CLICK HERE TO EXPLORE THE RESULTS

Investors Show Improved Confidence for CRE Recovery in 2021

Investors predict that the commercial real estate industry will noticeably begin to recover from the COVID-19 pandemic in 2021. Retailers will adjust to new norms, office will alter space needs based on teleworking trends, centrally located industrial distribution space will increased assuming growth in e-commerce, and multifamily development will recalibrate based on renter demands. The recovery will vary by asset class and market, and it will all depend on the containment of the coronavirus. However investors show improved optimism and some property types will emerge much stronger than others.

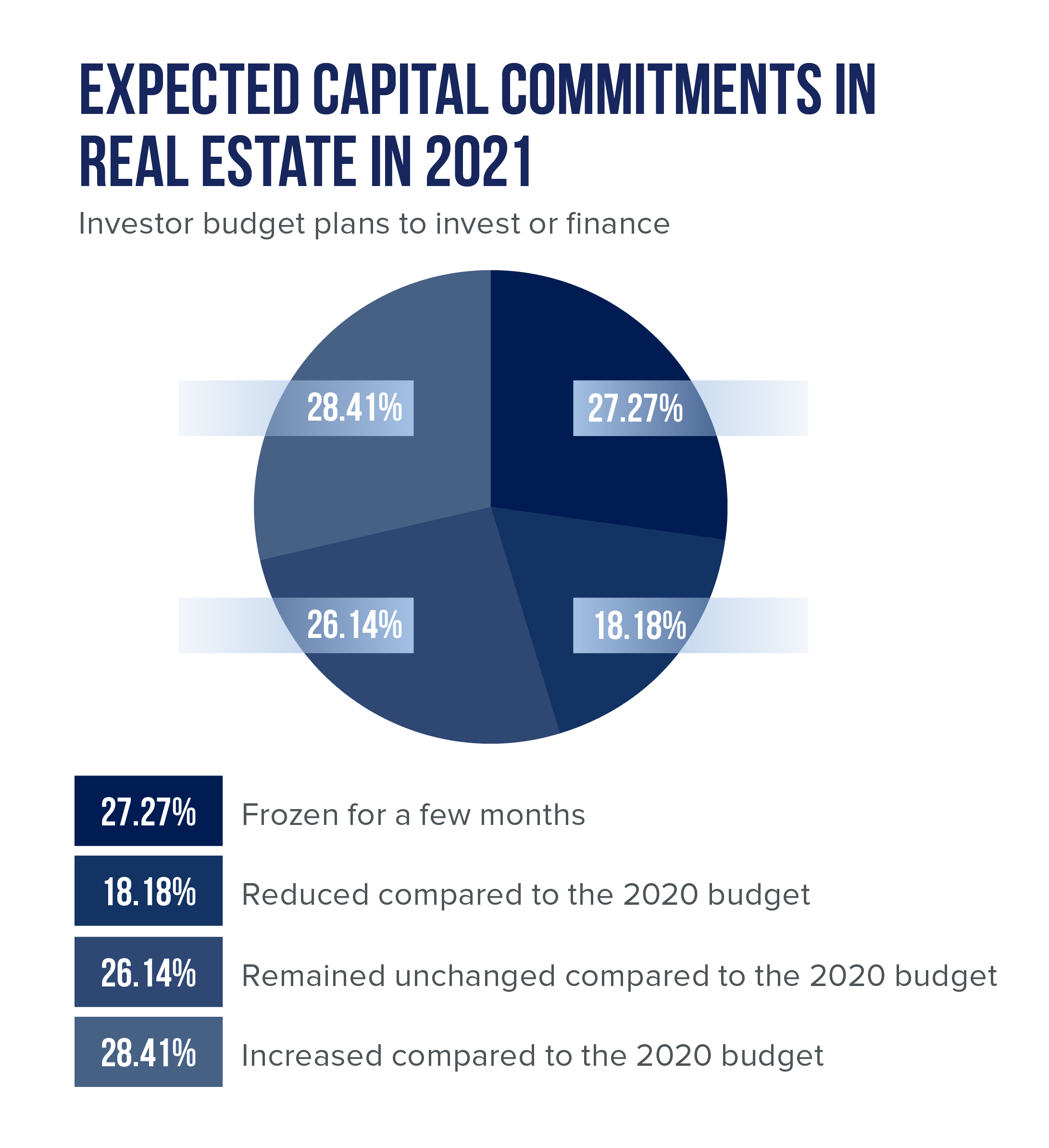

In the Matthews™ December 2020 Investor Outlook Survey, investors predicted CRE performance for 2021 including where the best opportunity for investment is. For investors who are planning to be active, 37.50% see strong corporate guaranteed single tenant net lease properties (office, industrial, or retail) as the best opportunity in 2021. 22.73% of investors see multifamily properties as the best opportunity for investment in 2021, and 15.91% will continue to stay on the sidelines. Additionally, 13.64% of investors see multi-tenant commercial (shopping centers and office buildings) as the best opportunity, and 10.23% see non-corporate credit or franchisees single tenant net lease (office, industrial, or retail) as the best opportunity. Further, CRE capital commitments (investor budget plans) for 2021 were split equally between frozen for a few months, reduced compared to the 2020 budgets, remained unchanged compared to the 2020 budgets, and increased compared to the 2020 budgets.

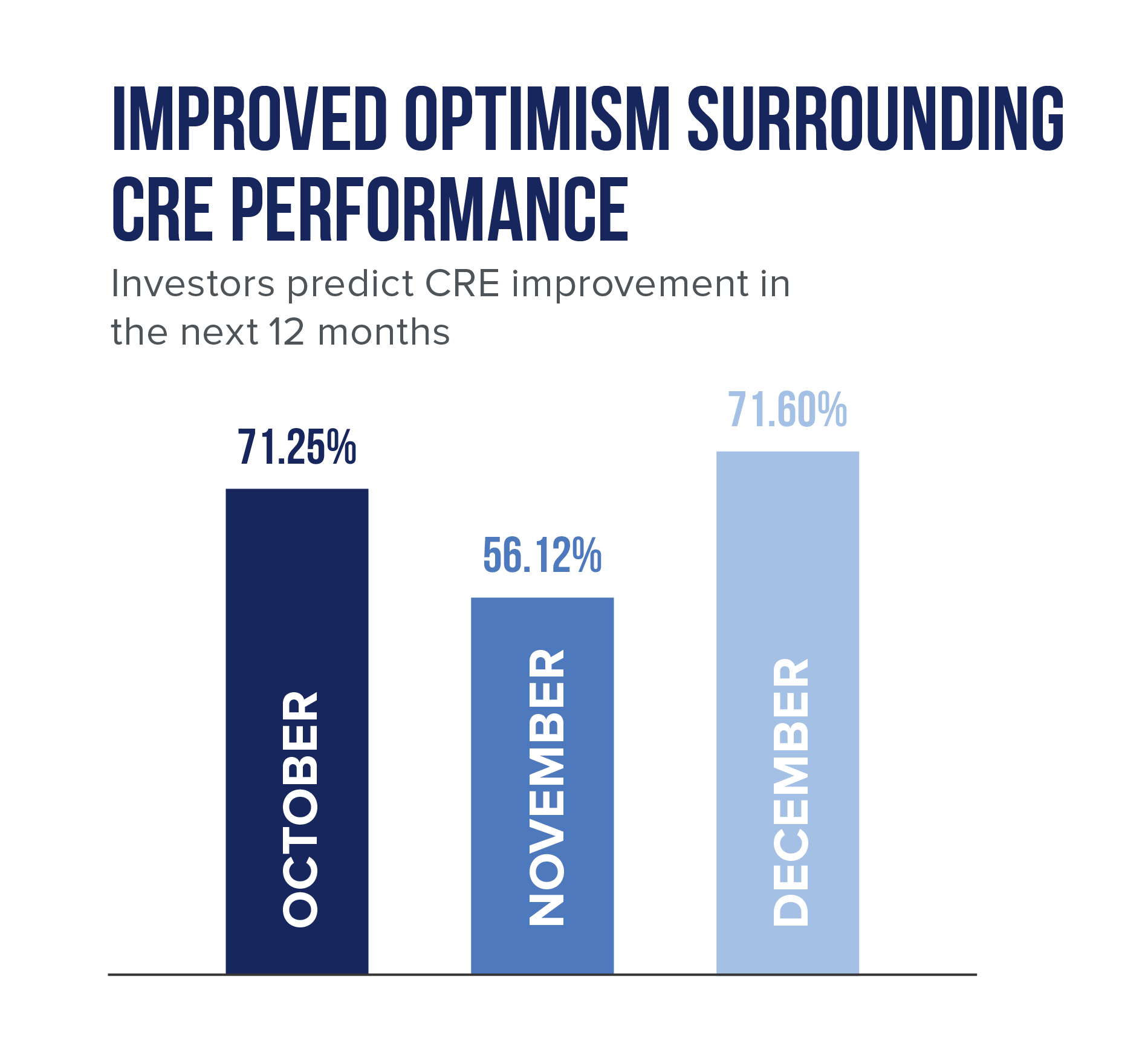

Despite uncertainty going into 2021, investor optimism has improved surrounding CRE Performance for the next 12 months. In December, 71.60% of investors predicted that CRE improvement for the next 12 months is expected. The product types that are expected to emerge the strongest from the crisis include industrial, multifamily, and healthcare.

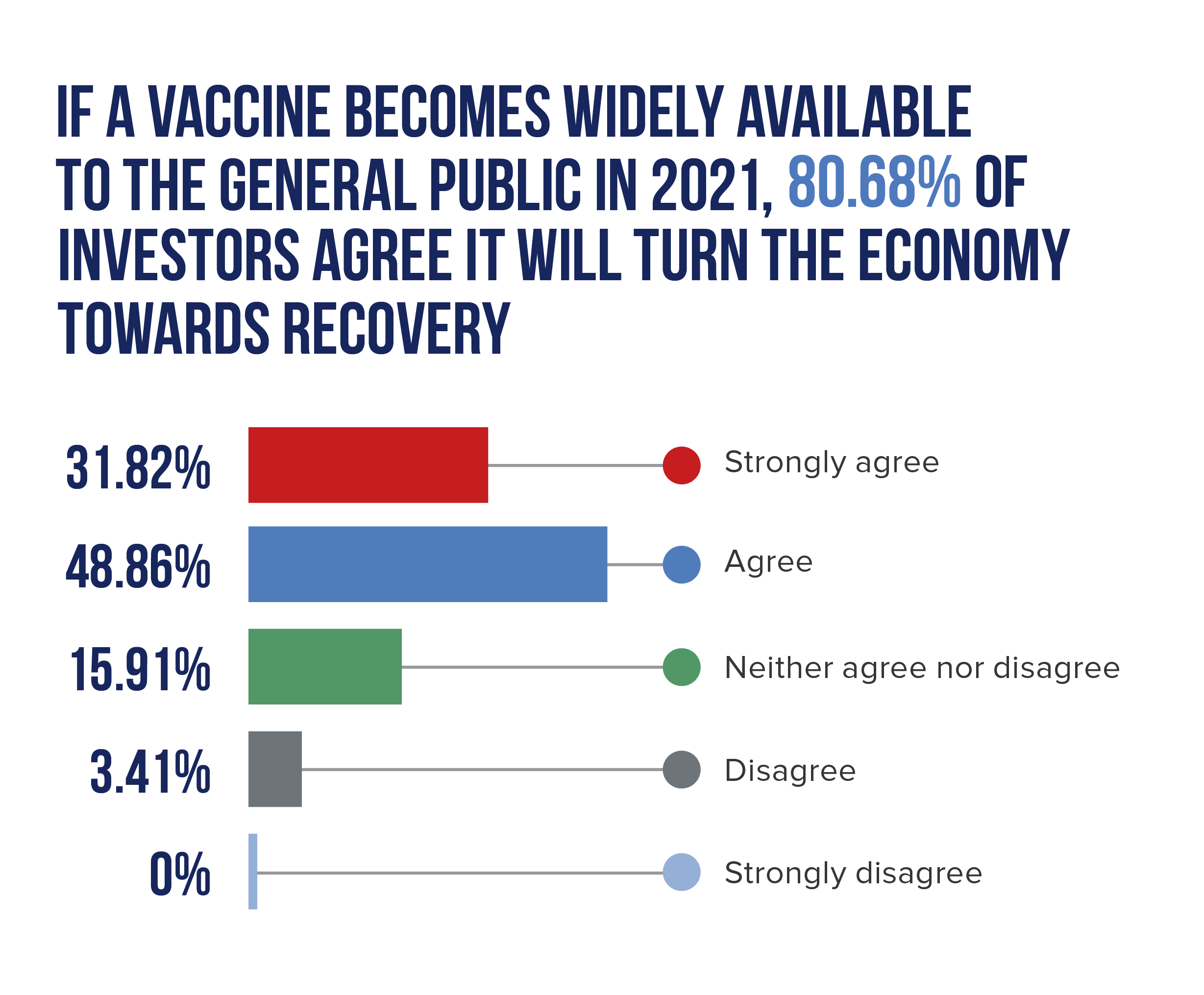

2020 not only brought COVID-19 but also an election year. In 2021, 79.55% of investors said they are concerned about Biden’s tax plan as it relates to the 1031 Exchange program and other tax breaks in 2021. Further, investors anticipate that GDP Growth in 2021 will be impacted by COVID-19 negative one to five percent. However, if a vaccine becomes widely available to the general public in 2021, 80.68% of investors agree it will turn the economy towards recovery.

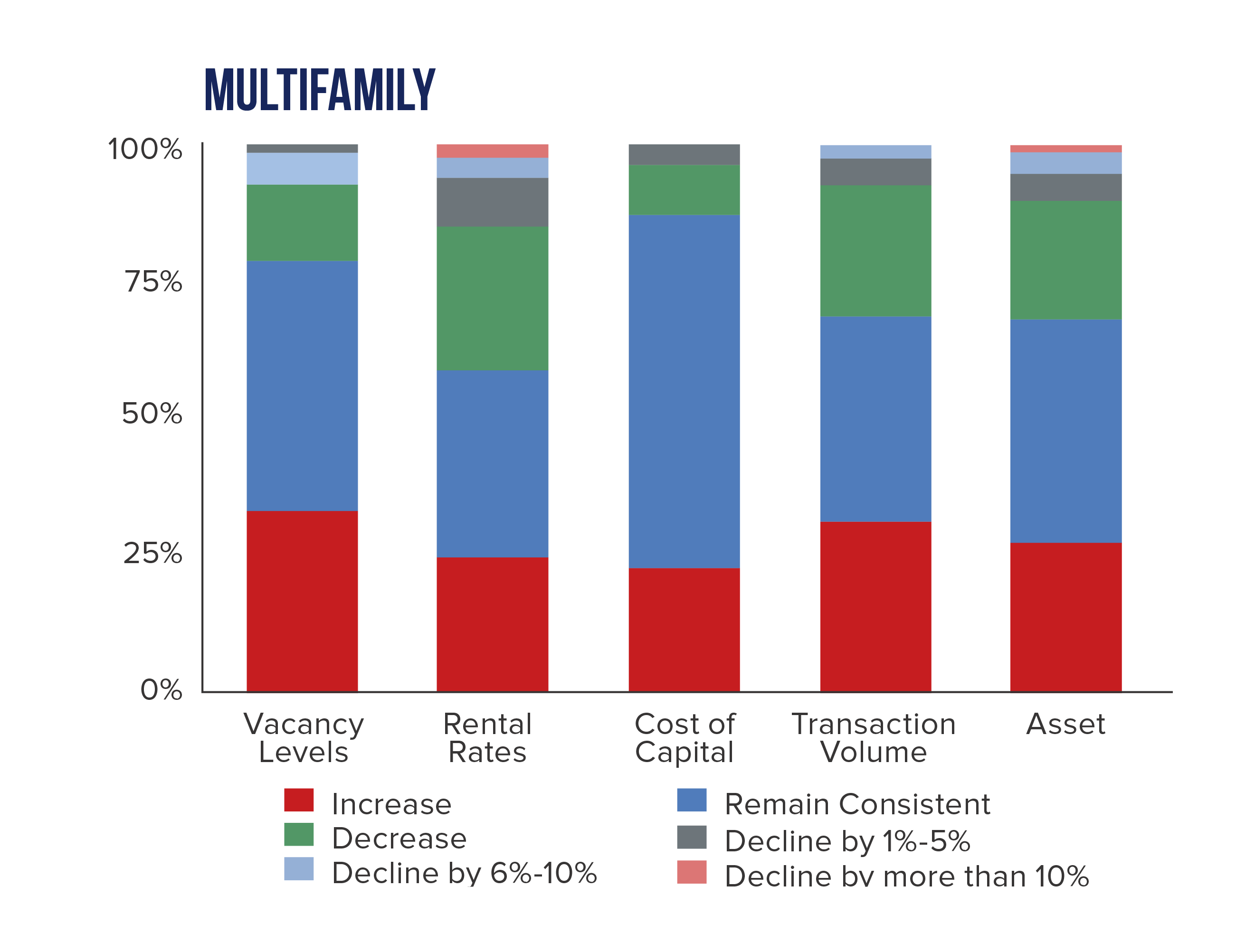

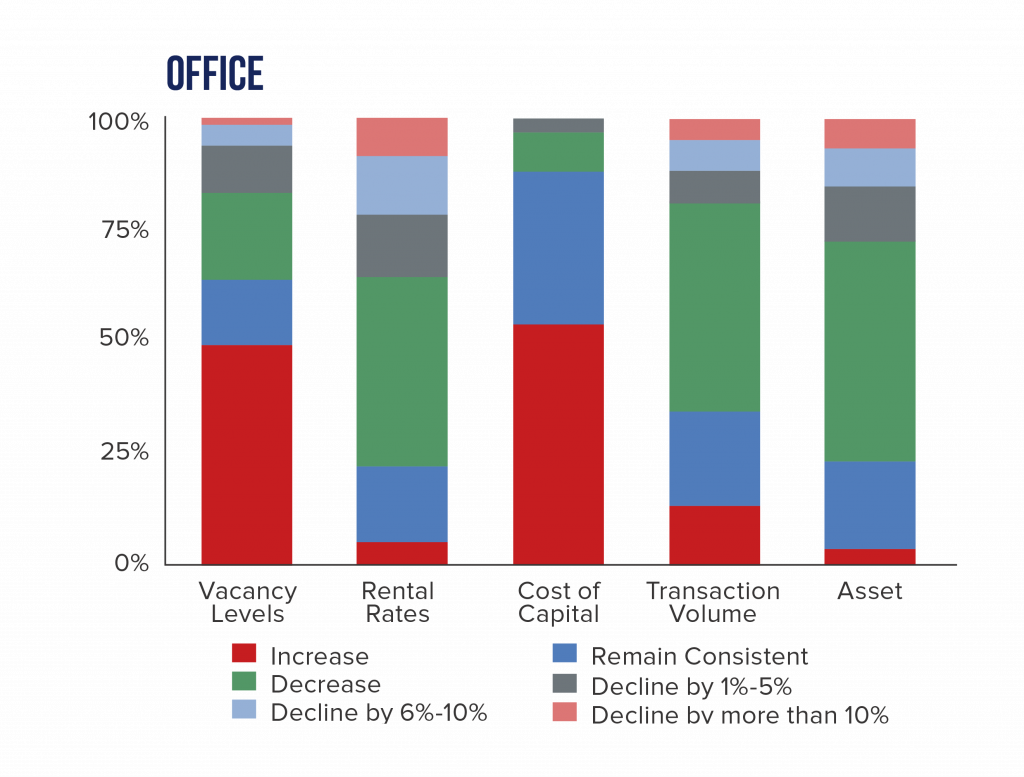

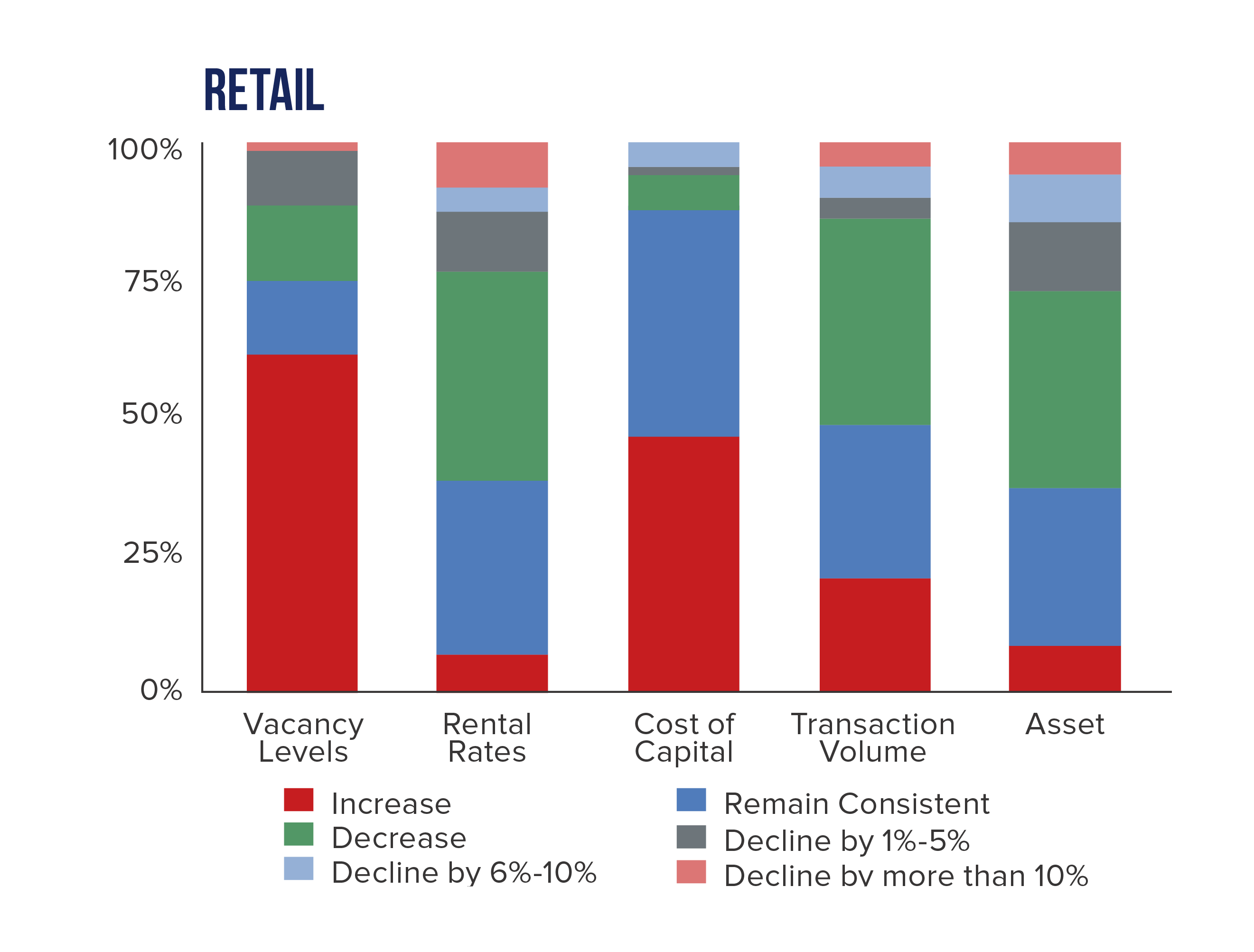

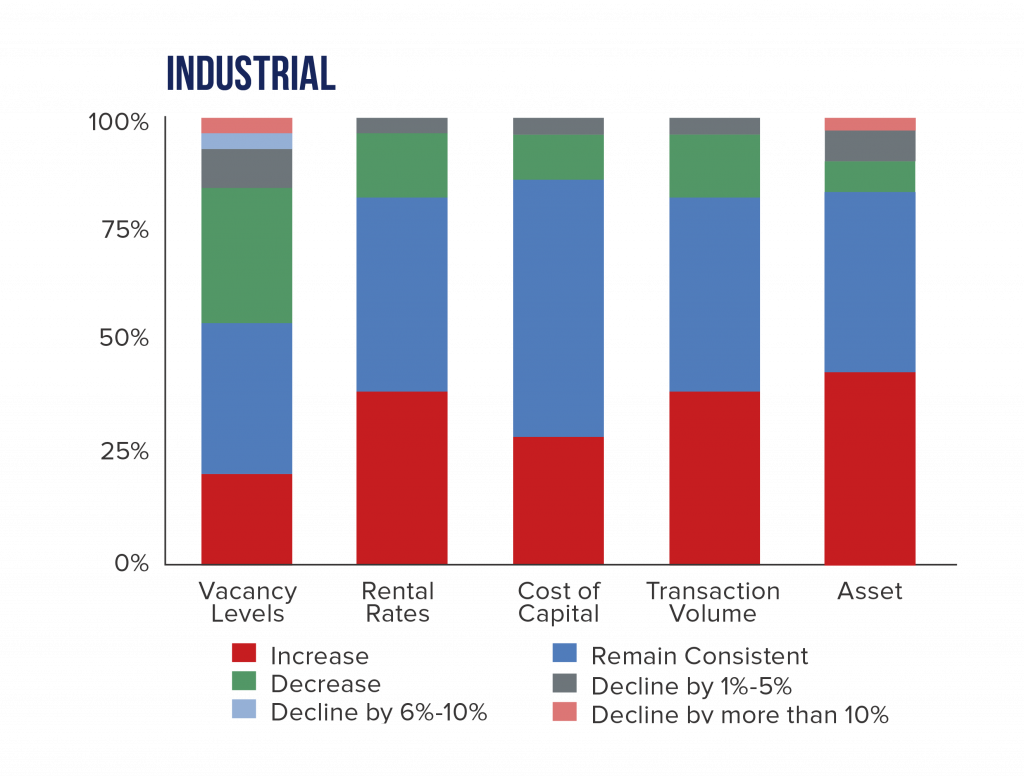

Impact on CRE Fundamentals Per Sector Over the Next 12 Months

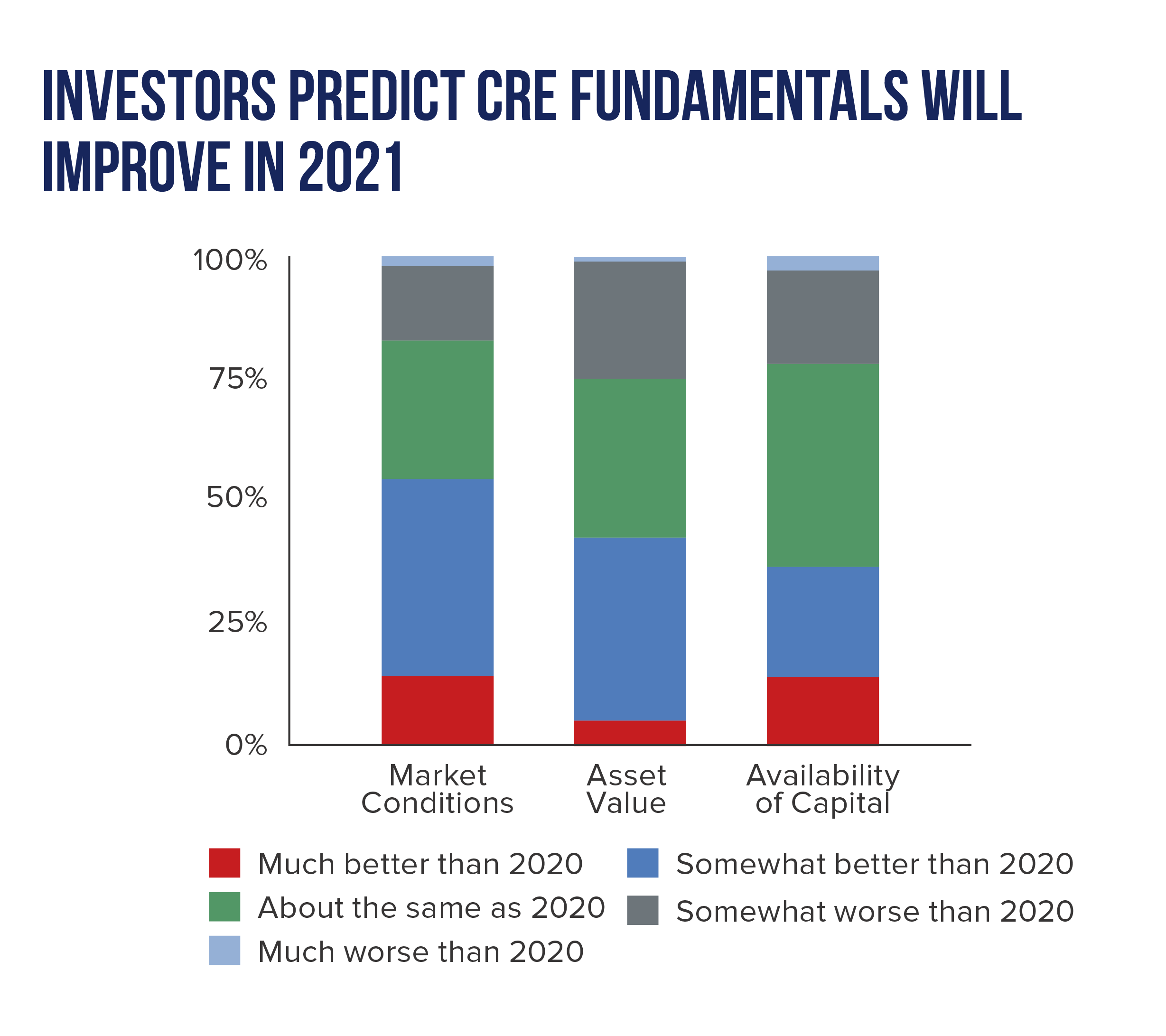

The overall CRE trends that investors predict for 2021 include, continued alterations in CRE for social distancing requirements, decrease in rent rates, increase in adaptive reuse, people and businesses migrating from large urban cities to suburban neighborhoods, higher taxes and inflation, tenant renegotiations and lease language modifications, and an increase in value-add investment.

Multifamily: For multifamily, the prominent trends that investors predict in 2021 include increased demand for ADU’s, more feasible locations for living and working, such as incorporating room for an at-home office in units or adding a common workplace in a complex. Other trends include migrating away from Class A multifamily housing development and focusing instead on rental housing for the unemployed, and lastly looming rent control regulations might come to fruition in 2021.

Office: It is anticipated that in 2021, office space requirements will adjust due to the permanency of teleworking. Further, investors expect for there to be a decrease in the demand for traditional office space and office space that is left vacant will be a prime opportunity for adaptive reuse.

Retail: 2021 will bring new retail formats that comply with social distancing guidelines. This includes pick-up windows, drive-thrus, and outdoor dining. As COVID-19 has changed the way consumers shop, investors predict a shift in retail preferences and some retail locations will repurpose space for last-mile delivery.

Industrial: In 2020, industrial has been a favored asset class, and in 2021 this trend is expected to continue. As a sister to the industrial product type, data centers increased in popularity due to teleworking, more time spent online during stay-at-home order, and an increase in e-commerce. This will translate to 2021 with investors predicting an increase in data REITs and investment in data centers. Further, there will be an increase in industrial absorption and demand for centrally located distribution space to assist with e-commerce growth.

For more information, please contact a Matthews™ specialized agent!