Geoffrey Arrobio Featured on The Real Market Podcast

The Real Market Podcast hosted by Chris Rising recently hosted Matthews™ First Vice President Geoffrey Arrobio. The two explored Matthews Real Estate Investment Services’ nationwide expansion, current market dynamics and trends, challenges in financing and construction, building a commercial real estate career, and more.

To listen to the episode, click here.

The following article will dive into the current market dynamics and the effect on commercial real estate, with insight from Geoffrey Arrobio.

Current Market Dynamics

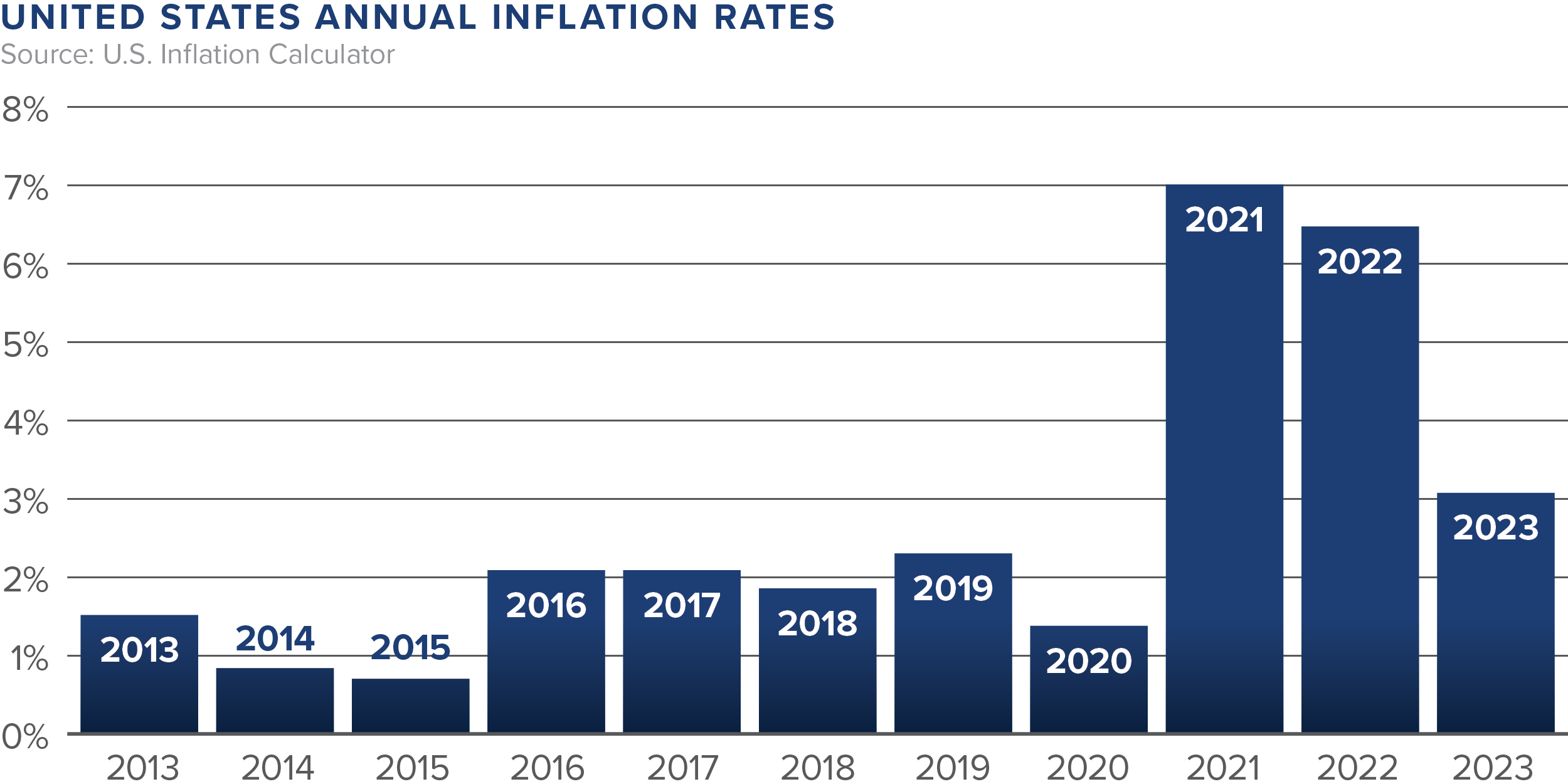

The U.S. experienced a 3.1% annual inflation rate for the 12 months ending in November 2023, as per data released by the U.S. Labor Department on December 12, 2023. This was a slight decrease from the previous rate of 3.2%. The upcoming update on inflation is set to be disclosed on January 11, 2024, and it will include details on the inflation rate for the 12 months ending December 2023.

The Federal Reserve has implemented a significant increase of 500 basis points over the last couple of quarters. This adjustment has directly impacted the pricing of construction financing, utilizing either the SOFR or prime rate as a benchmark. Consequently, many individuals and businesses are finding it challenging to underwrite projects, leading to a scenario where some are putting their plans on hold. This cautious approach involves waiting for the markets to stabilize in the next few quarters. Alternatively, others are turning to private debt funds for financing solutions.

Despite a slight decrease in the 10-year interest rate, the overall environment is still characterized by rising interest rates. As for the asset classes making their way through this time, medical office spaces remain resilient.

“Medical tenants pay their rent on time and always have a consistent flow of customers needing services. I think they are one of the better asset classes out there” – Geoffrey Arrobio.

When asked if the U.S. is going to have lower interest rates in the next year or two, Geoffrey responded –

“I’m in the camp where it’s challenging for government at 120% of debt to GDP to lower rates unless you’re really going to start the money printer again. The catalyst for such a monetary intervention typically stems from either an unforeseen black swan event or significant disruptions in the financial landscape. I perceive it less as an inflationary concern and more as a complex fiscal policy challenge. The sheer magnitude of our financial commitments adds a layer of complexity to their management.”

The government faces challenges in servicing its debt, with a significant portion of the budget allocated to interest payments, Medicare, and defense, leaving limited room for other programs. This leads to the conclusion that the Federal Reserve is in a difficult position.

Looking ahead, there is a concern about a potential liquidity event due to the need for repricing of substantial amounts of debt, including junk bonds, corporate bonds, and treasuries, within the next 18 months. This presents a substantial challenge, as refinancing such a large amount of debt will absorb a significant amount of liquidity.

Regarding the market outlook, there is a shared desire for a shorter lull, ideally lasting three years. However, a more realistic timeframe may be five to seven years. Those who can maintain an aggressive approach during this period are anticipated to find profitable opportunities. Cash is projected to be a valuable asset in the coming years, especially when deployed strategically.