CLICK HERE TO DOWNLOAD THE ARTICLE

Following the outbreak of COVID-19, state-mandated lockdowns swept the nation, preventing the majority of the population from leaving their residence. For nonessential retailers, this meant closing their stores. For multifamily owners, this meant restricting renter’s access to apartment amenities and services. The mounting unemployment, paired with downtown offices closing, has drastically increased the number of blue-collar workers teleworking. In this article, Matthews™ discusses the new renter demands and changes occurring in the multifamily space.

New Renter Expectations

Apartment complexes in dense urban areas see struggling renters fleeing to spacious and affordable markets. As residents spend more time at home, more are looking for additional space such as room for a home office or extra bedroom for a gym. Others are looking for updated kitchen features to accommodate cooking more at home.

With renters avoiding enclosed spaces, such as hallways and elevators, garden-style apartments are increasing in demand, especially those located in more affordable markets. Developers are noticing these new trends and new projects are forecasted to incorporate pandemic priorities like social distancing, remote working, and touchless technology. These developments will likely be found in suburban markets near urban hubs.

What does this mean for Co-Living?

The multifamily market was evolving before the pandemic arrived, with trends like short-term rentals and co-living concepts taking off. For residents looking to save on rental costs in big cities while cohabitating with like-minded individuals that shared similar lifestyles, co-living was their best option. Appealing primarily to the younger demographic who were new to a city,

co-living concepts typically included a multiple-bedroom apartment with a shared kitchen, bathroom, and living room space. With the introduction of a global virus, co-living no longer meets the needs of the new health-conscious renter.

Technology Becomes Essential in Multifamily Operations

As COVID-19 accelerated tech adoption across various industries, renters have started to expect the same from their apartments. For example, online payment portals, virtual leasing, and virtual tours have become the new norm. While some multifamily operations resisted tech integration, the virus has forced many to rethink their stance as it becomes increasingly difficult to operate without it.

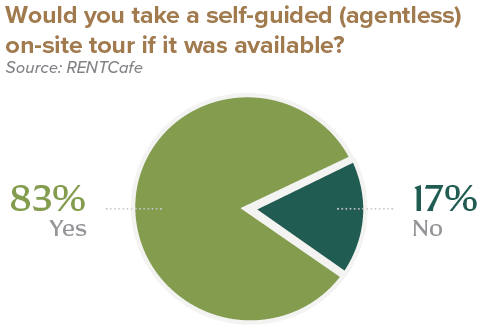

Virtual Tours

Before the outbreak, PERQ, a marketing technology company, found that 20 percent of multifamily operators used virtual tours, compared to the 80 percent who use virtual tours today as their primary way of conducting business. For prospective residents, landlords pivoted to virtual or self-guided tours. Multifamily communities began to roll out virtual touring software, and those that couldn’t afford the software leveraged free platforms, such as Google Hangouts, Zoom, Skype, and FaceTime.

Resident Portals

While leasing offices closed, landlords still needed a way to gather payments. Many pivoted to resident portals that allowed for submission of rent payments online, community discussion boards, leasing information, and more. Online resident portals are a great tool to help manage communities, continue leasing activity, and keep renters informed on community news, all from a distance.

Increased Bills

As renters stay home for more extended periods of time, utility bills and energy consumption increase. A tech solution to this is LineMetrics, a cloud-based analysis and API that tracks and collects data on a building’s energy consumption, air quality, temperature, and much more. Integrating technology that reports on building operations can help owners find great new sources of cost-savings.

Contactless Entry

A widespread tech integration in apartment buildings is automatic doors. With leasing offices and community rooms being the most accessed areas in apartment complexes, it would be beneficial for operators to consider installing automatic doors which would better serve their community and prevent the spread of the virus.

Leveraging Proptech to Engage Residents

As multifamily operators limited access to the amenities and services offered in their apartment complexes, a new challenge was presented: engaging with residents while practicing social distancing. Without altogether abandoning their tenants, some landlords kept a minimal amount of staff onsite. There should be at least one maintenance staff member onsite and one leasing office employee for emergencies.

One multifamily management group, The Franklin Johnston Group, reported that most people opted for virtual tours over in-person visits and found that they could interact better with prospective residents. Since they could schedule one-on-one remote visits, there were minimal disruptions from walk-in prospects or multiple phone calls that would occur during in-person visits. As a result, some communities are entertaining the idea of having closed office hours to decrease distractions for leasing consultants and drive more meaningful conversations. After just a few days of going virtual, one community serviced by The Franklin Johnston Group received four new leases.

Social Media Integration

The expansion of virtual touring has led to more exposure opportunities, as multifamily properties can repurpose any video tour by adding the footage to social media platforms, like YouTube. With renters adjusting to this new norm, the convenience of virtual touring is likely to remain a preferred service among prospects who don’t have the time to schedule and drive to complexes in person.

As far as operations go, multifamily operators had to quickly adopt new communication strategies to keep their community up-to-date on events, rules, and more. Social media filled the void in place of pool parties or barbecue events that would take place in apartment commonplaces. Some multifamily communities would host giveaways or contests to increase resident interaction and engagement. Apartments have also integrated apps to communicate with residents, or CRM tools for email or text blasts.

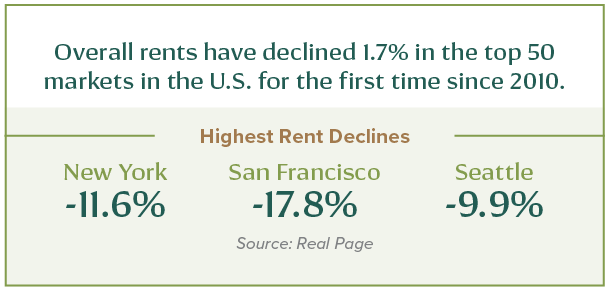

The Shift to Suburbs

Renters are abandoning pricey urban apartments due to the increased unemployment rate, widespread teleworking trends, and public transportation concerns. They are trading in their conveniently-located units for high-quality, lower-priced rental options in the suburbs with two or three bedrooms for an at home office or gym. As a result, landlords in heavily supplied and expensive urban-core markets are unable to push rents as their occupancy rates decline and many continue to struggle with collections.

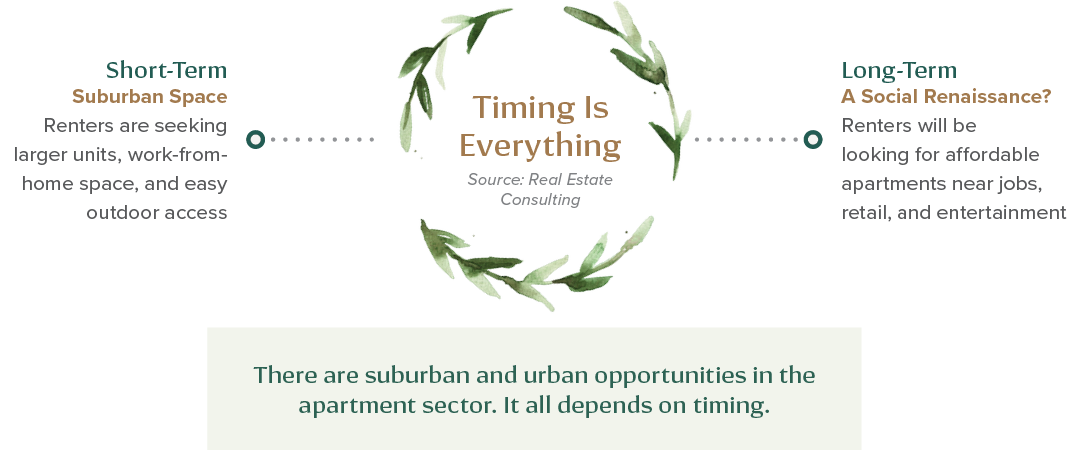

Experts predict a significant shift towards vintage, garden-style apartment communities that optimize social distancing through open hallways, less density, outdoor access, and better air circulation. Suburban garden-style apartments are often located in or near major cities with impressive demand stemming from population, income, and job growth. Garden-style apartments are mostly Class B and C properties that are decades old and present value-add opportunities. The average occupancy rate in Class B and C assets average around 91 percent for the last few decades, offer improved NOI, and healthy demand. Although garden-style suburban apartments typically command lower rents than Class A properties in major metros, many are usually near job hubs and have become increasingly in demand.

What This Means For Multifamily Investors

With a murky outlook on COVID-19 and its duration of impact on the economy, the renter demographic will likely avoid purchasing a permanent residence. In direct correlation to this, renter demand will remain, and developers will continue to build. Investors who will follow this migration to suburban markets will find plenty of opportunities for long-term value creation. Purchasing older products presents an excellent opportunity for markets with low land availability and high construction costs or difficult permitting processes as investors upgrade the interior, amenities, and landscape of a dated complex and create an appealing space at a lower price.

Now is a great time to be innovative with multifamily operations and solutions. While the multifamily sector was already adopting new proptech, COVID-19 boosted the rate of adoption, distinguishing the top players. Multifamily is seeing major upgrades across the board, positioning the industry to be the most valuable for the next ten years, especially among garden-style apartment communities. For more information, please contact a specialized Matthews™ agent.