Investors predict that the commercial real estate industry will noticeably begin to recover from the COVID-19 pandemic in 2021. Retailers will adjust to new norms, offices will alter space needs based on teleworking trends, centrally located industrial distribution space will increase assuming growth in e-commerce, and multifamily development will recalibrate based on renter demands. The economy continues to see improvement with the widespread distribution of the vaccine.

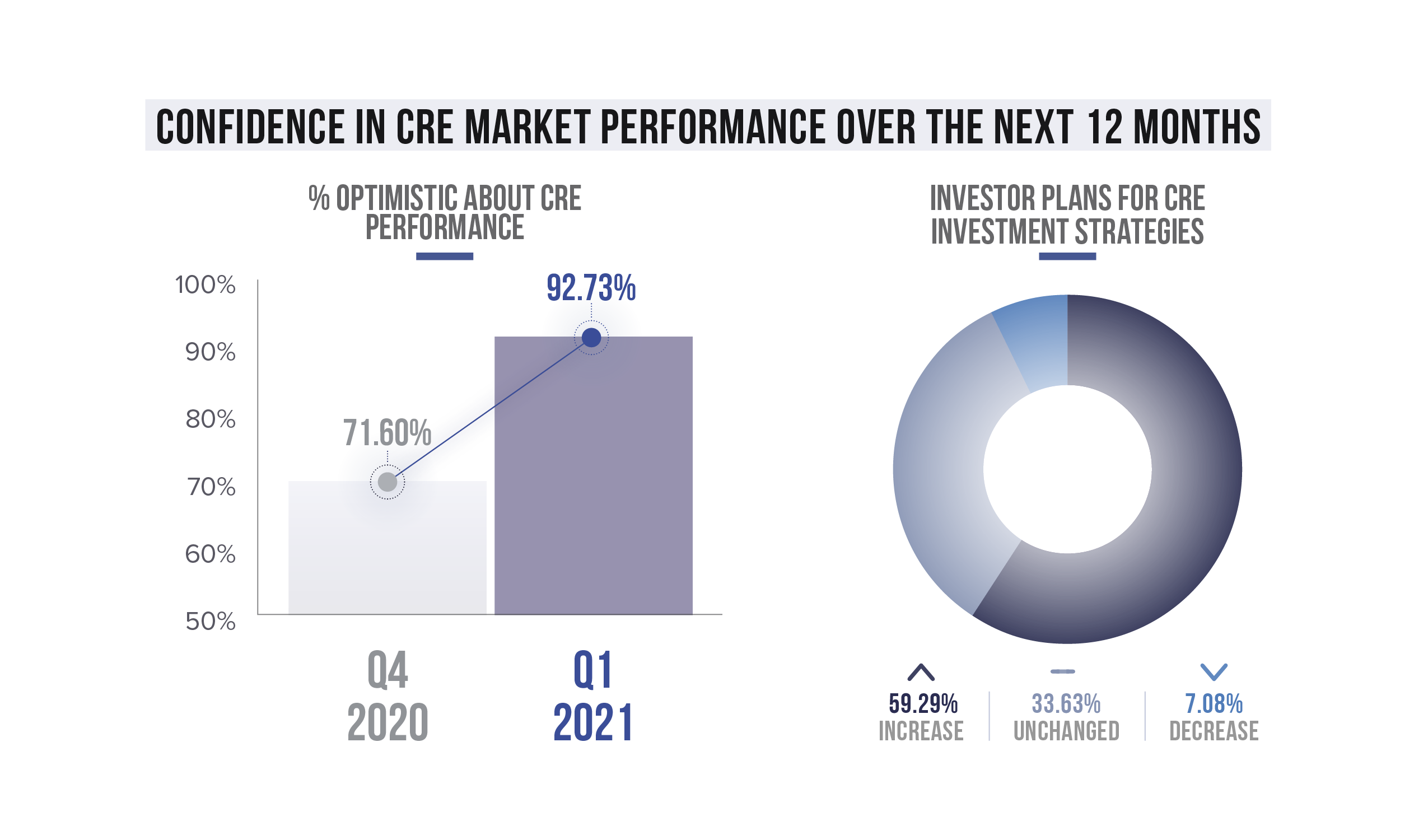

CRE Optimism Picks UP

In the Matthews™ Q1 2021 Investor Outlook Survey, investor confidence in CRE market performance increase, and optimism picked up. Compared to Q4 2020, where only 71.60% of investors were optimistic about CRE performance, Q1 2021 optimism increased to 92.73%. This over 20% jump in optimism indicates that the commercial real estate industry is moving towards recovery. Further, over 50% of investors plan to increase their investment plans over the next 12 months.

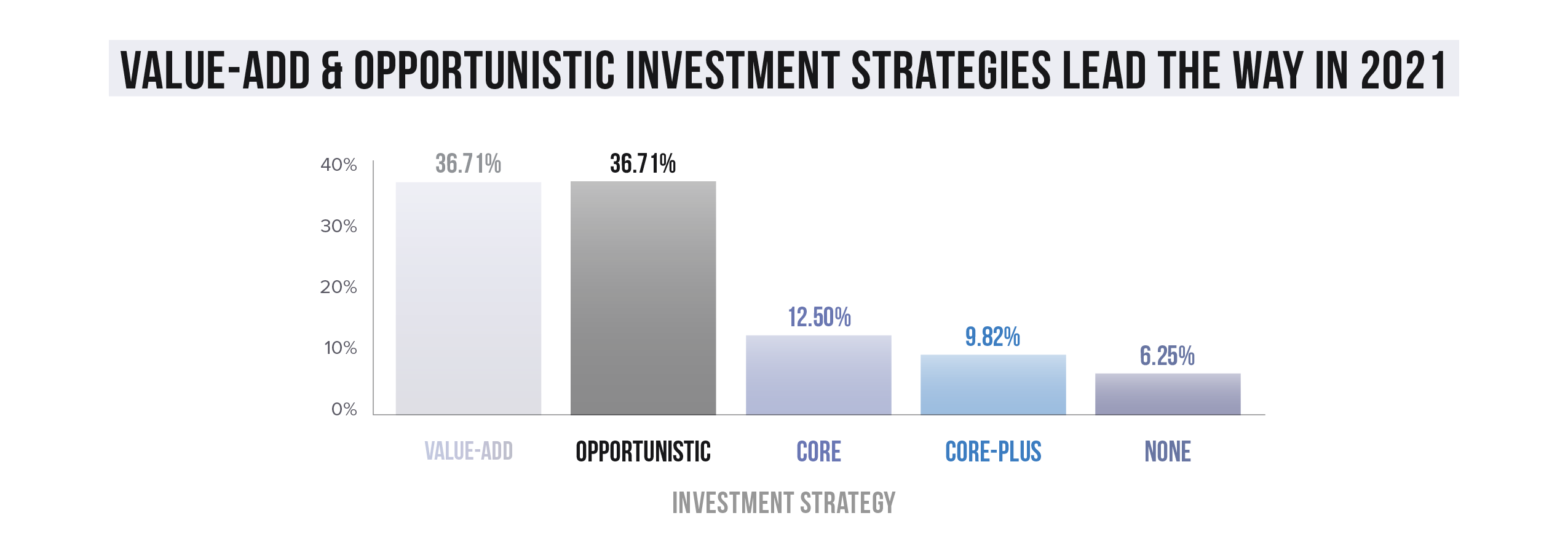

An Increased Appetite for Risk

The results from the survey indicate that investors have an increased appetite for risk. Almost 75% of investors seek investment strategies focused on value-add and opportunistic segments. Core investments are considered to be the least risky and have the lowest expected return. In contrast, opportunistic investments offer the highest level of risk along with the highest expected return to investors. Value-add commercial real estate investments target properties with cash flow in place, but increased cash flow through improvements over time will reposition the property to command higher returns.

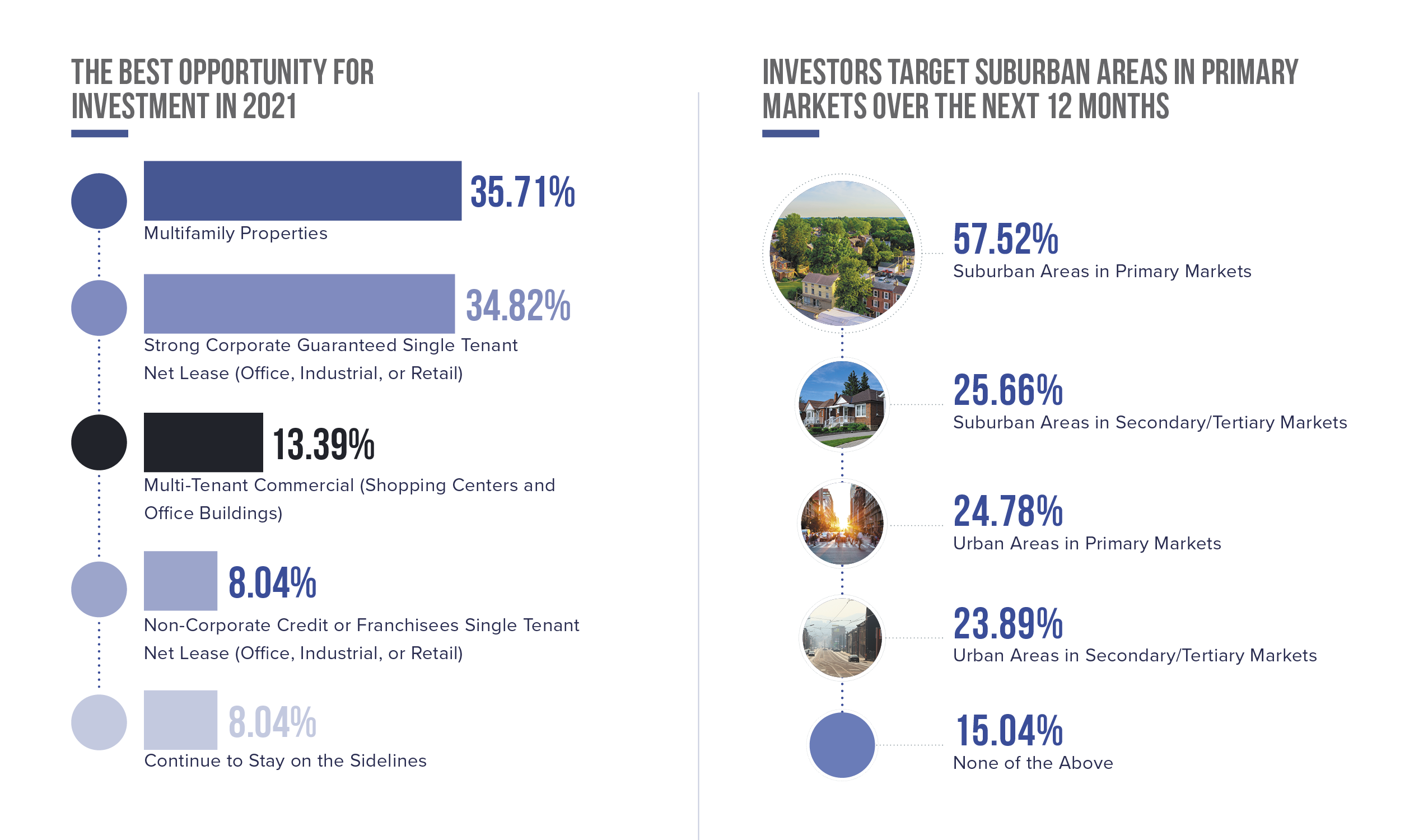

The best opportunity for investment in 2021 by property, market, and region

For investors who plan to be active, 35.71% see multifamily properties as the best opportunity for investment in 2021 (compared to 22.73% in Q4 2020). 34.82% of investors see strong corporate guaranteed single tenant net lease properties (office, industrial, or retail) as the best opportunity in 2021. Additionally, 13.39% of investors see multi-tenant commercial (shopping centers and office buildings) as the best opportunity, and 8.04% see non-corporate credit or franchisees single tenant net lease (office, industrial, or retail) as the best opportunity. Only 8.04% of investors will continue to stay on the sidelines in 2021, compared to 15.91% in Q4 2020.

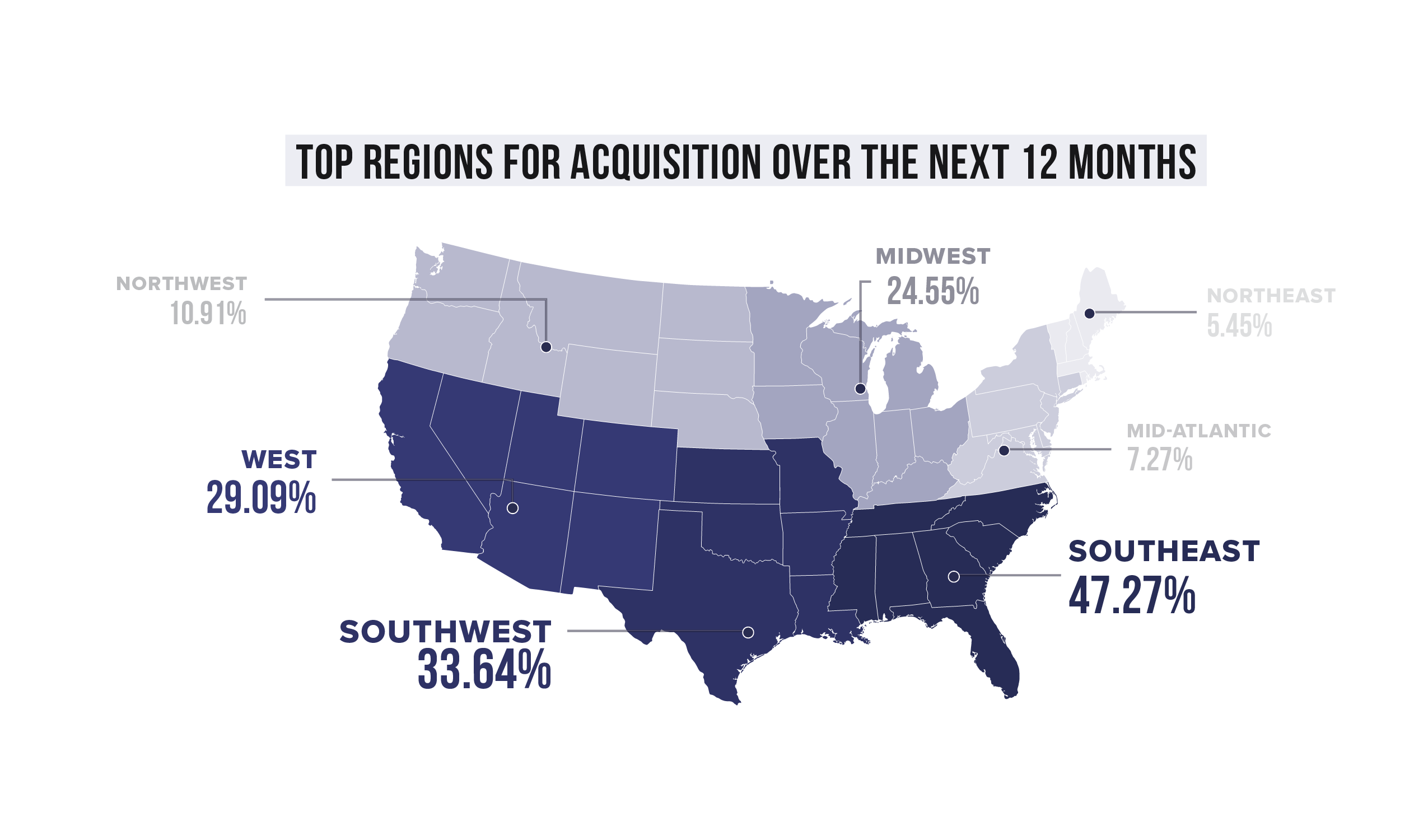

Over the next 12 months, most investors are targeting suburban areas in primary markets, at a whopping 57.52%. This is unsurprising as the COVID-19 crisis in 2020 altered housing choices and office-location requirements. Further, the top regions for acquisition over the next 12 months are located along the sunbelt. 47.27% of investors believe the southeast is the best region for acquisition, 33.64% indicated the southwest, and 29.09% indicated the west.

The Greatest Challenge for CRE Remains COVID-19 & Higher Personal Tax

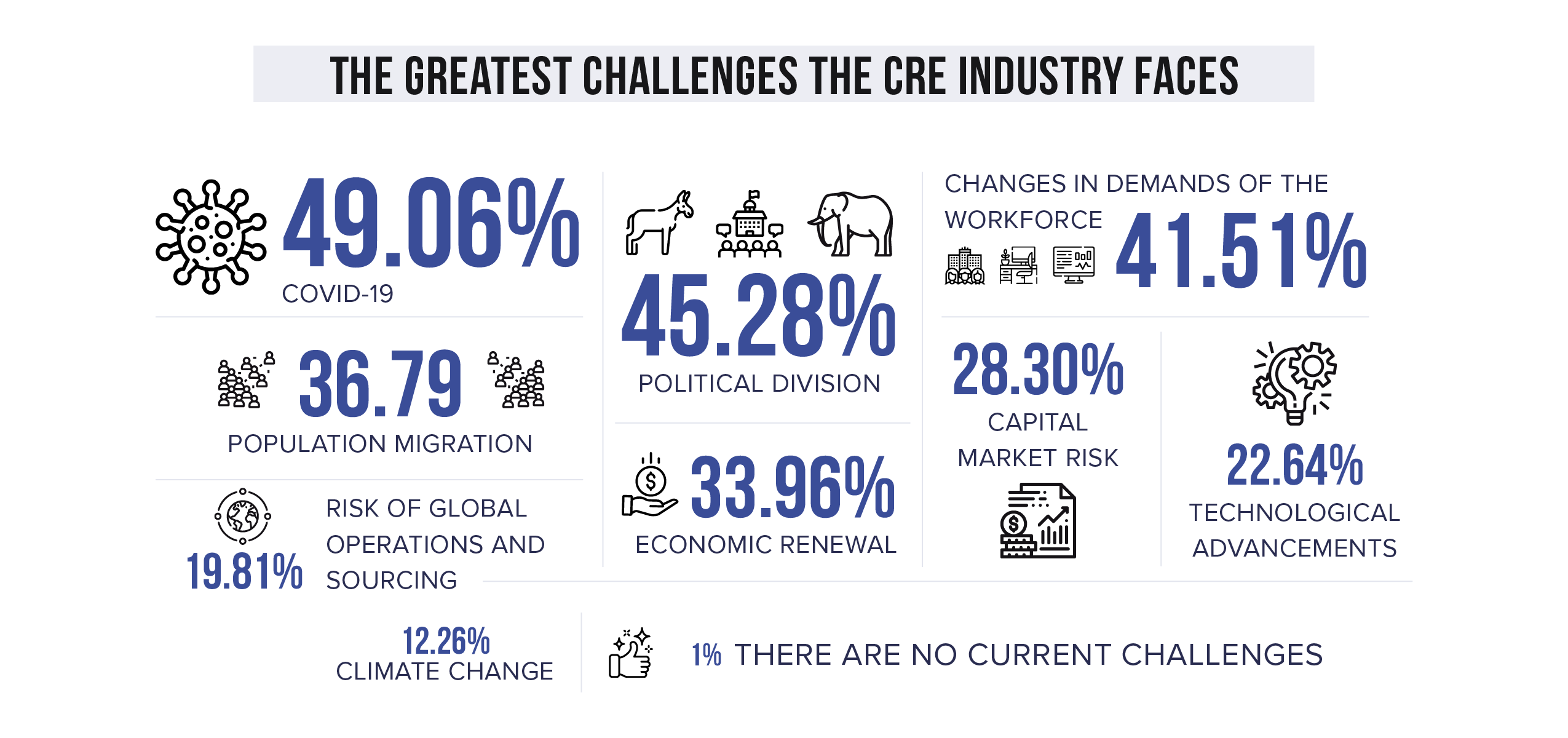

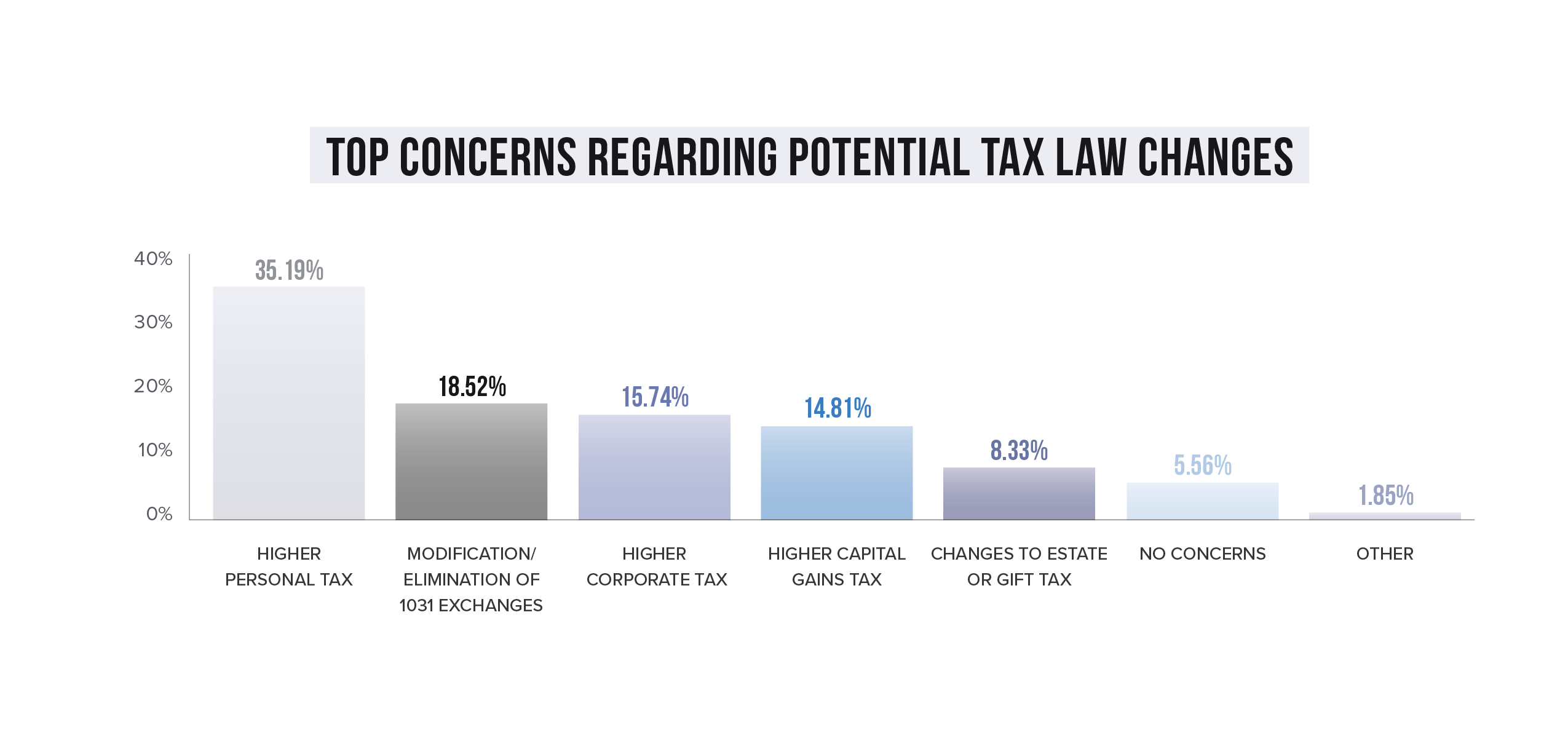

Investors selected their top challenges and concerns the CRE industry faces today. A majority of investors believe COVID-19 to be the most significant challenge faced by the industry, although it is anticipated to decrease as the vaccine reaches widespread distribution. Other concerns included political division, changes in demands of the workforce, and population migration. Investors also indicated concern regarding potential tax law changes, with 63.21% of investors indicating that they believe these tax law changes will take effect in 2022.

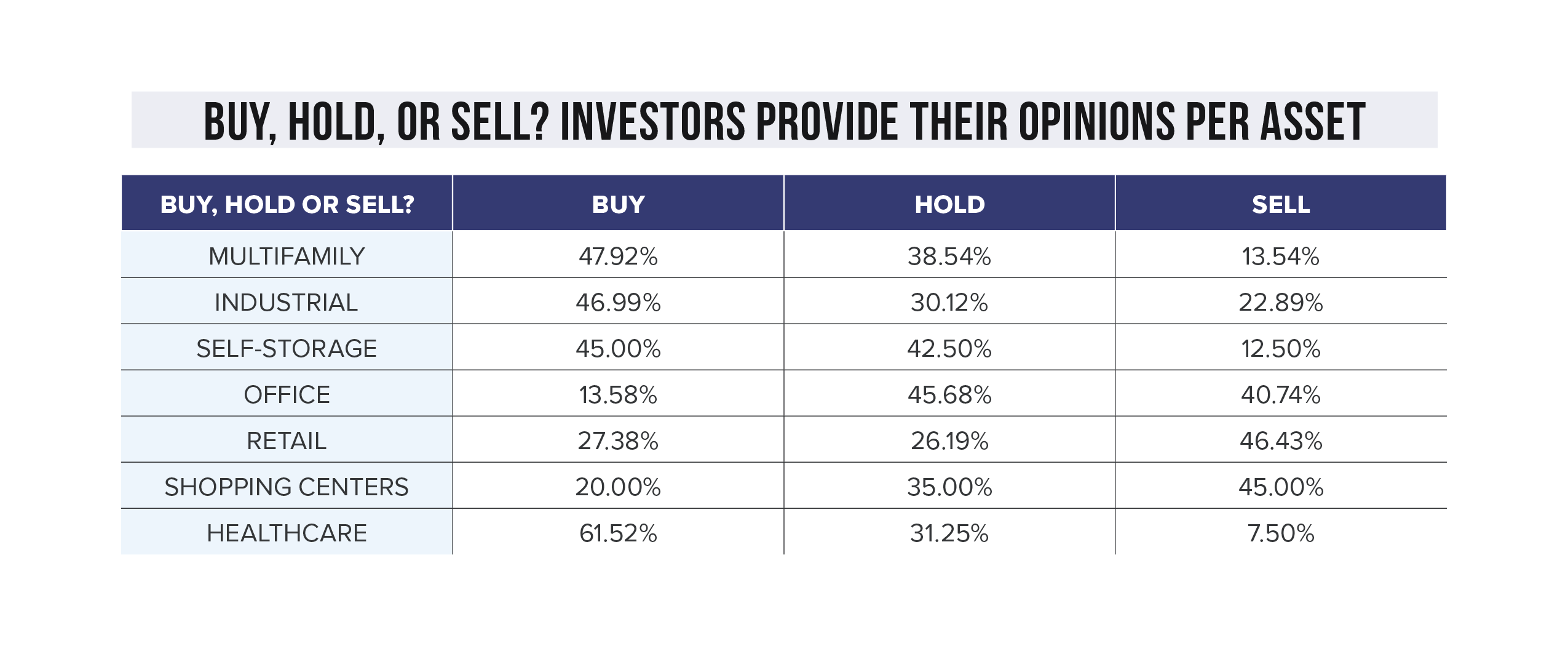

Buy, Hold, or Sell?

In the table below, investors provide their input on what asset classes to buy, hold, or sell. A majority of investors believe healthcare, multifamily, industrial, and self-storage are prime for acquisition. Given the current market, office is the only asset class to hold as 56.07% of investors expect remote work to only take place 1-2 days a week for positions previously located in the office full-time before the pandemic. Investors believe retail and shopping centers should be viewed as prime disposition assets.