Commercial real estate (CRE) has historically lagged behind other industries in adopting technology, particularly the disruptive changes that transform the way business is done. Customer relationship managements (CRMs) and email campaigns have replaced the Rolodexes and flyers of 30 years ago. But digital replacements for physical processes provide relatively minor benefits when compared to the innovations that have turned other industries (retail, entertainment, taxi service, print media, etc.) on their heads. As with many other trends in business, the COVID-19 pandemic has exposed this disconnect and highlighted the need to accelerate technology adoption. This article explores the historical reasons for the gap between CRE and other industries, and the technology that Matthews™ believes will be at the forefront of the coming transformation.

How Did We Get Here & How Do We Fix It?

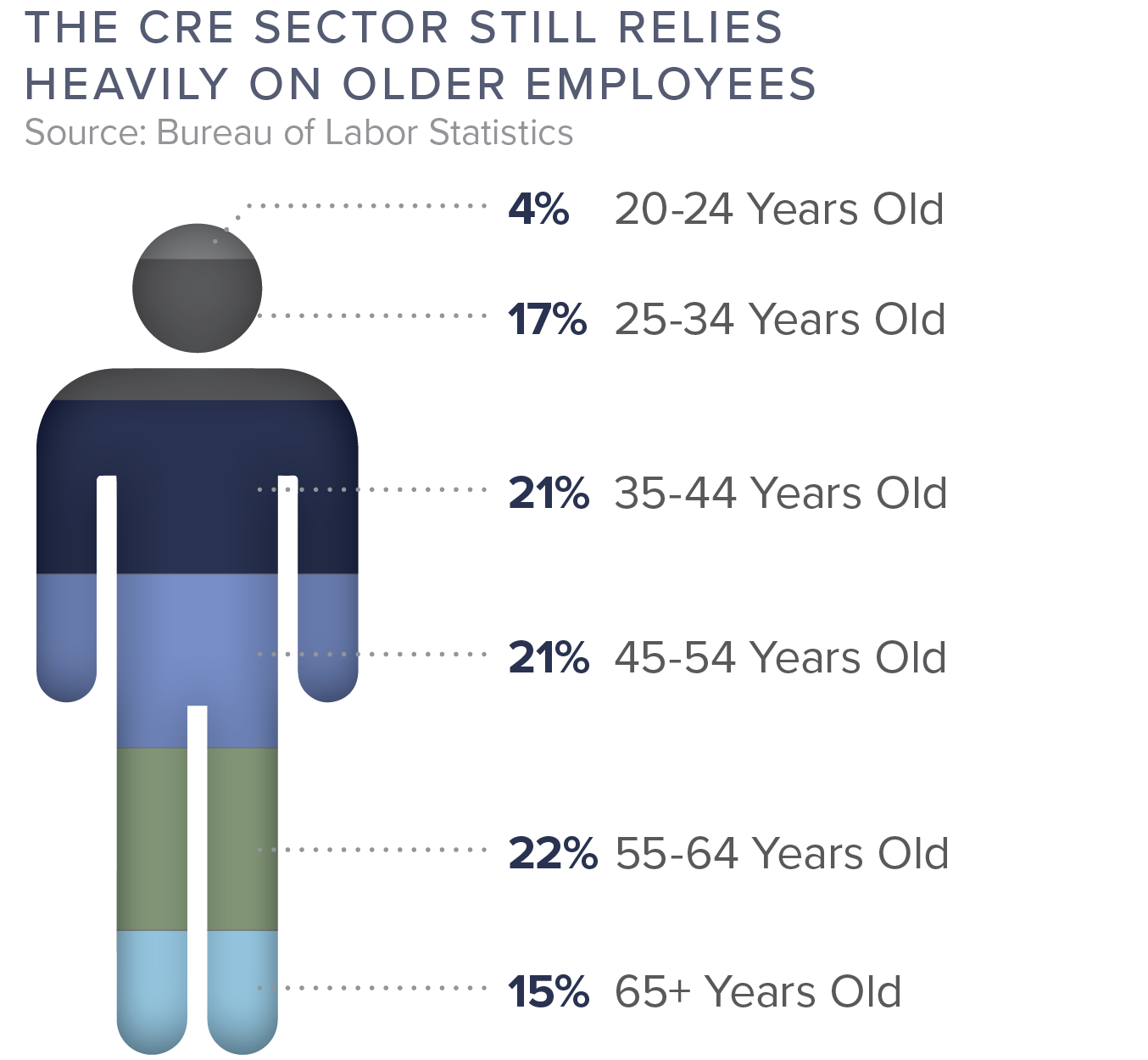

The real estate workforce is one of the oldest in the nation, according to the U.S. Bureau of Labor Statistics (BLS). As of 2020, 37 percent of industry workers were 55 years or older, compared to 23 percent in the finance and insurance category. This is significant, as older workers are slower to adopt new technologies, preferring the familiarity of traditional job roles still common in CRE. The obverse is also true – younger job seekers expect technology to be integrated with their work, eliminating repetitive, menial tasks and obviating the need for endless meetings. This may cause younger workers to avoid positions in the relatively tech-poor real estate field, exacerbating the trend.

Enter the so-called “geriatric millennial.” Born between 1980 and 1985, this micro-generation provides a critical bridge between digital natives and digital immigrants. They likely grew up with a PC in their home and remember a time before everyone had instant access to the Internet through a device in their pocket. According to Erica Dhawan, credited with coining the term earlier this year, “Geriatric millennials can read the subtext of an SMS just as well as they can pick up on a client’s hesitation in their facial expressions during an in-person meeting. They are neither ignorant of technology nor so engrossed in it that a voicemail inspires fear.”

Allowing for a slightly more inclusive birth date range (1976-1985) to accommodate the less granular BLS data, at the beginning of the last decade, geriatric millennials (then in their mid-late 20’s and early

30’s) represented just 17 percent of the real estate workforce, compared to 24 percent in finance and insurance. That gap has largely constricted in the last ten years, with more members of the micro-generation entering the real estate space as they now represent 20.5 percent of the workforce.

This cohort of “natural-born guides” to the information technology space could not have arrived in the CRE space at a better time. Pandemic-related restrictions have forced, or at least accelerated, the adoption of rich communication technology, made people think in terms of virtualization, uncovered troves of data, and in many cases, exposed opportunities for automation that went unnoticed for years. According to McKinsey, COVID-19 preparations and mitigation strategies “vaulted five years forward in consumer and business digital adoption in a matter of around eight weeks.” We are now at an inflection point for CRE and should anticipate a significantly higher technology adoption rate across the industry, particularly in property technology (PropTech).

PropTech combines innovative technologies and solutions that optimize the creation, sales, and management of real estate. Put simply, it is technology that improves interactions between people and property. Much of this technology focuses on gathering and analyzing data, which is used to determine the performance and value of real estate, optimize the use of space, improve tenant experience and satisfaction, aid with real estate transactions, and manage the carbon footprint.

The PropTech industry witnessed-more than $50B in venture capital-investment in new startups across-2019 and 2020.- Source: CRETI

New & Emerging Proptech Disrupting CRE

Big Data

CRE has been slow to adopt Big Data, as the term usually implies extensive data sets, from hundreds of millions to trillions of records. On the surface, CRE deals with comparatively minimal data sets. For instance, according to the U.S. Energy Information Administration’s Commercial Buildings Energy Consumption Survey (CBECS), there are 5.9 million commercial buildings in the United States as of the 2018 survey. Extrapolating to similarly small sets for ownership, transaction records, financing data, etc., one can understand how CRE firms have been hesitant to invest in more complex analytics than those offered by traditional data-processing methods.

It’s become cliché to say that “data is the new oil,” but it’s an apt comparison. In the last ten years, early adopters have started collecting substantial amounts of often unstructured data under the seemingly simple surface. The industry now has a tremendous amount of market demographic, rent/lease, building telemetry, and other data ripe for analysis using Big Data techniques.

The promise of that analysis is enticing. Sophisticated investors armed with those insights have a significant advantage when determining aggregated demographic trends and patterns, allowing them to evaluate a deal accurately, forecast ROI, rate a market, and plan for development. Big Data analytics can significantly accelerate data-to-decision times, help investors make decisions quickly, and find deals that fit their criteria.

Internet of Things (IOT)

A major driver enabling Big Data is the number of connected devices installed in and around commercial buildings. Smart thermostats have become commonplace in residential as well as commercial spaces with positive impacts on energy costs. Connected security cameras and access control systems provide better security and peace of mind. Industrial properties can leverage smart warehouses and robotics to make delivery times and products faster. Retailers use sensors and camera-based tracking to operate stores without checkout lines. IoT-enabled building management systems (BMS) make building performance more efficient, and sensor-generated data enhances the building-to-user experience. Overall, the increasing number of IoT devices provides significantly more data from which to derive actionable insights.

Virtual Reality (VR)

As travel restrictions and hesitancy continue in response to the COVID-19 pandemic, VR has emerged as an alternative to on-site tours. Whether it be a potential renter looking at an individual unit or an investor virtually walking an entire property, VR is another option to touring a space.

Augmented Reality (AR)

Readers are certainly familiar with navigation apps on their phone and may also use other AR applications such as Google’s Sky Map or games like Pokémon GO. In all cases, they enhance the user’s experience of the physical world by layering digital elements over images captured by a device’s camera or other data such as geolocation. AR is already being used to enhance the capabilities of maintenance technicians in commercial properties by helping diagnose and repair malfunctioning equipment.

Drones

The mark of a premium listing is that it’s worthy of flown aerial photography for marketing materials. A couple of years ago, that meant spending thousands on hiring a helicopter pilot and photographer. Advances in drone and camera technology have made high-resolution aerial photography significantly more accessible, giving agents and investors alike a relatively inexpensive bird’s eye view of a property and its surroundings.

For those who own and operate commercial spaces, airborne drones provide easy access to otherwise hard-to-reach areas such as roofs, attics, and exterior antennas. Drones are equipped with specialized equipment like high-definition cameras or spray nozzles capable of tasks, including inspections, painting, cleaning, and security. The key drivers include personnel safety and cost.

Commercial real estate has been historically slow to adopt technology, at least partly due to an older workforce that is resistant to doing so. This has largely shielded the industry from the disruptive changes witnessed in other fields, but the industry is at a turning point where tech-savvy talent and pressing needs push CRE into the modern era, whether companies want to or not.