Santa Barbara Multifamily Market Report

Market Overview

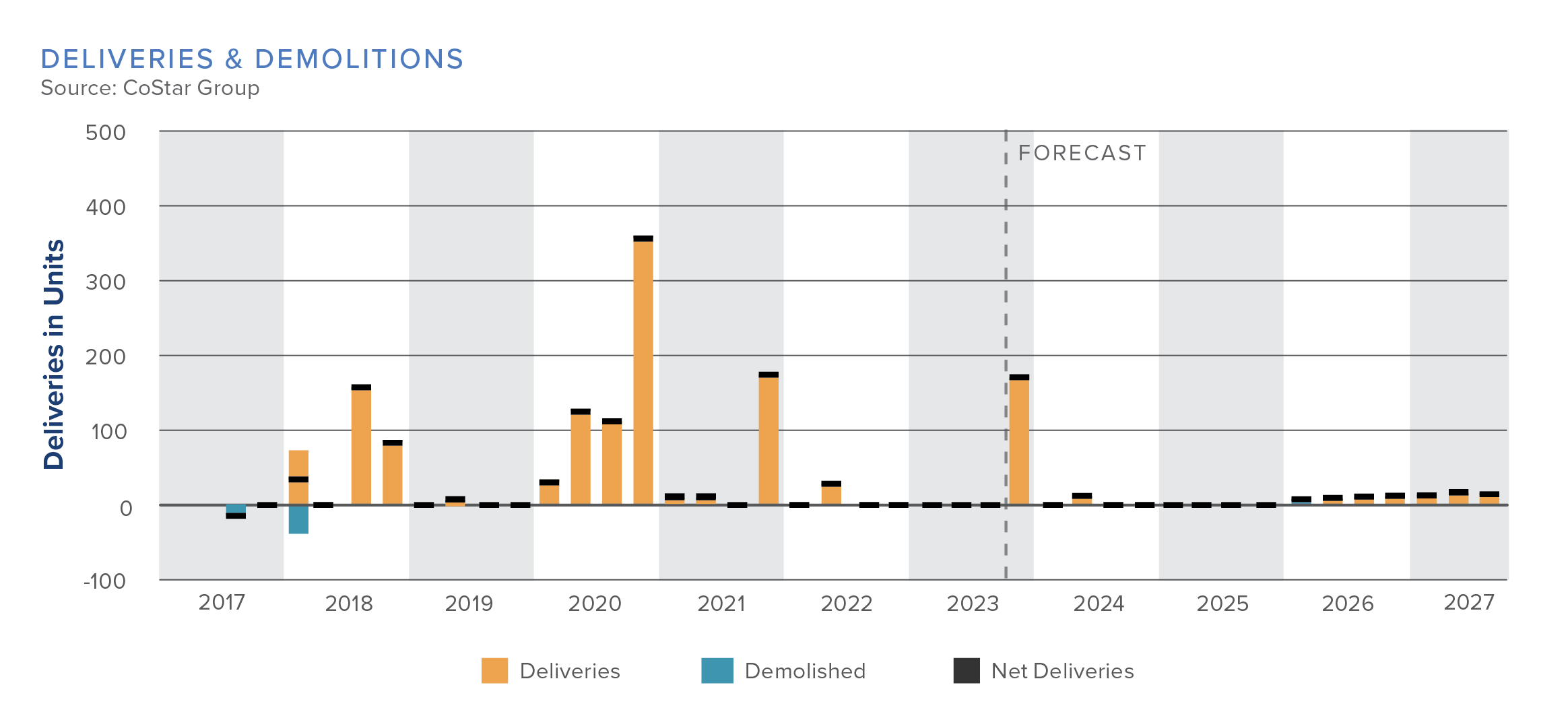

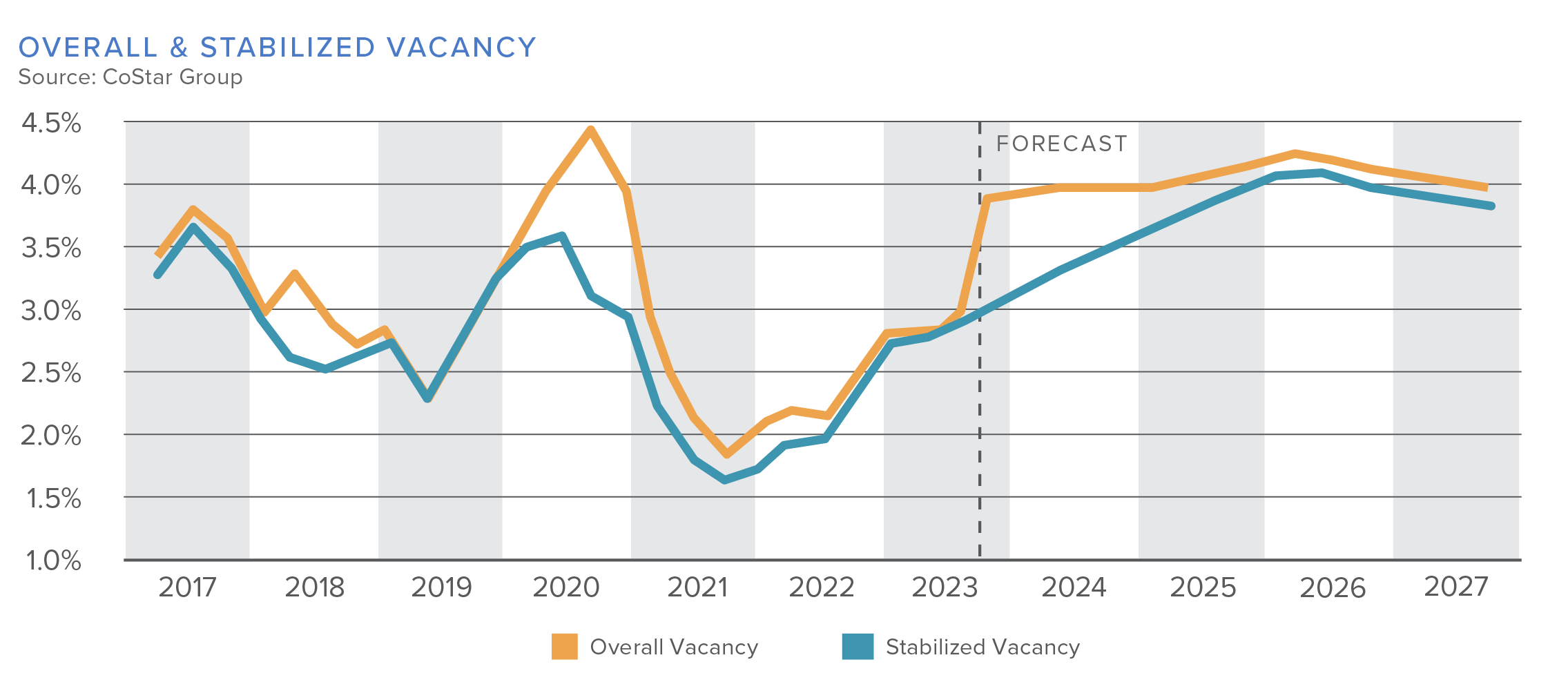

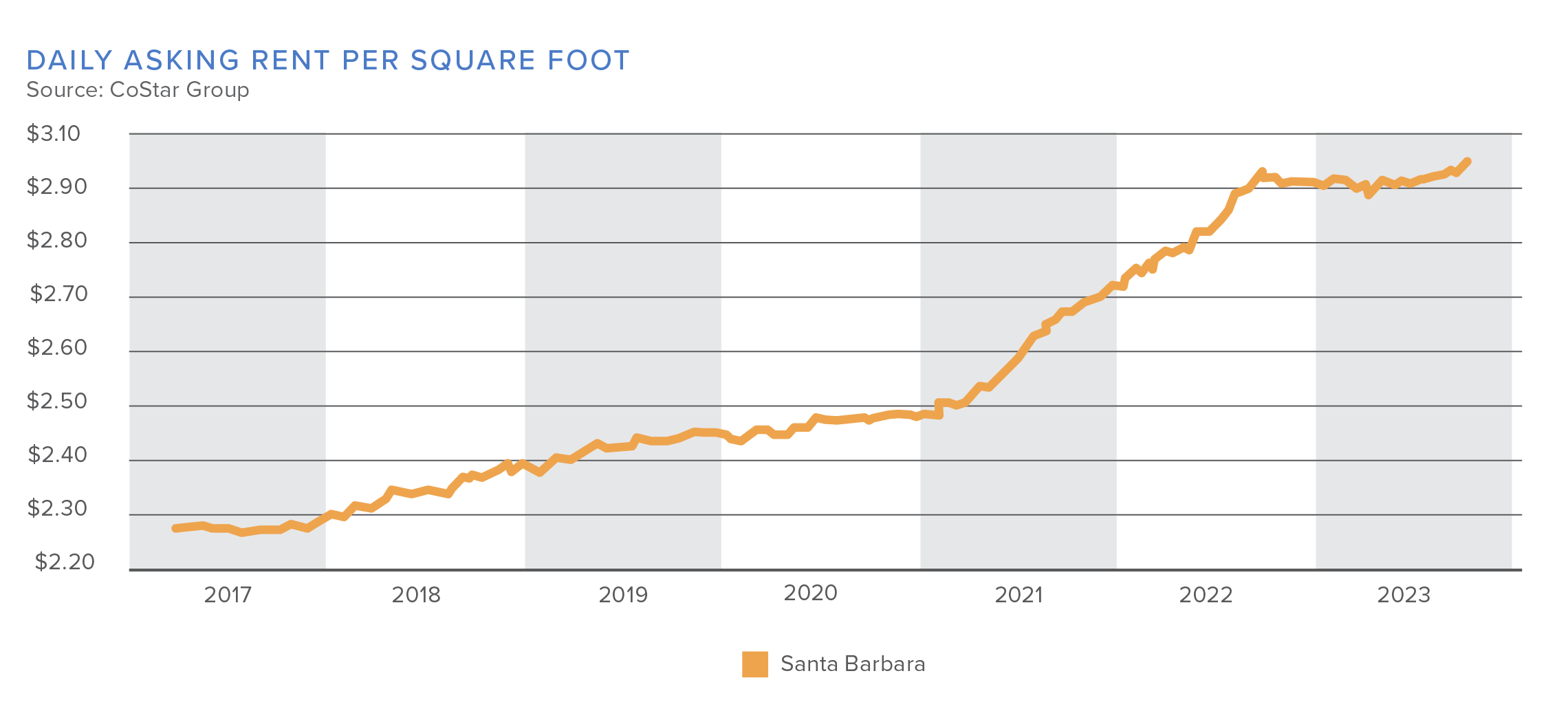

Santa Barbara attracts many residents who enjoy its trendy atmosphere and miles of beaches. Additionally, its strong aerospace and defense-related employment sector brings in many families and young entrepreneurs. The vacancy rate has changed by 0.6% year-over-year, now standing at 2.9%. Rent growth in H1 2023 returned to typical historical patterns, following a decrease in rents during the latter half of 2022. The overall year-over-year rent growth has reached 1.7%. The pace of development has remained consistent, although not excessively high, considering the market’s inherently low vacancy rate. Over the past ten years, approximately 2,100 units have been added to the inventory.

Multifamily Market Snapshot

- Units Under Construction: 178

- Market Cap Rate: 4.2%

- Vacancy Rate: 2.9%

- 12-Month Rent Growth: 1.7%

The long term average vacancy rate in Santa Barbara has been 3.7% with recent hikes in demand to fill new luxury units after a short-term supply-induced vacancy bump. According to predictions, the vacancy rate is expected to increase in the future as the supply of new properties surpasses the demand.

Asking rents have increased in the past five years. Students at University of California Santa Barbara are a demand driver in the area, as the university has seen a shortage of housing. Developers are eager to match the demand, but obstacles by local opposition groups and coastal commission restraints have slowed down momentum.