Market Report

Capital Markets in Los Angeles

As a globally recognized metro, Los Angeles has been an epicenter of investment activity for some time. As a pricier coastal market, the metro’s commercial real estate environment experienced a downward momentum during the pandemic but has already started to increase to pre-COVID-19 activity. There is less concern for the retail, industrial, and multifamily sectors from a capital markets perspective and greater concern for assets affected by the constrained travel industry, like hotels, as investors feel pressure to deploy capital in the near term. Assets that boast high occupancy, essential tenants, and strong performance have seen the most interest as Los Angeles investors hunt for long-term, stable investments.

The Retail Market

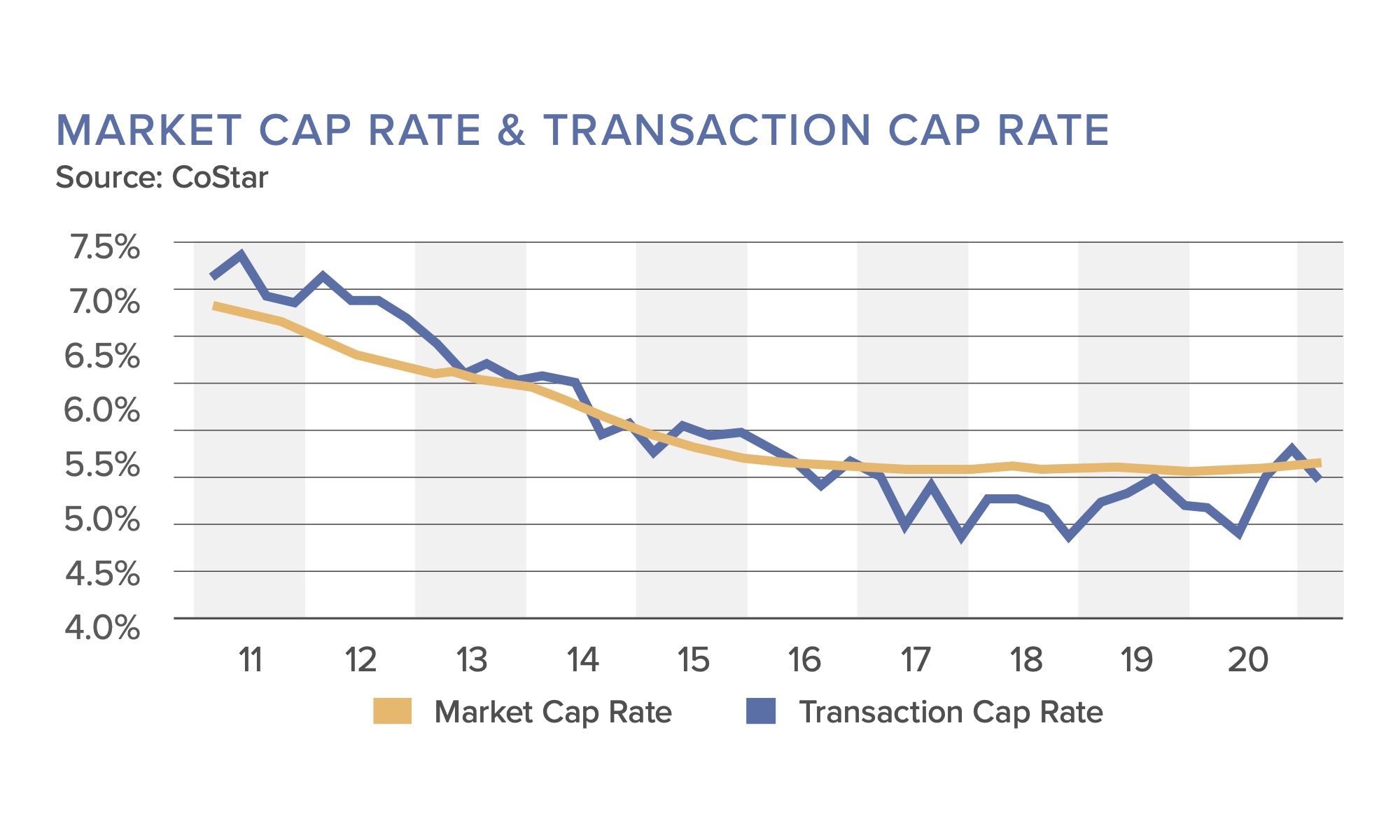

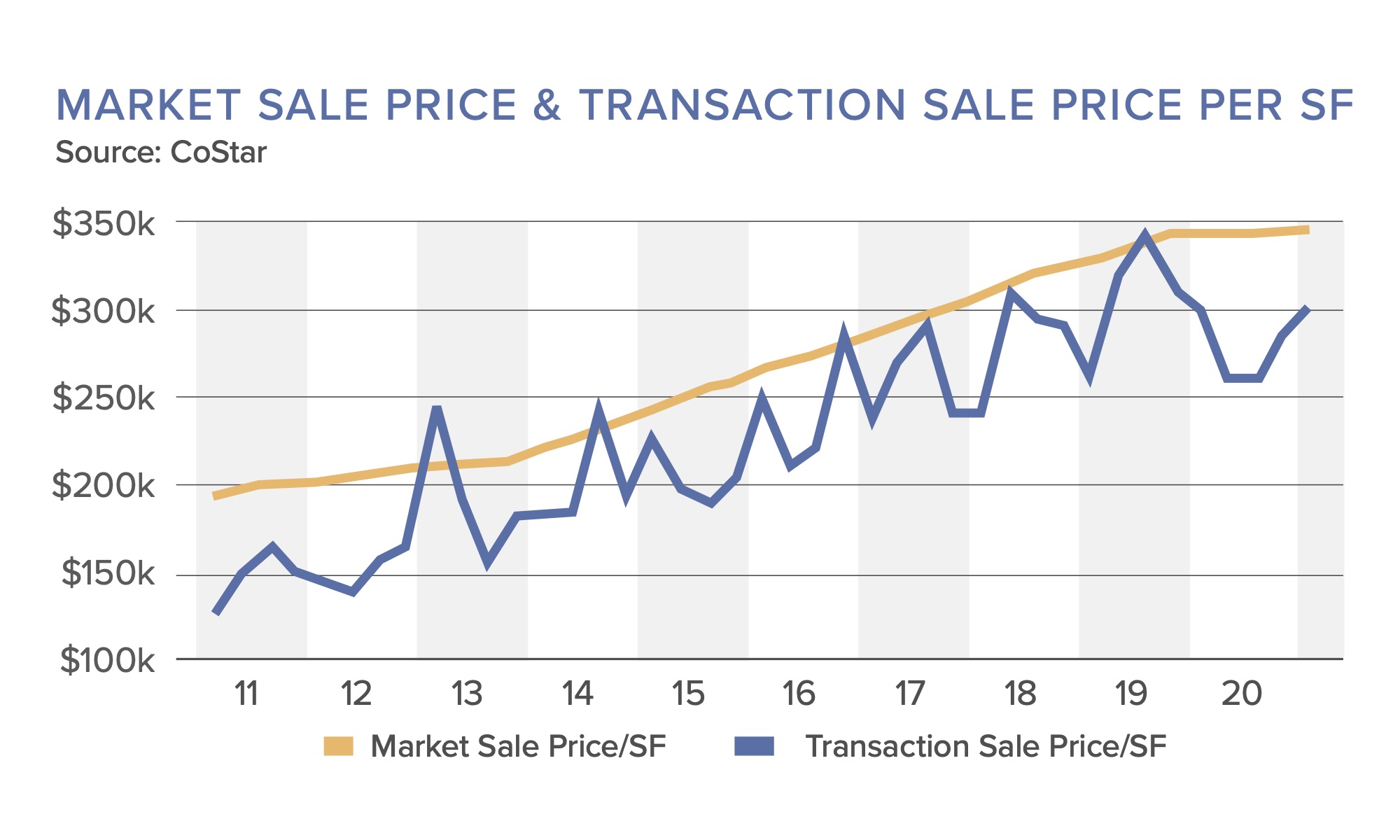

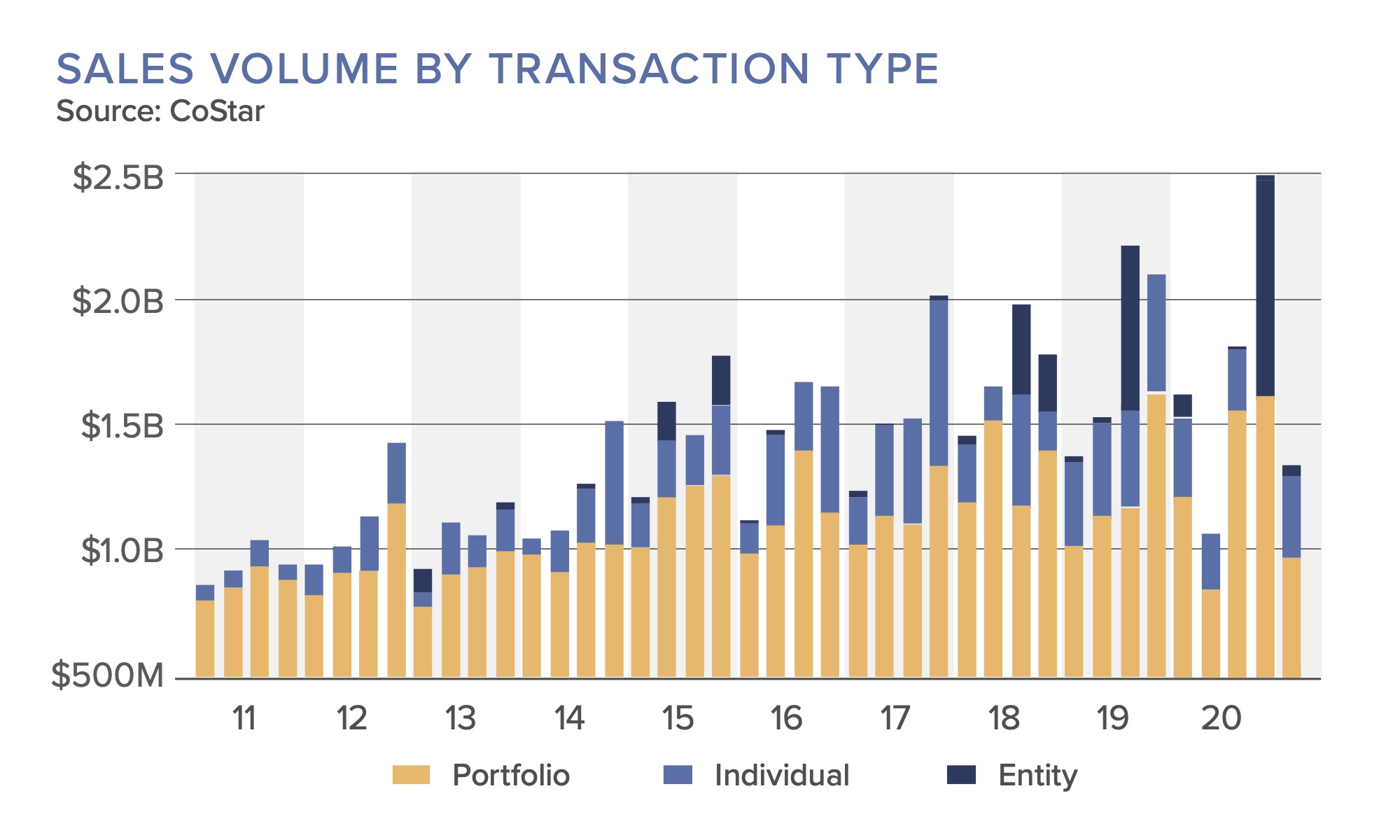

Retreating below Los Angeles’ 10-year average, sales activity amounted to $3.4 billion in the last year, the lowest sales volume since 2012. Both Q2 2020 and Q3 2020 witnessed minimal activity but saw a healthy rebound by Q4, making investors optimistic for 2021. A noticeable trend emerging in the market includes heightened investor selectivity with acquisitions. The most prominent deals focus on redevelopment opportunities and existing retail properties with reliable and stable tenants. The average price per square foot is almost double the national average, at $380, and the average cap rate is 5.4 percent, below the 7.1 percent national average. Pricing data shows that retail assets peaked at the beginning of 2020 and have since declined. Well-performing assets and the correlating investor demand have seen the most interest, which may result in a wide range of square foot pricing and cap rate bases in the future.

The Multifamily Market

Los Angeles’s multifamily market was a hot spot for investors pre-pandemic, recording $11 billion in sales for both 2018 and 2019. In 2020, there were 1,500 multifamily trades, compared to 2,400 in 2019 and 3,200 in 2018. The slowest activity in Los Angeles since 2012 occurred in Q2 2020, where transaction totals equaled $900 million. Trading has since picked up but nowhere near pre-pandemic action. A trade in November points towards new trends in multifamily, with the sale of a 551 unit 2 & 3 Star multifamily portfolio scattered throughout Camarillo, Glendale, and Canoga Park for $142 million. This indicates shifting renter preferences to larger units in suburban communities. Average pricing in Los Angeles is $340,000 per unit, a more than $100,000 increase compared to the national average. The average cap rate is around 4.5 percent for multifamily assets in Los Angeles, below the 5.5 percent U.S. average.

The Industrial Market

Even after the pause in activity due to the pandemic, industrial assets in Los Angeles reached the second-highest transaction volume in history, for a total of $5.4 billion in the last 12 months. Activity has picked up, and buyers are aggressive with pricing, bolstering the average market pricing. By Q4 2020, incredible portfolio deals were transacted. The most notable being a REIT acquiring four properties totaling one million square feet from the Gateway Point Industrial Campus in the City of Industry for $295 million. The average price per square foot sits at $114, and the average market cap rate sits at 4.6 percent, one of the lowest in the nation. The outlook for industrial assets is optimistic as investors show increased interest in the sector.

As investors grow eager to return to normalcy, treasury rates have seen rapid increases. Still, lenders have stayed strong and remained at their floor rates. Matthews™ aims to keep investors informed on the state of the capital markets by assisting in executing transactions that meet client’s timing and financial goals. Equipped with the industry’s largest database of active lenders, our capital markets experts are able to create lender competition and ensure you receive the best terms for your debt requirement.

Please contact a Matthews™ specialized agent for more information.