Debt Capital and CRE Financing | Webinar Recap

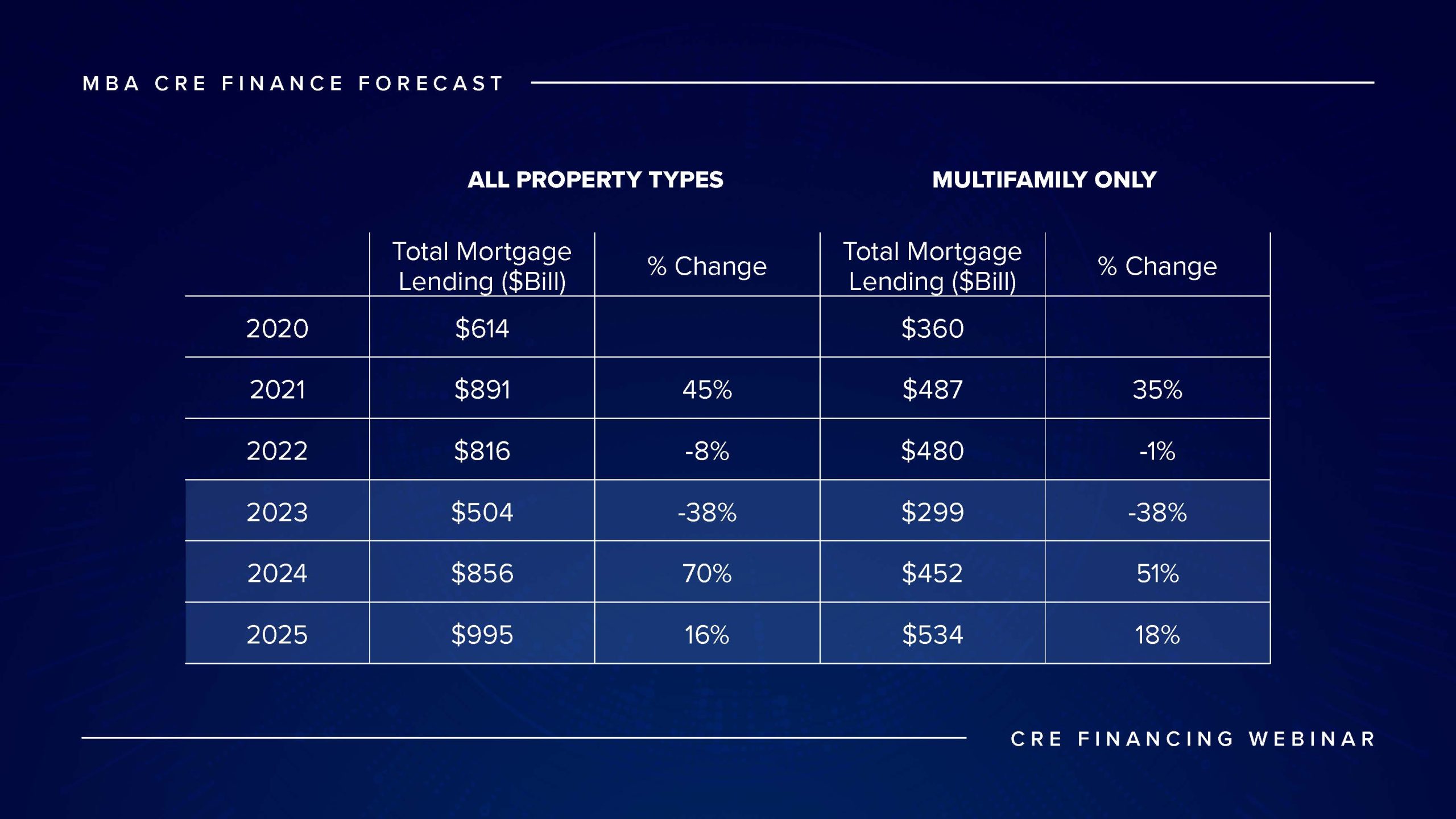

It’s expected to be a landmark year for commercial real estate financing. With over $856 billion of loans projected to mature in 2024—$452 billion of which are in multifamily alone—the demand for debt capital in recent years has never been greater. Matthews™ Capital Markets (MCM), represented by Cliff Carnes, Curtis Kaufman, and Clark Finney, recently held a webinar about the state of CRE financing and its direction in 2024 and beyond. Read the main takeaways below, and access the full recording at any time.

Where We Are

Matthews™ Capital Markets met with over 30 lenders at a Mortgage Bankers Association (MBA) conference in early 2024, and every lender made one thing clear: They have money to lend. At what rate and for what term lenders are willing to lend is another question that depends largely on the borrower. While the debt market emerges from a post-pandemic dip, debt capital is expected to be highly selective and investigative of each transaction. “The bottom line is that there’s plenty of money out there that’s going to be very investigative of each transaction to make sure it’s stabilized, or if it’s not, to make sure there’s a plan to get it to stabilization,” Kaufman concluded.

How We Got Here

The simple answer for the state of CRE financing today is inflation, which started heating up after the U.S. pandemic-era stimulus and subsequent supply chain disruption. To combat rising inflation, the Federal Reserve started a series of interest rate hikes that brought the federal funds rate up over 500 basis points in just one year. Many borrowers sought extensions amid drastically increasing rates, and lenders overall showed quieter financing activity. In 2023, the amount of refinancing and acquisition financing dropped 38% from the year before to $504 billion. Total mortgage lending for 2021 and 2022, in comparison, hovered around $800 billion for all property types and around $400 billion for multifamily. “It’s a very unique time to be in the market,” Finney added. “But people who are able to navigate it are going to be very happy about their portfolio in the next three, five, and especially 10 years.”

Where We’re Going

The total volume of commercial real estate financing is expected to jump 70% this year and 16% in 2025. According to the MBA, $856 billion and $995 billion of refinances or acquisition finances are projected over the next two years, respectively. Advisors at MCM expect the primary sources of debt capital in the coming months to be insurance companies, credit unions, and CMBS. “This is a huge wave of maturities,” Kaufman commented. “I expect we’ll see a good portion of it get kicked down the road another 12 to 18 months. If the borrowers are good citizens communicating with their lenders, they may be able to get their loans extended.”

CRE Financing Forecast

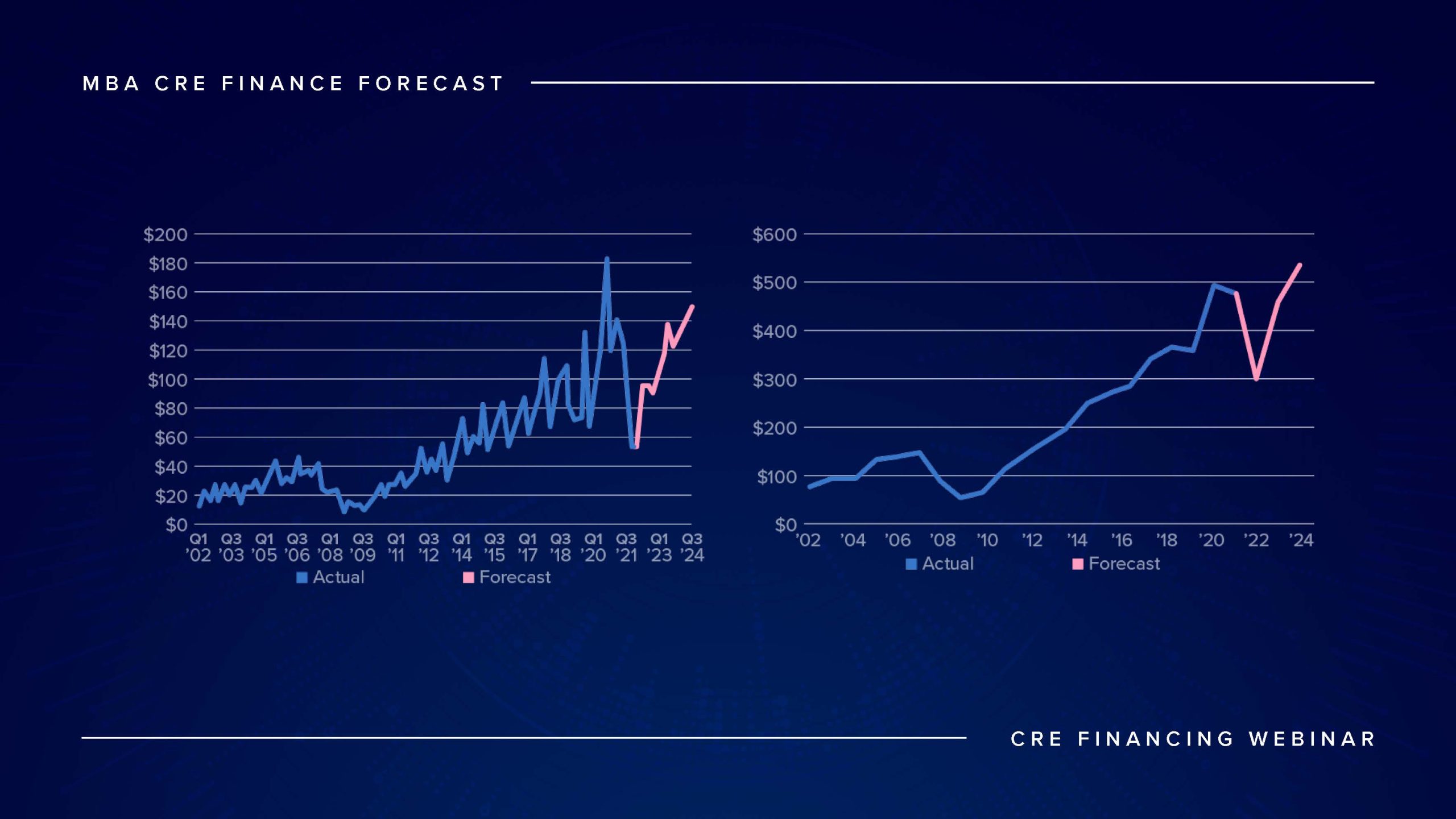

Total Multifamily Lending by Quarter (Left) and Year (Right)

In multifamily specifically, the majority of debt will be sourced from the agencies. Fannie Mae and Freddie Mac have some of the tightest spreads, which usually end up winning a multifamily deal. So far in 2024, Freddie Mac has originated $27 billion worth of loans, a 6% increase from the same time last year. What’s more, roughly 74% of that $27 billion has been refinances, and half of the refinances have been five-year terms. This suggests two things: Many buyers are not looking to sell right now, and those who are refinancing don’t want to lock in today’s rates. “Apart from that,” Finney added, “we’re going to see opportunities for people to buy distressed assets, and a lot of that capital will come from the private side and the world of bridge financing.”

Interest Rates: A New Normal

Carnes addressed recent concerns about interest rates with a simple question: “Have we become addicted to cheap money?” It’s worth considering that the pandemic and post-pandemic eras presented outlier rates, at once as low as 74 basis points. Now that COVID’s lingering effects have almost dissipated, investors should expect more moderation from the Fed. “This interest rate environment is likely a new normal,” Finney suggested. “What matters more than ever is a property’s fundamentals. This will normalize the market to a new basis, expand cap rates, and reset prices, overall yielding a healthier market for the U.S.”

Buy, Sell, or Hold?

A historical look at interest rates over the last couple of decades indicates that a near-6% rate is more normal than most people seem to think. “There’s some notion that rates will be going down, but historically, if we go back 20 to 25 years, a 6% coupon on real estate was a good coupon,” Kaufman shared. While there are mixed opinions about where interest rates and debt capital are headed this year, most investors that MCM works with are opting for short-term money, typically three or five years. Investors may pay a premium for five-year versus 10-year terms, but they gain the ability to refinance and lock in a better rate in just a few years. That said, the consensus among MCM advisors during the webinar was that it’s a buyer’s market, and owners who are holding should consider the duration of their existing loans. If the duration is short, it may be a good time to contact a Matthews™ advisor to replace existing debt.

To watch the full webinar, provide your email and download the recording.