The King of Commercial Real Estate

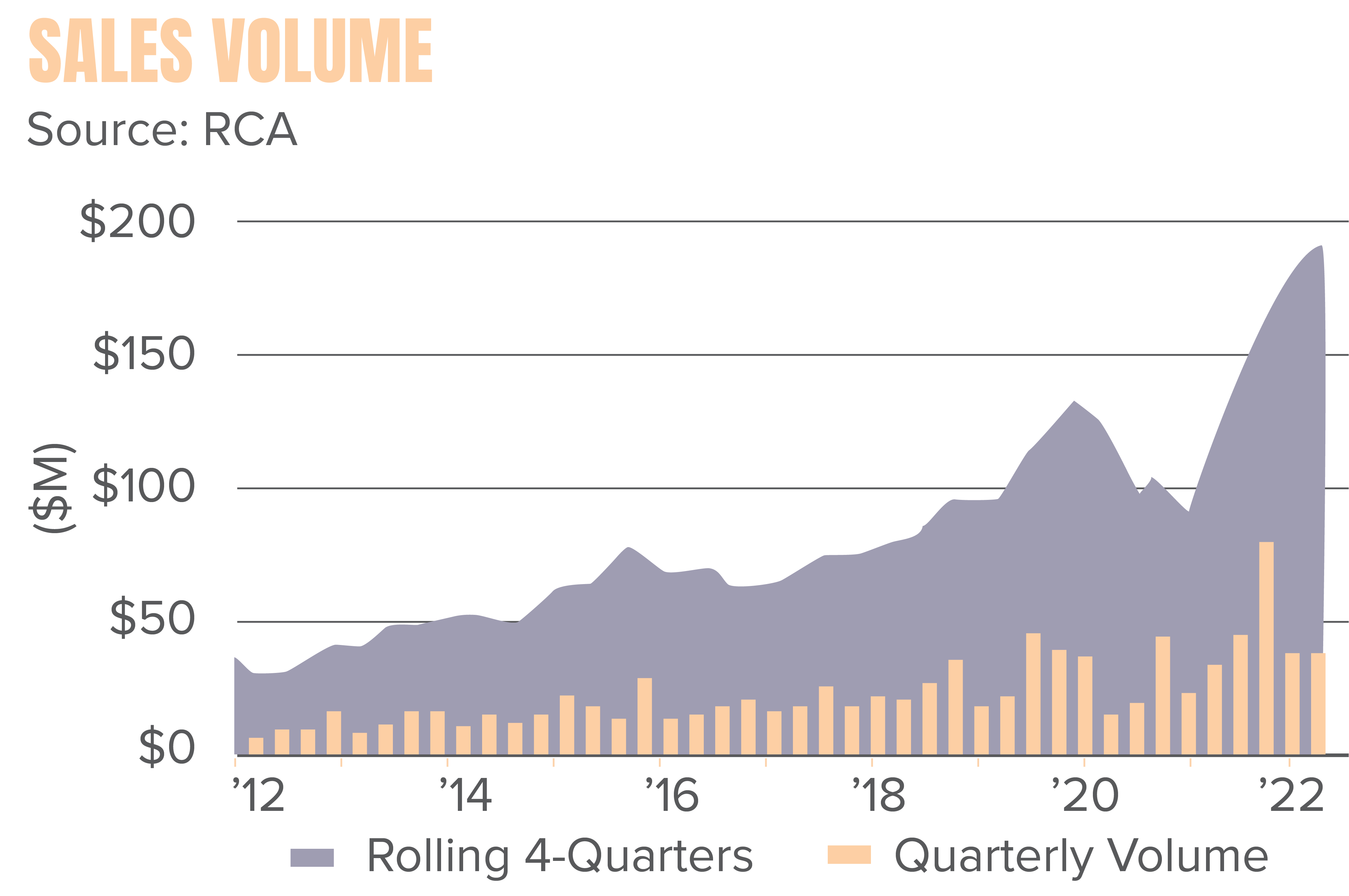

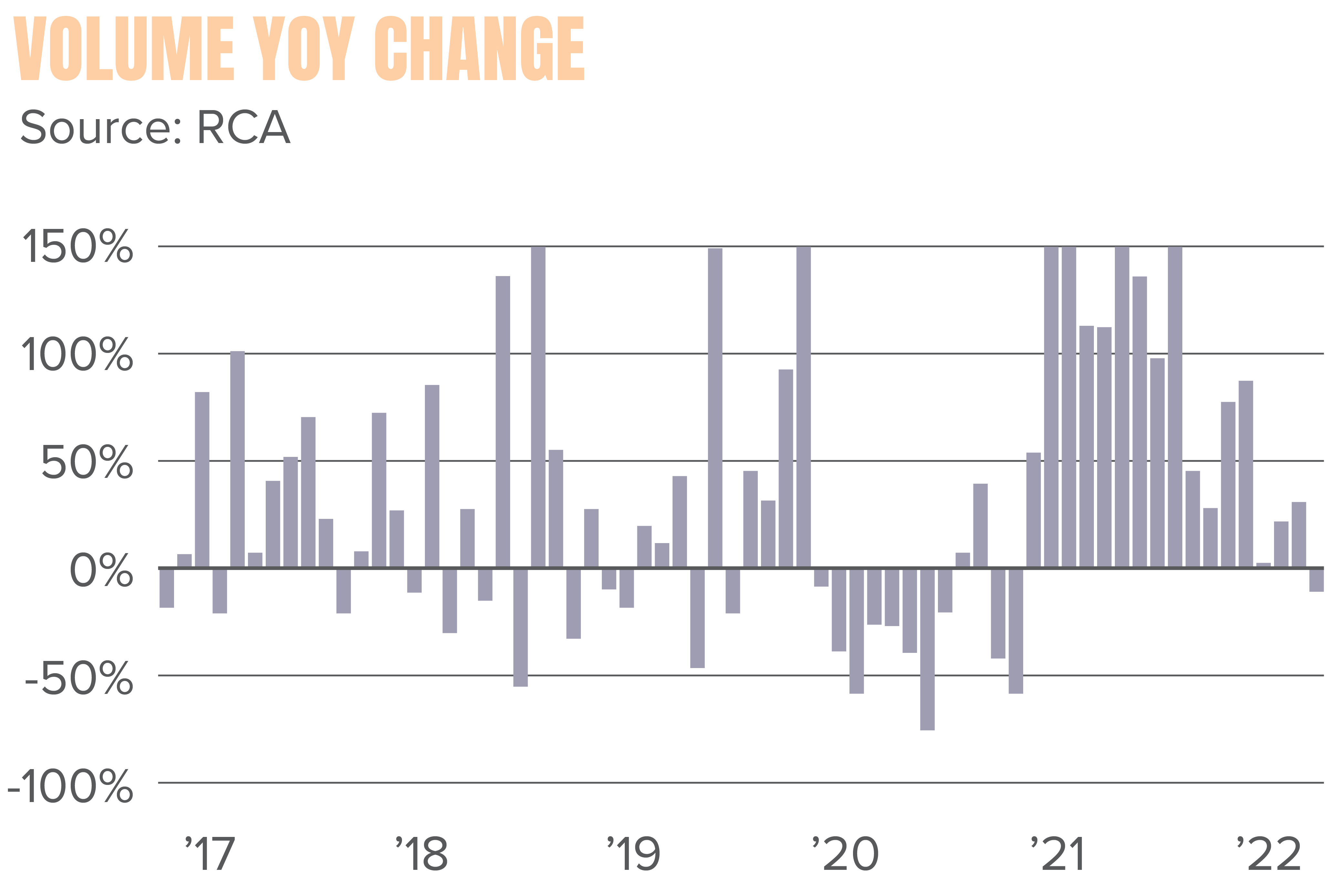

Over the past two years, investors have flocked to industrial real estate. Urgent demand, high rent growth, and low vacancy proved to be a recipe for success for the commercial real estate asset, recording historical growth, and sales numbers. Now, as the world moves forward into a post-COVID-19 era, the sector still looks to be top dog, but will that change? As markets across the country ramped up development, consumer trends started to change. E-commerce dominance slowed, pre-leasing stalled, and big-box tenants abandoned expansion plans. What does this all mean for industrial real estate, and what should investors look out for?

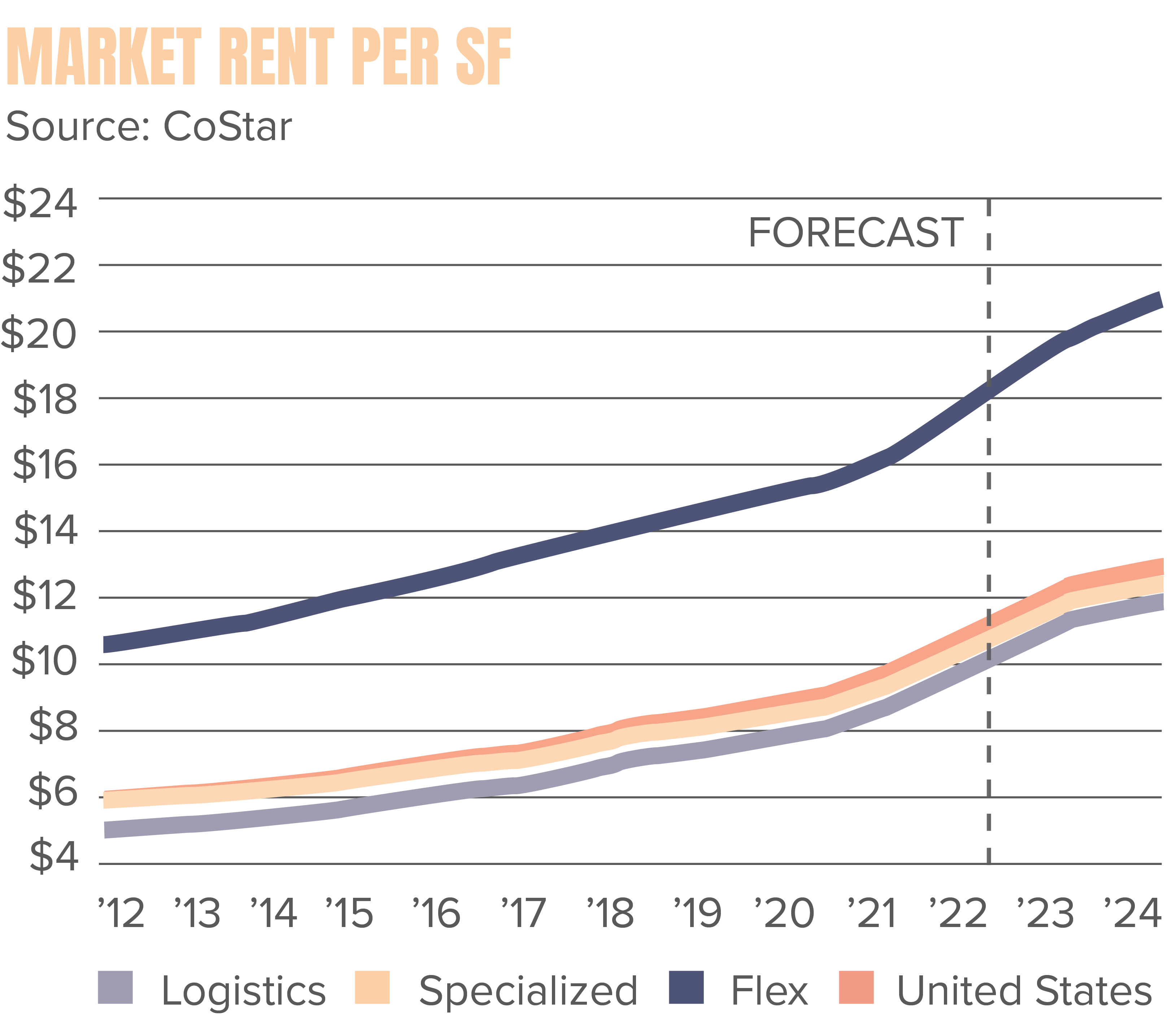

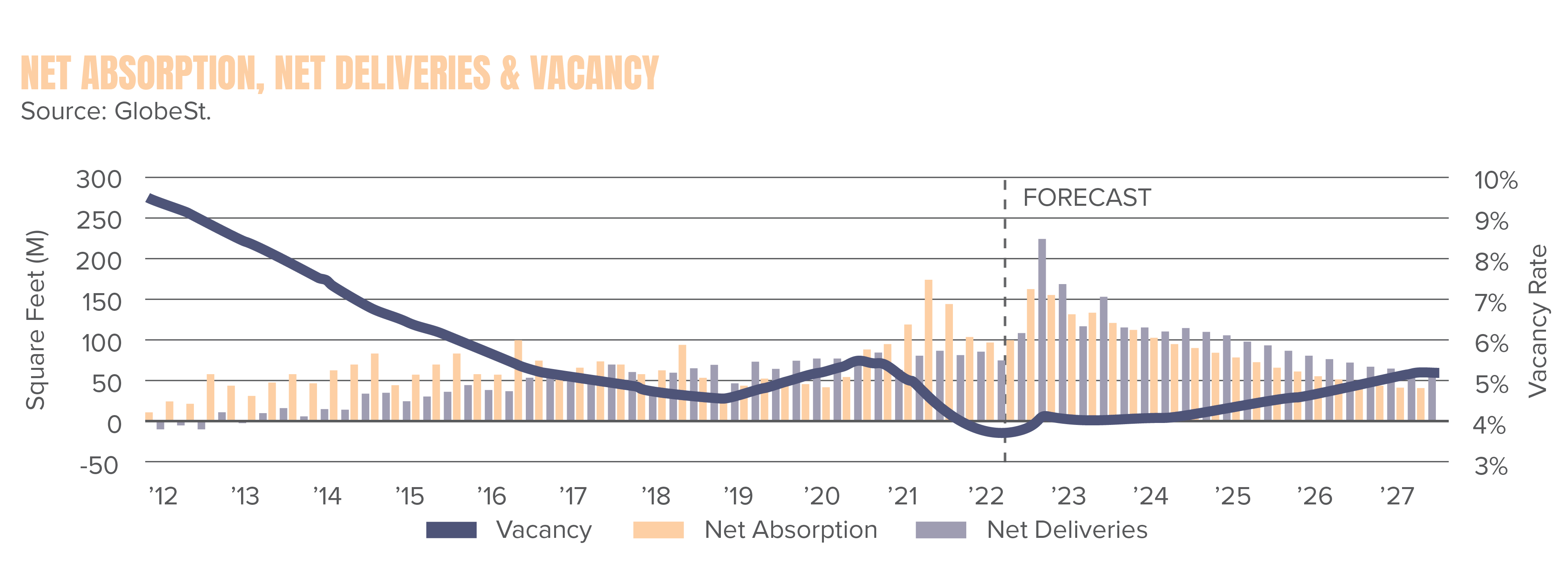

Industrial real estate throughout the U.S. performed strongly in 2021 and continued that success in 2022. Year-over-year rent growth is 11.6 percent, and vacancy is 4.0 percent as of September 2022. Demand for properties is still healthy and developers are keeping pace with demand in most major markets.

The concerns of some investors sprout from a shift of consumers pulling back from e-commerce and returning to brick-and-mortar retail. Online retailers dominated the retail space in 2020 and 2021, but shoppers are excited to be back in person, craving a more personal experience after long periods of seclusion. This shift has caused a decline in the expansion of warehouse and fulfillment facilities. Another reason investors are wary is the threat of a hard-landing recession of the market as inflation continues, and the stock market witnesses volatility. Lastly, purchasing power is down making it more difficult to buy and lease since sale and rent prices are at record-levels for industrial properties.

“Millions of square feet of industrial real estate are on the chopping block amid plans by Amazon to cancel or postpone the opening of 49 warehouses.” – Bisnow

High-Level Leasing

Lease rates are more expensive than ever. As of late August 2022, new industrial leases were $1.45 more per square foot than leases already in place. The gap between the average lease, market rate, and leases signed within the last 12 months is also higher than ever. The current average lease rate for the past 12 months is $8.05 per square foot, whereas the average was $6 in July 2022.

“The gap between the average lease and rate and leases signed creates a hefty premium for new leases and signals that average rents will likely continue to grow at a fast clip over the coming years.”- GlobeSt.

The markets seeing the most leasing activity and year-over-year rent growth are port cities, as they offer proximity to major coastal shipping terminals. The top five metros are the Inland Empire with 8.7 percent, Boston with eight percent, New Jersey with 7.8 percent, Los Angeles with seven percent, and Orange County with 6.8 percent.

Building for the Future

Due to deeply constricted supply, industrial projects couldn’t be built fast enough throughout 2021, leading to a robust pipeline in 2022 and the following years. There are currently 844 million square feet underway across the United States, 70 percent higher than development numbers prior to the pandemic.

Although demand for industrial has sustained and even strengthened in specific markets, some real estate experts predict that up to 90 million square feet built will not be leased within a year of completion. As of late 2022, 62 percent of properties under construction have not been leased. But as others raise concerns about overbuilding, others say that it is almost impossible to overbuild industrial assets because the market is so tight for supply, and the need is not going away. Construction is only getting more expensive and complex, meaning it would be difficult to continue the level of development long-term. The industrial pipeline needs to stay stocked in a time of great demand and limited options.

“Industrial vacancy rates remain historically low as the ability to supply new space continues to face physical and political limitations in land-constrained markets,”- GlobeSt.

What’s Next for Industrial?

There may be some skepticism surrounding the overwhelming construction of industrial facilities and climbing rent rates, but all in all, industrial is here to stay. Investors will continue to pour capital into the sector in hopes of continuing low vacancy and strong profits. Absorption rates are expected to moderate; however, vacancy will remain low, securing industrial as a top investment.