Evaluating Performance Per Retail Sector

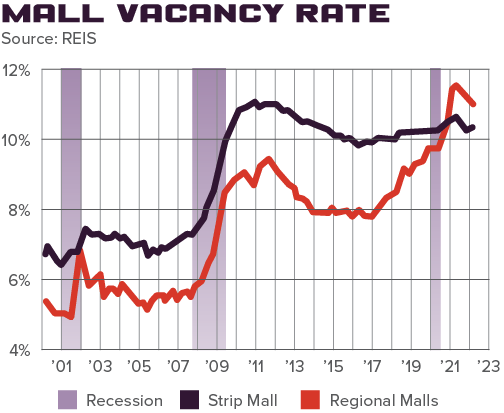

The United States retail market has made steady progress in its recovery from the pandemic, with nationwide net absorption reaching its highest level in six years. The increased demand has filled vacant spaces across the market, even though malls and regional centers still face headwinds. Developers and lenders are shying away from speculative retail projects, including indoor shopping malls. On the other hand, multi-tenant retail and open-air shopping centers have emerged and are on investors’ near-term watch list. As retail development continues to shift and consumers’ buying habits change, tenants are battling to be placed on investor and developer rosters. Some are strong contenders, making the first cut as “starters,” while others are falling behind and are in danger of being “benched.”

Strip Malls (Smaller/Inline Retail Shops)

Strip malls remain a viable asset class for investors both large and small. Less start-up capital, short-term lease structures, and the ability to frequently mark rents to market create flexible, inflation-resistant exposure to retail as an asset class. Strip retail has turned a corner. Over the last decade, leasing demand has fallen short of the abundance of supply. But the changes to consumer preferences coming out of the pandemic have proven very beneficial for convenient, local retail with tenants that are able to quickly adapt business models.

Strip malls earn higher demand than traditional malls, in part for buy online, pick up in-store convenience.

Landlords continue to do their part to offer a more convenient and experiential experience as well. A popular repurposing trend is a multifamily concept – changing a building’s use from retail to mixed-use. As a result, the prevailing areas with ample parking spaces could change into a shared lawn with the potential to include a garden pavilion that would serve as a communal space for all the tenants.

The pandemic and the growth of online stores limited a few players in strip malls from reaching their growth potential. However, other smaller stores are spearheading the race in 2022. Ulta continues to post strong quarterly results with increased profitability and thoughtful growth. Bath & Body Works has been executing well on the mall-to-open-air strategy and providing strong competition to Ulta, offering strong margins in a recession-resilient category.

Starting Players

- Bath & Body Works

- Ulta

- Dollar General

Bench Players

- Guitar Center

- Chuck E Cheese

Big-Box Retail

Some of the nation’s largest retailers have been holding strong against issues in the supply chain, high operating costs, inflation, and e-commerce. When consumers tighten their budgets, essential-based retailers such as grocers tend to outperform retailers that rely on discretionary spending. That dynamic could put pressure on companies like Bed Bath & Beyond Inc., a company that heavily relies on the sale of niche gadgets, products not purchased as often during high inflationary periods. However, in times of recession, big-box retail will remain a popular investment even when the sector is hit with issues like inflation and high cap rates. Since most tenants are backed by an investment-grade credit tenant, there’s a higher likelihood of them fulfilling responsibilities and payments.

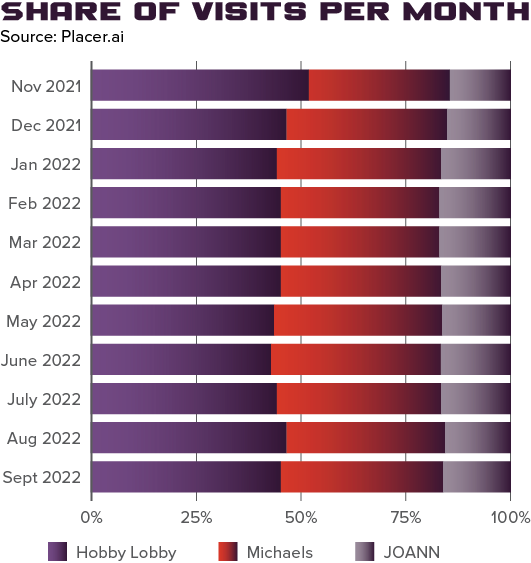

The tenants in the home goods, decor, and home improvement categories are the starting players of big-box retail. Stores like Jo-Ann Fabric and Craft operate within a difficult arts and crafts space that faces increasing pressure from e-commerce and competes with two dominant players, Michaels and Hobby Lobby.

Starting Players

- Hobby Lobby

- Home Depot

- Big Lots

- Ross

Bench Players

- Bed Bath & Beyond

- Jo-Ann Fabric and Craft

- Party City

Pad Site Tenants

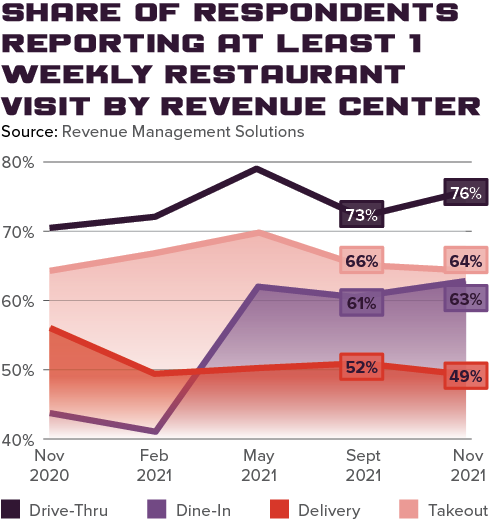

Commercial pad sites have opened the eyes to many investors looking to transform an underutilized commercial space into something much more functional and profitable. A retail pad or outparcel is a building lot adjacent to a mall or shopping center that is standalone and customized for a tenant. QSRs that adopt efficient online and drive-thru concepts will find the most success at these types of locations. Throughout the pandemic, drive-thrus remained profitable because they were able to continue serving customers even when dining rooms were closed. These models are most flexible to deliver products that mirror customer demands and will continue to thrive.

Sit-down restaurant concepts like Denny’s will likely be the most impacted by rising food costs in an inflationary environment. Table service and drinks are an easy expense to cut when belts start to tighten, causing more challenges for these retailers.

Starting Players

- Starbucks

- Chipotle

- Chick-fil-a

Bench Players

- Denny’s

- Red Robin

- Applebee’s

Grocery-Anchored

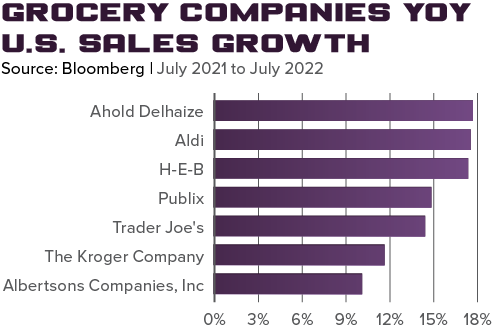

Grocery tenants were the big winners during the pandemic, with sales topping $800 billion last year. COVID-19 forced many grocers, large and small, to navigate supply issues and increased the demand for online orders and curbside pickup. A handful of grocers have chosen technology as their saving grace to provide consumers with better in-store and online convenience. Amid inflation, grocers will need to apply the same lessons learned at the height of the pandemic to sustain growth. Value-based grocers like Aldi and Walmart, who operate at razor-thin margins, will see the most increase in volume and traffic, while Whole Foods will need to weigh margin vs. traffic as consumers cut back on higher price point items. The major story going forward over the next year will be the mega-merger of Albertsons and Kroger, creating headaches for the unlucky landlords caught with one of the stores that are going to be shuttered or rebranded.

Grocery-anchored shopping centers recorded their second-most active quarter in a decade for Q4 22, and property transactions hit the highest number at 735 total trades, according to Globest.

Starting Players

- Walmart

- Aldi

- H-E-B

Bench Players

As more people seek cheaper alternatives for groceries, higher-cost grocers like Whole Foods and Trader Joe’s hold a customer base that is less sensitive to prices and will likely see a shift of customers switching to lower-priced substitutes. Although high inflationary pressures are going to squeeze margins, there is no real risk for grocery stores as the industry already has tight margins to begin with. Additionally, the credit and traffic driven by grocery-anchored deals will help the non-anchor retailers survive any upcoming headwinds.

Despite concerns about retail sub-sectors going out of business, the need for convenience will truly be the saving grace that prevents them from disappearing off the grid. More significant improvements are needed if these complexes are meant to thrive and not just survive. As consumer spending shifts, it’s clear retail owners will need to evaluate how to keep the shopping experience valuable and profitable. Investors who are recognizing and capitalizing on this relationship can create exceptional customer experiences and deliver value to various retail sectors.