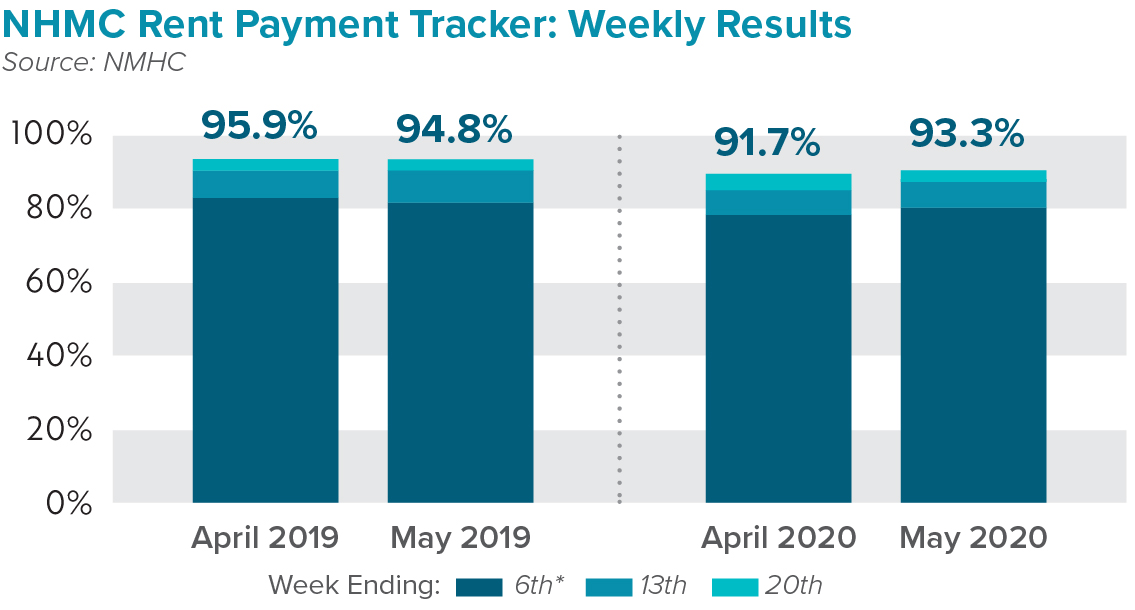

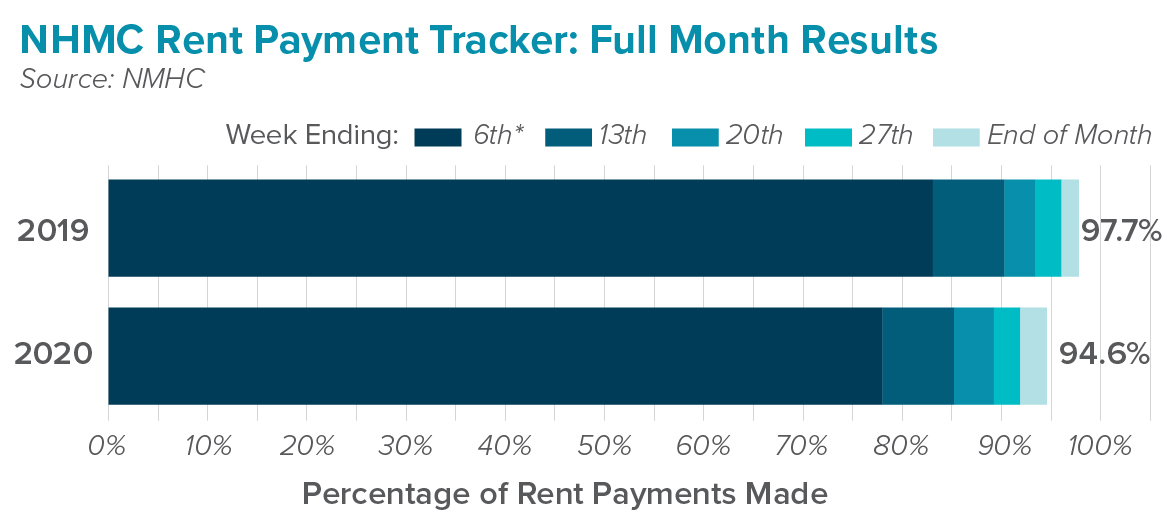

In recent weeks, we have released the National Multifamily Housing Council’s (NMHC) rent payment tracker data (Part 1, Part 2, Part 3, Part 4, Part 5, and Part 6) in an effort to keep investors informed. In this release, the data found that 93.3 percent of apartment households made full or partial payments by May 27th, 2020. Compared to the 91.7 percent that paid by April 27th, 2020, this is a 1.6 percentage point increase. The data was pulled from 11.4 million rental units across the country that vary by size, type, and average rental price.

The NMHC data details that apartment renters are completing their rent payment obligations when possible, but many worry that this data is “too good to be true.” April rent collection data was positive as unemployed residents dipped into savings, used their one-time $1,200 federal assistance check, or used their credit cards. As a result, many thought May would bring soaring rent defaults, but according to NMHC data, it hasn’t.

The federal relief package has provided unemployed workers with an additional $660 per week, which could cover rent for many unemployed workers. However, the program ends in July and is unlikely to be renewed. This could lead to a surge in rent defaults and residents moving out. The data shows that Americans are prioritizing their rent and landlords are working with them to create flexible payment plans. However, the hardships created by COVID-19 are not ending soon, and lawmakers are working on national rental assistance.

According to CoStar data, rents are falling in the nation’s most expensive apartment markets, and the worst may be yet to come. They report that tenants seem to be taking advantage of cheaper properties and cities, and are moving home, or to more affordable places to work from home. Q3 will be telling as operators begin to see impacts to their bottom line and cash flow as vacancy’s rise and non-payment of rent begin to add up.

As the industry enters uncharted waters, we are closing monitoring the events which unfold surrounding COVID-19 and the impact on the economy and commercial real estate. Information is sourced from NMHC, who will be monitoring and releasing updated Rent Payment Tracker data weekly. Please be on the lookout for reports with updated information.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.