Building for the Future

Shifting consumer habits and the ongoing dominance of e-commerce have forced traditional retailers to rethink their development strategies. At the onset of COVID-19, traditional malls, and centers heavy in soft goods retailers were hit the hardest. As lockdowns affected stores throughout the nation, the market saw a surge in online shopping and delivery services. But as the world emerges from the pandemic, the yearning for personal, local, and experiential retail has increased, encouraging retailers to look beyond tenancy and curate consumer-based experiences and community landmarks. Faced with rapidly growing development costs and evolving trends, owners, contractors, and designers are approaching retail development with a whole new mindset, shaping the future retail landscape.

One of the largest mixed-use projects underway in the U.S. is Southside Park, a $1B development featuring 1,200 residential units, office space, commercial and event space, and more, located near Southside Park in Miami. Source: Multifamily Dive

The New Generation of Shoppers

In today’s retail industry, consumers crave experiential retail, a strategy that offers experiences beyond buying products and browsing storefronts. Ironically, this trend has grown parallel to the boom of e-commerce, creating the need for digitally-based and personal services all-in-one. Mixed-use developments’ popularity soared over the past few years by integrating traditional retail spaces with entertainment venues, office space, and multifamily units. Such opportunities have led to new investors entering the marketplace, taking advantage of varying types of properties in a single investment.

Made popular by home delivery services and direct-to-consumer businesses, the new generation of consumers expect ease, efficiency, and instant gratification with their shopping experience. Technology can be instrumental in meeting these expectations. Retail stores that offered mobile apps, digital loyalty programs, buy-online-pickup-in-store (BOPIS), and curbside services reported stronger sales numbers in 2021. For example, Target’s same-day fulfillment services have expanded 400 percent since 2019, representing more than half of the company’s overall $13 billion in digital growth, according to the publication Eat This, Not That. Another strategy retailers are offering is moving toward a more contactless shopping experience. In an effort to lessen face-to-face interaction, global fashion retailer, Zara, introduced cashier-less checkouts in select locations, a technology that uses sensors to scan items and charge customers without an employee present.

Growing technology trends have forced contractors and designers to collaborate with IT services through the build-out process to ensure the stores’ infrastructure can support ongoing high-tech initiatives. For contactless checkout, developers are needing to create more space, integrate sensor technology, and train employees on how to use the tools. Oftentimes, developers are not equipped with the expert knowledge needed to implement various technology. By planning with IT services from the beginning and throughout the process, developers can avoid delays and ensure they have the right materials to provide efficiency and connectivity. Companies can also utilize it’s expertise to train employees and put systems in place for connectivity disruptions or system breakdowns.

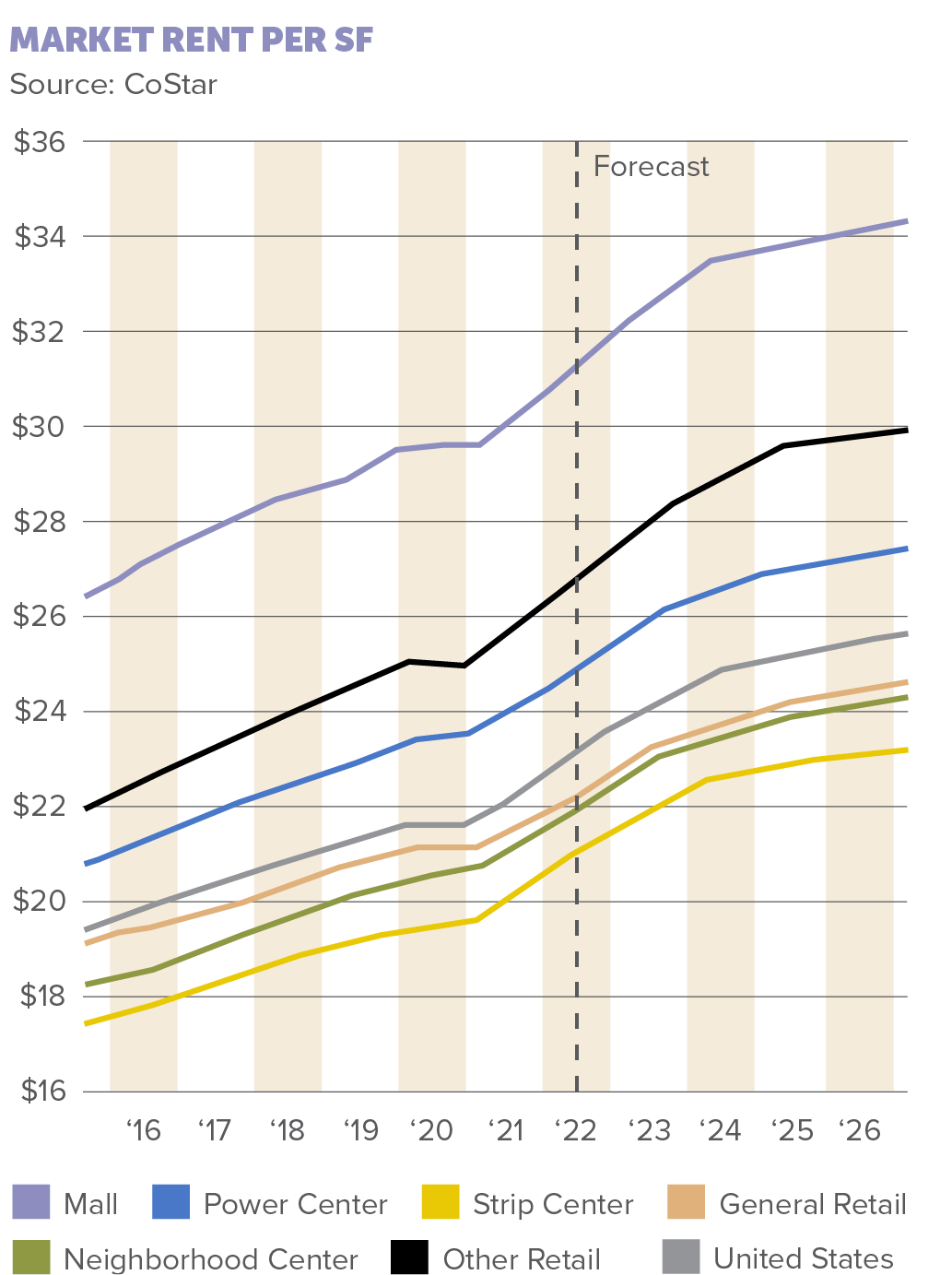

Retail Rent Growth

Retail rebounded swiftly in 2021 after facing the challenges of the global pandemic, and the asset class is expected to continue its strong performance. This rebound, though positive, has caused a significant increase in retail rent rates, with national year-over-year rent growth reaching 3.7 percent, according to CoStar. Inflation, paired with high investor demand, accelerated rates to historic highs, especially in major metros. Miami is one of the most expensive retail markets, with an average 6.3 percent rent growth rate.

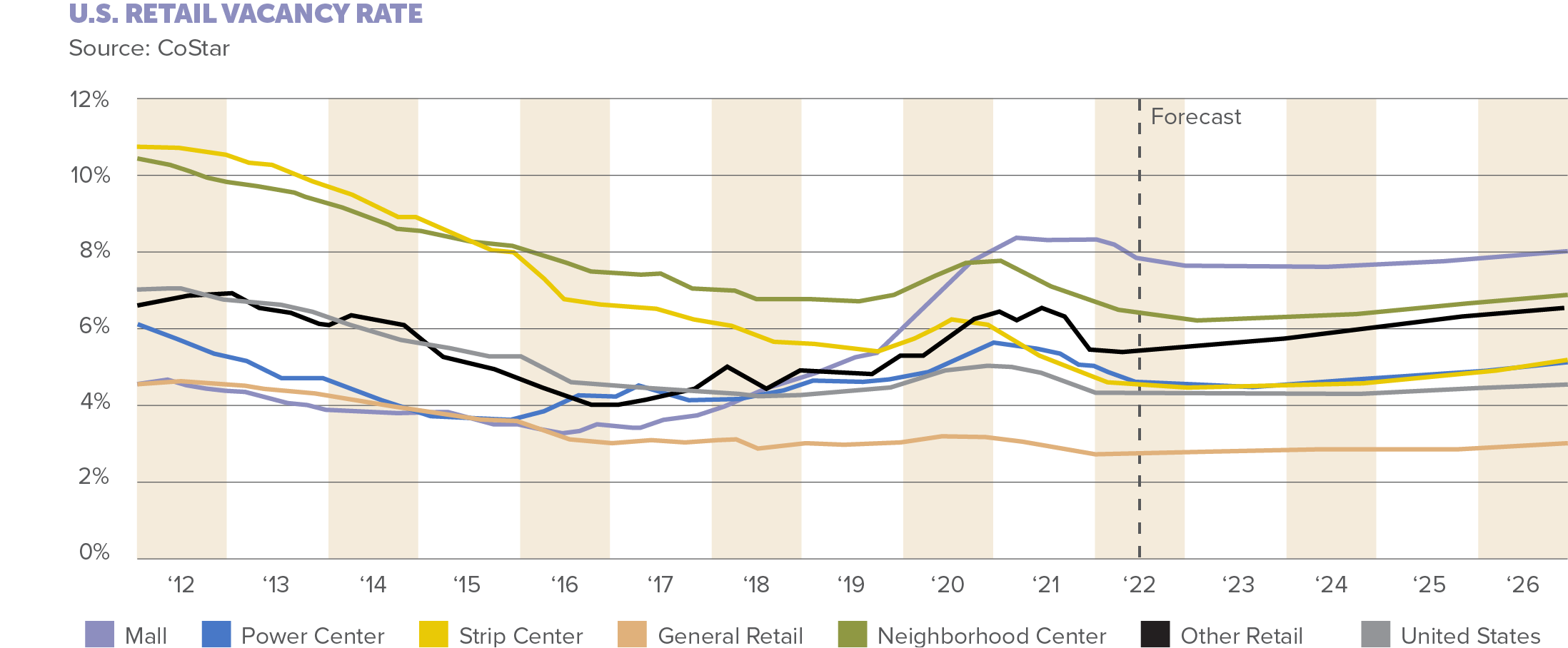

Low vacancy rates are also contributing to increased rent. Retail vacancies have dropped

to 4.5 percent in the first quarter of 2022, even lower than the closing rate of 4.7 percent at the end of 2021, reported GlobeSt. As consumer demand continues to reach pre-pandemic

levels, competition for existing spaces is rising, compressing vacancy rates, and driving rent prices.

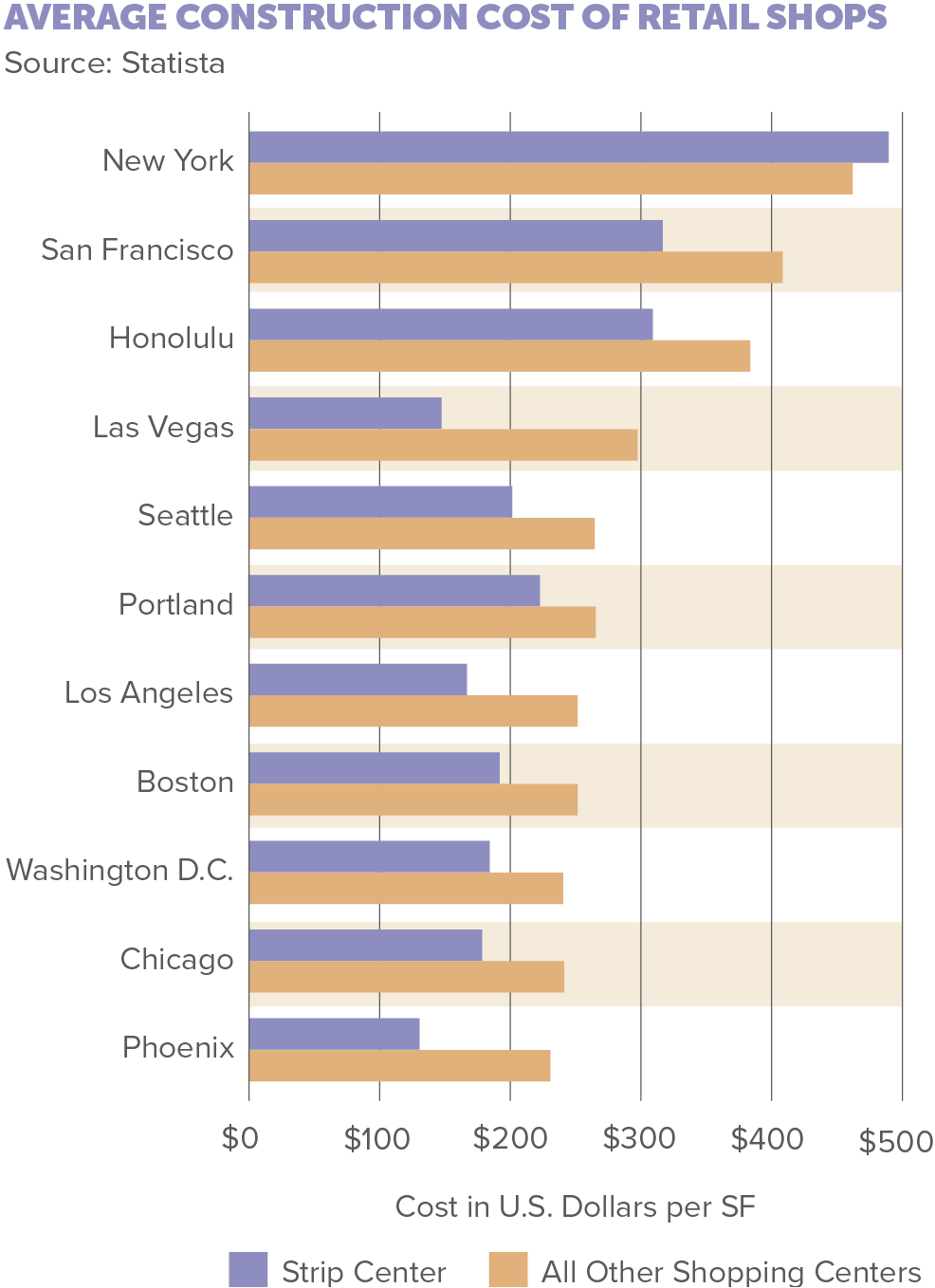

Rising Cost of Development

Retail development costs have skyrocketed over the past few quarters, challenging retailers and developers to find the right balance between price and profit. Increased material and wage costs, stricter permitting requirements, and an extreme labor shortage are all contributing factors to the rising cost of development. The U.S. Census Bureau stated construction costs were 23 percent higher in 2021 compared to 2019. Essential building materials such as lumber, steel, and concrete increased in pricing due to lack of supply. Necessary machinery and appliances are hard to come by as well, slowing down timelines and growing competition between developers for fair pricing.

The IHS Markit Peg Engineering and Construction Cost index increased from 75.3 in February 2022 to 85.5 in March 2022, a new peak in the index’s 10-year history. Source: IHS Markit

Although high rent rates can produce high yields, the annual rent growth rate is not keeping up with the hefty development costs businesses are facing. Some retail developers have taken a head-on approach to the pricing challenge, ordering materials in bulk and supplying them for contractors, lessening the cost of materials and labor. Another way developers are combating high costs is by collaborating with designers, architects, and IT services from the beginning of a project. This strategy ensures all building elements are accounted for, ordered, and built into the timeframe from the start, helping mitigate delays and unforeseen costs. Unfortunately, price increases are not expected to slow anytime soon, as the U.S. continues to experience high inflation and supply chain disruptions.

Up-and-Coming Development Trends

The retail industry is seeing several trends spike in popularity in 2022. From data-driven technology to redevelopment, here are the top trends in retail development.

1. Redevelopment

The mega-mall and traditional shopping centers no longer reign supreme. Consumers are looking for a more localized shopping experience beyond a singular purchase. Retail developers are taking established shopping centers and creating modern, open-air, and sustainable mixed-use assets. These developments introduce multiple opportunities in one space and become a community staple, offering services and entertainment alongside favorite storefronts.

2. Utilizing Technology

Technology is top-of-mind for retail developers in today’s age. As physical stores begin to launch high-tech initiatives, designers and contractors need to ensure the building has the correct infrastructure. Augmented reality (AR), QR codes, and in-queue checkout are all different ways retailers are using technology in daily store operations.

“Nike House of Innovation 000″ allows patrons to reserve shoes online, pick up in smart lockers, and try on in-store.

3. Collaboration

Teamwork is the main objective when starting development. Construction, marketing, and IT are working as partners to design next-level locations and environments that keep customers coming back and interacting with the retailer’s brand before and after entering the doors.

The future of retail development is bright but not without its challenges. Costs are predicted to heighten in the near term while the nation continues to battle with unbalanced supply and demand and historic inflation. The new generation of shoppers expects more and has revitalized brick-and-mortar retail, forcing a modern wave of design and technology in construction. As the retail landscape shifts, developers will need to pay close attention to the mix of vendors they engage and the overall experience they are offering patrons.