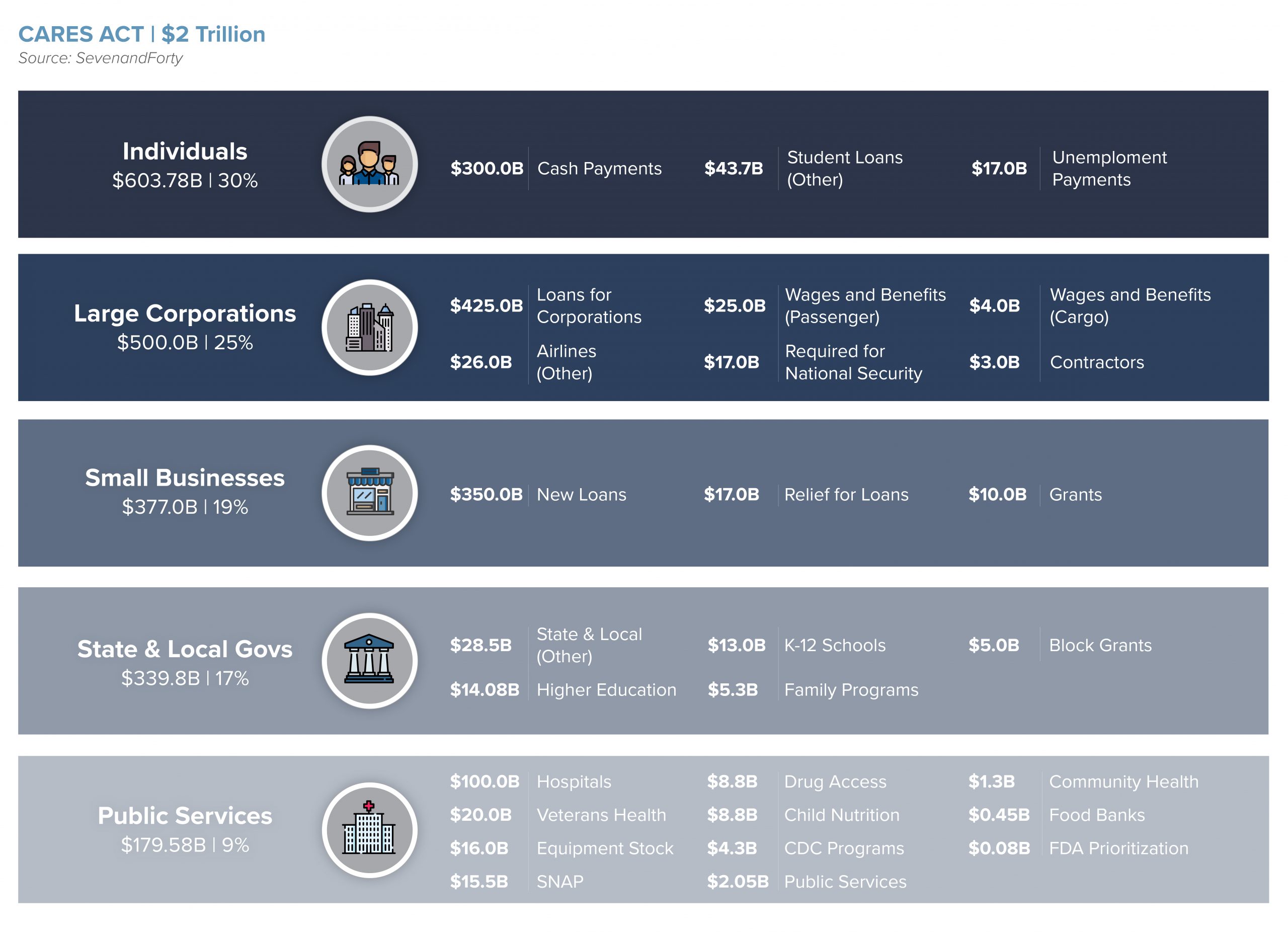

On March 27th, 2020 President Trump signed into law a historic $2 trillion stimulus package, the Coronavirus Aid, Relief, and Economic Security (CARES) Act. This stimulus package will help jolt the sudden stop we’ve seen in economic activity in the U.S., reduce the risk of a larger decline in employment, and aid in a post-virus rebound. Supporting both individuals and businesses (including changes to tax policy), this bill will provide fiscal stimulus, loans, and loan guarantees amounting to 9% of GDP. This report will dissect the CARES Act and actions important to the commercial real estate industry.

Paycheck Protection Plan

The CARES Act includes a $350 billion small business loan program, the Paycheck Protection Program (PPP), designed for businesses having fewer than 500 employees to be administered through the Small Business Administration (SBA). The deadline to apply for the small business loan program is June 30, 2020. The latest updates to the program were released on April 2, 2020 in a 31 page document.

- A company’s headcount, which includes employees, but also employees of their venture investors and their investors’ other portfolio companies, must be under 500-employees to qualify for the PPP.

- The maximum amount of the loan is the lesser of a multiple of 2.5x payroll or $10 million. If a company uses the loan for payroll costs (at least 75% of loan), interest payments on mortgages, rent, and utilities and maintains employee and compensation levels, their loan will be forgiven. Payroll costs are capped at over $100,000 on an annualized basis for each Due to likely high volume of applications, it is anticipated that not more than 25% of the forgiven amount may be for non-payroll costs.

- Payroll costs are defined as salary, wages, commissions, employee benefits, and state and local taxes assessed on compensation.

- The PPP loan rates initially are being set at 1 percent with two-year terms. With the changes in the economy, it is possible the terms will change again, but after you receive the loan terms, will not change.

- When business owners calculate the size of their PPP loan, they may not include wages paid to sole proprietors or independent contractors (1099 workers). Those workers need to apply for their own PPP loans beginning April 10 and payroll costs are also capped at $100,000 per employee.

- Seasonal businesses can now submit average monthly payroll from February 15, 2019 to June 30, 2019. New businesses can elect to use average monthly payroll between January 1, 2020 and February 29, 2020.

- It’s important to note that the PPP is based on a first-come, first-serve basis with the extensive amount of businesses applying and the reality of limited funds. The government has already supplied additional liquidity to participating financial institutions through term financing and has mentioned a potential request for more funds.

Large Business Loan Program

A second loan program has been set up for larger businesses that do not qualify for the PPP. While the total value of this program is $500 billion, after amounts are directed to airlines and industries designated for national security, there is $425 billion available.

- Loans must be secured for a term no longer than 5 years and are subject to an annualized interest rate capped at 2 percent per annum.

- For the first six months after any direct loan is made, there is no principal or interest due. We may see a further extension at the Treasury Secretary’s discretion.

- While the loan is unsettled, stock repurchases are prohibited by borrowers, existing employment must be maintained to the extent practical, and abide by established limits set on executive compensation.

Tax Provisions for CRE

There are several provisions providing corporate tax relief:

- Extension of net operating losses (NOLs) carrybacks for five years for non-REIT businesses for 2018, 2019, and 2020. The NOL limit of 80 percent of taxable income is also suspended, therefore businesses may use NOLs they have to fully offset their taxable income.

- Delay of employer Social Security payroll taxes until Jan. 1, 2021, with 50 percent owed on Dec.31, 2021 and the other half due on Dec. 31, 2022.

- Correction of qualified improvement property depreciation back to 15 years

- Employee retention credits

- Increases on the limitation on deductible business interest from 30% to 50% of EBITDA (earnings before interest, taxes, depreciation, amortization) for 2019 and 2020. Excludes, from income, the cancellation of debt related to new, emergency small business loans.

- Employee retention credits, which provides businesses with the incentives to retain employees

Alternative Cash Flow Options

In addition to Paycheck Protection Program loans, CARES Act also offers other opportunities for business owners to access capital.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.