The Industrial Arbitrage Opportunity

Looking back, we’ll likely recognize 2024 as the “Great Industrial Arbitrage Opportunity.” For a variety of reasons, it will be one of the best years in recent memory to trade out of your warehouse into a property that better suits your needs via a 1031 exchange.

All the Upside With None of the Downside

In NYC and nationwide, cap rates have surged by 100-200 basis points since 2023 due to increased debt costs, driving property values down. In today’s market, owners find themselves realigning their portfolios – selling underperforming assets (such as those in bad locations or of the wrong asset type) at a discount and acquiring “winners” at a discount. But with industrial real estate in the Boroughs, you can enjoy all the upside with none of the downside.

Brooklyn Industrial has been the most resilient asset class in the past few years despite the challenging market; as the average 30-year fixed-rate mortgage more than doubled from 2021 to 2023 (from 2.96% to 7.06%), the average price per square foot for industrial sales in Brooklyn increased (from $436/SF to $445/SF).

Why is this the case? Because users, who accounted for 84% of transactions in 2023, prioritize factors like ceiling height and access to major thoroughfares over yield. In contrast, other asset types are driven by return expectations, with yields nearing all-time highs. Cap rates for triple net lease (NNN) properties are at a 15-year high. 2021 cap rates in Brooklyn hovered around 5-5.5%, but today, they range between 6 and 7%. Therefore, industrial property owners find themselves uniquely positioned to sell to users at returns often less than 4% and to transition into high-quality assets with returns exceeding 200 basis points.

The Industrial Arbitrage Strategy: A Case Study

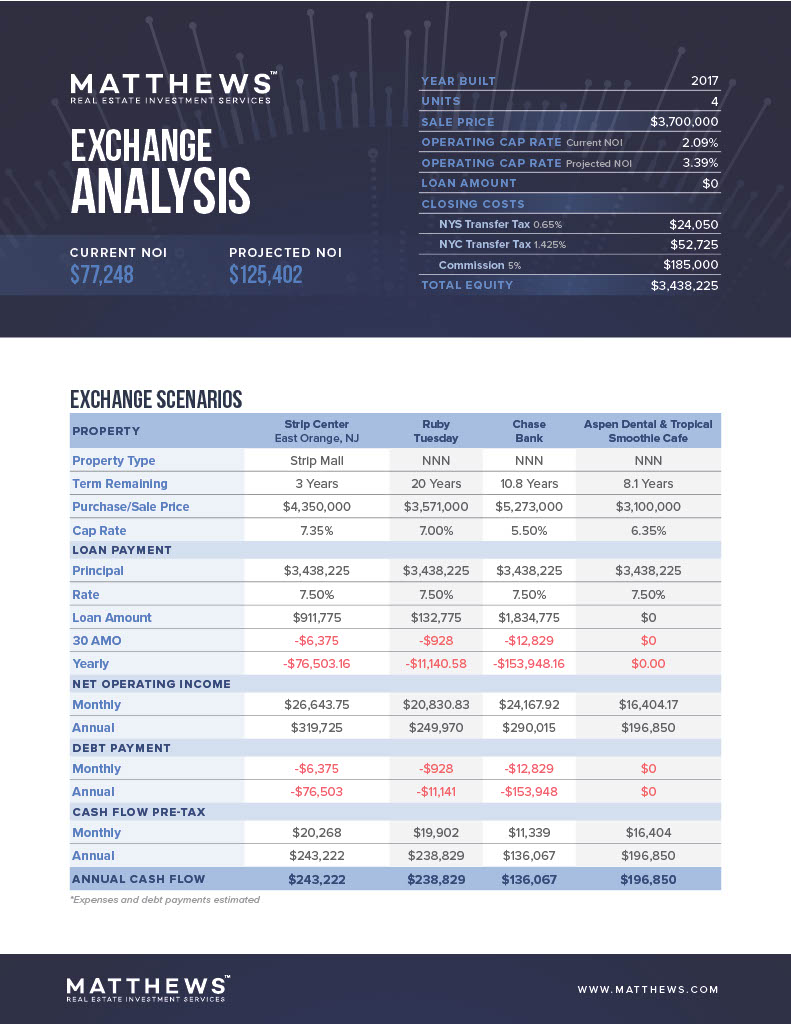

Consider a 1031 exchange analysis I recently presented to a client who is considering selling their industrial property and exchanging into a NNN property.

This is my typical client: someone who bought the property a long time ago for their business, has little to no debt, makes less than a 3% return on their equity, and is looking to explore their options. On the surface, the above analysis seems like a homerun – more than 3x your cash flow with a more financeable and less management-intensive asset. However, these conversations are nuanced. The term remaining on the lease, credit of the tenant, and location are all paramount. This is why whenever I present these analyses, I have one of my colleagues by my side who specializes in selling NNN properties and can outline the upside and downside of each opportunity.

Seize the Moment: The Clock is Ticking

This arbitrage opportunity is fleeting. Interest rate traders predict an 80% chance of lower fed funds rates in June 2024, which will eventually lower yields. Furthermore, the Brooklyn industrial market is buoyed by users paying premiums (~30%) over investors, yet the constant threat of a recession casts doubt on the sustainability of these premium buyers.

If you fit the mold of my ‘typical’ client, I highly encourage you to reach out and see if it makes sense to seize this opportunity!