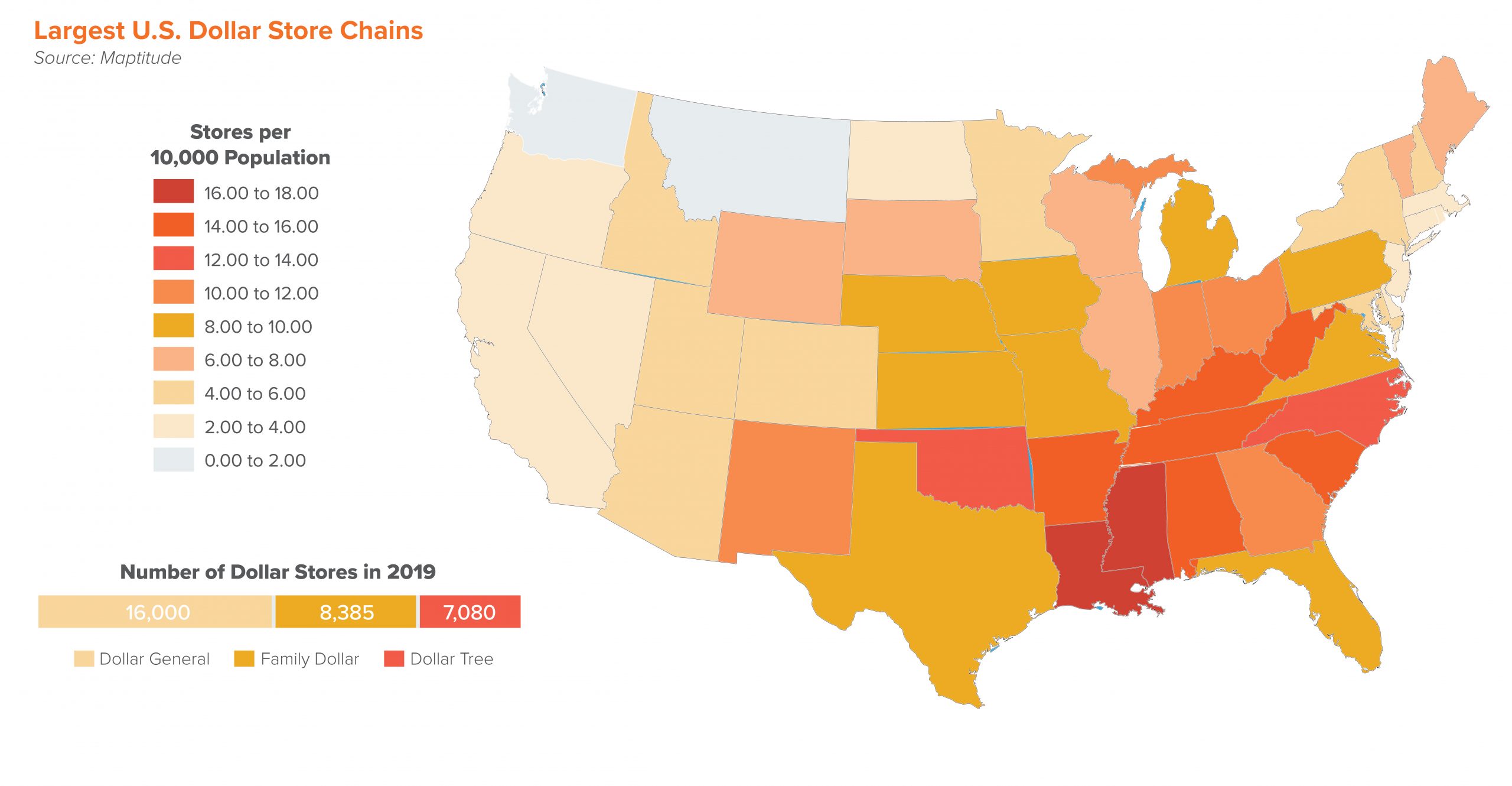

Beneath the cloud of uncertainty that COVID-19 has presented, some retailers are coming out on top and fortunately are thriving in the current environment. These retailers include discounters and dollar stores. The discount retail market has proven to be resilient in both good times and bad, data from Coresight emphasized that in 2019 from the 2,800 stores that were opened, some 1,800 were discount retailers. And, with just two companies, Dollar General and Dollar Tree, in control of the small-store discount market, they operate more than 30,000 stores nationally, vastly outnumbering Walmart and other retailers. This unique real estate footprint, combined with their value and convenience, remains a competitive advantage during COVID-19. In this report, we will take a look to see how dollar stores are performing, given the current environment.

Dollar Store Response to COVID-19

Discount retailers have been deemed “essential” during the COVID-19 pandemic as numerous rural and suburban communities rely on them to provide affordable and convenient household essentials. Dollar General is joining the retailers who are hiring more workers to meet the heightened demand with pans to hire 50,000 new employees by the end of April. Dollar General and Dollar Tree, including Family Dollar, have also dedicated the first hour of business to its senior shoppers and have started closing stores an hour early to give employees time to clean the store. As a result of COVID-19, Dollar Tree and Dollar General have also announced that will temporarily push 2020 expansions and renovations until the economy has restabilized.

The retailers entered 2020 from a position of strength and their retail format makes them well suited for today’s marketplace. The value and convenience that dollar stores offer continues to resonate with both new and existing core-consumers. As of Q3 2019, the dollar store market sold more groceries than ‘high-end’ stores—dollar stores sold $24 billion, while Whole Foods sold $15 billion. These companies have withstood the relentless competition from Amazon and Walmart, and now COVID-19, by conveniently selling cheaper products. Not only do the top three dollar store tenants thrive in a strong economy, but they also realize stable growth in times of market downturns. In 2008, the stock that beat all other S&P 500 stocks was Dollar General, rising more than 60% that year, almost double the second highest-returning stock.

Dollar Stores Competitive Advantage

In cities across America, dollar stores trade in economic despair. In these rural areas, dollar stores see an easier revenue stream because they lack competing grocery stores and are located where no other retailers will venture. This is the case for Family Dollar, which targets urban low-income shoppers, and Dollar General, whose target customer is in a permanent recession. As a result of COVID-19, many customers only have access to dollar stores to gather essential or are purchasing at dollar stores due to strained finances. Many residents also claim that dollar stores are a vital source of cheap staples, and accept SNAP benefits to purchase a wide variety of products.

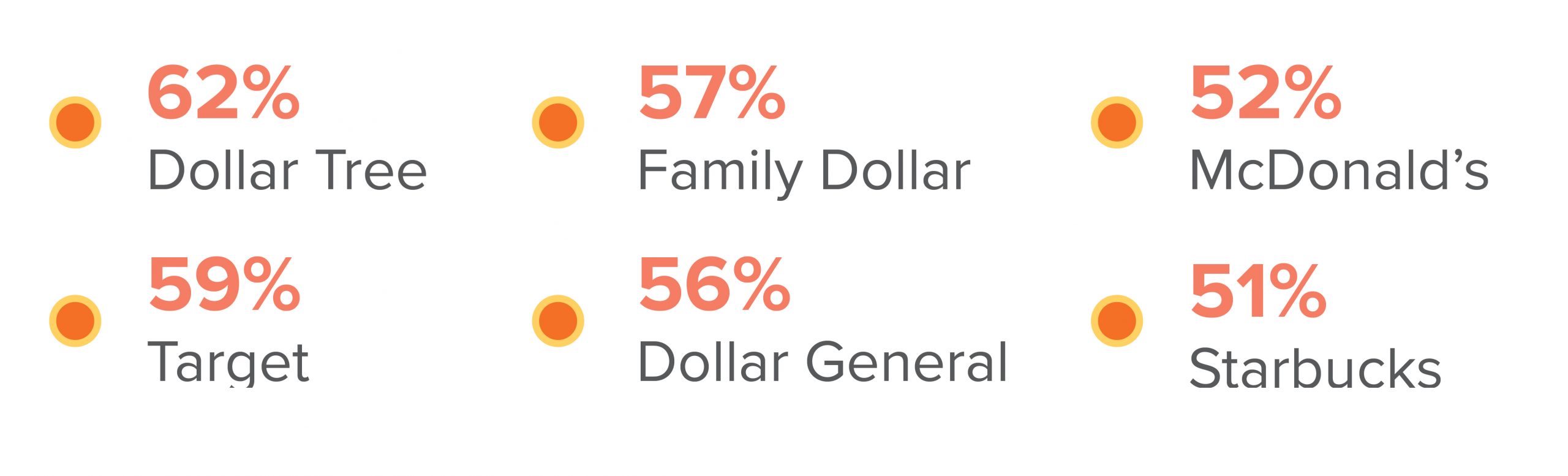

According to a poll conducted by Morning Consult Brant Intelligence, the results indicated that the following retailers had a “positive effect on their community.”

Dollar store chains capitalize on these conditions, much like an invasive species advancing in on a compromised ecosystem. Dollar General invested $22 billion as part of a plan to expand rapidly in low-income, rural communities in hopes of economic resurgence. Still, as the store’s cluster in these low-income neighborhoods, some residents worry that they deter business, especially in communities without a grocer or options for healthful food. Local grocers in numerous cities report that it’s typical for sales to fall by about 30 percent after a Dollar General opens nearby.

The market for dollar stores is only getting stronger as other retailers struggle as a result of COVID-19. Dollar Tree sales trends soared through March 29th, with the namesake chain up 7.1% and Family Dollar up 14.4%. Dollar stores continue to keep their core customer at the center of their operations while they remain steadfast in delivering long-term shareholder value.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords