CLICK HERE TO DOWNLOAD THE ARTICLE

It is evident that technology has infiltrated almost every aspect of our daily lives, and now, more than ever, data needs to be processed, stored, and secured. While the workforce, student population, patients, and many more demographics stay home, the use of data-driven technology has exploded. The massive pressure put on IT infrastructure has fed into demand for data centers globally. In this article, Matthews™ will explore the activity surrounding data centers and the outstanding demand for this product type.

Who’s Investing in Data Centers?

Data centers, which house servers, hardware, and data for organizations, are one of the top product types highly sought after and expected to shine throughout the pandemic. Data centers have enabled digital commerce, online meetings, secured data, and more. As the world moves to remote work, the importance and demand for digital infrastructure has increased. While data centers are proven crucial during the pandemic, COVID-19 has not left the sector unscathed. Industries that utilized data centers, such as retail, travel, and hospitality, have pulled back on IT spending as a means to cut costs while they wait for the economy to stabilize.

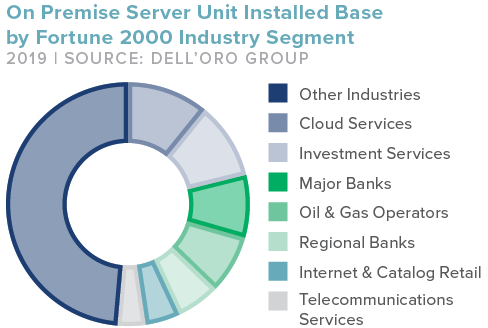

As an alternative to purchasing and owning data centers, companies conserve capital spending by turning to public cloud services, like Amazon or Microsoft. These public cloud resources vary by the provider but offer a flexible and consumption-based infrastructure to help the remote workforce and distance learning students. Cloud providers are the biggest players in data center acquisitions and largely sponsor data center operators that are looking to expand their geographic footprint. Spending on public cloud data centers spiked 25 percent year-over-year, reaching an all-time high of nearly $17 billion in Q2 2020 as companies prefer the expenditure-based

IT consumption model. Enterprises, like financial institutions, are active players in buying and deploying data center infrastructure, accounting for 24 percent of server installation.

It’s unpredictable how long COVID-19 and the economic distress will be in effect, so it’s uncertain when other industries will migrate to the Cloud. Undoubtably, the essential role data plays in the digital world today, will provide exponential future growth in data centers as the demand for digital infrastructure will continue to increase.

The Current State of Data Centers

In 2020, data center capital expenditures were projected to reach $188 billion, despite the pandemic’s disruption on demand. According to IT research firm, Gartner, this estimate is 10.3 percent less compared to 2019, with over 60 percent of new facility construction on hold due to the global crisis. However, end-user spending on data center infrastructure is expected to pick back up in 2021 and reach $200 billion, growing annually through 2024.

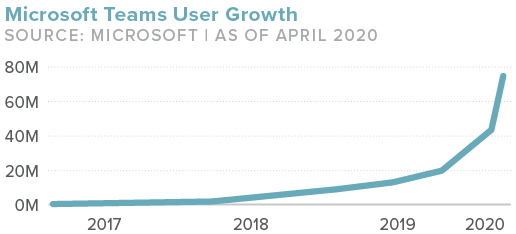

The top four cloud service providers in the U.S., Amazon, Google, Microsoft, and Facebook, are on a healthy growth trajectory for the next five years, according to Dell’Oro Group, a data center market analysis firm. AWS and Google opened the most data centers in the last 12 months, accounting for more than half of the 541 that opened in Q2 2020, followed by Microsoft and Oracle. Microsoft’s cloud business, which entails Azure, Office 365, Dynamics 365, and more, grew 30 percent year-over-year, reaching $14.3 billion, according to Microsoft’s earnings report.

Development

While 2020 was a slow year for data center development, specific markets are seeing sparked activity as developers race to build new IT capacity in 2021. Markets that are pained by oversupply will see decreased pricing, and some providers may lease at lower than market rates. Over 373 megawatts (MW) of capacity was under construction across the nation in early 2020, and another 100 MW have broken ground since.

The Future of Data Centers

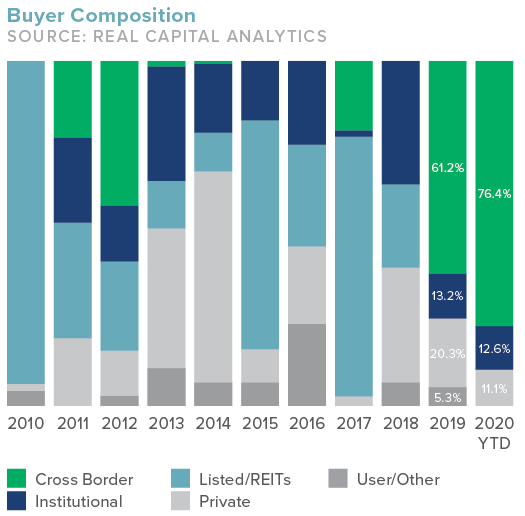

In a post-COVID-19 world, the exponential growth trajectory and the importance of data centers are set to continue. As businesses hunt for digital transformation programs to remain viable and accessible, and users remain active online, data centers are here to stay. According to Data Center Frontier, some of the world’s largest investors are raising billions to invest in digital infrastructure. As data centers convert the nation to digital infrastructure, here are some considerations investors are taking in evaluating their data center needs.

Access to New Markets

Enterprises were already looking for ways to monetize their data before the pandemic hit by selling them to data center providers. This will save time on developing a data center from the ground-up, which often averages 12 to 18 months as the data center already exists. Therefore, data center providers could attempt to court these deals to create a speedy and hefty supply of data centers in various markets.

Fiber Connectivity

Additionally, fiber connectivity is becoming an essential part of data centers, as fiber cabling is the only network infrastructure that can support 50G+ data rates. As fiber increases in popularity and stretches across the nation, this translates to new access in new markets, including rural areas. This potential reach, space, and power in new locations will lure major cloud providers to the area.

Evaluating Needs

Data centers that were acquired in the last ten years are now in need of upgrades to keep pace with new technologies, like fiber connectivity. At the start of 2020, companies were beginning to evaluate their mission-critical needs. Due to oversupply, some market’s pricing began inching down. To maintain efficiency and value in their decade-old data centers, companies looked to infrastructure upgrades or hybrid IT solutions.

While the booming data center sector stole the spotlight from upcoming 5G technology, smart cars and devices, virtual and augmented reality, these technologies will likely create a second wave of demand. With the wide acceptance of data centers as an asset class, the more conservative investors and lenders will enter the market.