With COVID-19 presenting some new challenges to the evolving retail industry; Shopping centers, restaurants, grocers, and other retailers are taking action to prevent the spread of the outbreak. These actions include temporarily closing, adjusting store hours, offering curbside pick-up, and encouraging online shopping. Many CRE experts have shared their concerns to business flow and progress on the transaction side. The dramatic shift in businesses will not last forever and the economy will rebound. Now is the time to gather information and feedback. This report will aid in providing guidance for investors and realty professionals in the retail market.

How the Retail Industry is Weathering the Storm

Restaurants

Depending on the sector and region, restaurants are facing significant challenges, especially in states and cities that have enforced closures. In response to the decline in foot traffic, restaurants are focusing on delivery and pick-up services to engage cash revenue. Food delivery services have seen increased activity and interest due to the need for social distancing as the Trump Administration advises against gatherings of more than ten people.

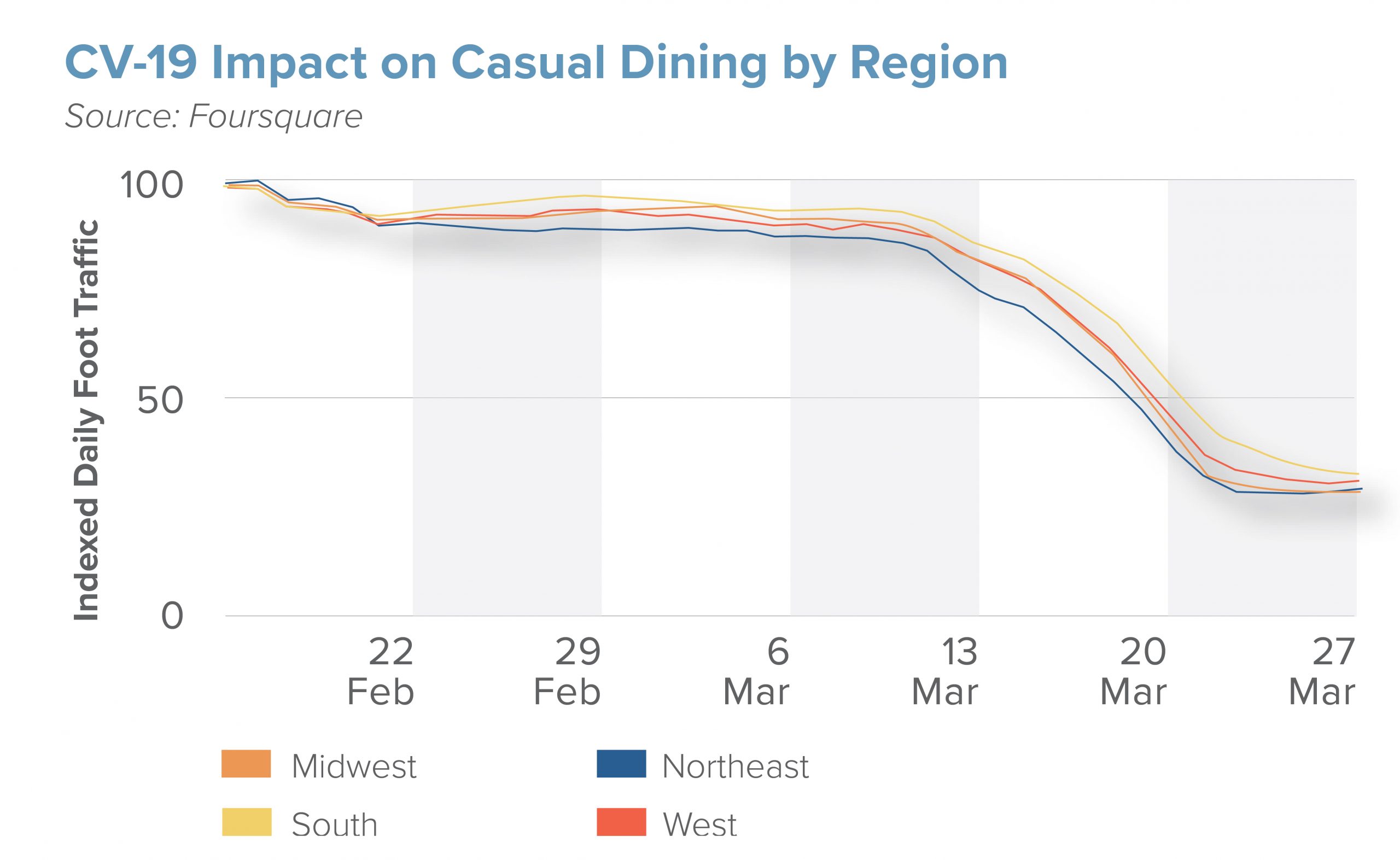

Casual Dining

- National data from Foursquare showed a 73 percent decline in foot traffic through Friday, March 27th.

- The restaurants that began offering strict delivery and pick-up services have seen upwards of a 20 percent increase in to-go sales compared to the previous year.

Despite restaurant closures, there has been foot traffic, and consumer spending increases at grocery stores, gas stations, QSR locations, and dollar stores!

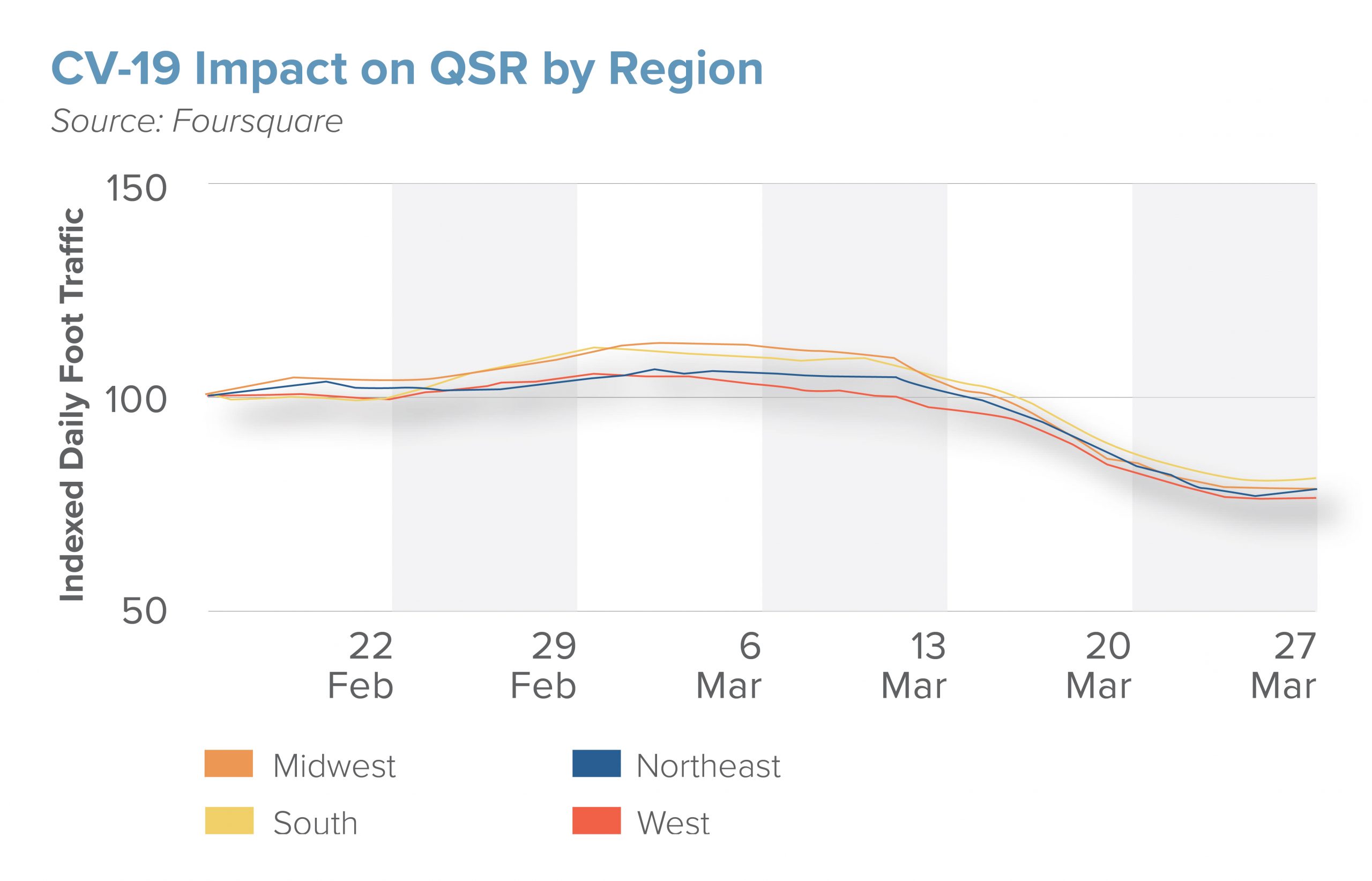

Quick Service Restaurants (QSR)

- Nationally, QSR is down 18 percent through Friday, March 27th, but many pivoted to the drive-thru or pick-up options.

- 91% of respondents to a Foursquare survey said they chose QSR drive-thru or take-out between March 20th and March 24th .

- At the beginning of March, many QSR chains saw year-over-year growth, and those with losses notched a stronger start than many have predicted.

Restaurant owners and operators should consider speaking to corporate companies or franchisees to start gathering information for the next steps and discuss distribution. It is best to have a plan in place to account for the potential increase in consumer sales and delivery once people revert back to dining out and delivery. Businesses should also have staff in place to support a recovery and growth cycle.

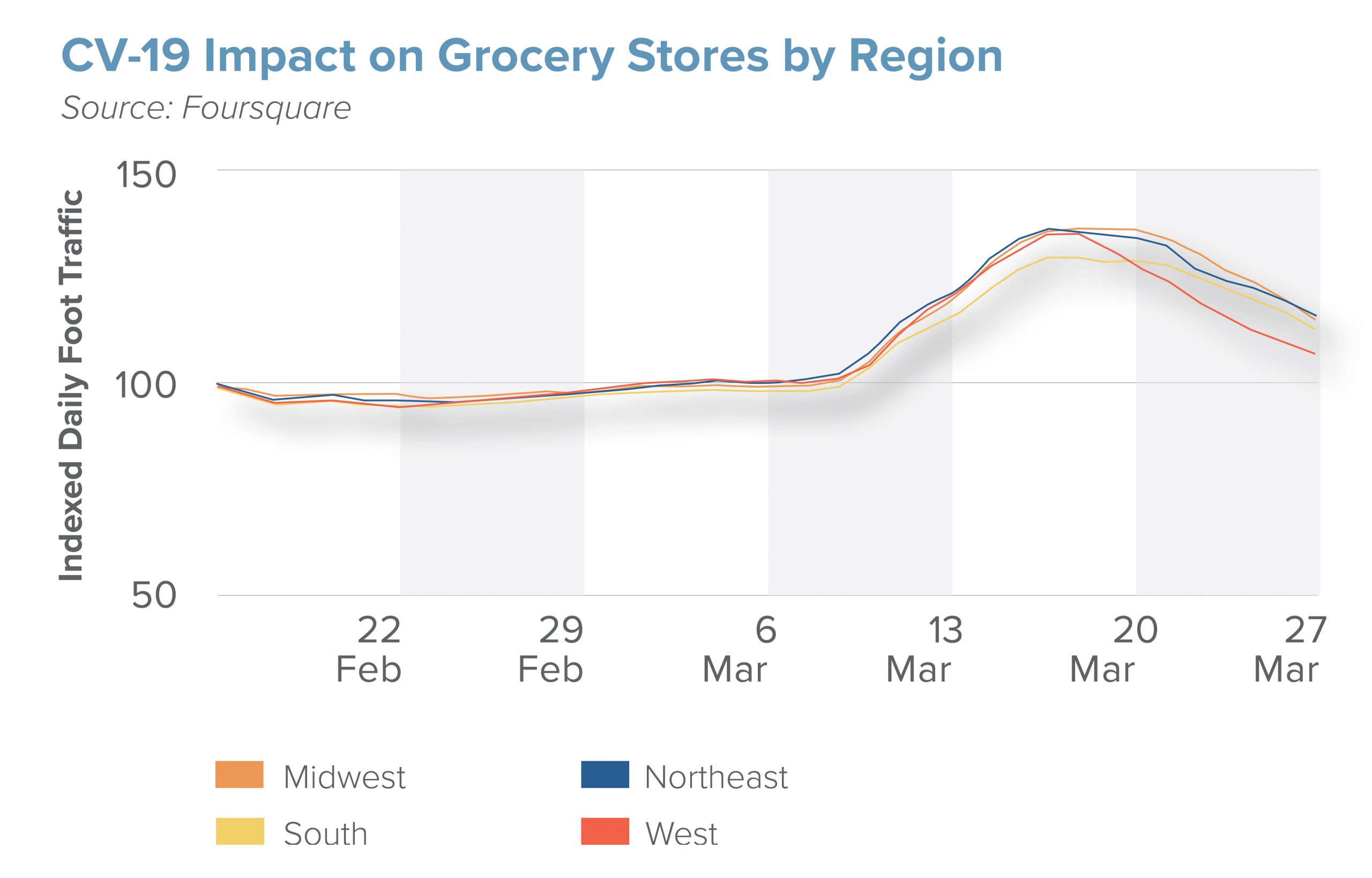

Grocers

Over the last month, grocery retailers have faced a plethora of benefits from the stock-up phenomenon as panicked customers rushed to wipe out all essentials at supermarkets. As a result, it is expected that grocery-anchored retail centers will fare better than regional malls as they are more necessity-based rather than discretionary purchases that can be placed online. With social distancing being enforced nationwide, grocery delivery services, such as Instacart, have increased in popularity.

- Downloads for Instacart increased 215 percent between February 14th and March 15th, with another 50 percent increase the following weekend.

- Visits to bulk-buy grocery stores, like Sam’s Club and Costco, were up nearly 39 percent in major markets from the week of February 19th to the week of March 13th. Now, they have returned to roughly normal levels.

Many grocers are taking preventative measures to assure the public they are safe to continue shopping in-store. Trader Joe’s, for example, stated in a recent press release that they would revise store hours at all locations, give employees additional sick time, restock items every hour, and increase routine cleanings. Other grocers are limiting the purchase count on certain sanitary products that sold out early on and allowing the elderly to shop first. However, with increasing delivery orders and a diminishing inventory, customers can expect delays in grocer services with demand at an all-time high.

Retailers

National brands like Apple, Nordstrom, Foot Locker, and Nike, who drive a lot of foot traffic in shopping centers, announced temporary store closures, urging customers to shop online instead. E-commerce, which was once considered a threat, has stepped in as an ally to help save retailers and provide essentials without fear of spreading the virus. Other national retailers have announced reduced hours, like Kohl’s and J.C. Penney. Dollar Stores, who have proven to be recession-resilient and rely more on domestic vendors for their products, have also announced reduced store hours to help prevent the spread of the virus.

Large national tenants are likely to survive this event as big-name brands can rely on online sales, but the same cannot be said for some mall-based retailers. Good business professionals will most likely have a savings account and have the cash available to withstand a downturn. Small shop tenants are seeking any relief from their landlords through payouts and other measures. Among other retailers, those that have stated publicly that they do not expect to pay normal rents include The Cheesecake Factory, Mattress Firm, Subway, Bealls Outlet, Kohl’s, and H&M.

The Coronavirus was mentioned 160 times on 19 different retailer earnings calls in the past two weeks.

Landlords are turning to credit facilities while others are cutting dividends to help pay their mortgages. Those without 6 to 12 months of earnings are going to see a rippling effect in their business short-term. The CARES Act, passed by Congress and The Trump Administration on March 27th, includes multiple provides to help small businesses stay afloat. For retailers that are making few sales, liquidity is provided to them in the form of tax provisions or access to credit. The provisions will allow businesses to slow the payment of payroll taxes to keep employees on their payroll, loans and grants, and allow businesses with little to no revenue access to a bridge loan that will continue paying employees.

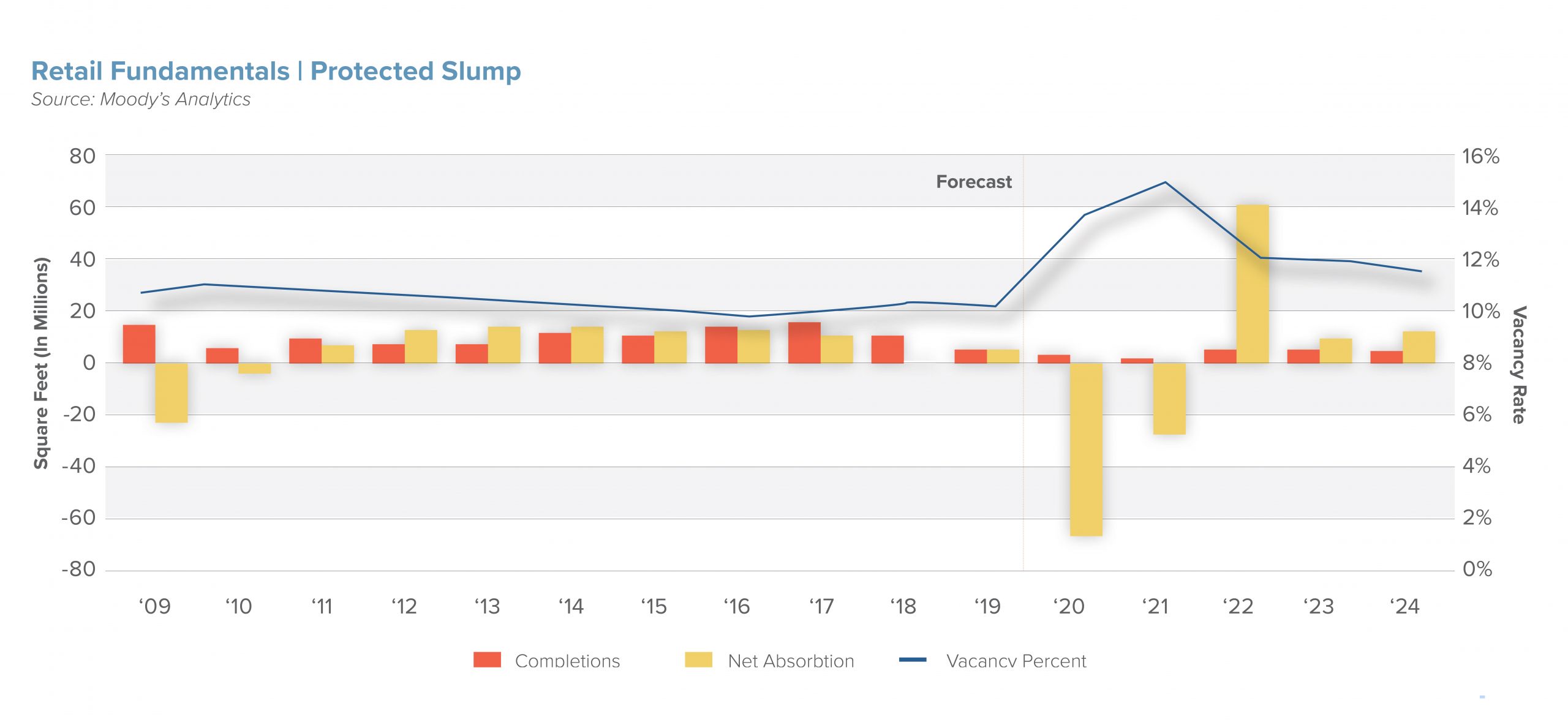

The Coronavirus has pushed many tenants into financial distress sooner than expected, and those that were planning to expand through store openings have been put on hold or stopped until certainty is regained in the market. But, some retailers are doing better than others as consumers first flocked to warehouse stores, then grocery stores, and most recently drug stores.

- As of March 27th, the retailers with the largest relative upticks in foot traffic were drug stores, with CVS and Walgreens up 28% nationally.

- Foot traffic at hardware stores like The Home Depot and Lowe’s are up 27%, nationally for the week ending March 27th.

- According to data from Cowen, foot traffic in stores for the week ending March 13th was down 30.7 percent year over year.

- A March survey conducted by Coresight Research found that 72 percent of respondents will avoid malls if the outbreak worsens, with 64 percent avoiding all shops in general.

Guidance from our Agents

We want to urge investors to avoid panic and be proactive.

- Take this time to research and understand everything about your property and tenant.

- Property owners should be reaching out to their tenants, corporate companies, or franchisees to put together a game plan.

- Landlords and property owners should also be prepared to offer reductions on rent and rent holidays to provide relief for their tenants who are not open during this time.

These conversations will vary depending on tenant types, ties to the operator, and the type of concept. However, the vast majority of these tenants are struggling, and it is important to understand the dynamic. Realistically, there are ways for the landlord, to not only help tenants out during this time but also find ways to benefit on the backend. For example, finding different ways to restructure leases that allow tenants to help the landlord liquidate their assets in return for a healthy tenant.

In comparison to two months ago, cap rates will most likely not be lower, and property values will not be higher. Of course, there are different effects across different retailers. It’s important, now more than ever, to talk to a professional who spends their time, energy, and effort understanding everything they need to know about that specific tenant. This will help you make better decisions because these specialists can better understand what is going on.