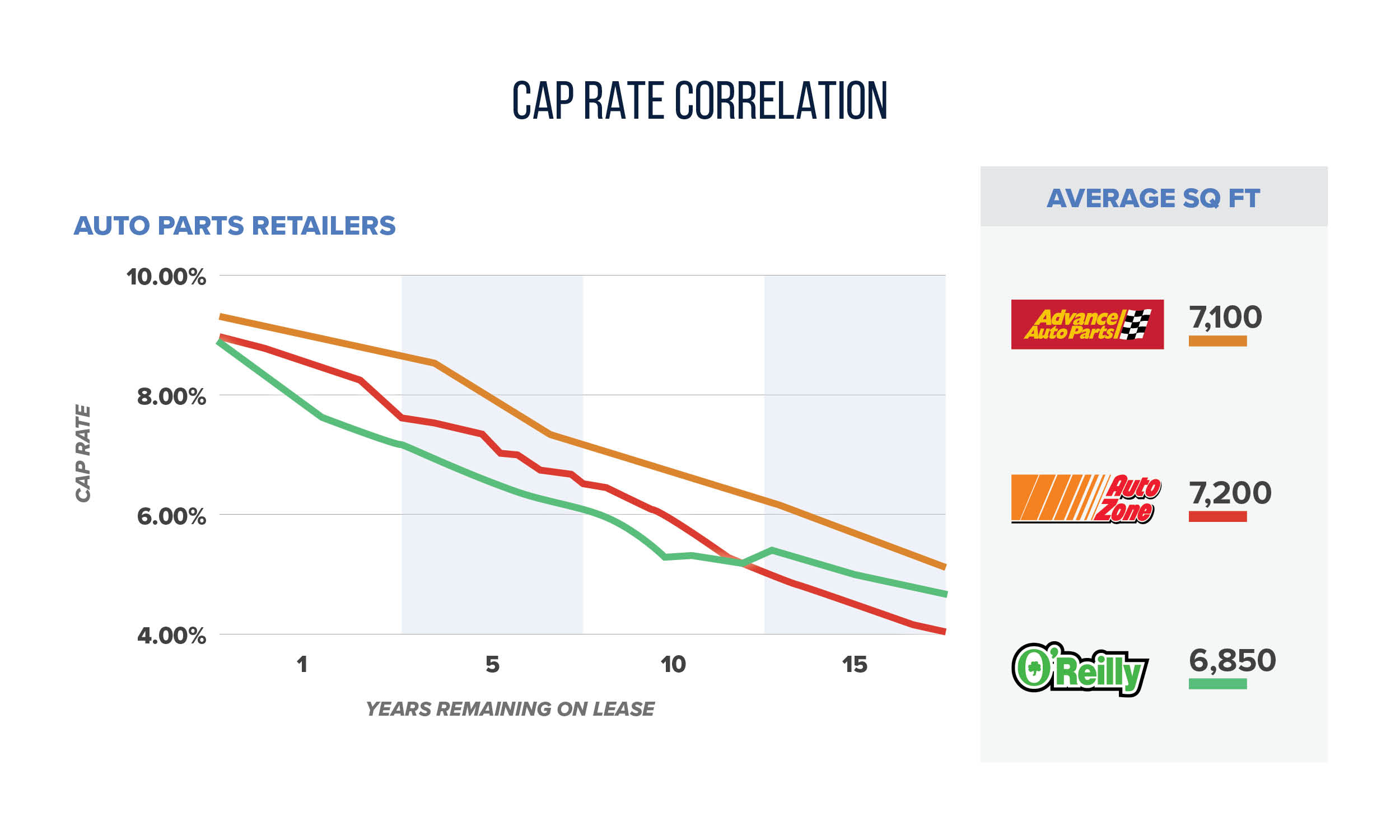

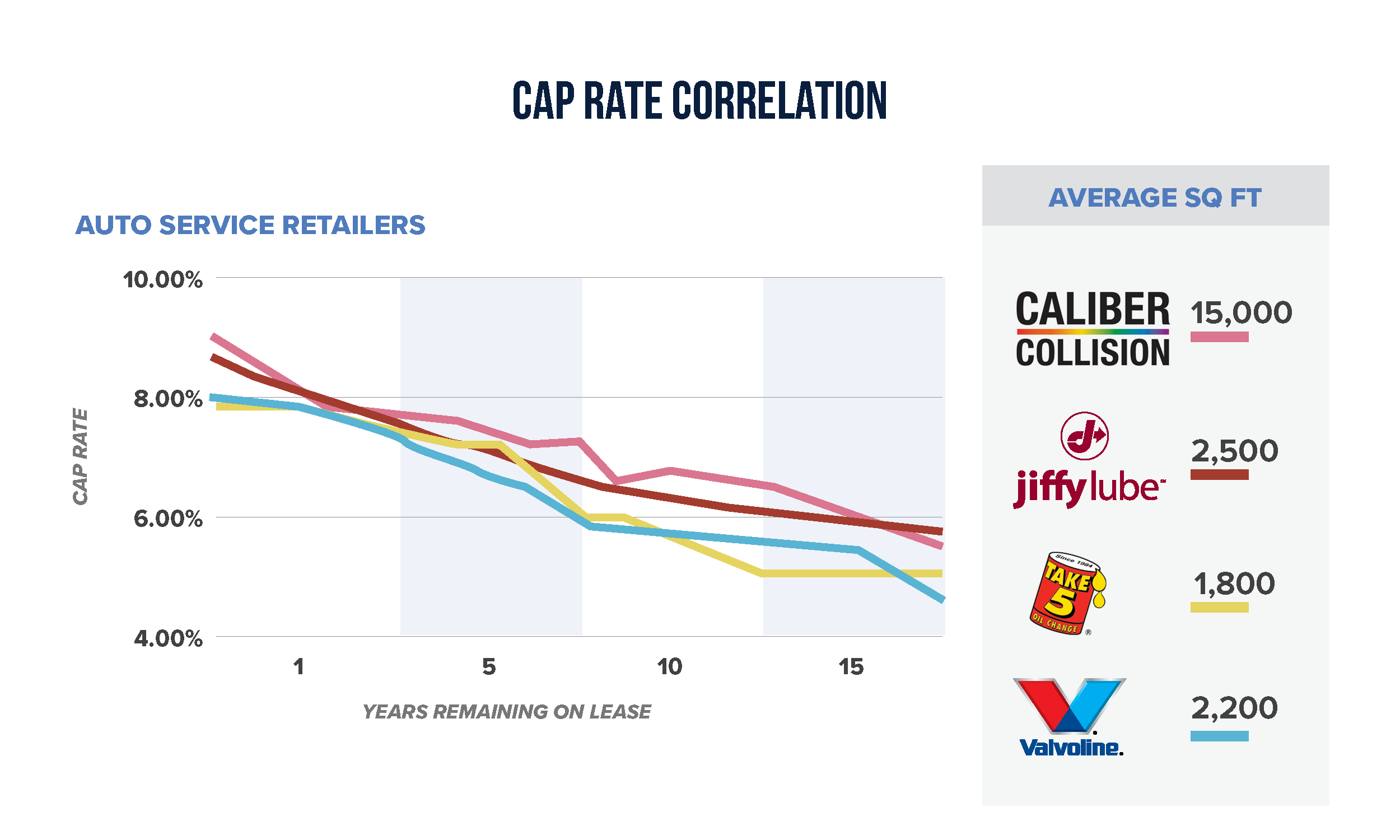

- Cap Rates

- Auto Part: Brand new, 20-year auto part retailers often trade between the 5.25 to 5.50 percent cap rate range.

- Auto Service: Brand new, 15-year auto service retailers often trade between the 5.50 to 5.75 percent cap rate range.