Grocers Pushing Back on Recession Fears

With soaring inflation, rising interest rates, and a volatile marketplace, analysts are predicting that an economic recession is on the horizon. However, investors continue to keep their eye on the grocery-anchored retail sector due to its impressive sales growth, better risk-adjusted returns, and strong performance during the pandemic. Technological innovations and infrastructure improvements fuel the bullish outlook, and discount grocers are leading the sector as prices continue to rise.

State of the Grocery Market

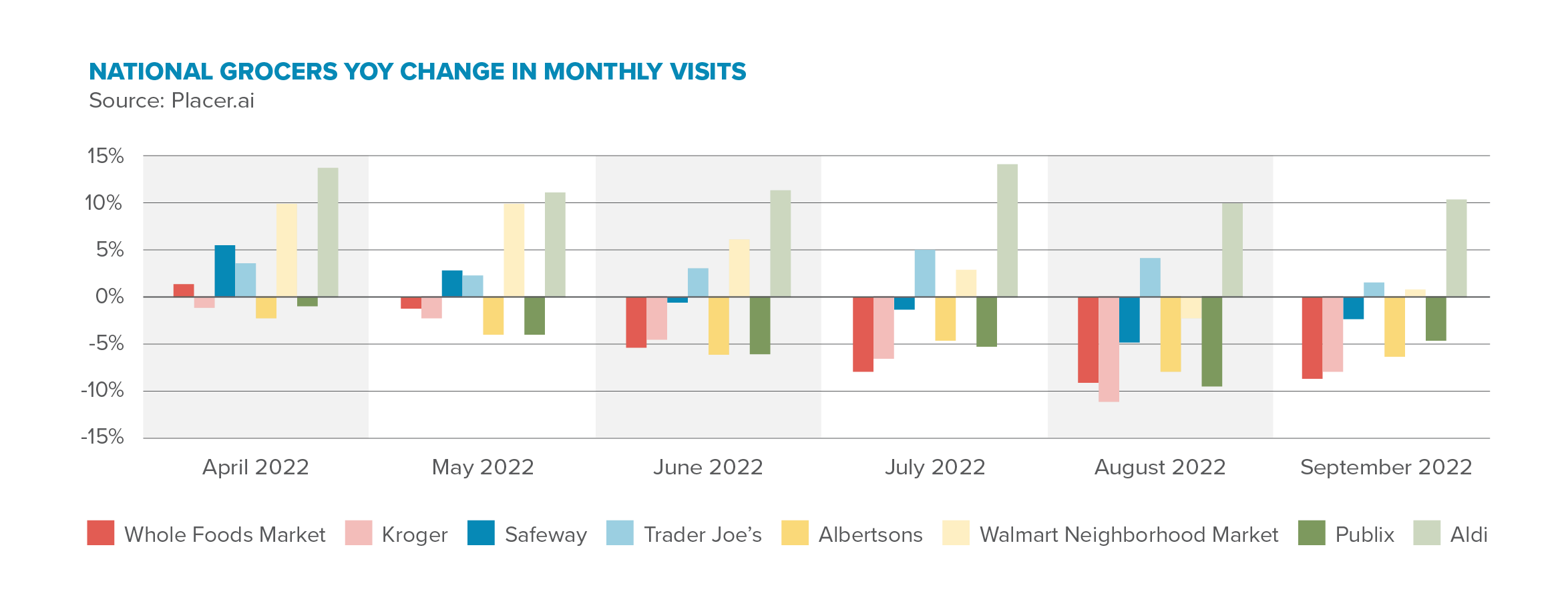

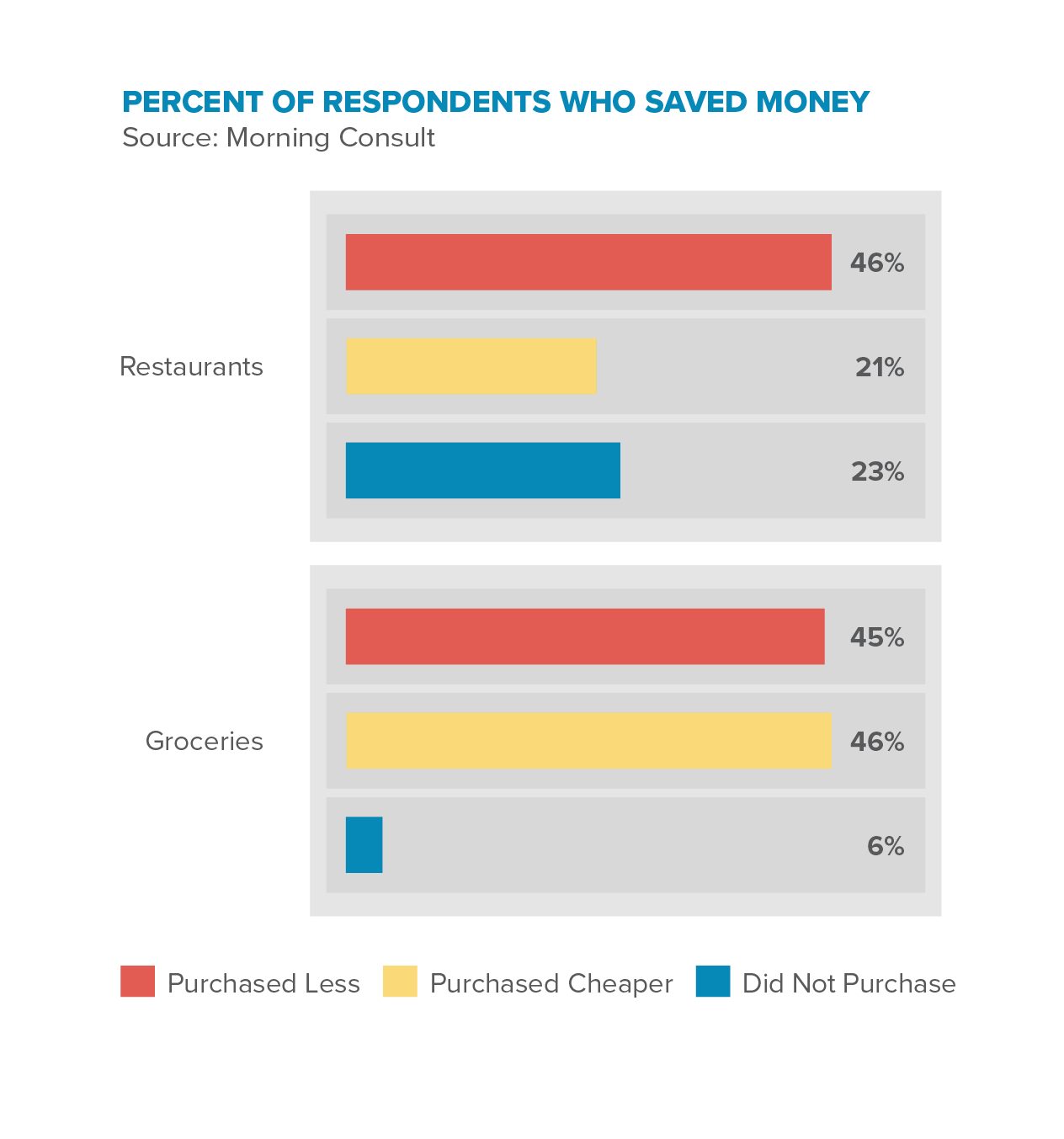

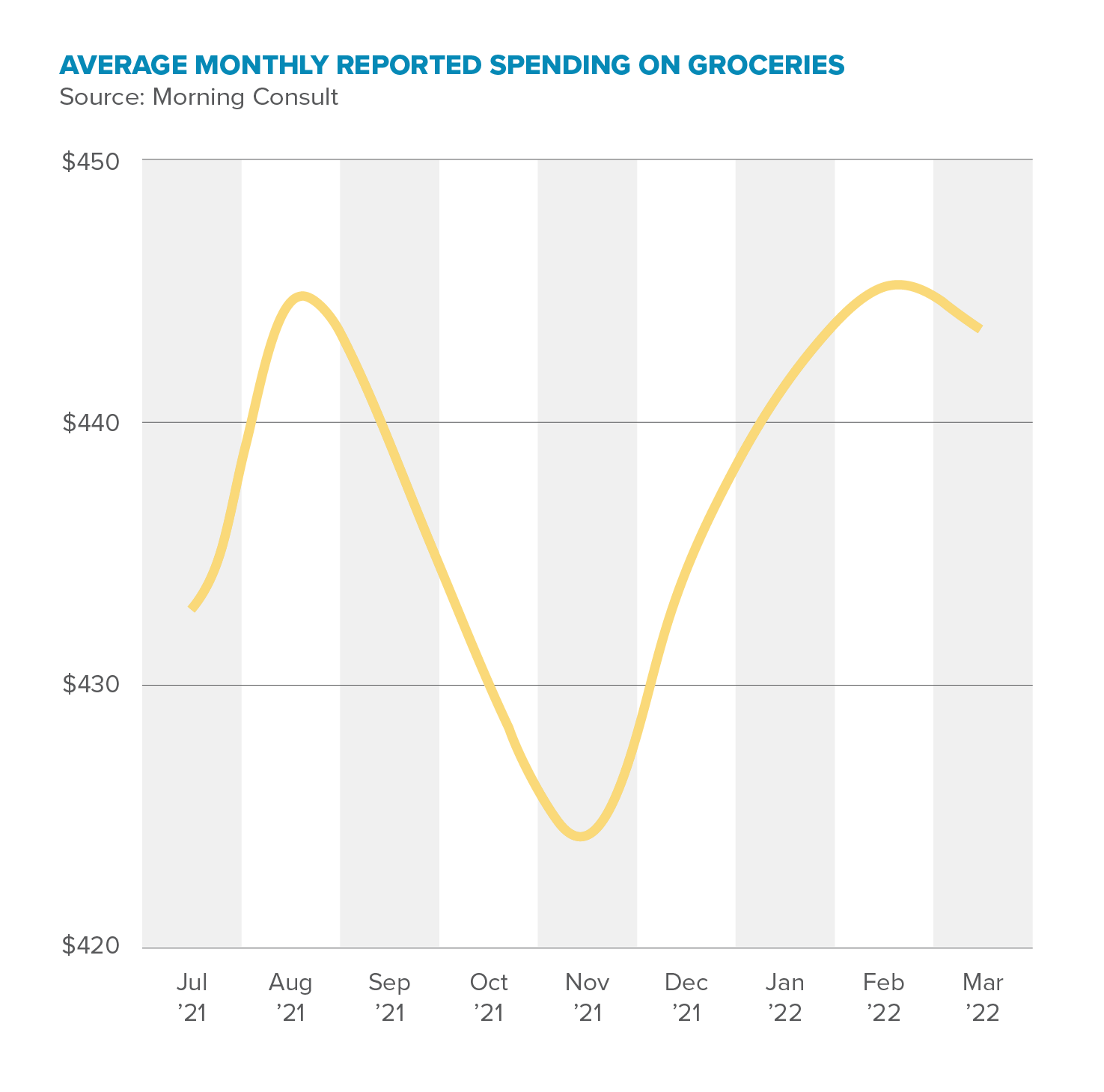

When stay-at-home orders were issued during the pandemic, it drove a surge in buying that wiped grocery shelves out of stock and provided an important reminder of the critical role grocers have in providing essentials to consumers. The result of panic buying caused a significant increase in sales and ignited a resurged interest in the grocery space for investors. As more consumers trade down restaurant outings in favor of home-cooked meals, chains emphasizing low prices are seeing positive year-over-year visit trends despite the overall retail sector downturn.

Despite a decline in in-store visits as consumers adjusted to inflation and high gas prices at the start of 2022, grocers are seeing foot traffic bounce back quickly.

Consumer Shifts in Grocery Shopping

Grocery inflation is currently at its highest point since 1979, and the price of food at the grocery store is expected to increase by up to 11 percent this year, according to the U.S. Department of Agriculture (USDA). Consumers are looking for ways to cut back on expenses and think twice about buying name-brand items. As a result, the shift to cheaper private-label products is trending. This switch has happened during other periods of economic downturns, and it’s a boom for retailers like Aldi and other discount grocery chains with a strong roster of private-label brands.

Food-at-home prices leaped ahead in August at a 13.5% annual rate — the fastest pace in more than 43 years, according to data from CSA.

How to Adapt to Cost-Conscious Consumers

Consumers have no choice but to buy essentials like groceries, although they will likely switch to more affordable brands or change how frequently they buy items amid rising prices. Kroger has revised its store brand strategy to simplify its budget-priced options and launch a private label line called Smart Way, including 150 products. Grocers providing more value-based options and prices that meet the needs of customers on a budget are seeing the most increase in sales and traffic.

In a recent price comparison between Aldi and Walmart, Aldi had lower prices in most grocery categories, including produce, pantry sales, meat, and eggs, according to Business Insider.

Retailers that host new programs and initiatives, including specials, loyalty, and subscription programs are also performing better. Grocery chains operating on a membership model like Sam’s Club, and Costco, are benefiting from the same trends pushing customers to shop at discount grocers. Recent price comparisons from Insider found lower prices at Costco and Sam’s Club than at other grocery stores due to bulk discounts and deals offered.

Why Budget-Friendly Grocers are On Top

Aldi’s aggressive expansion quickly made it the most active grocer, with 88 new store openings in 2021, nearly tripling the new store count of its next closest competitor, Publix. Aldi’s branding is built around being a low-budget option, where items are shelved in their shipping packaging to cut back on labor needs and to keep costs low. The chain says more than 90 percent of its products are Aldi brands, which are much cheaper than its name-brand counterparts.

Furthermore, the store is particular about its design, as it plays a crucial role in the business’s success and how it provides the most convenient option to customers. Stores have a modest size of 22,000 square feet, and all products are organized into five aisles, with each store location holding a minimum of 95 dedicated parking spots. The simplicity of the store design gives the tenant or the company a huge leg up over traditional grocers because of low overhead, great value for high-quality products, and an easy-to-navigate environment.

Due to the success of profitability for discount retailers, several national chains and off-price retailers are planning to open thousands of new stores in 2022. In August, WinCo opened its 138th store in Washington. The chain now has locations in 10 states across the nation. Dollar General has expanded its footprint this year by opening 1,110 new stores and additional distribution centers. The retailer is also doubling down on its $1 offerings to provide a wider range of private brands and fresh produce. Soaring food costs will continue to send more shoppers, even in higher income brackets, into discount retailers.

Food for Thought

Since the pandemic sent grocery sales soaring, investors regained interest in the sector due to the resiliency and adaptability it provides. Historically, grocers have proven resilient to the type of e-commerce-driven disruption that has challenged other retailers and is adapting incredibly well to changing shopper habits. Market downturns can be an opportunity for retailers and investors alike to capitalize on growth opportunities and expand into new markets. Grocers will need to enhance their fulfillment operations and provide better convenience to stay in the battle against high inflation and increasing grocery prices.