14 Markets Seeing the Most Apartment Demand

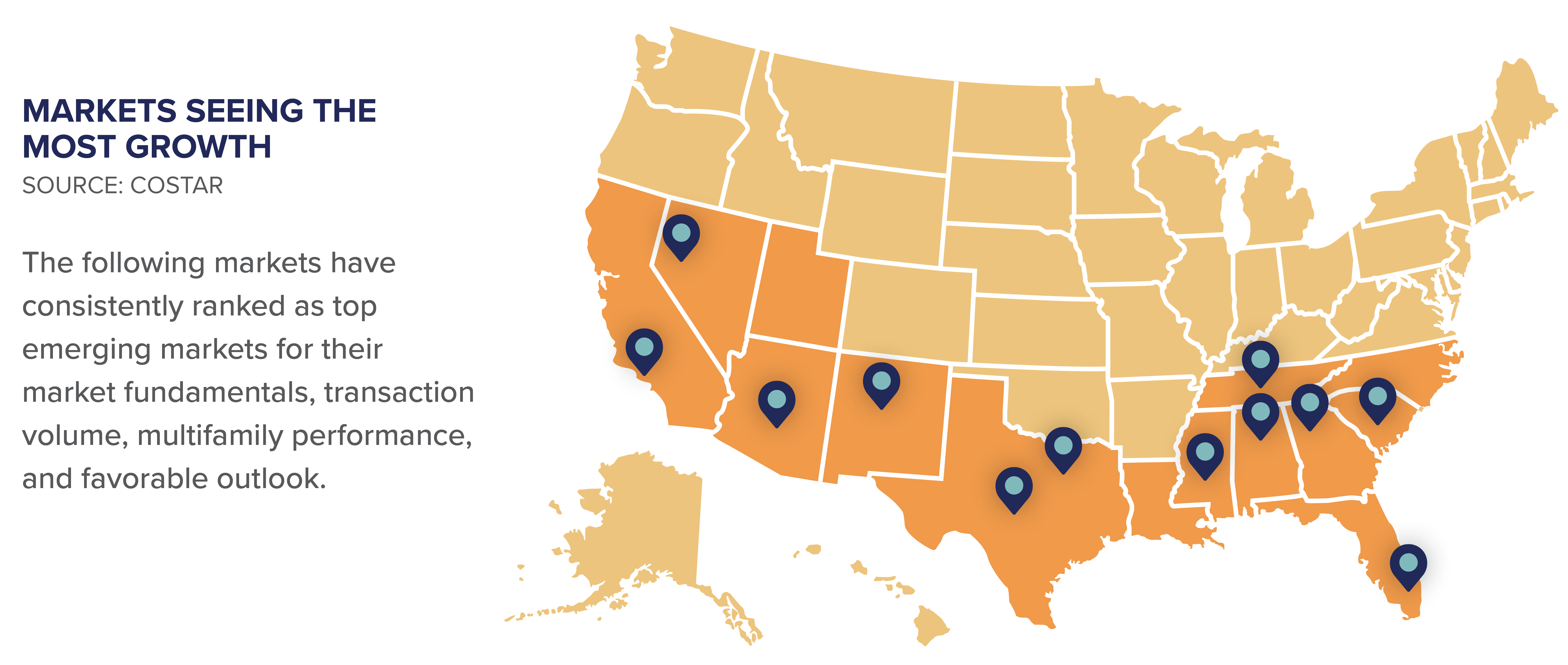

The U.S. Sunbelt encompasses the southern and southwestern portions of the nation, including Alabama, Arizona, Florida, Georgia, Louisiana, Mississippi, New Mexico, South Carolina, Texas, Tennessee, and parts of California, North Carolina, Nevada, and Utah. The term “Sunbelt” refers to the area’s warm climate and rapid economic and population growth that has been recognized for decades. In conjunction, the Sunbelt states have drawn in businesses and residents alike due to the affordable cost of living, lower cost of doing business, tax-friendly environment, and copious developable land. The people, job, and business growth on the Sunbelt point to favorable demand for multifamily properties. In this article, Matthews™ will review the various Sunbelt markets experiencing the incredible multifamily performance.

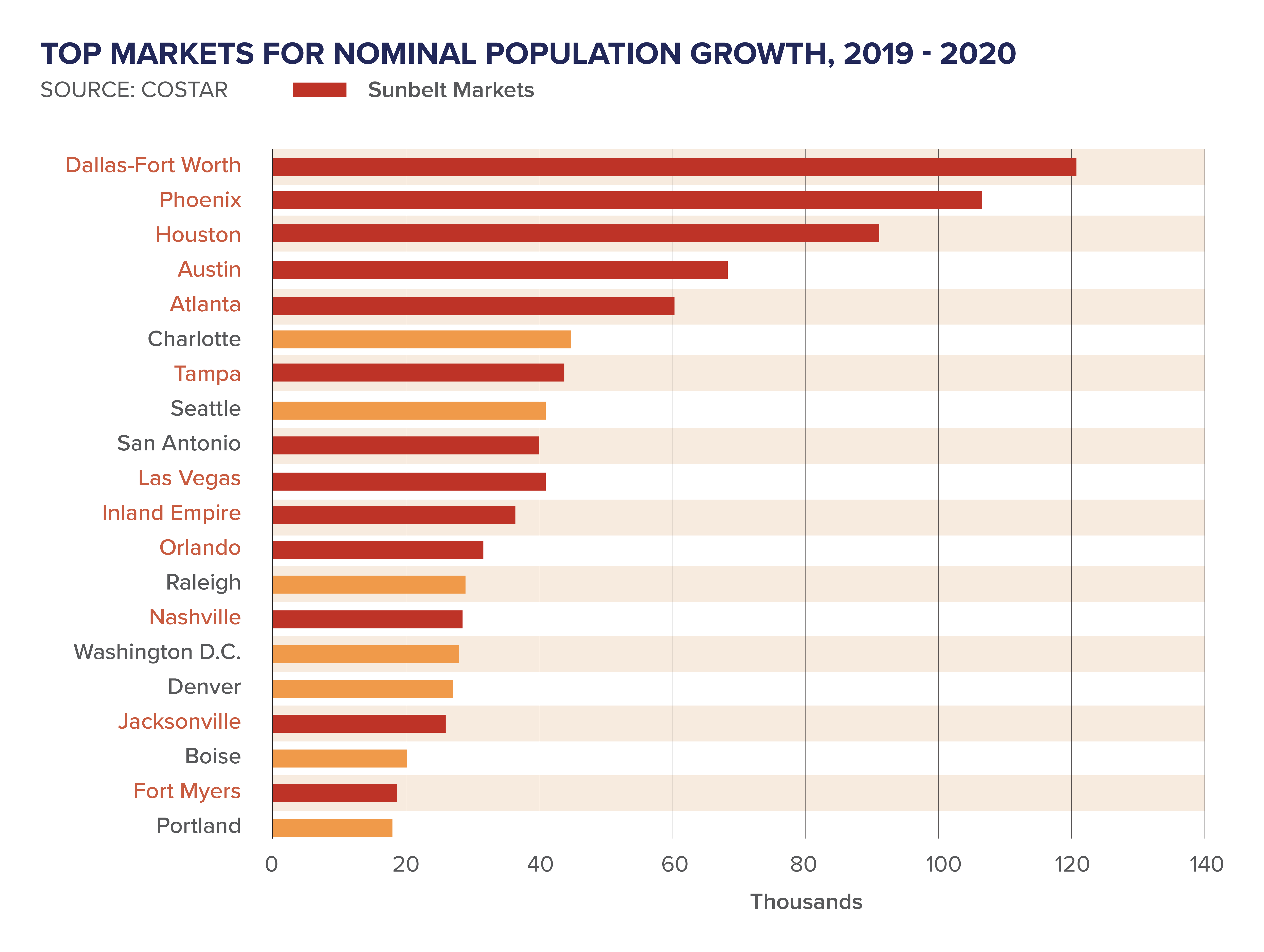

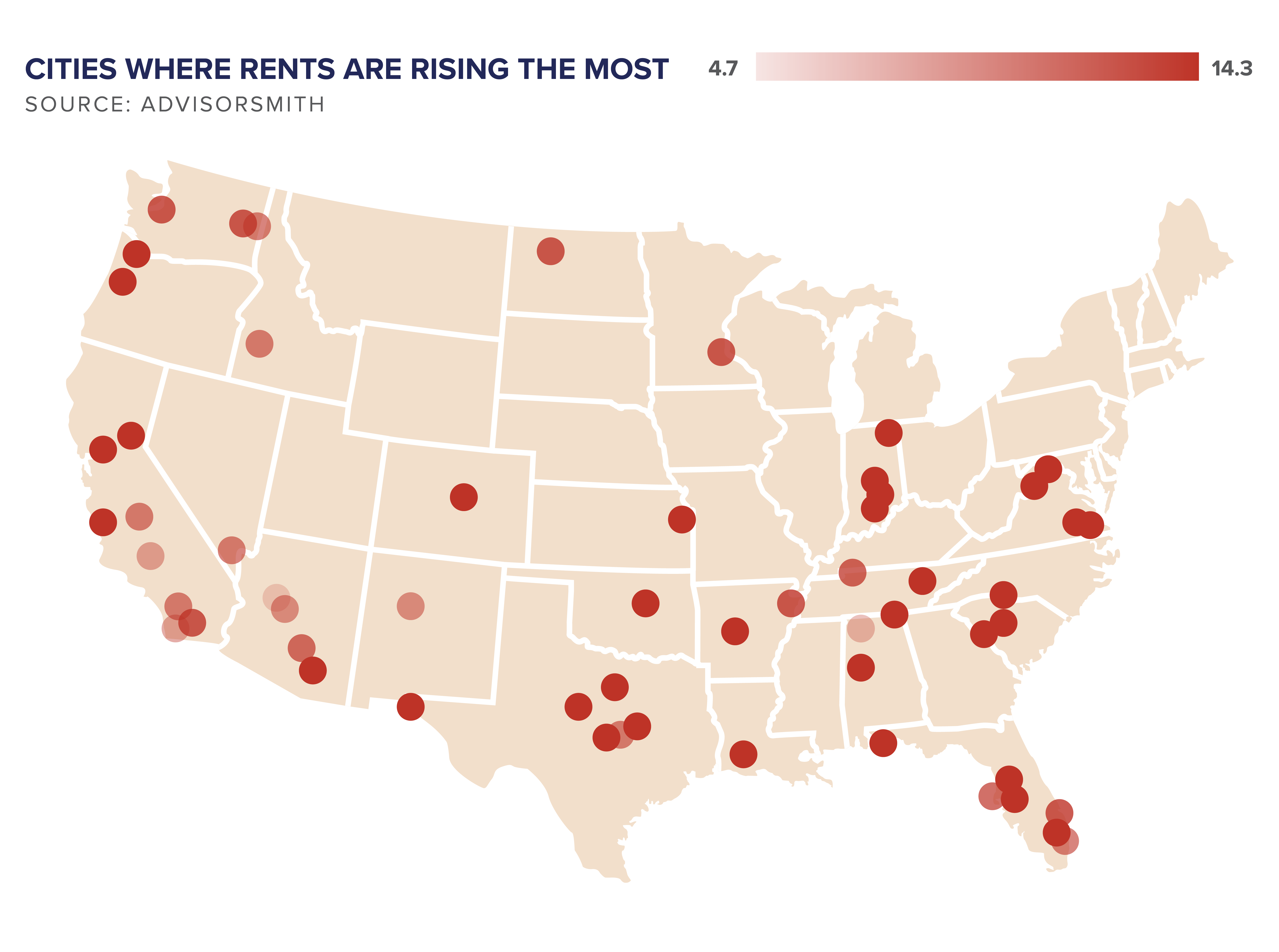

The Sunbelt markets saw attractive apartment growth, higher rates of move-ins than move-outs, more robust rental rates, single-family home appreciation, and stronger office fundamentals through the pandemic. Due to the Sunbelt’s long-term positive performance, several Sunbelt cities were ranked as “buy” recommendations in PWC’s Emerging Market Trends in Real Estate 2021. Sunbelt markets even take up half of PWC’s top ten markets in overall real estate prospects for their dynamic economies. PWC estimates the Sunbelt markets to produce 28 percent of new jobs from 2019 to 2025. Most metros in the Sunbelt are affordable markets that encourage growth, drawing in demand and rapid price appreciation.

Albuquerque, NM

Albuquerque’s significant draw to investors and renters is its impressive employment base and continually diversifying economy. The economy is dependent on various industries, including military, manufacturing, oil and gas, education, healthcare, and entertainment. Job growth was close to reaching the national benchmark before the pandemic, with the education and health sectors bolstering employment. Additionally, Netflix, NBCUniversal, and TaskUs have all recently expanded to the metro, potentially boosting apartment demand as additional workforce pours into the metro over the next several years. The local and sixth-largest air force base, Kirtland Air Force base, employs 23,000 people, and the University of New Mexico employs 7,000 faculty and staff.

The Albuquerque multifamily market remained stable through the pandemic, thanks to its affordability. Rent is a fraction of a cost compared to the National Rent Index, at almost 25 percent less than Phoenix and 55 percent lower than Denver. In the last 12 months, 308 units were delivered to the market, and only a few small projects are in the pipeline, making minimal impact on the market. That outlook is projected to change, though, as the demand, job growth, and population growth resemble the national average. The majority of activity is from out-of-state buyers, specifically from California. Two of the biggest trades in 2020 were from a Wisconsin-based firm involving a $73 million transaction and a California-based firm with a $38.5 million trade. Due to strong momentum in 2019, rental growth has continued through Q2 2021, with an 11.9 percent annual rent growth. Vacancies have remained stable and even reached a ten-year low by the end of 2020, at 4.8 percent. With the economy taking off, apartment demand will remain present in Albuquerque for the remainder of 2021 and onward.

Atlanta, GA

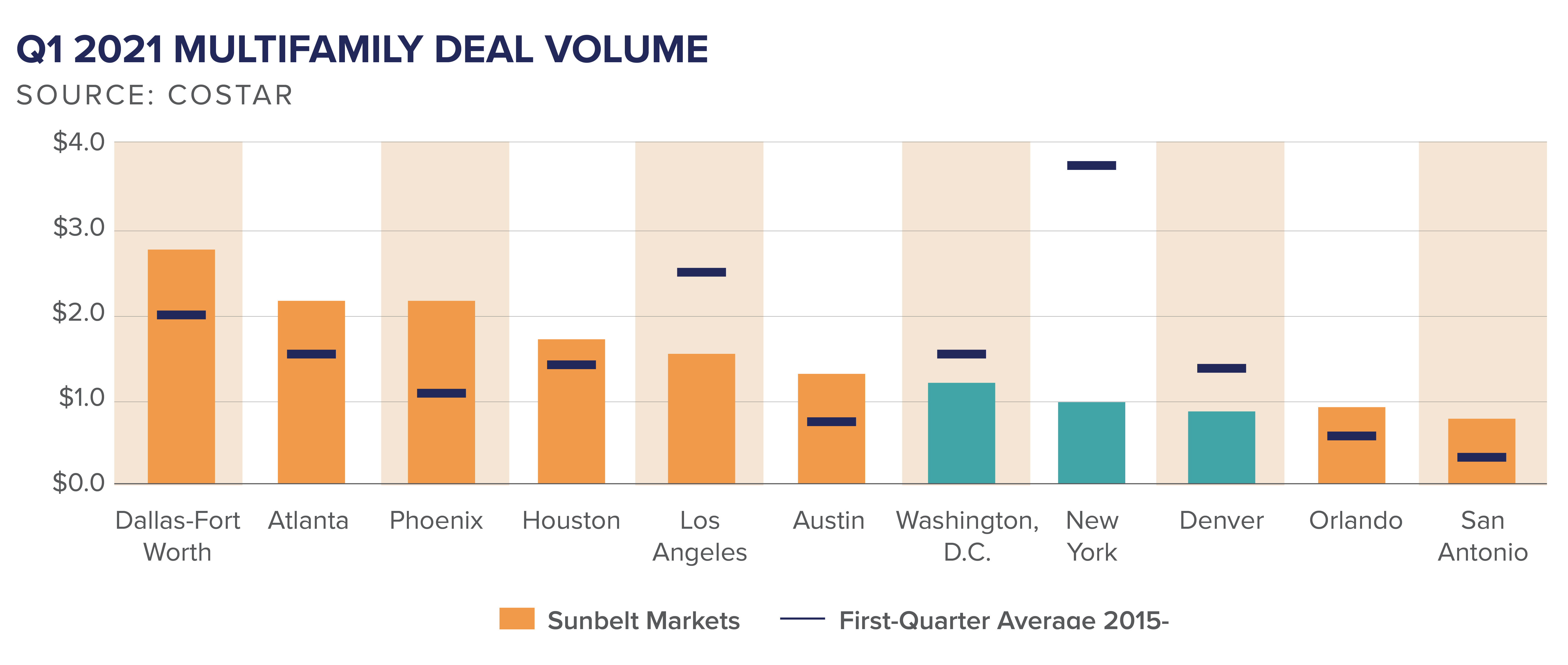

The Atlanta multifamily market has shown signs of significant improvement since mid-2020. The metro has experienced a 12.6 percent rental growth year-over-year, well above the national average. Additionally, the vacancy rate and 12-month rental growth have surpassed pre-pandemic levels, thanks to solid apartment demand. Submarkets seeing the most rental growth include South Fulton, Henry County, Douglas County, and Clayton County. In Q4 2020, Atlanta broke the quarterly deal volume record with $4 billion recorded in trades, the highest in the nation, driven by out-of-state investors. In Q1 2021, Atlanta broke volume records again for first-quarter sales, positioning the market as one of the top in the nation for 12-month sales volume. Q2 2021 recorded stronger than usual demand in the first two months of the quarter, indicating a solid performance for the rest of 2021.

More than 20,000 units were absorbed over the last 12 months, driving down the vacancy rate, and Atlanta welcomed 13,000 units during that same time. Since 2010, the market has added 70,000 units and compares to smaller, fast-growing markets like Charlotte (60,000 units) and Austin (80,000 units). Developers target South Atlanta, along the Beltline Southside Trail, and within the Summerhill neighborhood. The metro has experienced one of the tremendous nominal population gains in the nation, growing 6.4 percent over the past five years and forming 320,000 households since 2010. This growth can be attributed to the region boasting the highest concentration of colleges and universities in the Southeast, producing more than 40,000 college graduates annually. Consequently, Atlanta has the third-highest percentage of college-educated workers in the U.S.

Austin, TX

Before 2012, Austin consistently sold under $700 million in apartment trades, but Austin has surpassed that figure over the last five years, solidifying the metro as a secondary market.

Even though Austin has one of the highest vacancy rates among significant markets, the apartment market has quickly recovered. Asking rents increased over seven percent compared to pre-pandemic levels, despite the hefty supply pipeline with 6.5 percent of inventory under construction, or 15,818 units. Thanks to large corporations moving to and developing in Austin, such as Tesla’s Gigafactory, Oracle’s headquarters, and BAE’s expansion, the market saw strong apartment demand. The metro was named the best place to live by U.S. News and World Report for the last four years, and the growing tech sector and the University of Texas continue to retain young renters, keeping vacancies tight in the coming years.

Downtown Austin has the most considerable supply risk, with over 2,500 units underway, over half of the submarket’s inventory. Therefore, more than half of all downtown apartments offered some concession in the last half of 2020, with some offering two or more months free. The metro is notorious for its heavy traffic, with Interstate 35 crowned the most congested highway in Texas. This could have spurred the recent passing of Propositions A & B in the 2020 election cycle, which focuses on improving the city’s public transportation and walkability. With improvements on the horizon and fewer traffic concerns, it could entice renters to move to the market. Experts predict Austin will outperform many other major metros in 2021, attributed to the young population growth and retention, educated workforce, and impressive economic growth.

Columbia, SC

Columbia saw improved vacancies in 2020 due to strong demand from tenants working in various local industries, including military, education, health services, and professional and business services. The University of South Carolina has a student population of 35,000, and the state capital benefits from nearly 20 percent of employment entailing government jobs. This resulted in net absorption surpassing deliveries in 2020 and rental gains of 7.4 percent over the last year. The market’s stability has attracted investors, with investment activity almost doubling the historical average in 2020. The steady population growth and revitalization of Downtown Columbia have sparked business development in the area, increasing foot traffic and consumer spending. Columbia’s outlook for 2021 is positive, led by a strong construction industry, new job growth, and life science companies.

There are numerous value-add investment opportunities in Columbia, with over half of multifamily buildings built before 1995 and minimal new additions. Local and out-of-state investors appear to be targeting low to mid-range apartment communities, taking advantage of discounted pricing. Almost all deals in 2020 were transacted by out-of-state buyers, stemming from the metro’s fast-growing population, low cost of living, and numerous local tax incentives. Companies continue to target Columbia for its favorable economic indicators, including Call 4 Health, a healthcare facility call center, announcing their new operations projected to add 300 jobs.

Dallas-Fort Worth

Dallas-Fort Worth (DFW) is one of the fastest-growing and balanced multifamily markets in the nation due to continuous supply and corresponding absorption. The metro held strong job growth and in-migration leading up to the pandemic, making it a top market for apartment demand. DFW led the nation in 2020 for multifamily absorption, possibly attributed to the several corporate relocations and expansions to the metro. Multifamily sales picked up traction in the second half of 2020 and carried over into 2021, most of which were value-add opportunities in the Mid-Cities and East Dallas. With 3.7 million people employed in the metro as of mid-2021, the abundant job growth will bolster population growth and apartment demand.

Although DFW leasing activity took an initial hit in mid-2020, absorption has rebounded, keeping vacancies stable, with 29,870 units absorbed in the last 12 months. In the past, DFW rents grew between two to three percent annually, though it has stalled due to the pandemic. Growth is more prominent in expensive submarkets like Downtown Dallas, Uptown, and West Dallas. In contrast, suburban submarkets like Plano, Frisco, and Allen/McKinney have seen less demand due to the tight competition.

DFW ranked first nationally in 2019 and 2020 for construction starts in multifamily, industrial, and office, and ranked seventh globally in overall CRE sales volume, according to Real Capital Analytics. Even so, construction has tapered due to slow multifamily permitting in recent quarters, with about four percent of inventory under construction. The market has routinely added 145,000 multifamily units annually since 2010, expanding inventory by 25 percent, more than any other U.S. market.

Fort Lauderdale, FL

Fort Lauderdale saw some of the highest multifamily investment volumes in the nation, with more than $1.5 billion recorded in trades in 2020. There are currently more than 6,500 units in the pipeline, causing an expectant rise in vacancies in 2021, pushing Fort Lauderdale above the National Index rate. However, apartment demand has surged, helping rents expand in the recent months to pre-pandemic levels. Annual rent growth has surpassed five percent in the metro. The annual sales volume is 40 percent higher than the ten-year average, reaching $2 billion, thanks to more than $800 million in trades in the last quarter of 2020 alone. Fort Lauderdale ranks among the top 15 markets in the nation and as the second market in Florida for the most transactions.

Leasing has improved considerably over the last six months, and the previous two quarters have broken quarterly records. With net absorption outpacing deliveries by nearly two to one in the first quarter of 2021, rental demand is prominent in Fort Lauderdale. Absorption should keep up as price growth surpasses income growth, deterring people from long-term residencies. Before entering 2021, rents were already back to pre-pandemic levels in December, and rents are bolstering so far in 2021. Economic recovery is anticipated to be slow in 2021 due to South Florida’s lengthy lockdowns during the pandemic.

Huntsville, AL

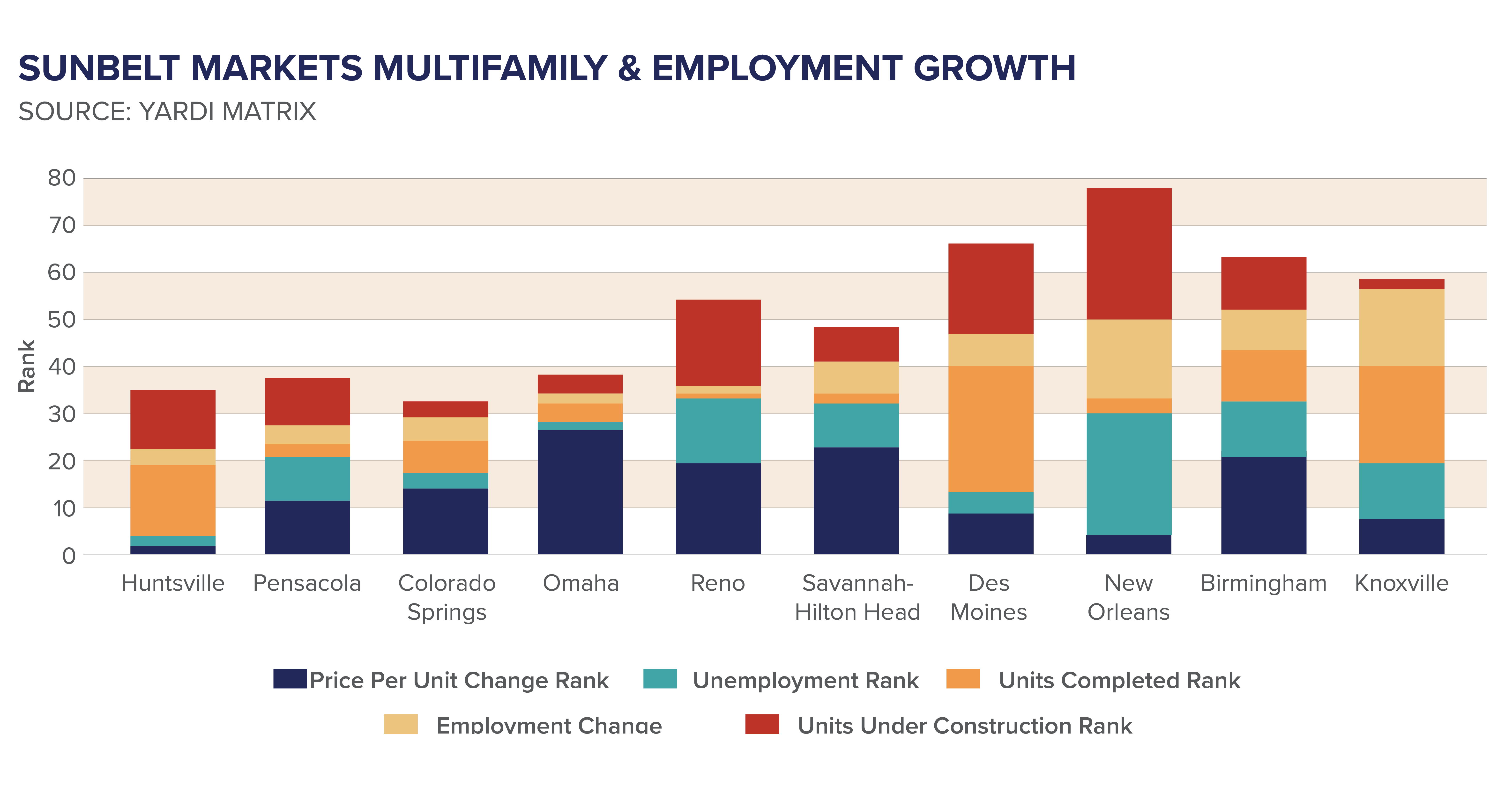

Annual investment reached a record high in 2020, garnering the interest of larger buyers and out-of-state investors for its impressive demographic trends and relatively low acquisition costs. Huntsville’s population grew 13 percent from 2010 to 2019, projecting to become the state’s largest metro this decade. The market’s diversified economy has helped in times of economic hardship and attracted a highly skilled workforce. Toyota, Google, NASA, Blue Origin, and Boeing are expanding in the area through employment or development, retaining educated workers. Huntsville remains an affordable market despite the strong presence of tech jobs and healthy income growth, which will benefit the metro in 2021.

Rents have seen a cumulative growth of 30 percent since 2010 and year-over-year growth of eight percent, despite a record number of deliveries over the last ten years. Huntsville’s vacancy reached historic lows in mid-2020, with a 96.8 percent occupancy rate, 200 basis points above the national average. Since then, new supply has been added, putting pressure on vacancies. Still, the market’s stabilized properties have an average vacancy of less than five percent. This has attracted developers to the area. Inventory is expected to grow by ten percent in the coming quarters. Rents are projected to cool with roughly ten percent of inventory currently underway.

Jackson, MS

Jackson, the capital of Mississippi, is an established manufacturing hub, ranked third nationally for overall advanced manufacturing growth. Manufacturers have come from across the globe, including Continental Tire, which recently revealed plans for a $1.45 billion manufacturing plant in Hinds County. Jackson possesses impressive market conditions, home to dozens of universities and colleges, an expansive young professional population, and affordable real estate. Jackson’s annual multifamily net absorption and rent growth are highest in over a decade, even through the outbreak. Rents rose 6.5 percent over the past four quarters, despite the market adding the largest supply since the 2000s, for a total of 1,000 units.

Construction is limited, helping keep vacancies tight. Though, most developers target dated properties for renovations and value-add opportunities. Multifamily trades in Jackson have held up substantially compared to any other commercial real estate product here. So far into 2021, buyers have been active in the market, with $80 million in trades already recorded. The average price per unit has grown five percent in the last 12 months, and cap rates have compressed to the low six percent range. Due to this favorable activity, the outlook for Jackson is positive.

Los Angeles, CA

With almost half of households renting, Los Angeles boasts one of the highest percentages of renters in the nation. The expensive home prices have kept demand in favor of apartments. Suburban submarkets experienced the most rental growth and demand in 2020 and 2021, while urban areas are slow to recover.

As shown by the massive move to the Inland Empire, affordability drives the demand, where rents average $400 less per month. With the impending expiration of the eviction moratorium right around the corner, renters continue to migrate to the suburbs in search of more affordable rents.

Though Los Angeles experienced rent losses, it is known as the U.S.’s financial, cultural, technology, and government capital, which has helped recovery.

The state recently kicked off a new program to help preserve affordable housing in a region that holds some of the nation’s most expensive houses and apartments. As of May, the most extensive multifamily trade of the year closed for $300 million in Glendale. The Glendale acquisition is one of nine deals partially funded by the state development authority, intending to offer essential workers an affordable community in the same cities they serve.

Nashville, TN

Although rents dropped three percent in 2020, they have since increased by seven percent in the last 12 months due to the strong performance in suburban submarkets.

Nashville has one of the most active multifamily developments in the nation, with almost 15,000 units underway. Downtown entails 40 percent of the construction pipeline, followed by Southeast Nashville due to the number of Opportunity Zones in the area. Since Q2 2020, demand and lease-up activity have improved, with an average of 20 units leased per month in Downtown and suburban properties. Both national and international investors have been active in Nashville since the second half of 2020, keeping annual sales volume elevated.

The metro holds one of the strongest office-job markets in the nation and benefits from expanding industrial, automotive, and healthcare industries.

Several large corporations have announced headquarter relocations or expansion plans to the metro for its business-friendly environment, including AllianceBernstein, Amazon, and Mitsubishi. Additionally, Oracle recently made one of the most significant commercial real estate transactions in Nashville history by purchasing 65 acres of land for $253.7 million as part of its expansion plans for its regional headquarters, creating 8,500 jobs. Nashville ranks among the top cities for “desirability” by the U.S. News and World Report and Smart Asset. Even with the expansive pipeline on the horizon, the metro benefits from job and population growth, boding well for the apartment market.

Pensacola, FL

Known for its beaches and navy presence, Pensacola has fared better than most metros through COVID-19. Rents have risen 10.5 percent annually, marking as one of Florida’s highest increases.

The market fared well through the pandemic, enabling landlords to push rents throughout 2020. Yet, Pensacola remains affordable compared to other Florida markets, by roughly 15 percent, with an average asking rent of $1,170 per month. Coinciding with this, vacancies are near historic lows, at 4.4 percent across the entire metro. This can be attributed to the growth in office-using jobs, student population, and overall population.

The financial sector has been particularly active, with the Navy Federal Credit Union adding thousands of new jobs in 2019 and plans to double the workforce by 2026.

The Naval Air Station in Pensacola has also bolstered employment, with over 23,000 military and civilian employees. Both these employers have contributed to healthy income growth. Pensacola welcomed 550 units last year and currently has 954 in the pipeline. So far into 2021, $140 million in trades have been recorded. The market offers a discounted rate on pricing compared to Panama City or Fort Walton Beach, with an average of $88,000 per unit.

Phoenix, AZ

Phoenix is welcoming 200 new residents each day as renters migrate to the market in search of affordability. The metro has seen significant employment gains in the financing, technology, and manufacturing industries – a key in the market’s resiliency amid the pandemic. It is one of the best-performing markets in job growth and recovered 72 percent of job losses from the pandemic by March 2021. Additionally, Phoenix has a low supply of single-family homes, influencing people to rent in the area. Over the last two years, Phoenix has led the growth in apartment rent increases and single-family home appreciation, according to CoStar.

Phoenix’s apartment demand is mainly present among affordable properties following national trends, causing concern as most new supply consist of A-Class projects. Vacancies are sitting at historic lows, though federal and state aid may have stimulated this. With a 21,000-unit development pipeline, vacancies may increase in the coming quarters, but the market’s net in-migration could counter this. Like other markets, Phoenix began to swiftly recover in the second half of 2020, as shown by the eight percent year-over-year increase in rents as of January. Although Scottsdale, Tempe, and Camelback submarkets saw the slowest rent growth, they still surpassed the national average due to the extreme demand to live in those areas. The submarkets offer restaurants, nightlife, and shopping options, allowing landlords to push rents. The suburban submarkets posted the highest rent gains, at ten percent.

Reno, NV

Reno is on the receiving end of heightened apartment demand. Net absorption reached an all-time high in 2020 and has carried over into 2021. Within the first three months of the year, Reno already reached $200 million in sales, breaking its quarterly volume record. Historically, the market achieved an average annual volume of $121 million. Rents have increased by an incredible 11.1 percent compared to pre-pandemic levels, reaching an average of $1,430 per month, an almost 40 percent discount than major California markets, such as San Francisco. Reno’s population has grown twice the national rate in the last ten years, with most in-migration coming from California, feeding into apartment demand.

With neighboring states such as California, Reno benefits from its proximity to Silicon Valley, a business-friendly environment, and low living costs. Major corporations like Apple, Google, Tesla, eBay, and Walmart have all announced expansion plans to Reno, including a one million square foot data center, a 27,000 square foot warehouse, and land acquisitions for future development plans.

The market’s proximity to nine states allows shipping to be on a next-day basis, crowning Reno as a trade and transportation hub. Moreover, the new fulfillment centers added to the market have pushed the trade sector to 12 percent above the pre-recession peak, marking it one of the top-performing employment industries in the metro over the last decade. The strength of Reno’s economy, soaring investment volume, and affordability point to an optimistic outlook in 2021.

San Fernando Valley, CA

Encompassing several neighborhoods, San Fernando Valley is a growing suburban submarket offering a plethora of larger garden-style units. According to Curbed LA, San Fernando Valley can expect heightened development in the coming years as investors continue to make the submarket more city-like by building thousands of new multifamily units, opening new retail spaces, and constructing new offices. The average asking rent is $2,002 as of June 2021. Renters are shifting demand from nightlife, entertainment, and access to jobs in the urban core to a better quality of life, more space, and affordability that San Fernando Valley offers.

As the affordable alternative to Los Angeles, the submarket houses over 1.8 million people, including half of all Los Angeles County contractors, a third of business professionals, and plentiful healthcare workers. A significant industry bolstering San Fernando Valley’s economy is aerospace, employing thousands of skilled workers in research and development engineers and designers. The Orange Line bus route is going through a major extension, a project worth $393 million. As a popular transportation method in San Fernando Valley, the project is expected to complete in time for the 2028 Los Angeles Olympics.

The elevated activity on the Sunbelt will have lasting implications, and the business migration will benefit the area for years to come. The powerhouse economies, lower taxes, and cost of doing business will continue to appeal to a wide range of businesses even after gateway markets recover. These markets also benefit from their tech-driven environments, with many taking advantage of the new work-from-home policies; this has many young professionals reconsidering where they live and work. Existing apartment properties will benefit from the decade-long population growth, enabling landlords to push asking rents and incentivize developers to build new units. The Sunbelt offers various attractive buying opportunities, especially for investors hunting for the best value.