With ongoing COVID-19 events affecting millions of Americans, unprecedented circumstances are following. So far, 16 million Americans have filed for unemployment, and 93 percent of the population has been mandated to shelter-in-place, affecting the 40 million renters in the United States. The multifamily industry is playing a large role by seeking federal relief for both owners and renters.

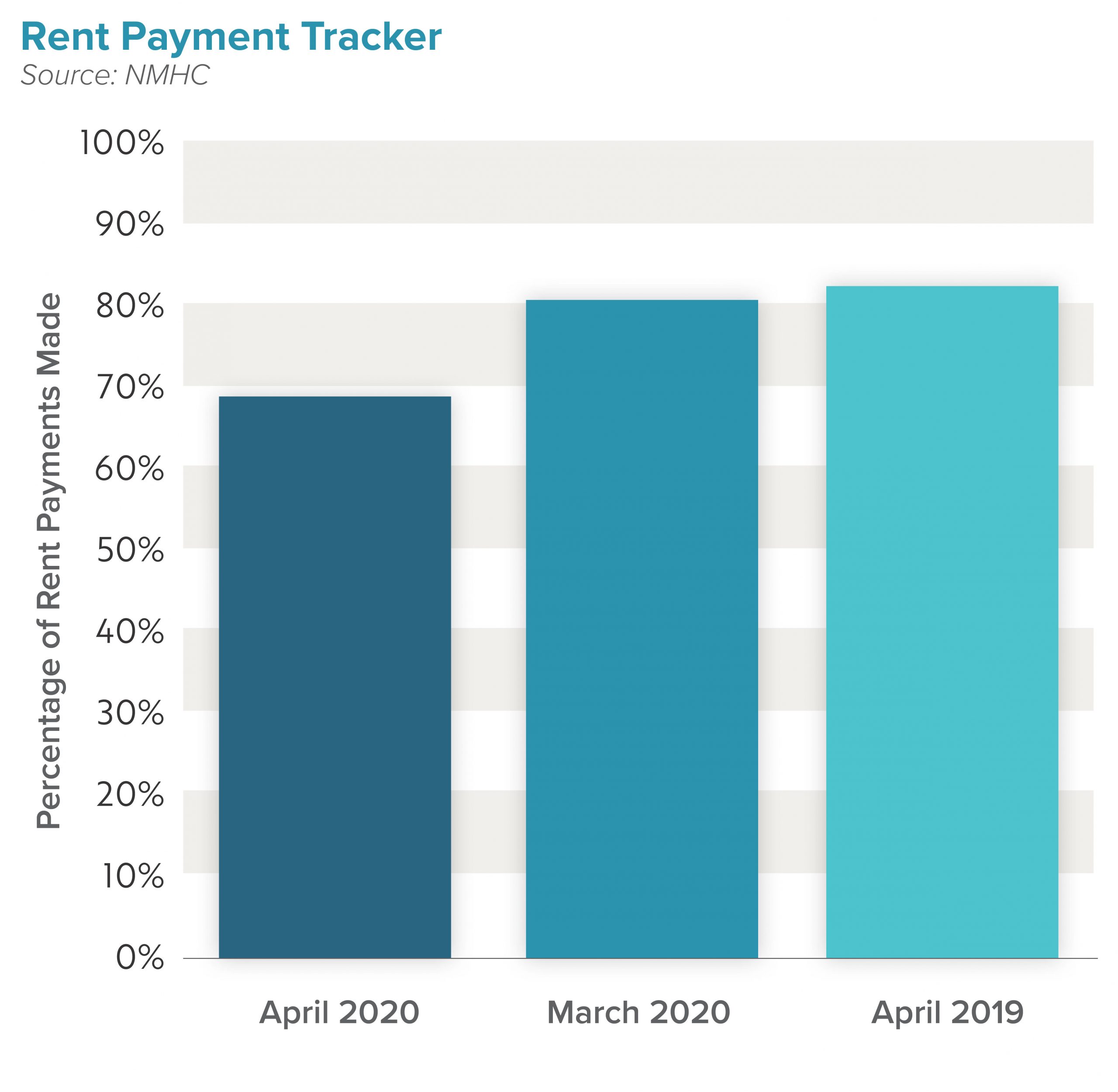

On April 8th, the National Multifamily Housing Council (NMHC) released initial key data on the impact that COVID-19 has had on the apartment industry. The data revealed that 69 percent of apartment renters paid their rent or made a partial payment the week of April 5th, a 12 percent decrease when compared to that same time in March, and 13 percent less than last year.

Rental property owners hold financial obligations that they must meet on a regular basis, such as mortgage, payroll, insurance, taxes, and utilities. In response, housing providers across the nation are working with their renters whose health or financials have been impacted by COVID-19. However, the important takeaway from the data provided by NMHC is that a large number of renters are still fulfilling their rent obligation.

A number of factors shaped the figures demonstrated in the Rent Payment tracker graph, including:

- Closed offices

- Delay of collections

- Unavailable technology to submit online payment

- Unreleased potential payment plans

Owners and property managers are offering flexibility with their residents during these times and want to be a part of the solution. Housing providers are offering creative payment options including, flex payment schedules, rent deferment plans, waiving credit card and late fees, and applying security deposits towards rent. Thus far, these payment strategies are working, especially repayment plans, which are seeing triple digit percent increases. These repayment plans comprise of taking the current month’s rent and applying it to future payments, affecting payment submissions.

Apartment properties across the nation are taking safety precautions and practicing social distancing by closing offices. This could create problems for renters who submit physical payments, such as cash or check. Further, an employee would have to visit the office to pick up payments. Other late payments can be attributed to renters’ initial hesitation to submit payment, whether through mail or a drop box.

Industry experts weighed in on this data with high hopes in the coming weeks. These experts found that despite the unprecedented times and an overall decrease in the amount of rent paid, they anticipate bolstered figures as soon as May as we gradually return to normalcy. Additionally, the recently enacted CARES Act, a $2 trillion stimulus plan, should also serve beneficial to affected renters as it includes helpful provisions such as direct payment to individuals and expanded unemployment insurance.

NMHC will be monitoring and releasing updated Rent Payment Tracker data weekly. The next release is scheduled for April 15th. Please be on the lookout for reports with updated information.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ multifamily agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.