Data Centers Update

The insurgence of data centers in the commercial real estate industry came rapidly and tenaciously. As the world increasingly digitizes, investors continue to look to them as a secure and profitable investment option. In 2023, high-interest rates and a volatile market affected almost all asset classes, pushing sales volume down and cap rates up. However, data centers report stable fundamentals and software and technology companies plan expansions. Most recently, Google announced the construction of a 167-acre site in Mesa, Arizona, reported GlobeSt. Novva Data Centers and EdgeConenex also announced expansion plans.

The biggest draw to data centers for investors is the sectors’ consistently high returns, averaging 19.4%-23.9%, according to Nareit data. The market is the strongest performing sector in 2023 throughout North America and Asia, outperforming traditional industrial handily. Vacancy rates are historically low, with some markets reaching below 3%. The Wall Street Journal reported the Silicon Valley data center vacancy rate reached 2.9% in Q1 2023, while annual rent growth reached 43%. These strong fundamentals will keep investors returning to achieve higher yields in an expensive debt market.

In addition, investors appreciate the security these centers provide. Consumers typically don’t limit their data usage or change data plans during economic downturns. Instead, they may restrict retail spending or downsize living expenses. This guaranteed use helps make this market recession-proof. These tenants typically sign long-term lease terms and will continue to generate revenue during downturned markets.

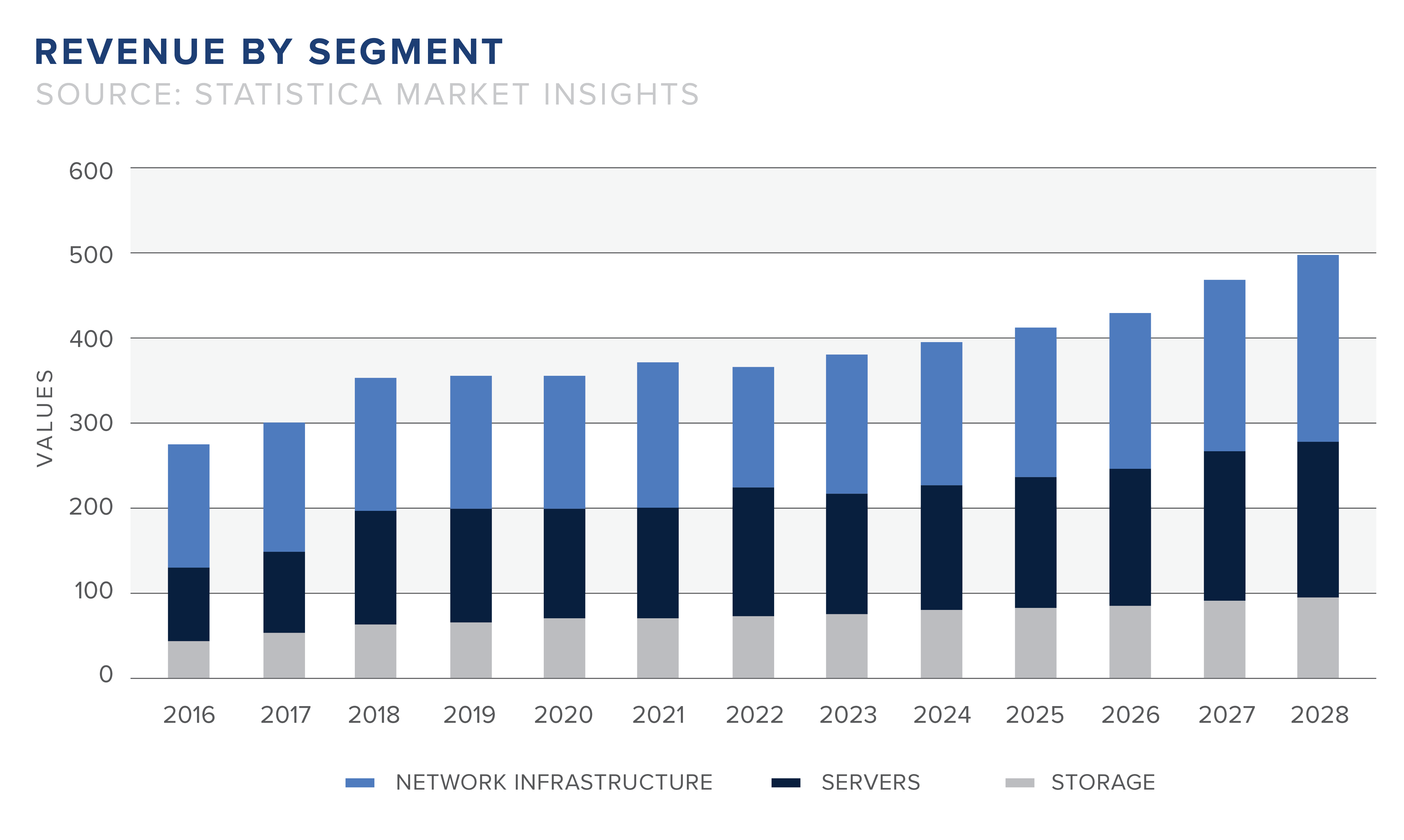

According to the Internal Data Corporation, data usage is set to grow at a 24% compound annual rate through 2025. In addition to traditional data use, the increased popularity of AI will drive the additional need for data center supply, as AI burns more energy and will need advanced hardware. Overall, the market is profitable for investors and offers room for growth.