Click here to download full report

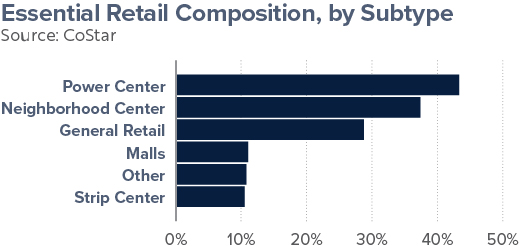

With the nation on the road to reopening, retailers are reflecting on the disruption created by COVID-19, an estimated $150 billion in sales was lost in April. Over the last two months, 75 percent of non-essential retail stores remained closed, and 1.3 million U.S. store employees were furloughed. The essential retailers, such as supermarkets and big-box stores, have remained open throughout the pandemic and are projected to continue doing well following the global crisis, according to CoStar. This report will discuss how the shopping center sector is planning to adapt to the new consumer and provide insight to owners.

Shopping Center Update

As stores across the U.S. quickly adapted to the travel and social restrictions, there is a natural migration away from traditional brick-and-mortar shopping and some retailers had to get creative with providing their services. For example, Best Buy has been offering curbside service for online pickup and on-site ordering, which managed to retain nearly 70 percent of its typical sales and increased online sales by 250 percent. Additionally, e-commerce has become the primary source of shopping and research company Nielsen found the following categories as the most commonly purchased items online.

- Preventative Health & Wellness Products

- Personal Protective Equipment

- Groceries & Household Essentials

Grocery Stores

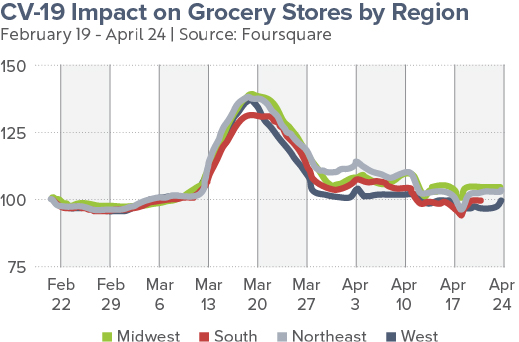

When news broke of the coronavirus reaching the U.S. in March, customers surged foot traffic to essential businesses that offer food, drinks, and household supplies in a panic. Once social distancing policies were enforced around mid-March, traffic behavior settled. The U.S. Department of Commerce reported a 26.9 percent increase in grocery store sales in March. By April 12th, grocery stores went back to pre-COVID-19 levels. In the Midwest and Northeast, visits to grocery stores are slightly up, and in the West and South regions, visits are resembling normalcy as of April 24th.

Acosta recently reported in their study regarding the shifting consumer shopping habits, citing new trends from week-to-week, such as prioritization of comfort food over pantry food, surging e-commerce, and continually declining in-store trips as concerns escalate among shoppers. However, Darian Pickett, CEO of Acosta, is optimistic shopping habits will normalize after the pandemic is over.

For Phoenix-based Sprouts Farmers Market, they reported a successful first quarter, with net sales increasing by 16.1 percent or $1.65 billion. In April, the grocery store saw same-store sales increase by 7.2 percent year-over-year, the average basket size was $51, e-commerce sales increased 950 percent year-over-year. “In order to avoid social contact, customers are consolidating their shopping trips and shifting their visits more throughout the week and less on the weekend,” Sprouts CEO, Jack Sinclair said. “The less trips are resulting in many more items in the baskets but at a reduction to traffic.” Sprouts announced they are on track to add 20 new stores this year to their existing 344 stores, with only one store experiencing development delay.

Shopping Malls and Centers

Northgate Mall in Durham, North Carolina, is the first super regional mall, with over 410,000 square feet of retail, to permanently close due to financial difficulties brought on by the coronavirus. However, the 86,610 square feet retail area surrounding the mall, called Shops at Northgate, still plans to reopen. As for the tenants, J. Crew, J. Hilburn, and Gold’s Gym have all filed for Chapter 11 bankruptcy protection. The U.S. Department of Commerce reported a 50.5 percent decline in sales at clothing stores in March. Among the struggling retailers from the shelter-in-place restrictions include Brooks Brothers, J.C. Penney, Neiman Marcus, and Sage Stores.

Department stores such as Macy’s opened 68 of their locations with more to follow, and Nordstrom is following suit with their 380 stores but in phases. Retailers are enforcing a number of changes to comply with social distancing policies and adapt to shifting shopping behaviors. These changes include more frequent cleaning, adjusting store layout to allow social distancing, limited group seating, limited in-store customer capacity, and adjusted store hours.

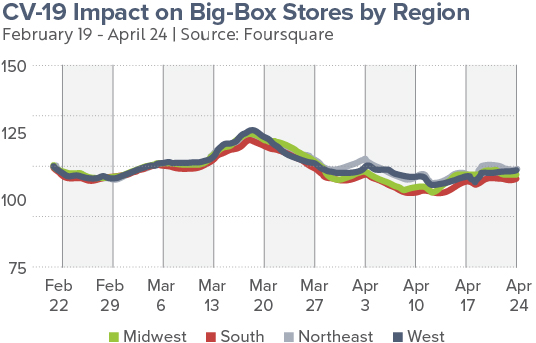

Big-Box

As for visits to big-box stores, the likes of Walmart and Target are experiencing increased traffic from mid-April, especially among 45-64 year-olds. As of April 24th, visits are down five percent, compared to the 7-11 percent decline during the weeks before.

- The Northeast is only down two percent in visits

- The South is still down by six percent

- Rural area visits are down by three percent

- Urban area visits are down by eight percent

New Consumer Shopping Habits

It is universally known that the arrival of the pandemic has caused nearly all shoppers to adopt new behavior. While travel restrictions were still in place, people refer to online shopping to retrieve any clothing or other non-essential items and utilizing contactless delivery or pickup for groceries. Further, big-box locations and grocery stores will likely fare better than strip centers as shoppers rely on their local grocer or supermarket for their household items.

Shopping Behavior Post-COVID-19

Once retail stores across the nation are fully up and operational, we will likely see which markets will suffer from over-exposure to non-essential retail, like San Francisco, New York, and Miami, and those with heavy essential retail will come out shining, like Sacramento, Phoenix, and Albany. We will also see new approaches to filling vacant spaces in struggling retail locations, like malls or strip centers. Fitness centers and experiential retailers were the prime candidates to fill these spaces, but now face their own set of struggles due to the coronavirus.

For the most part, shopping over the last two months has been conducted through online sites, by 10 – 30 percent more, and picked up curbside or shipped directly home, which experts believe will become the more common method. Once shelter-in-place restrictions are lifted across the nation, experts determine shoppers will become more conscious of the product and brand they’re purchasing, so companies will need to be more transparent about their global supply chain. Shoppers will also practice new safety habits, like contactless and distant shopping. Brands that prioritize consumer health and safety will gain more loyal customers, and local businesses are receiving support from people who want to keep shops in business. With over 30 million Americans filing for unemployment and retail sales dropping 8.7 percent, focus has shifted from purchasing non-essential items to groceries and household supplies.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.