In recent years, shopping centers have combatted waned foot traffic and vacancies due to changing consumer shopping habits. Now, shopping centers are being forced to contend with another unwelcomed factor—COVID-19. Although the pandemic has already hit struggling retailers, some shopping centers are doing better than others, especially if they include a grocery store. As we emerge from this pandemic, it is anticipated some shopping centers will face bankruptcies, closures, and e-commerce will continue to grow and take a greater piece of the pie.

COVID-19’s Impact On Shopping Centers

On March 29th, President Donald Trump announced that federal social distancing measures would continue through the end of April. While the details of the extended recommendation have yet to be announced, it is likely that non-essential stores, including malls, will remain closed until further notice.

With extended closures, retail and restaurant tenants are advising landlords to work with tenants during the changes we are currently facing. However, the landlord still must pay its lenders, utility companies, and insurance companies to maintain the appropriate level of operation. The rental income that is received is essential to meet these obligations. Though, if landlords continue to demand rent when no sales are coming in, it will push tenants to close more permanently. As a result, the real estate industry is bracing for the financial impact widespread closures will bring.

In response, The International Council of Shopping Centers (ICSC) addressed President Donald Trump, Vice President Mike Pence, and Treasury Secretary Steven Mnuchin in a letter asking the federal government to guarantee or provide business interruption coverage for commercial tenants and landlords. The letter states:

“Without ensuring the stability of our tenant base, the repayment of up to $1 trillion in secured and unsecured debt underlying the shopping center industry will be at risk. This will jeopardize the entire industry and cause long-term damage to financial markets, rampant unemployment, and irreparable harm to communities across our country.”

Malls & Shopping Centers

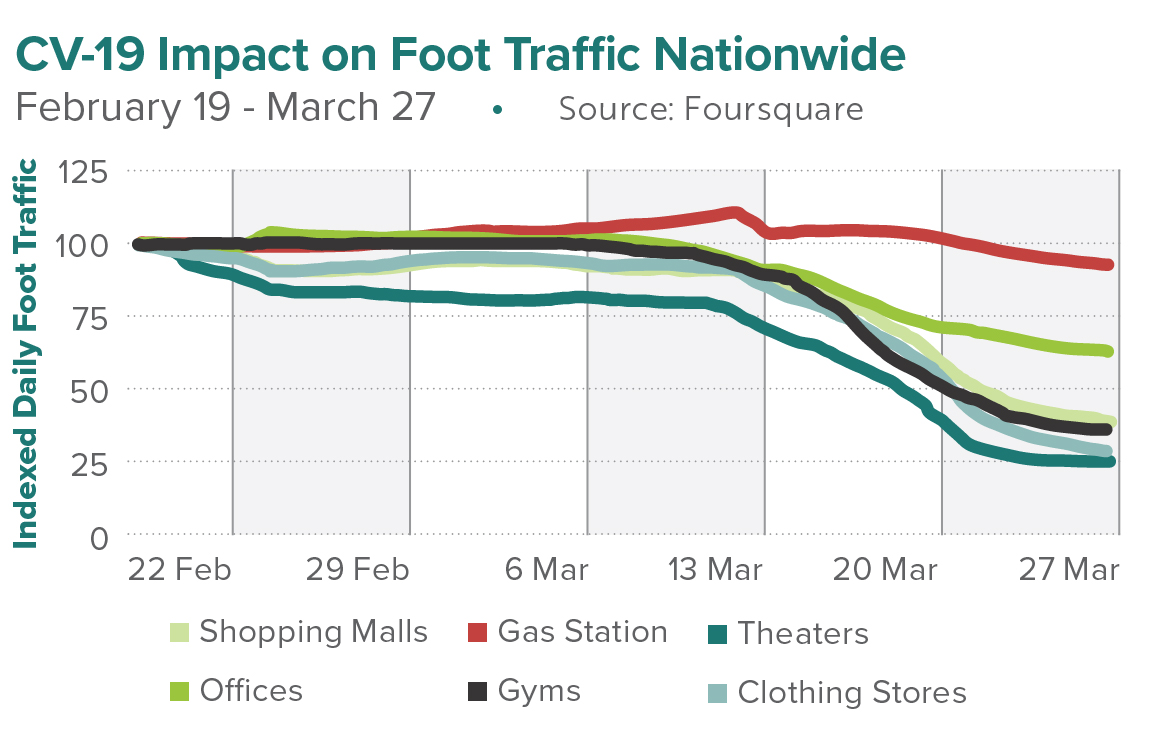

As people shy away from large public places, the once-bustling corridors of shopping malls have turned into ghost towns, and retail properties are suffering from the slowing sales. Some retailers are in better positions than others, and therefore shopping centers with these tenants will likely not be affected.

- Retailers such as Nike, Apple, and Lululemon have their inventory in an ideal place to survive a pandemic.

- Retailers such as Dick’s Sporting Good, Target, and Walmart, have robust omnichannel capabilities to weather the coronavirus pandemic.

- Retailers that are in a worse position include those that were struggling before the pandemic

- Retailers such as Macy’s, Sears, Forever 21, Pier 1 Imports, and Gap were already facing financial challenges due to declining sales, and now they may be forced to close more stores.

As of mid-March, Coresight Research expects 15,000 stores to close permanently in 2020 and could be even higher, depending on the duration of the pandemic.

In the past, as department store space is left empty, owners find business opportunities with experiential tenants. If the coronavirus prompts permanent closures, it could, in effect, accelerate the current evolving and modernization of shopping centers, which have thrived on a social component. However, it remains to be seen how social-distancing will impact the retail environment as these concepts are currently vulnerable.

- Movie theaters, which anchor many shopping centers across the country, have already been threatened by streaming services, and retail experts foresee a drop in demand.

- Fitness centers, which many shopping center owners have looked to fill the vacancy, have also become vulnerable to the pandemic.

While the spread of cases in the U.S. has shifted the focus to consumer demand, the retail industry faces impacts to supply chains. National Retail Federation survey in March found:

- 40% of its members said they see disruptions to their supply chains from the coronavirus

- 26% expect to see disruptions to their supply chains from the coronavirus

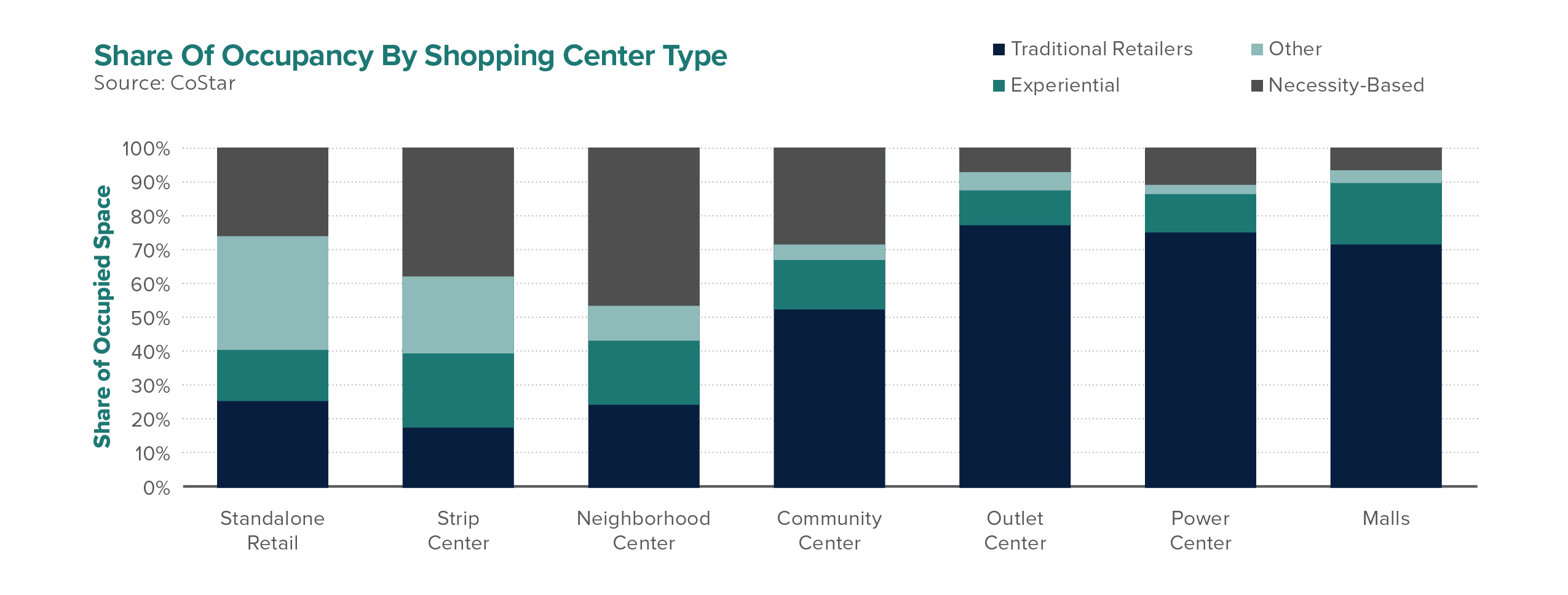

Beyond supply and demand issues facing retail, experts say the larger threat COVID-19 poses is a recession. This would have a longer-term impact on consumer spending, and thus the profitability of shopping centers. CoStar predicted that traditional retailers and experiential retailers would be more susceptible, while necessity-based retailers are unthreatened.

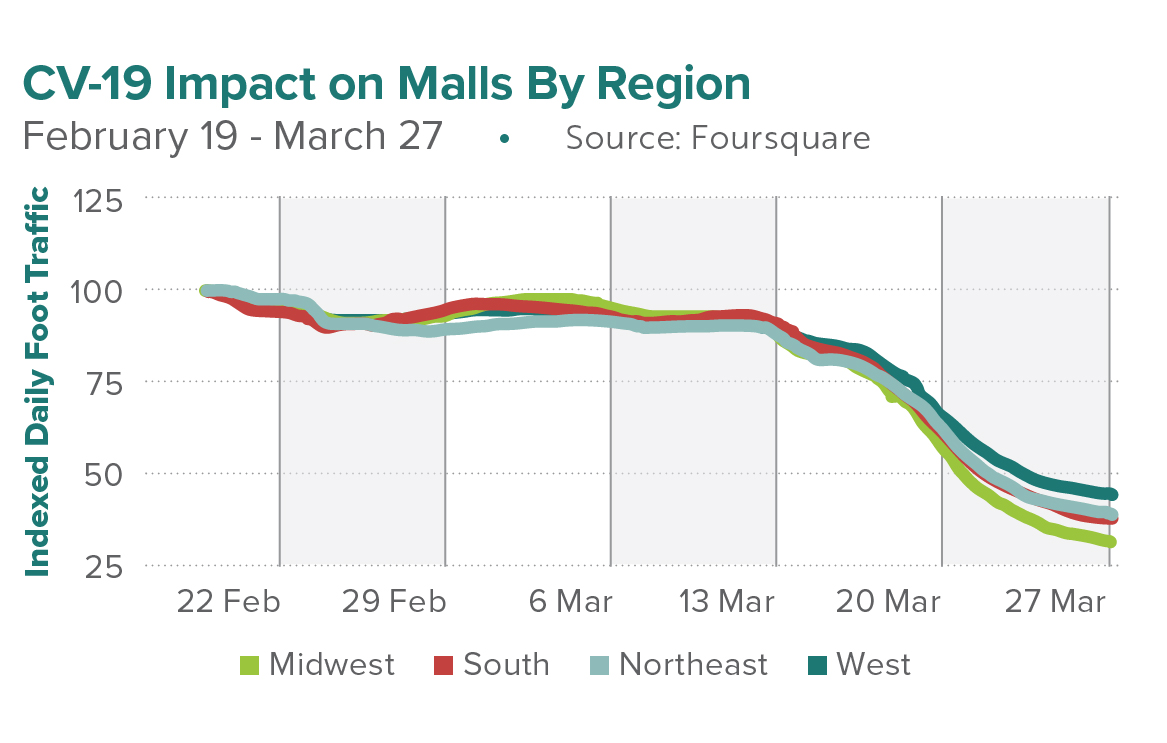

Regional malls will face more trouble than local grocery-anchored retail centers as malls tend to attract shoppers making discretionary purchases of non-essential items. In the long-term, indoor malls are likely going to be affected more than outdoor malls and strip centers, and regional shopping centers will be impacted more than grocery-anchored shopping centers.

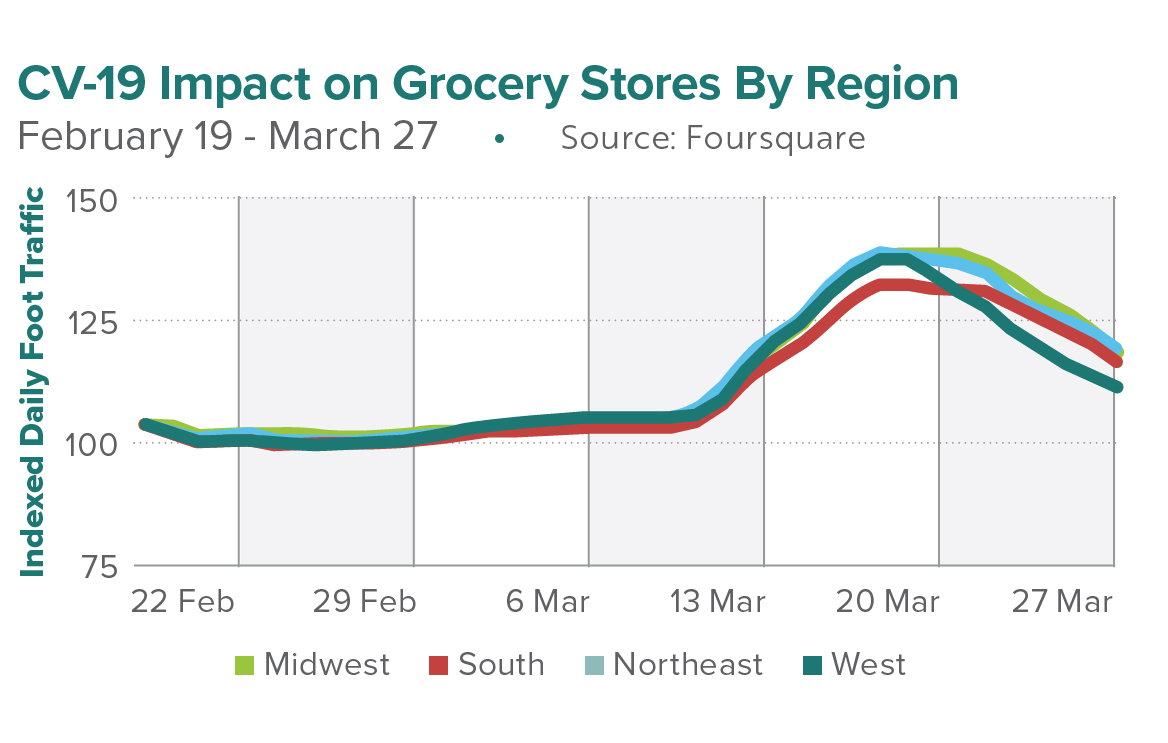

Grocery-Anchored Shopping Centers

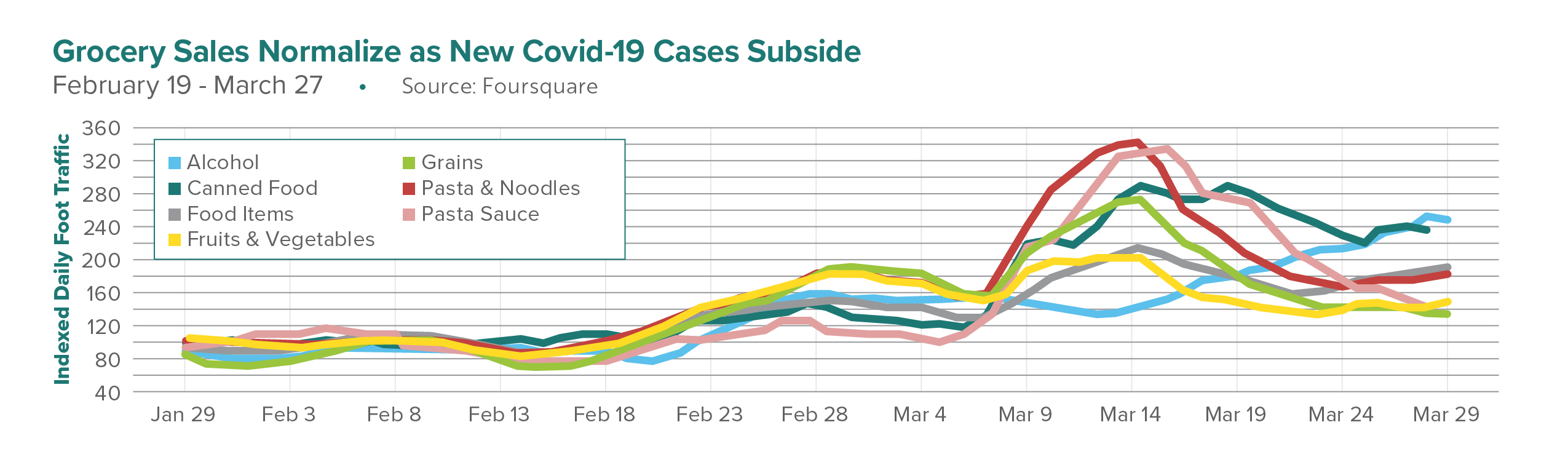

Early beneficiaries of COVID-19 have been mass-market, drug, and grocery retailers. Open-air shopping centers, neighborhood centers, and community centers, many of which are anchored by highly productive grocers, drug stores, or home improvement chains, are essential during the pandemic. Many consumers have rediscovered the grocery store anchoring their neighborhood shopping center after finding online sources to be unreliable and warehouse club retailers chock-full of panicked people stock-piling. Shopping locally provides comfort in these uncertain times, and more importantly, consumers can more easily return to the store to buy items that were previously found out-of-stock.

According to Pacer.ai, year-over-year traffic spiked by 40 percent at Albertsons stores and by 36 percent at Kroger stores on March 13th through 15th

As a result, grocery-anchored retail centers will likely see gains well through the pandemic. And, investors have been betting on grocery-anchored retail as a way to compete with online shopping sales. Therefore, grocery-anchored shopping centers have become a popular retail investment class this cycle.

Through strong and weak economic cycles, neighborhood shopping centers that are grocery-anchored have been favored by lenders, as they recognize the significant draw grocers provide. Customers that frequent the service businesses are typically tenants in side shops that offer cash flow stability to the center. In contrast, unanchored centers, usually strip centers, experience the most distress in downturns as the small service-oriented tenants are undercapitalized, which is true today. COVID-19 will positively affect sales at the grocery anchor, but the restaurants and side shops at the center will face challenges.

Side shop tenants will most likely negotiate rent reductions with their landlords, but some may fail and go out of business. This loss of tenant income will impose significant cash flow stress on landlords and debt coverage covenants in loans. Well-capitalized landlords will be able to weather the downturn, but those that are not will be required to work with tenants and lenders to modify terms of payment.

Navigating the Shopping Center Market

The strongest players will find ways to conduct business and continue building on customer loyalty by offering timely restocking and home delivery options. This should help grocery-anchored shopping centers survive the long haul—particularly compared to malls and other retail properties that lack necessity retail components. Owners unable to make payment will seek Chapter 11 protection, others will give the properties back to the lender. This will present buying opportunities for investors that have liquidity and tenant relationships that can backfill vacant space. For any landlord, the retail center should be able to adapt to shopper demands for amenities like home delivery and order pickup. The grocery store needs to be very flexible, and have the economic background to withstand disruptions to their stores.

This pandemic is going to reshape long-term shopping behavior, including how groceries are purchased as consumers will grow accustomed to ordering online. Look out for a long-term shift in how we shop for groceries.

- According to Rakuten Intelligence, online grocery order volume surged 210% from March 12 to 15, compared with the same period in 2019.

- NetElixir showed a similar trend and reported that online food sales surged 183% between March 1 and 25, versus the same period in 2019.

- In a CivicScience poll, the percentage of people who said they increased their online grocery shopping increased from 11% to 37% from March 1 to 22.

The U.S. retail landscape is oversaturated with retailers, and closures of struggling retailers will come as no surprise. However, to help retailers maintain their employees and emerge in a better position to advance an economic recovery, the International Council of Shopping Centers (ICSC) joined a broad coalition of the business community to establish a recovery fund.

This recovery fund will help distribute funds and liquidity to impacted businesses. According to Forbes, nearly 70 percent of shopping center tenants are small businesses that employ less than ten people. The majority of the estimated $6.7 trillion of consumer activity is generated by the retail, food-and-beverage, entertainment, and consumer service industries occur within American shopping centers, with nearly 1 out of every 4 American jobs retail-related.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.