EVs Electrify the CRE Space

The popularity of electric vehicles (EVs) continues to gain ubiquity across the country and is pushing many businesses to add property value through EV-integrated solutions. Development in EVs will create multiple opportunities for the real estate sector as multifamily, office, and retail adapt properties to cater to EV users. CRE owners can lead the e-mobility future by adding EV charging stations to their properties and gain a revenue-generating investment that is also an asset to the community. These stations add tremendous convenience for tenants, shopping centers, and other retail properties. President Biden has set an ambitious goal for half of the new car sales to be electric, fuel cell, or hybrid electric by 2030. If half of all cars sold by 2030 were electric, EVs could make up between 60 to 70 percent of vehicles on the road by 2050.

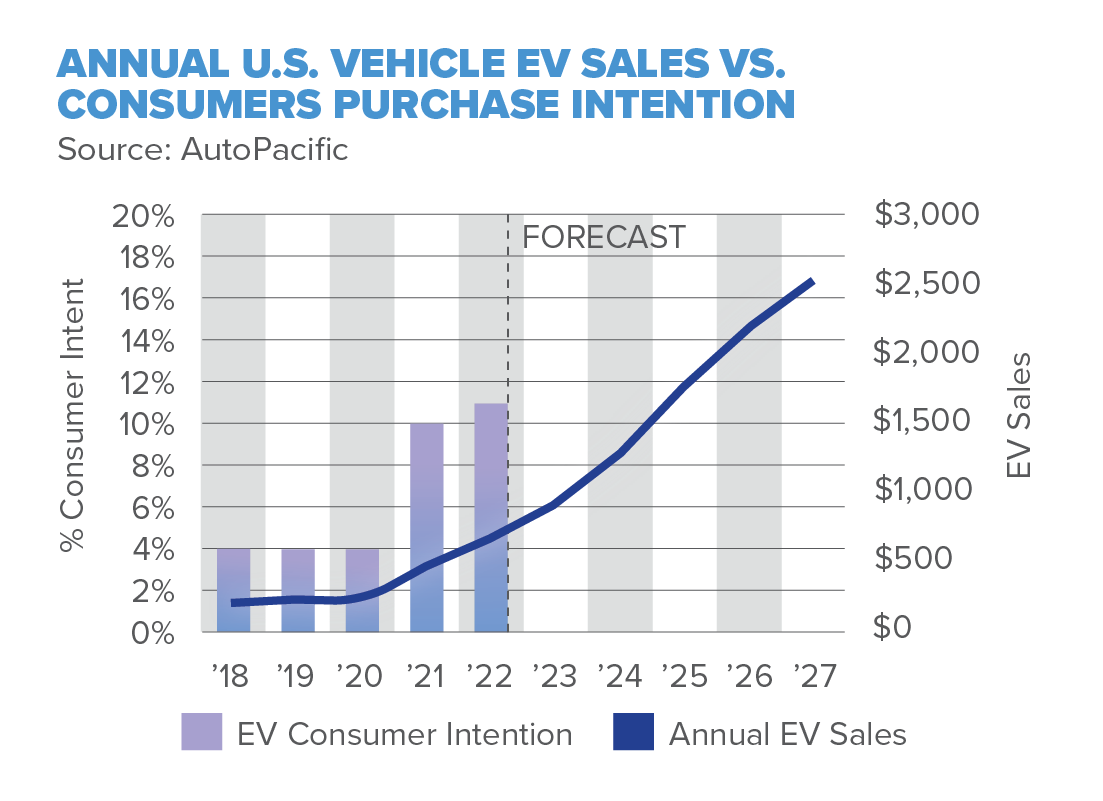

Electric vehicle sales are projected to grow from $163 billion in 2020 to $823 billion by 2030, according to Globe Newswire.

EV Cost Fundamentals

Those looking to venture into the EV market may not know about charging stations’ costs. There are three different charging technologies used today:

Currently, the majority of commercial real estate properties use Level 2 chargers. Although some models may cost a bit more, they provide a shorter charging time which is attractive to consumers and can be used by all EVs, widening the customer base.

In addition, property owners can utilize charging companies that offer monthly subscriptions, producing customer loyalty. Most EV drivers don’t want to get tied down by monthly subscriptions or membership fees, however, it can be worthwhile as membership provides drivers with discounts and easy access to public stations. For example, Electrify America’s, a DC fast charging station network, membership program saves California residents $.012 per kWh.

Impact of EV Charging on Existing Properties

First off, increasing EV adoption means a concurrent rise in electric charging system demand. The pressure is on property owners and developers to provide charging stations for tenants and offer a handful of charging ports in parking lots where people already go to work and shop. Commercial real estate investors can monetize and drive more revenue to their assets by implementing charging stations. Product types such as offices, multifamily, gas stations, and more can take advantage of the increasing demand.

Consumer Standards

People prefer to charge up where they can multitask – have a meal, get some shopping done, or access other services. Business owners offering charging incentives in areas with higher EV drivers will attract more customers and increase the amount of time people spend in a store or restaurant. As a result of the growing popularity of electric vehicles, commercial owners who provide charging stations are likely to see increased property values. The same goes for multifamily communities and office buildings, as on-site chargers are a major desire for many apartment residents and employees. EV drivers are often willing to pay more rent for access to these charging stations and tenants are more likely to agree to long-term leases.

So far, 14 states and Washington, D.C., have adopted California’s regulations that require the sales of a certain number of zero-emissions vehicles per year and for all cars sold to be zero emission by 2035.

Opportunities for Redevelopment

The industry must develop updated technologies to meet the growing demands of EV drivers and to support the charging infrastructure. Design, infrastructure, and IT will all be significantly impacted by the implementation of EV charging stations, increasing redevelopment costs. On the other hand, charging stations bring in their own form of revenue and have proven to have a return on investment.

One multinational hotel chain that offers EV charging capabilities at over 3,000 locations has seen indirect revenue increases by installing EV chargers, including one Southern California location. The hotel owners said the new EV charging capabilities had driven a new stream of overnight guests, along with those who stay in the lounge and restaurant long enough to charge their vehicles and enjoy a meal.

A few major retailers have already begun providing EV chargers at their stores:

- Kroger – Struck deals with EVgo, Blink, Electrify America, and Tesla to implement more than 350 chargers across their locations to ensure customers could charge while running necessary errands like grocery shopping.

- Whole Foods – Installed its first fast charger in 2013, which can charge in less than an hour. By 2019, 200 of Whole Foods’s 504 stores had traditional chargers and more than 50, mostly in California, had fast chargers.

- Target – Announced the installation of EV charging stations to a goal of 600 parking spaces in over 20 states over the next two years and partnered with Electrify America to provide DC fast-charging stations.

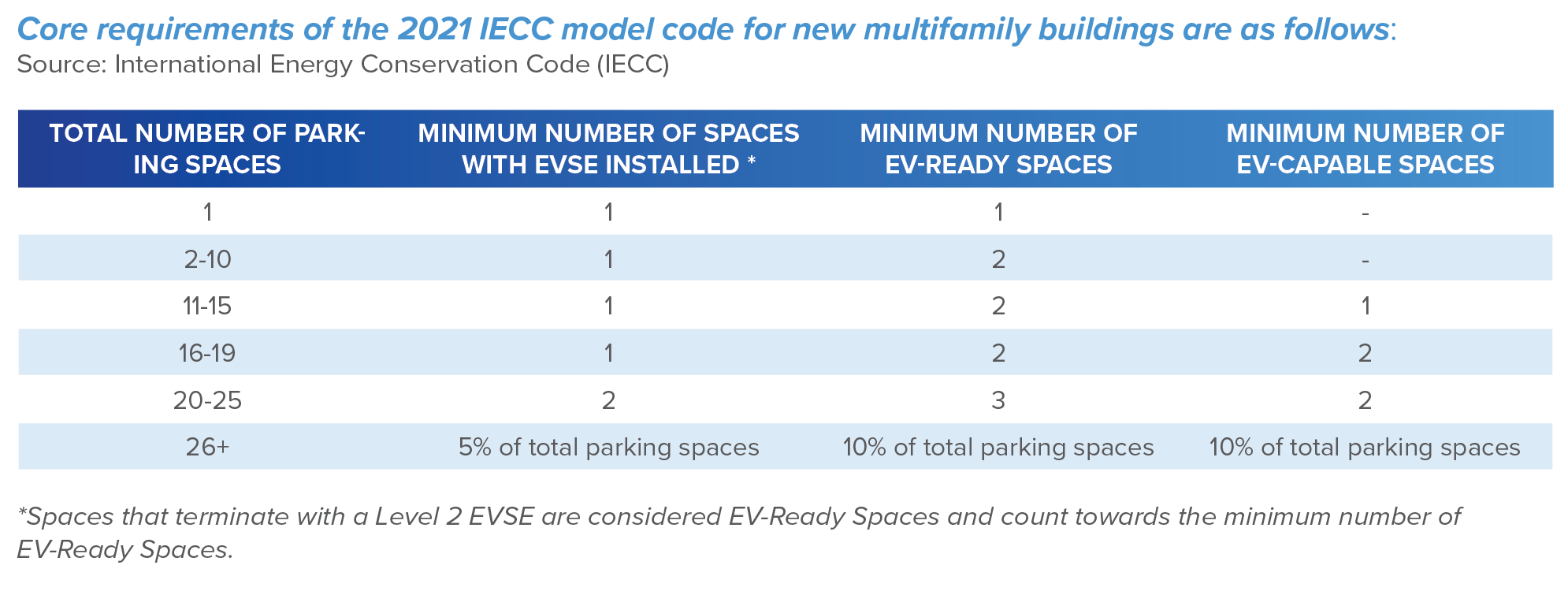

Due to the high demand for electric vehicles, there is an increasing need for more EV infrastructure as most existing buildings are not equipped with EV-ready parking spaces. Early last year, the approved version of the International Energy Conservation Code (IECC) will require new commercial properties with two or more parking spaces to include at least two EV-ready spaces. The IECC defines an EV-ready space as one that has a 40-ampere, 208/240-volt dedicated branch circuit to support a Level 2 charger.

Core requirements of the 2021 IECC model code for new multifamily buildings are as follows:

How Property Owners Can Prepare for EVs

Today, preparing a building for EV charging is imperative — especially if planning to install charging stations right off the bat. In fact, according to CalMatters, “installing EV infrastructure at a time of new construction is the least expensive way to create EV charging access. Retrofitting can be four to 10 times more expensive.”

“The state of California will save $1.4 billion by installing EV charging technology upfront, rather than through redevelopment.”

Property owners will need to think about the long-term viability of the chargers they choose. Depending on the size of the building, owners should be strategic when offering residents or customers options in how they decide to charge EVs. Installing the right type of charger at the right location will be crucial. For multifamily properties or offices where occupants spend long hours, Level 2 chargers work well. At retail locations, industrial facilities, bus depots, roadside stops, and other places where getting in and out efficiently is key, faster charging will be needed. Fully understanding a property’s clientele and the costs associated with installation will ensure the chargers will actually be used on-site.

How Profitable are EV Charging Stations?

The installation of EV charging stations can pose several benefits beyond an additional revenue stream for businesses. Billing customers for their use is the easiest way to maximize revenue, especially in areas where chargers are in high demand. A survey from E Source found that 18 percent of EV owners were willing to pay up to $3 per hour for charging, and 12 percent were willing to pay $4 per hour.

Implementing EV charging infrastructure increases the following for a CRE owner:

- Convenience for Consumers

- Sustainability and Visibility

- Increase in Property Value

To see a rapid ROI on charging stations, owners should consider subsidies. Bishop Ranch, a commercial business center located in San Ramon, CA, with over 500 businesses, including retail and office space, took advantage of a grant from Pacific Gas & Electric (PG&E) utility company and partnered with a local bank to subsidize the costs of installation. The bank had its branding on the EV chargers, which helped showcase the bank’s sustainability support and added visibility for the brand. Between the grant, local and federal incentives, and subsidies, Bishop Ranch paid very little for the charging infrastructure and estimated their EV chargers would become profitable within five years.

The cost of electricity gets passed directly through the charger. Owners can choose to subsidize the electricity costs as a perk to workers or require tenants to pay for charging.

The Long Road Ahead

Since the upcoming years are critical for properties in areas with high EV adoption, simplifying the setup and management of charging stations, from installation to driver support, can aid other properties in modeling the expansion of EV infrastructure. Those looking to implement an affordable, profitable, and scalable EV infrastructure will have the most success and impact the industry for decades.