Through most of the U.S. economic expansion, the apartment sector has been a favored asset class. Investors were excited about renter growth and millennial increases in urban locations, and as a result, investment in mid to high-rise properties surged. However, before the fears of the coronavirus pandemic took hold, the apartment deal activity in February registered a sharp decline. Compared to 2019, which experienced a significant amount of deal activity, 2020 thus far has experienced a 20 percent decline in deal activity. According to Real Capital Analytics, volume was down for both portfolio sales and individual asset sales across all markets. This decline can be attributed to the growing rent control regulations nationwide, the substantial supply, affordability, and rising homeownership rates, all affecting rent growth and renter demand. This report will provide information and guidance on the developments occurring in the commercial real estate apartment market.

COVID-19’s Impact on Apartment Fundamentals

With 40 million Americans practicing social distancing and with state mandated stay-at-home orders, a growing number of residents are turning to their property owners and managers for assistance. The pandemic has certainly affected renters, with over 10 million Americans, thus far, applying for unemployment benefits. Several states, including California, New York, Connecticut, and more, are issuing a temporary eviction moratorium that provides protections for tenants and extends timelines to repay any past due rent related to COVID-19 circumstances.

The near $2 trillion fiscal stimulus package will also send checks to more than 150 million American households, arrange enormous loan programs for businesses large and small, pump billions of dollars into unemployment insurance programs, boost spending on hospitals, and much more. In the immediate term, the stimulus package will aid renters who are unable to pay their rent.

The Federal Housing Finance Agency (FHFA) has extended mortgage forbearance to federally-backed multifamily housing property owners who suspend evictions for those who have been financially impacted. Forbearance is needed to prevent foreclosure, lien placements, utility shut-offs, defaults, and judgments that would impact property operation.

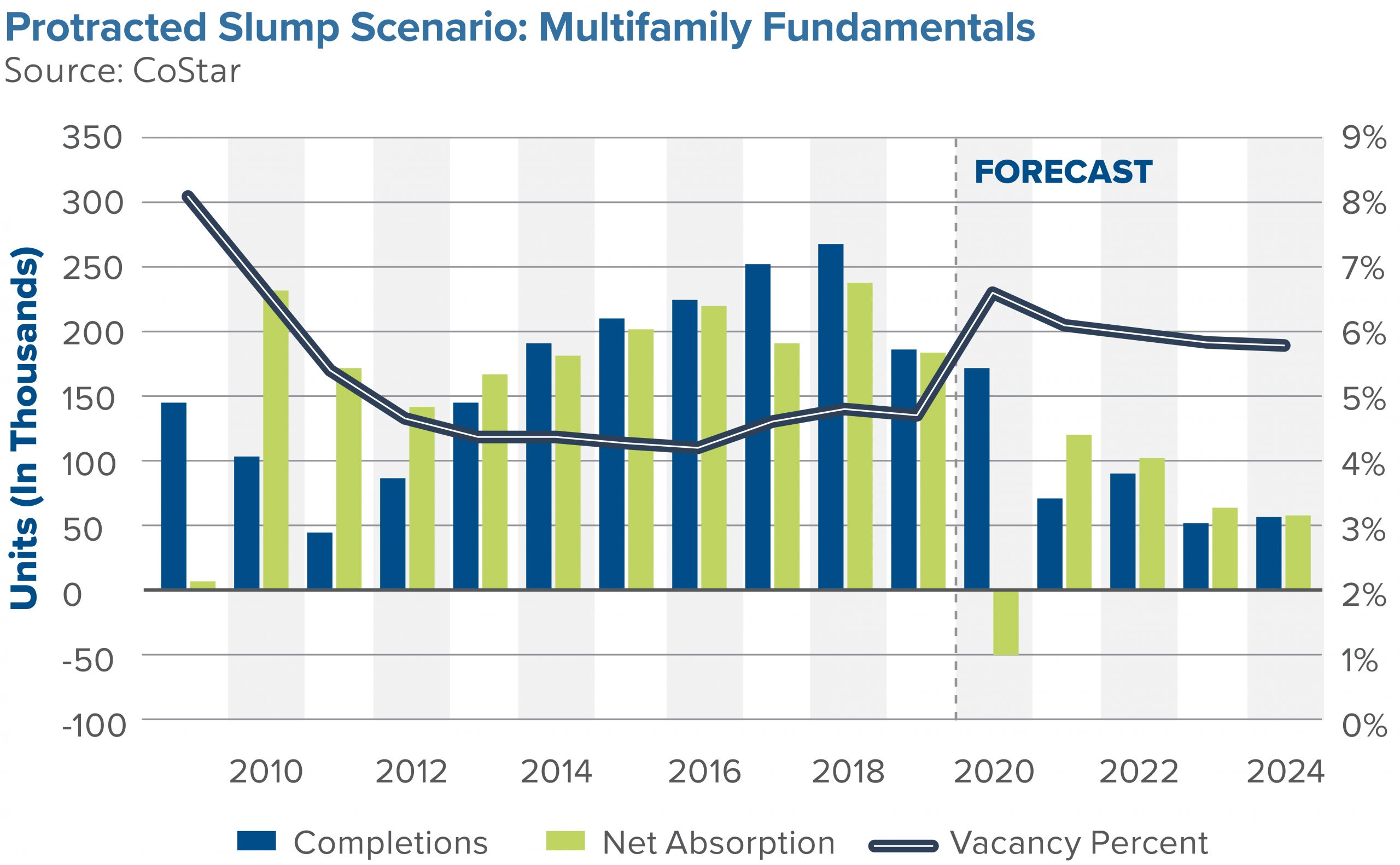

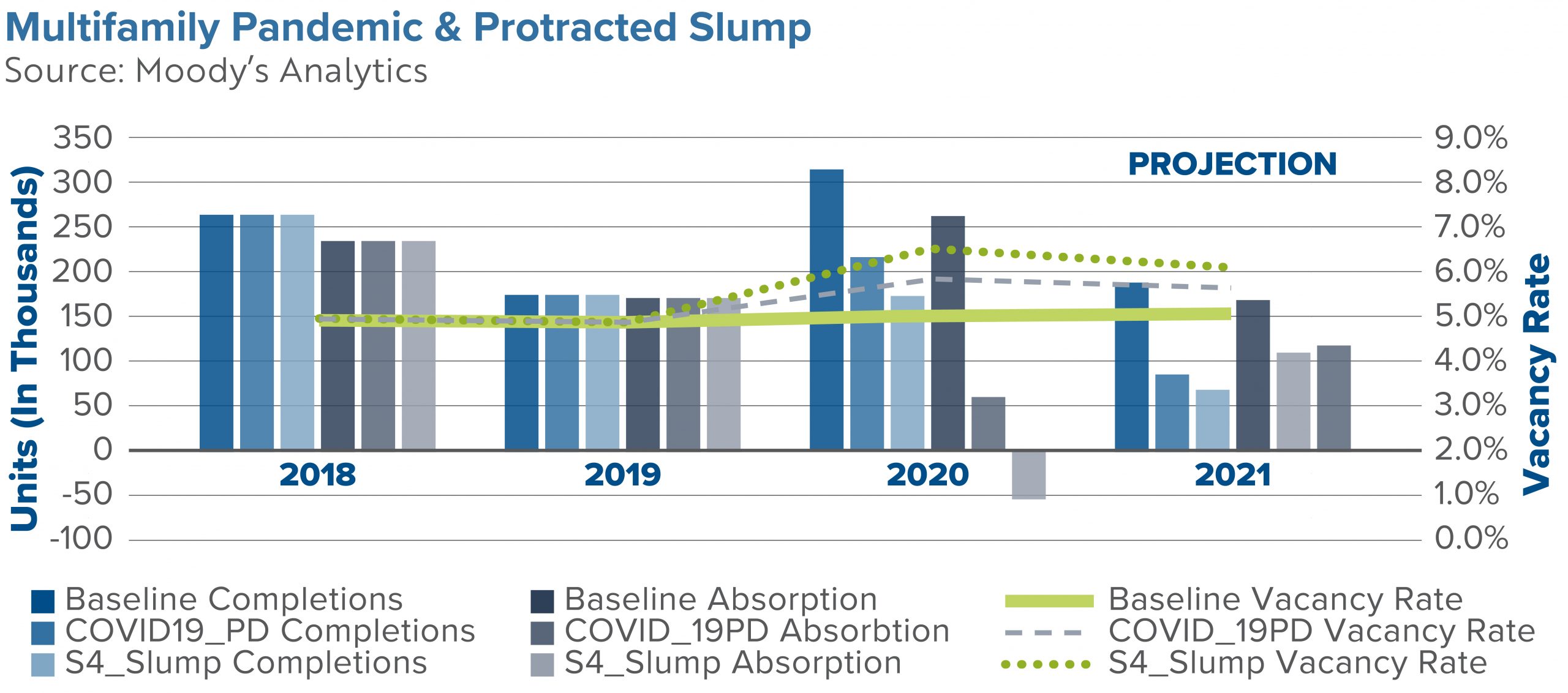

In the short-term, we will see deliveries put on hold until demand normalizes. Multifamily supply chains will experience disruptions that could result in construction delays and an increase in material costs, but this could serve as beneficial to markets experiencing oversupply. Countervailing effects, like a decline in new construction as a response to the economic slowdown, could help normalize rent growth and vacancies. But, if the past has shown us anything, it’s that the apartment sector is resilient during downturns, and transaction volume is slow to react as real estate transactions take time to complete.

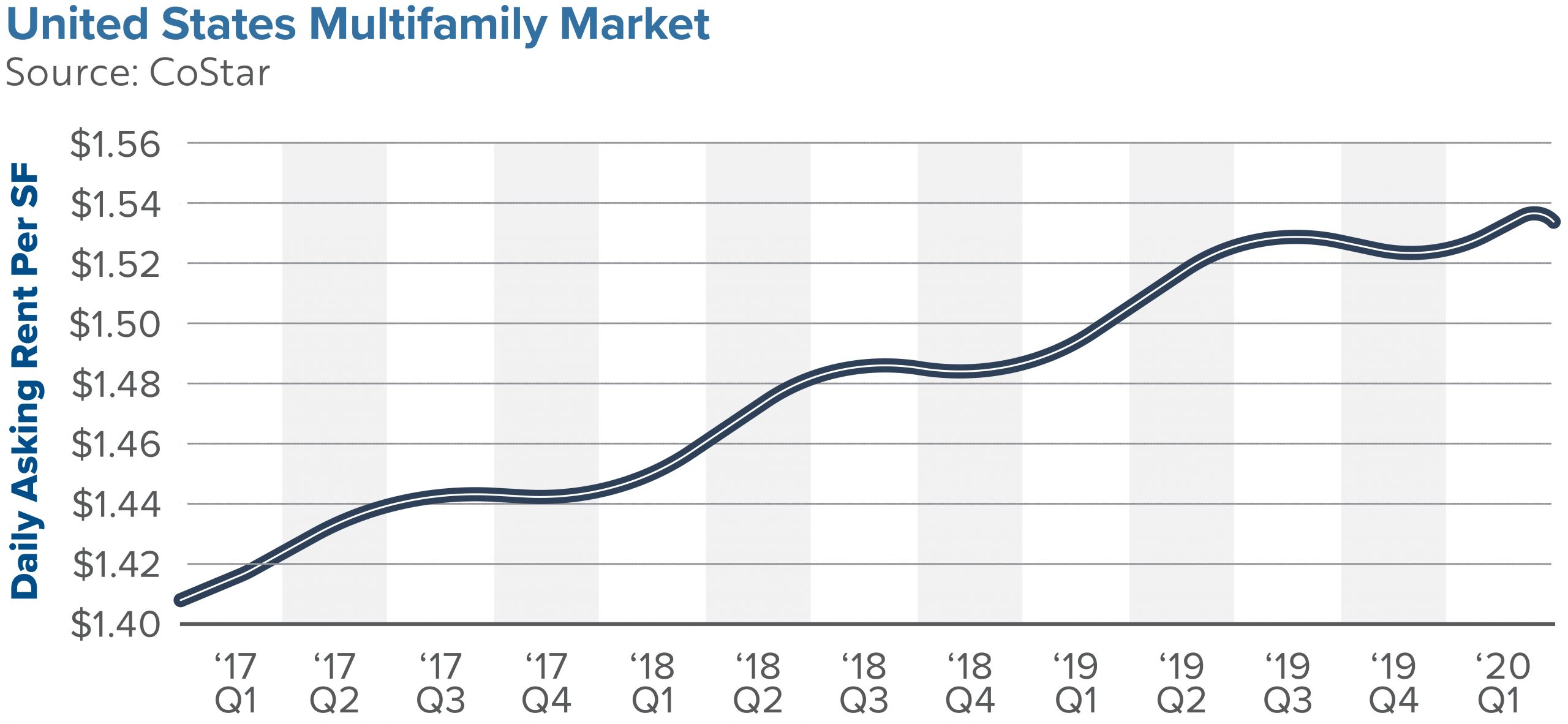

Rent

Rent growth was already slowing at the end of 2019, and continued into 2020. It is expected they will decline further due to rent deferral programs for those affected by COVID-19.

- In February, rents increased 3.2 percent on a year-over-year basis but have since fallen .3 percent since March 10th, translating to eight percent on an annual basis.

- Asking and effective rents are expected to fall by 2.8 percent and 3.9 percent, respectively.

Vacancies

Multifamily is seeing rising vacancies, but primarily due to the notoriously slow winter season for leasing.

- National vacancies were at 4.7 percent at the end of 2019, whereas the Great Recession started with vacancies at 5.7 percent. Therefore, we are starting from a lower base in this cycle.

- Given historical fluctuations, there is no correlation between vacancies and downturns. However, given the recent record of oversupply, it is expected that these new deliveries will see nonexistent lease-ups in the short-term.

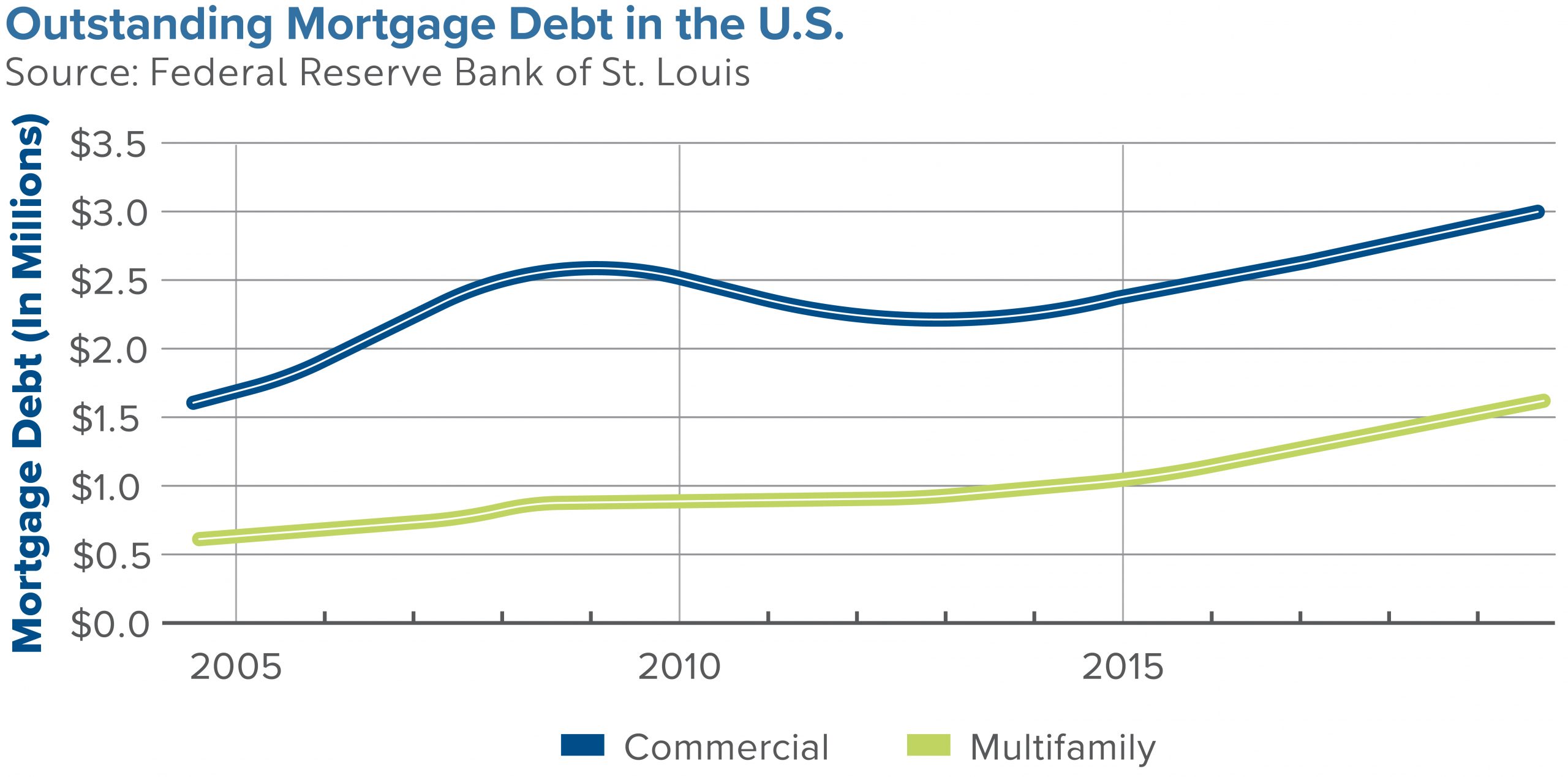

Lending

Fannie Mae, Freddie Mac, and other government agents are tightening some lending standards, are offering several loan processing flexibilities, and providing mortgage forbearance to multifamily property owners affected by COVID-19.

- Lenders are offering a 90-day forbearance, in which they will not be obligated to pay principal, interest, or escrow contributions. During this time, there will also be no late fees assessed to the loan and no interest charged.

- At expiration, borrowers must work with lenders to extend the forbearance or establish a repayment plan. For Fannie Mae and Freddie Mac the forborne amounts are repaid through 12 equal installments.

- Additional flexibilities are applied to desktop appraisals completed for new construction properties, demonstrating construction has been completed, and allowing for renovating disbursements.

Guidance For Property Owners and Operators

It is suggested that owners and property managers put a rent deferral program in place to deal with COVID-19. This program should address rent expectations and guidance, assessing monthly until there is an update on what lenders will do to assist and the economy normalizes. The National Multifamily Housing Council released some recommended principles for apartment firms to support residents impacted by COVID-19. These include:

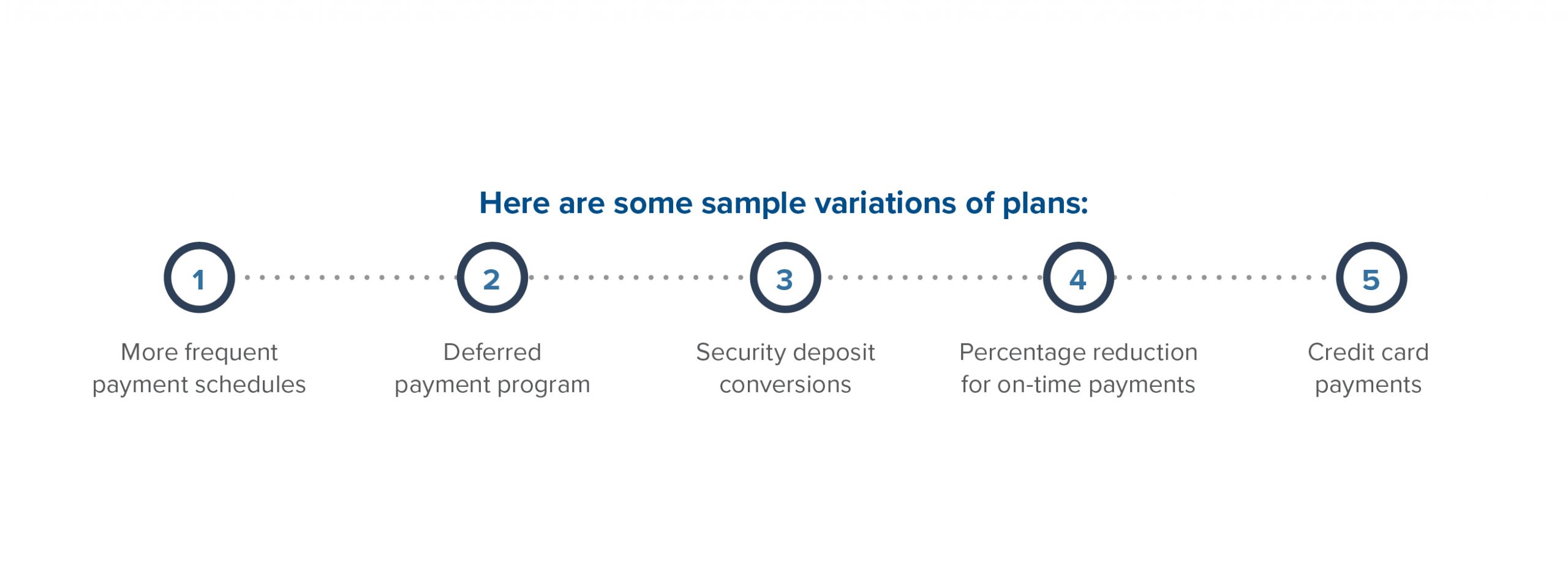

During this time, property owners and managers must work with residents to create a payment plan and wave late fees for those directly impacted. It is also suggested that these plans are put together on an individual basis, and additional resources should be provided to residents offered by federal, state, local governments, and community organizations. Here are some sample variations of plans:

Be sure to receive documented proof such as a letter from their employer stating termination, lay off, or reduced hours, and the resident must sign a written agreement with clear expectations outlined. It is also important to remind residents that if they are not financially impacted by the pandemic that all existing rent and related obligations remain.

With about 45% of all mortgage holders backed by Fannie Mae or Freddie Mac, and an additional, 12% backed by FHA loans, mortgage forbearance is available through the Federal Housing Finance Agency (FHFA). Any borrower with a federally backed multifamily mortgage loan can request forbearance of up to 30 days with two additional 30-day periods, for a total of 90-days. The borrower must be current on payments as of February 1st and borrowers need not provide any documentation to verify their financial hardship.

Multifamily Outlook

Although the multifamily industry may feel the impact of COVID-19, the sector is positioned to weather the storm. In the short-term, owners and operators may face rent collection issues from tenants who have fallen ill or have become unemployed, and flexibility will be required. From an investment perspective, most investors are poised to sustain their operations, and numerous opportunities are available for owners with ample cash as borrowing rates remain at an all-time low. It is expected that the impacts of coronavirus will last three to six months before a steady recovery boosts the economy, and deliveries will resume.

Beginning on April 8th and continuing weekly for the duration of COVID-19, NMHC and apartment data providers are releasing key data on the impact of the COVID-19 outbreak on the apartment industry. Please be on the lookout for reports regarding this information.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.