CLICK HERE TO DOWNLOAD THE ARTICLE

A Look at Austin’s Growing Economy

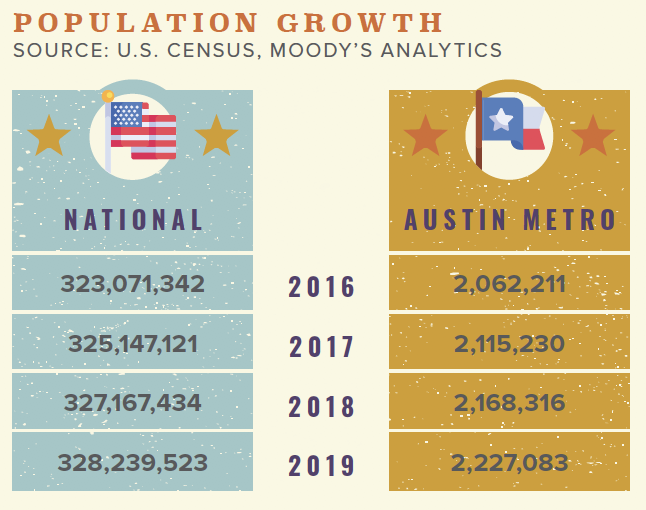

With 120 to 150 people moving to Austin per day, it comes as no surprise that Austin has experienced over 25 percent growth in population since 2010 and is projected to reach 3.2 million in the next ten years. Austin’s booming tech industry, business-friendly climate, and the young population are the primary factors driving growth. In effect, Austin has experienced substantial housing demand. Recently, nine zip codes in Austin saw at least 100 percent growth in home value from 2010 to 2020. The metro also ranks as one of the best places to live in 2020 through 2021. Among others, these are the main factors why Austin has gained upward of 75,000 new multifamily units since 2012.

Before the pandemic onset, Austin’s strong job market was among major rankings related to economic and demographic development. According to the Bureau of Labor Statistics, Austin saw the fewest job losses of any market in the U.S. as a result of COVID-19. Job growth and economic activity have picked back up, but the state of the market will be determined by the city’s response to the worldwide pandemic.

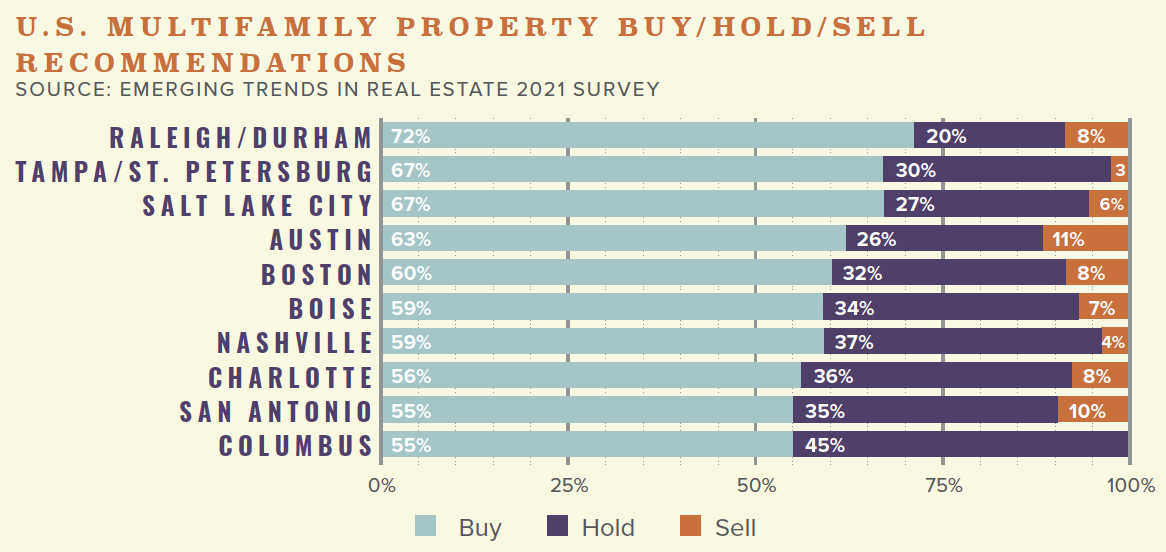

According to a ULI survey, Austin is ranked as the second top market in the country for real estate prospects heading into 2021. As tech companies flock to the metro, Austin will likely weather the economic downturn better than most metros. Recently, Austin has seen nearly half of all investment activity come from out-of-state, as savvy investors continue to see value in the metro.

Young Demographic Fuels Multifamily

Austin is not only a destination hotspot; it is home to more than two million residents, over 40 percent of which are renters. According to data by Rent Café, Austin has taken over as the most sought-after city by millennial renters in 2020. CoStar also consistently reports that Austin is the most desired destination to move to, with the least amount of people looking to move away. The 20 to 34-year-old demographic in Austin is reaching half a million. It is likely to remain consistent due to the University of Austin and tech companies recruiting young talent, keeping apartments occupied. Further, the Austin market is rounded out with newcomers and people moving from other cities searching for a better cost of living.

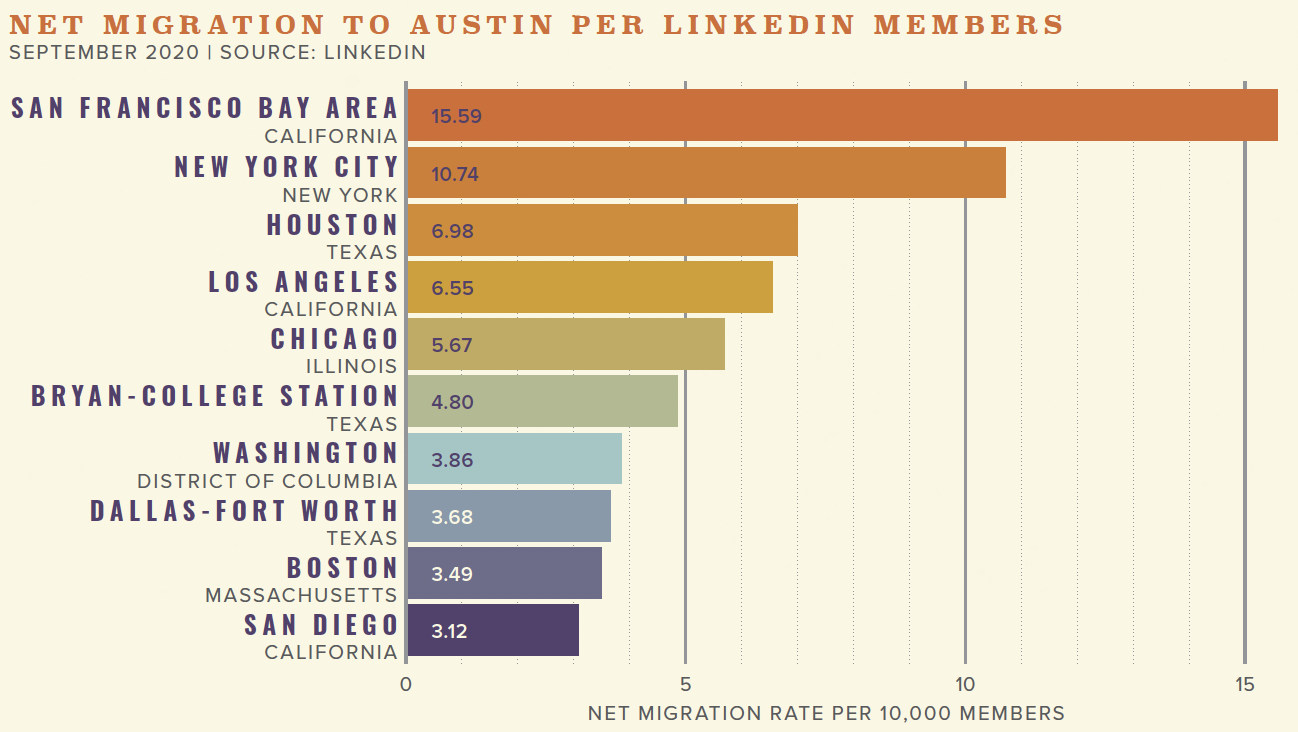

Tech Companies Eye Austin

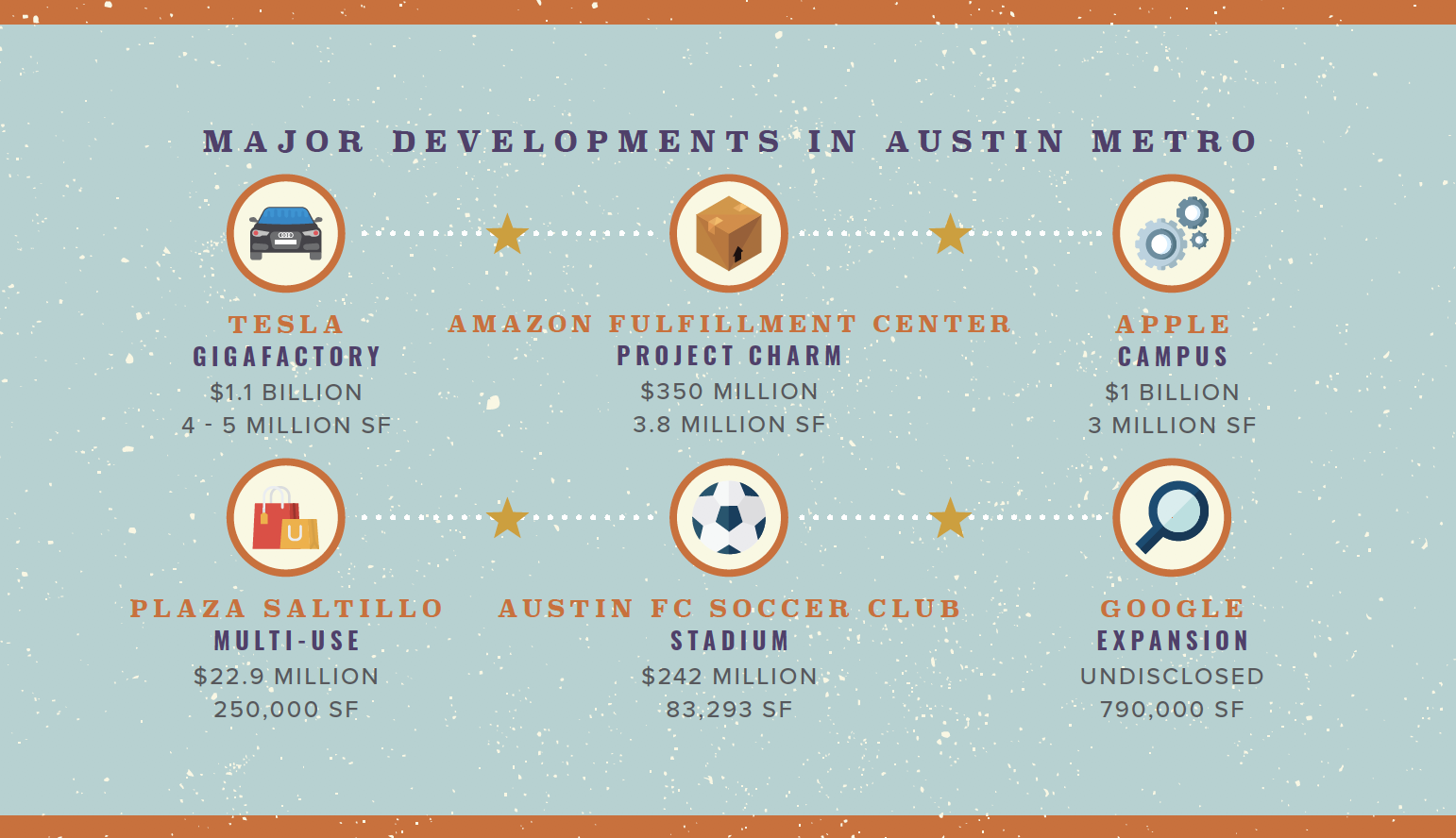

The recent buzz about Austin stems from major influential tech companies migrating to the area, specifically from Los Angeles and Silicon Valley. Famous podcaster Joe Rogan recently announced his $100 million empire would be moving its headquarters to Austin. Elon Musk also recently announced Tesla’s largest Gigafactory in the world would be located in Austin. It appears a wave of tech companies are following this trend, and California residents are catching on, with a total of 35 companies announcing 2020 relocation plans. According to the Greater Austin Chamber of Commerce, a record-breaking amount of new jobs have come to Austin due to these corporate relocations, bringing 9,790 jobs across the metro. According to apartments.com, searches for homes in Austin by San Francisco residents have increased dramatically since February.

While the global outbreak disrupted construction, projects have since picked back up and progressed. With Austin’s growing technology sector, which has shown no signs of pandemic-related harm, job growth should regain momentum. Just like Tesla’s new Gigafactory, other companies are making headlines with their expansion plans. Each major development comes with more job opportunities, drawing in more population to the area; therefore, increasing the demand for multifamily housing.

Recent Activity in Austin

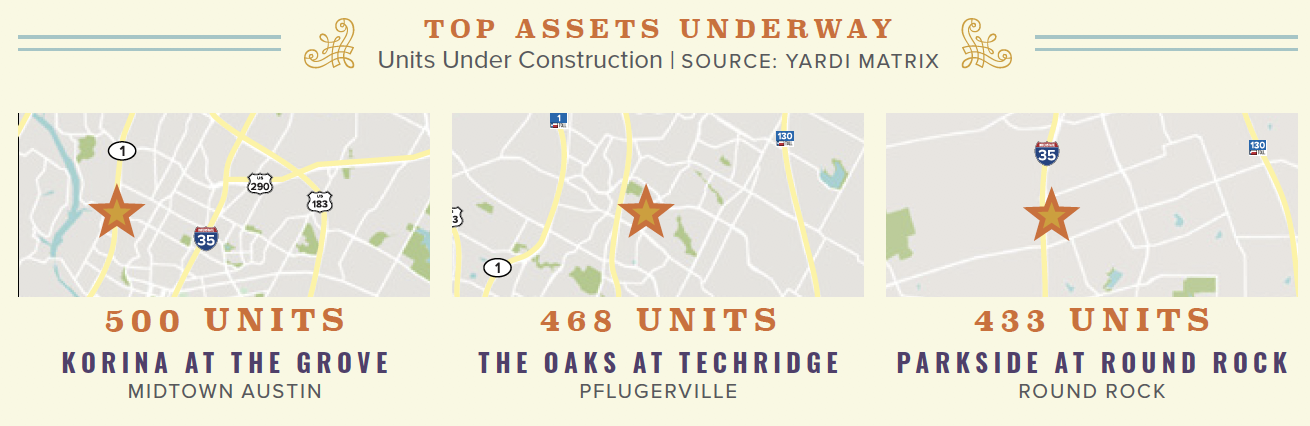

Austin leads in the number of apartment deliveries as a percentage of total stock, with 6,072 new units delivered within the first eight months of 2020, accounting for 2.5 percent of total stock. There are currently 28,053 multifamily units under construction, and the metro is expected to reach 9,342 new completions, which will increase the percentage of existing stock by 3.9 percent. Due to the impressive number of new units and the disruption brought on by COVID-19, occupancy has dropped from a historical average of over 95 percent to 94 percent, according to Yardi Matrix.

Emerging Austin Markets

North Austin

Expected to see 1,809 new renters annually for the next five years, North Austin is ranked fifth among the surrounding markets on or east of I-35. The Domain, a mixed-use development in the submarket, continues to drive multifamily demand to the area and has brought vacancies down to seven percent, according to CoStar. The Austin metro’s average rent is $1.50 per square foot, whereas this submarket boasts $1.90 per square foot. There are 1,500 units currently underway, and about 700 of those surround the Domain.

Pflugerville

Pflugerville expects to gain 803 new renters annually for the next five years, and 24 percent of the population is aged 25 to 39. Pflugerville is the top destination for new households and has seen speedy lease-up with newer units. One of Pflugerville’s major employers, Amazon, is making a four million square foot distribution center along TX-130, which will employ 1,000 people, feeding tremendously into job growth and eventually renter demand once the market stabilizes. The second-largest employer to the submarket is the school district, which also draws more residents to the suburban area.

East Austin

Close to the CBD, East Austin benefits from rents well below CBD prices. Further, the neighboring Downtown area and a short distance to the University of Texas have attracted young households with 31 percent of the population aged 25 to 39. The median income in East Austin has increased 22 percent in the last five years, seven percent more than the metro’s average. There are currently 1,900 units under construction, accounting for 20 percent of inventory. The new product has attracted institutional investors, contributing to the growing price per unit since 2011.

Riverside

Adjacent to Austin’s urban core, Riverside apartment demand is robust and is expected to continue with Oracle’s campus expansion plans that reside in the submarket. Recovery is likely to see delays in the area, with 2,200 units currently in the pipeline as of August 2020, ultimately increasing vacancies. Riverside’s renter population is projected to grow by 4,745 people annually for the next five years. Lease-up activity held reasonably well, leading up to the crisis, averaging 18 units per month. As a quickly-gentrifying submarket, Riverside sees new additions regularly, especially since it is an Opportunity Zone. Owners have renovated product built in the ‘60s and ‘70s to lure higher-income renters.

Downtown

Known as the renter-by-choice submarket, with rents averaging $3 per square foot, Downtown has 4,000 units currently under construction or a third of inventory. Austin’s Central Business District (CBD) still sees apartment demand, so units should not have difficulty leasing up. Downtown expects to see 241 new renters annually for the next five years. Occupancies have flattened at 90 percent as no new product has been delivered in the last few years. There is optimism in the market that Downtown will have a steady recovery as 100,000 jobs are located in the submarket. Renters will likely migrate here, which will ultimately change the dynamics of a traditional urban CBD. Austin’s urban core has been the focal point of numerous California-based companies, and this trend is expected to continue, ultimately resulting in increased rental demand. In fact, tech giants, including Google, Indeed, and Facebook, are actively expanding and leasing Downtown.

Central Austin

Central Austin is expected to grow the renter pool by 378 people annually for the next five years. Nearly 20 percent of inventory is underway, which makes occupancy volatile, but with the renter demographic predominately students, demand should keep consistent once things return to normal. About 35 percent of jobs in Austin are located in neighboring submarkets. Before the pandemic, rent consistently grew by 1.9 percent each year for the last decade.

Investor Outlook

Austin’s growth has presented numerous opportunities for investors. Despite COVID-19, the metro is expected to remain a top market in the country for many years. It has been recorded as one of the best long-term real estate investments in the U.S. over the past ten years. The metros’ recent appreciation has long-term owners looking to exchange into something newer, bigger, or with fewer management responsibilities. National investors continue to eye Austin prospects, accounting for 90 percent of transactions, according to CoStar.

A place that prides itself on being “weird” and unique, Austin, TX, is on the rise. With a booming tech industry, healthy outside investment activity, and California-based companies migrating to the lone star state, Austin is on a tremendous growth trajectory. For more information on multifamily investments in the capital of Texas, contact a Matthews™ specialized agent today.