In a historic move during unprecedented times, due to the coronavirus outbreak, the federal government is taking action to reduce the impact on taxpayers. The Emergency Assistance Act instructed the Secretary of the Treasury “to provide relief from tax deadlines to Americans who have been adversely affected by the COVID-19 emergency, as appropriate, according to 26 U.S.C. 7508A(a).” According to the guidance, the Internal Revenue Service (IRS) has officially announced that deadline for making tax payments has been delayed from April 15th, 2020 to July 15th, 2020.

Payment Deadline & Eligibility Details

Filing Details:

- Those who want to delay their tax payments must submit their tax returns or another form to the IRS by April 15th.

- No special form is needed to file by the new extended date. Nor will you incur interest or penalties as long as you file a return or automatic extension request and pay taxes by July 15th.

- If you need more time to complete tax paperwork, ask for an automatic extension by filing Form 4868 by July 15th. The deadline to file an extended return is October 15th, 2020.

- Deadlines to contribute to an Individual Retirement Account, ROTH IRA, Health Savings Account, Archer MSA, or penalties on withdrawals from retirement accounts have also been extended to July 15th.

- If you’ve already filed your 2019 return or scheduled an automatic withdrawal of tax payments, the IRS will not delay payments until July 15th.

Eligibility Details:

- The relief applies to federal income tax payments, including tax payments on self-employment income due on April 15, 2020, for the 2019 taxable year, and tax payments on self-employment income, due on April 15, 2020, for the 2020 taxable year.

- Relief for individuals is up to $1 million regardless of filing status. The amount available for relief for businesses that do not join in filing a consolidated return is up to $10 million.

- The relief does not extend to the payment of any other type of federal tax.

- Estate and gift taxes, excise taxes, payroll taxes, and information returns, such as 1099 forms, do not qualify for the July 15th Also, tax items that didn’t regularly have April 15th deadlines don’t qualify.

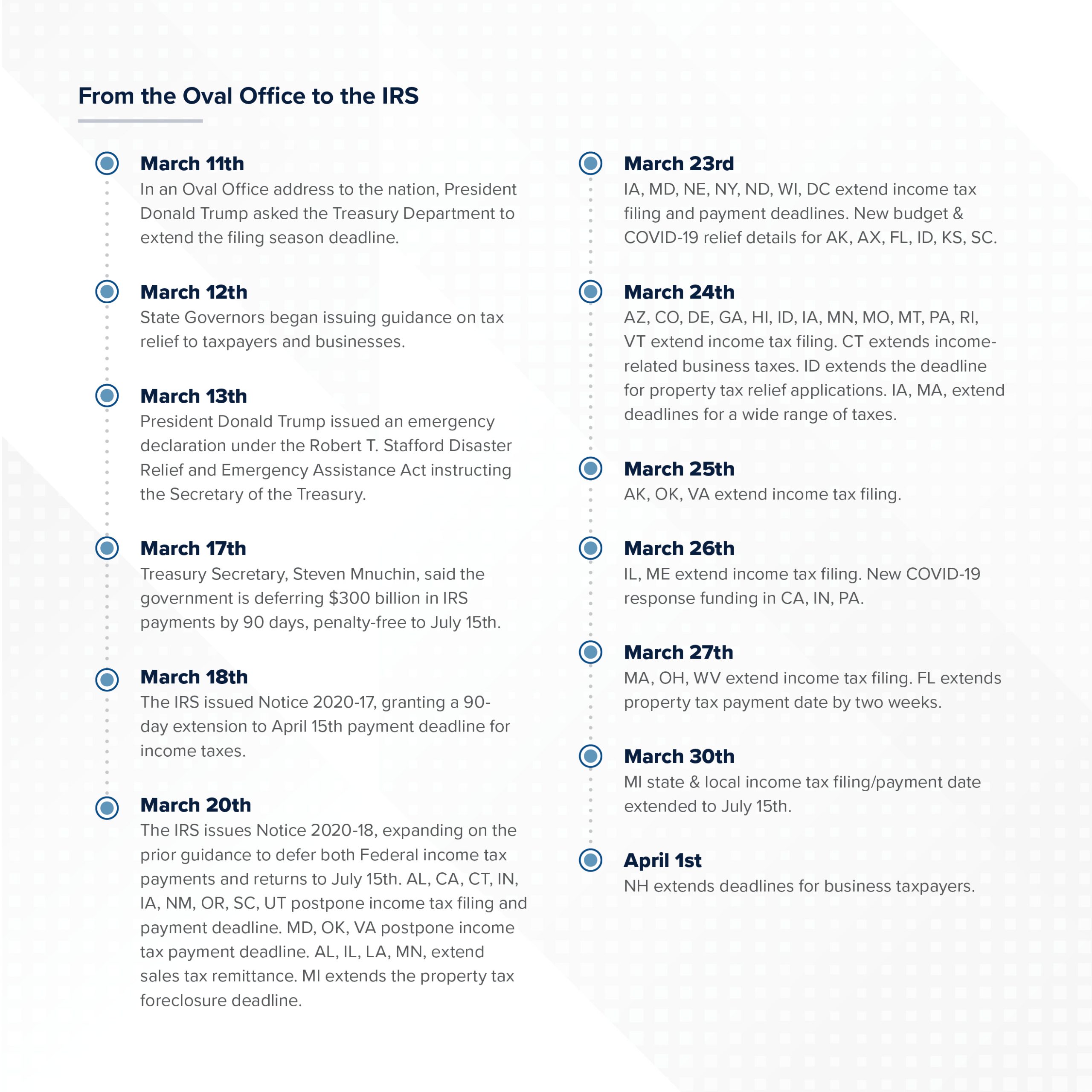

From the Oval Office to the IRS

Additional Relief Requests

The National Association of Realtors and a large portion of investors are advocating on behalf of the interest of commercial real estate for relief packages among all sectors being impacted by the crisis. These requests include:

- Extension of the 1031 like-kind exchange deadline

- Extension of Qualified Opportunity Fund working capital safe harbor

- Relief measures for multifamily property owners that address tenant relief/eviction foreclosures

- Relief for small businesses that have closed down and/or laid-off employees

Leveraging Your Investment for Tax Incentives

Cost Segregation– A strategic planning tool that assesses an entity’s real property asset and identifies a portion of those costs that can be treated as personal property. This allows real estate owners to accelerate the depreciation of property assets, thereby reducing their federal taxable income. Benefits include increased cash flow, reduced tax liability, increased current tax deductions, uncovering missed deductions, accelerated depreciation, and defers income tax.

Sale Leaseback- A financing tool, which allows owner-operators to sell their real estate interests to a buyer and simultaneously sign a long-term lease as a tenant to secure the location and operate at the property long-term. In addition to numerous other benefits, a sale leaseback provides a tax advantage. Typically, the rental payments under a lease can be fully deductible against the company’s taxable income, while with traditional financing, the group is only able to deduct interest and depreciation.

Qualified Opportunity Zones- A program that drives capital to designated Opportunity Zones. By investing in these areas, there is potential for tax-free appreciation, such that no capital gains tax will be levied on Opportunity Zones investments held for at least ten years.

CARES Act Tax Provisions- The CARES Act, which provides over $2 Trillion in incentives, includes addition tax provisions that extend to net operating loses (NOLs) carrybacks for five years, increases the limitation on deductible business interest from 30% to 50% of EBITDA, and delays employer Social Security payroll taxes until Jan. 1, 2021. These provisions allow businesses to use NOLs to fully offset their taxable income.

For more information and guidance on how you can leverage your investment for tax incentives, please reach out to a Matthews™ specialized agent, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.