Amid recent events, self-storage is faring well with many experts deeming the sector recession-resistant. Starting from a strong position before the outbreak, many self-storage facilities experienced heightened demand, despite the stall in rent growth in primary markets due to over-supply. Proving to be less susceptible to COVID-19, self-storage is anticipated to be a leading sector following the pandemic. This report will discuss the performance of self-storage during current events and provide insight for owners.

Self-Storage U.S. Performance

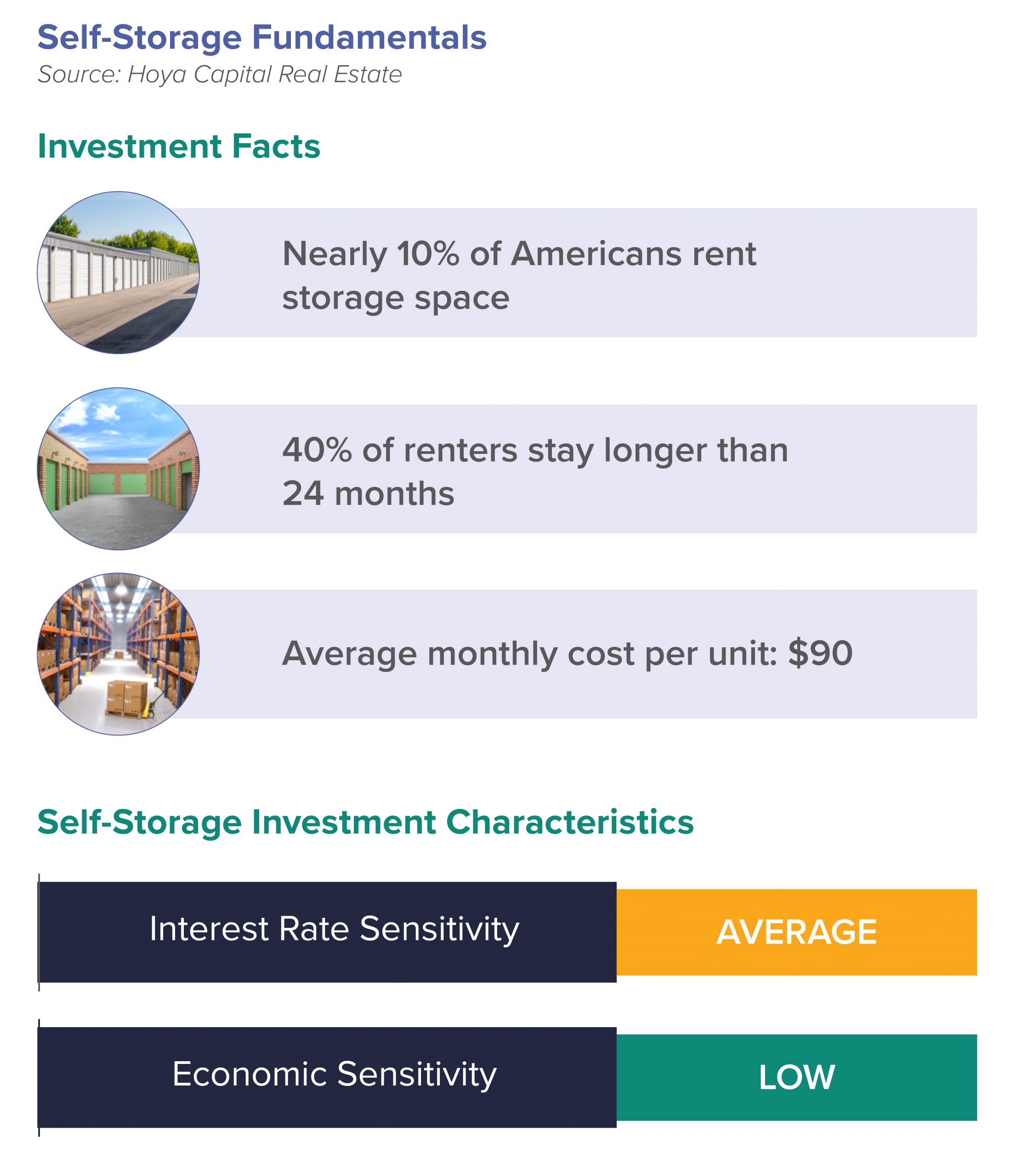

Almost half of the 30 million self-storage renters stay in storage units for longer than two years, and almost 25 percent store their possessions in a unit for a decade or longer. There is a total of nearly 50,000 self-storage facilities in the United States, and roughly one in ten households rent a self-storage unit. The industry boasts a $50 billion annual revenue and saw even higher-than-usual demand in March 2020. “Storage listing searches have been up significantly since the impact of COVID-19 began in the U.S.,” Manager of Business Intelligence for Yardi Matrix, Doug Ressler, said.

Even during the Great Recession in 2008, self-storage units outperformed other sectors with vacancy levels increasing two to three percent, compared to the six to eight percent increase in more economically-sensitive sectors. Self-storage sees more rent paid by collateralizing the renter’s stored inventory, and unpaid rent will result in repossession of the unit, including their stored possessions. This is more likely to impact lower-income renters who may not have savings and will likely use their government relief checks on bigger priorities, rather than their storage unit rent.

Although self-storage over-supply weakened fundamentals over the last five years, the sudden stall in construction projects leaves plenty of acquisition and consolidation opportunities as less successful operators are weeded out by the effects of the pandemic. The cooling in supply will help return rents to normalcy, as non-climate-controlled and climate-controlled units began to see year-over-year declines by 1.9 percent and 2.3 percent, respectively. Delivery forecasts for the rest of 2020 expect ten percent fewer deliveries, and 40 percent fewer deliveries for 2021-2025 following the global crisis.

Guidance from our Agents

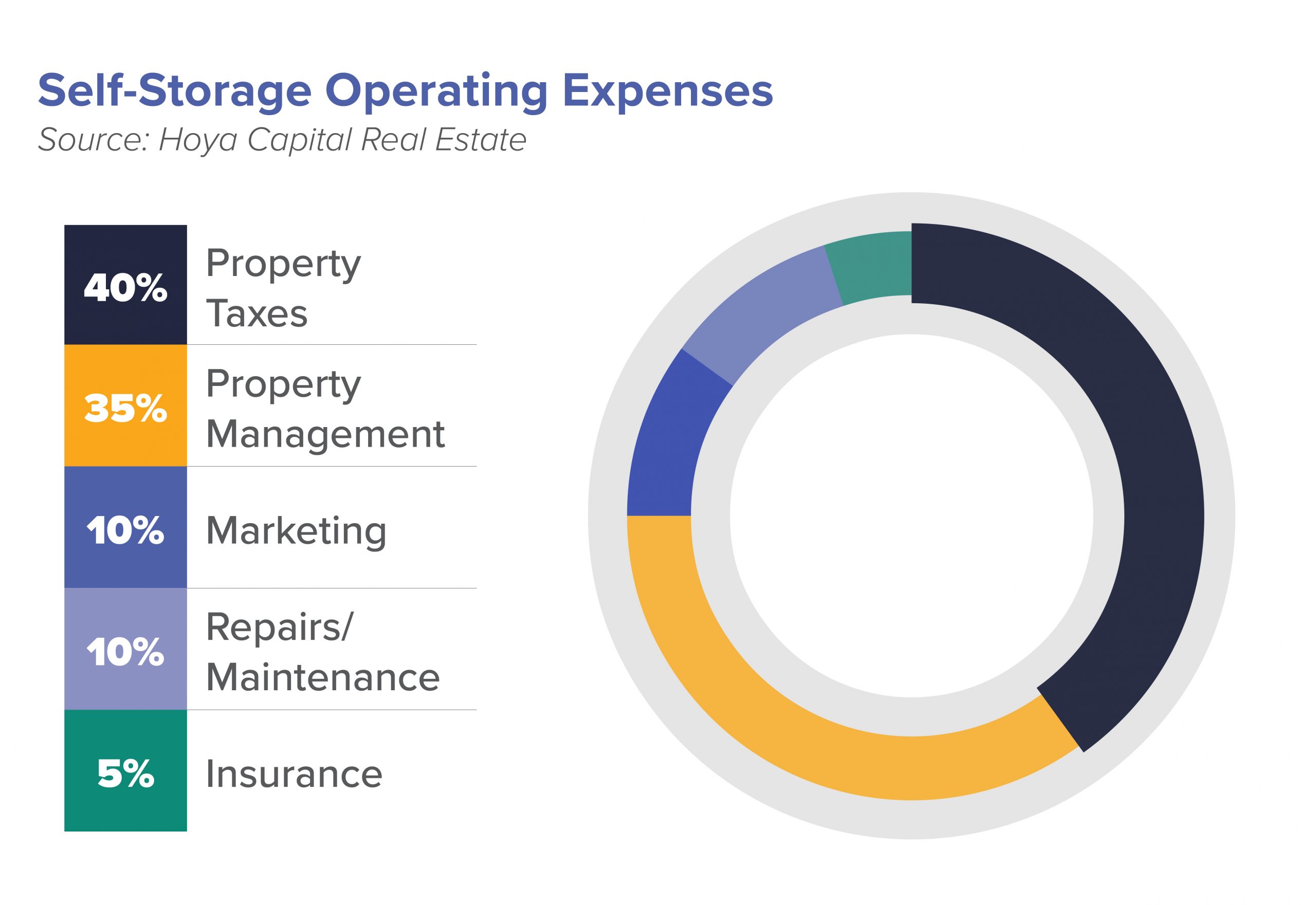

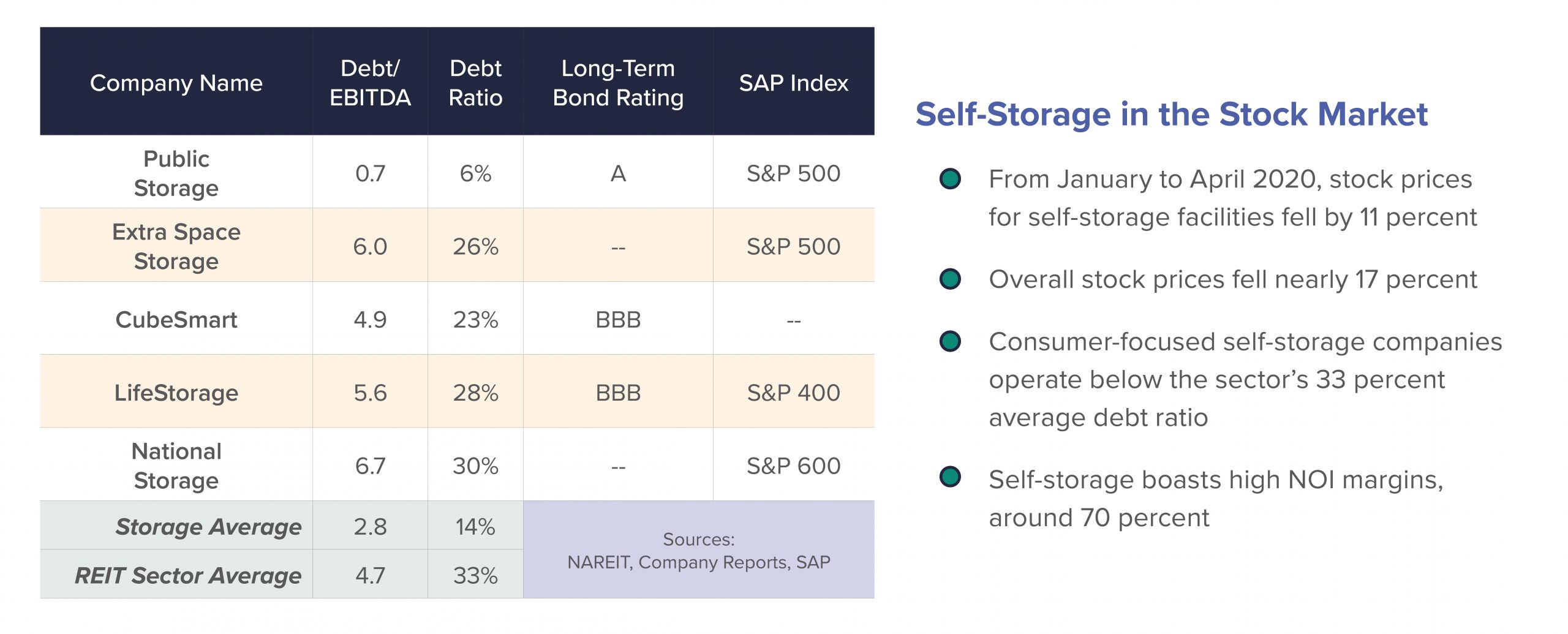

Low balance sheet leverage, high operating margins, and limited economic impact on rental demand are the appealing attributes to investors during a time of economic uncertainty. Although there are more obstacles in navigating through transactions at a time like this, such as difficulty in securing financing in a timely manner, the demand from all buyer pools remains strong. Additionally, as collections continue to remain high throughout the COVID-19 environment, self-storage will continue to prove its resiliency through economic downturns.

Self-Storage Deliveries

Communicate with developers to adjust projections.

Keep loan commitments alive for construction projects that were already underway prior to the pandemic.

Expect lease-up delays in facilities that just opened due to the decrease in traffic.

Maintaining Investment

Work with tenants to ensure they are discussing rent payment options with struggling renters.

Comply with shelter-in-place government mandates, operate virtually as much as possible, and allow access to the facility through keypad to reduce person-to-person contact.

Consider applying for the Paycheck Protection Program loans, to potentially benefit from the stimulus package.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.