FTC May Block Grocery Merger: What It Means for Retail

There’s a new development in the famed supermarket mega-merger. The Federal Trade Commission (FTC), joined by several state attorneys general, recently sued to block Kroger’s $26.4 billion acquisition of Albertsons. The charges state that a merged Kroger-Albertsons, the largest ever in grocery’s history, is ultimately anticompetitive. Specifically, the FTC believes the grocery merger will lead to higher grocery prices, lower quality of products and services, and fewer choices for consumers.

According to the U.S. Department of Justice Antitrust Division website, and as said by the Clayton Act, an illegal merger occurs “when two companies join together in a way that may substantially lessen competition or tend to create a monopoly in a relevant market.” An illegal merger resulting in reduced competition can severely harm consumers, who lack adequate choices for products or services, and workers, who face lower wages and fewer employment opportunities.

Kroger and Albertsons are known for comprising grocery-anchored centers, an increasingly favored option for real estate capital due to their immunity to market disruptors. Following the move, the supermarket giants released individual statements refuting the lawsuit, claiming that a blocked merger would actually harm the very people the FTC aims to protect while strengthening retail titans like Walmart, Amazon, and Costco. While it’s still unclear whether the grocery merger will take place, two key takeaways remain top of mind for investors: divestitures and market share.

A New Divestiture Plan

At this point, the merger’s fate may as well be up to a coin toss. On one hand, the FTC blocks the mega-merger once and for all. On the other hand, Kroger and Albertsons are forced to revise their divestiture proposal, which the FTC believed fell short of creating an adequately competitive business. Typically, divestitures can be expected to gain regulatory clearance since the FTC’s objective is to prevent monopolies or market dominance.

The real question is which and how many stores will be affected. For Kroger or Albertsons store owners, divestitures can introduce various complications. At best, landlords can expect a change in their property’s value. At worst, they may be forced to find new tenants or buyers for the divested locations. Even if an owner’s store isn’t affected, another divested store nearby would impact the demand for retail spaces in that location.

A new divestiture plan would almost certainly bring more store divestitures and more intervention from companies like C&S Wholesale, which had previously agreed to purchase over 400 Kroger and Albertsons stores. But there’s growing speculation about the ability of C&S Wholesale to deliver on its promise for the divested stores. The last thing the FTC wants, if the merger proceeds, is for the divested stores to fail.

Grocery Retail: A Disproportionate Market Share

The FTC’s decision to block the Kroger-Albertsons link comes as somewhat of a shock, considering the current market share for U.S. grocery stores. Ironically, while the FTC cautions against a potential monopoly, one may already exist.

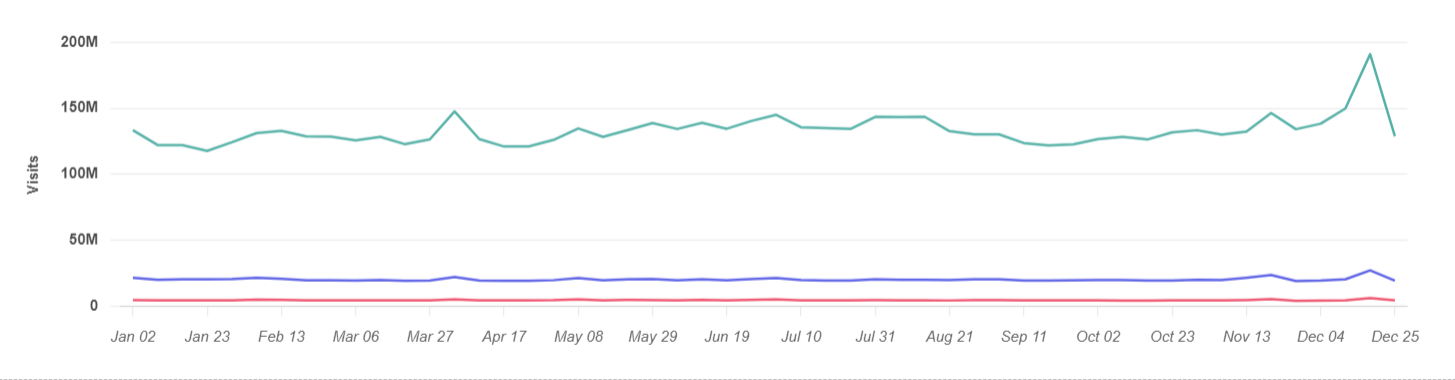

In 2022, Walmart made up 25.5% of the grocery retail market—more than any other retailer. Kroger, in comparison, claimed 9.8% of the market, followed by Albertsons at 3.6%. During the same year, Walmart consistently drew an overwhelming majority of weekly store traffic (Figure 1). Because Walmart’s dominance in the grocery space shows no signs of slowing, market analysts believe the FTC’s proposed block lacks quantifiable substance. In other words, Walmart needs a competitor to prevent a true monopoly.

FIGURE 1: WEEKLY U.S. GROCERY VISITS, 2023

Source: Placer.ai; Note: Walmart trend line excludes Walmart Neighborhood Stores (668K average visits per store, 682 stores)

If the grocery merger proceeds, Kroger-Albertsons would gain a massive bump in market share and compete more closely with Walmart, Amazon, and Costco. A combined 5,000 stores would generate $220 billion and place Kroger-Albertsons second in the U.S. grocery retail space with an estimated market share of 13.4%, behind only Walmart. Shifting market shares will inevitably impact the demand for retail spaces in affected areas, meaning owners of those assets must be prepared for anything.

What Should Landlords Do?

This isn’t the first time an Albertsons merger has been in trouble. In 2018, the retailer sought to join forces with Rite Aid in what would be a similarly lucrative yet unsuccessful supermarket merger. At the time, investors eyed Albertsons-anchored centers across the country for their promise of post-merger value. The same could be said now for Kroger-Albertsons—if the deal happens, owners can expect those properties to change in value.

While any merger poses a genuine concern for consumers and workers, perhaps equally at risk in a mega-merger like Kroger-Albertsons are landlords. Owners of Kroger and Albertsons stores now face more pressure than ever to assess the risk of their properties. Last year, Matthews reported that 56.5% of all Albertsons stores are within a five-mile radius of a Kroger store, which means that the chances of divestitures—or even cannibalization—are high. Since divestitures bring a high chance of vacancies, property owners need to know the exact risk their assets face.

How can landlords determine if a particular property is likely to be divested? There are three factors to consider when determining possible divestitures: store performance; proximity to the next closest Kroger or Albertsons store; and ownership of the nearest store. The result of these considerations can help property owners build risk profiles and be proactive. When investors and owners finally see the impact that the mega-merger (or lack thereof) has on their Kroger or Albertsons investment, it may be too late.