Unpacking the Impact: How Economic Conditions Shape the Self-Storage Industry

In the face of a challenging market, investors remain optimistic regarding the self-storage sector thanks to its inherent resilience. However, it is undeniable that the self-storage industry is feeling the effects of the broader economy. Over the past several quarters, both rent growth and occupancy rates have steadily declined. This is primarily due to reduced demand resulting from rising interest rates, sluggish home sales, and shifting migration patterns. Owners with the ability to adapt to this economic climate will secure their survival and position themselves to thrive. Adaptability is a crucial factor for long-term success.

Self-Storage Industry Overview

The number of people utilizing self-storage increased to 14.5 million in 2022, up by 970,000 since 2020, according to Yardi Matrix. Additionally, over a recent nine-year span, self storage facility owners across the U.S. saw an annual return on their investments of almost 17%, according to Real Estate Daily News.

2020 – 2021 — The Height of the COVID-19

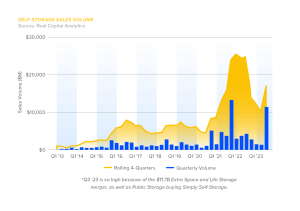

Americans became increasingly comfortable with relocating across the country, resulting in additional storage space demand. Sales volume for self-storage increased 180% from $8.4 billion in 2020 to $23.9 billion in 2021, according to RCA.

2022 — Moderation Across the Sector

A decrease in home sales and consumers holding back on spending for non-essential items/services caused a slowdown in self-storage usage. The average rate per unit decreased marginally year-over-year (YOY). In November 2022, the street rate for non-climate-controlled units was $128 (a 2% decrease YOY). While climate-controlled units averaged $144 (a 0.8% decrease YOY). Sales volume dropped to $14 billion in 2022.

2023 — The Market Downturned

After a long string of Fed hikes and high inflation, self-storage witnessed softened occupancy rates. Q1 through Q3 saw a combined sales volume of $14.2 billion. However, a majority of sales occurred in Q3 with over $11 billion sold. This was primarily due to the Extra Space/Life Storage merger, as well as Public Storage’s acquisition of Simply Self-Storage.

Street Rates Affected By A Tough Leasing Environment

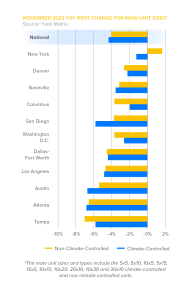

Interest rate volatility has created significant changes in financial markets. In particular, rising short-term rates have impacted self-storage developers and owners seeking construction and similar loans. Due to interest rate increases, the self-storage industry is navigating the broader economic landscape. Marked by almost a year of negative YOY street rate trends and an increased vacancy rate to 7.0% as of Q4 2023, up by 4.6% YOY. The influx of supply in lease-up has also hampered street rate growth. This is particularly present in markets with high overall supply volume and recent deliveries.

In November, street rate growth continued to be negative YOY in the majority of Yardi Matrix’s top metros. Combined same-store rates for non-climate-controlled (NCC) units fell in all but one of the top metros on an annual basis. Asking rates for same-store climate-controlled (CC) units decreased in all of the top metros.

The growth in street rates is expected to stay sluggish in the coming months due to the housing market’s influence on reduced demand.

Construction & Supply Update

Despite continuous drops in street rates, the industry maintains a positive outlook. The lack of home sales has caused new rental activity to dampen. Both occupancy and rental rates are coming out of a period of all-time highs, with current levels remaining above 2019 rates. Although there is a degree of uncertainty regarding the performance of these metrics, numerous operators maintain a guarded sense of optimism.

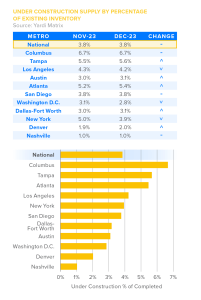

H1 2023 saw a pullback in self-storage construction projects, which allotted more time for the existing supply to be absorbed. This trend is expected to continue in the coming years, with deliveries projected to dip below the long-term average. This shift is anticipated to reduce operator competition, fostering a more favorable market environment.

As of November 2023, construction activity remains stable, but the number of abandoned projects continues to rise. Project duration from planning to under-construction has consistently increased, more than doubling in the past few years. This trend implies that projects are becoming less viable and are decreasing in the likelihood of being constructed. Consequently, the number of project completions is expected to gradually decline.

Major Self-Storage Acquisitions

The self-storage industry has changed tremendously in the past five years, with an increasing consolidation trend taking center stage. In March 2023, Extra Space Storage completed the largest self-storage transaction in history by acquiring Life Storage for $12.7 billion. As a result of the merger, the combined company became the biggest self-storage operator in the nation in terms of facility count, boasting more than 3,500 locations. The merger between Extra Space and Life Storage is anticipated to bring substantial strategic, operational, and financial advantages to Extra Space moving forward.

Another prominent merger in the self-storage industry in 2023 was the recent acquisition by Public Storage. They purchased Simply Self Storage from Blackstone Real Estate Income Trust for $2.2 billion.

The transformation of the self-storage industry into a consolidation hotspot exemplifies the operational efficiencies accelerated by achieving significant scale in the marketplace.

The Impact Of Rising Rates On Self-Storage Assets

As anticipated, rising interest rates have impacted the commercial real estate market. The number of sales in the U.S. self-storage sector decreased by 40% in 2023 compared to 2021, which is primarily due to the rising cost of borrowing and a general shortage of available funds in the market. This decline has created a multifaceted environment, presenting challenges for facility owners with high levels of debt while at the same time opening doors for well-financed investors.

The dynamics of the rental housing market are closely intertwined with self-storage demand. Areas with a high percentage of renters, 60% or more, tend to exhibit a more consistent demand for storage solutions, as renters normally move more frequently than homeowners.

Housing Market’s Effect on the Self-Storage Industry

The constant fluctuations in mortgage rates have created volatility within the housing market, influencing the self-storage industry, which relies on people moving and needing storage. The national average 30-year mortgage rate ended 2023 at 6.61%. This surge in mortgage rates has resulted in YOY existing home sales declining since the beginning of August, dropping by 0.7% across all four major U.S. regions, according to the National Association of Realtors.

In addition to rising mortgage rates, the housing market is grappling with elevated home prices and limited housing inventory, all contributing to the decline in self-storage demand and street rates. Homebuyers may have to allocate more of their income towards mortgage payments or rents, leaving them with less disposable income.

Seasonal fluctuations in the housing market can also affect the self-storage industry. The housing market tends to be more active during the spring and summer months, resulting in higher occupancy and demand for self-storage.

The Self-Storage Industry Looking Forward

In 2024, the housing market is expected to stabilize after a long period of uncertainty. Mortgage rates are expected to drop, while home prices are likely to stay relatively stable throughout the year. The U.S. News Housing Market Index indicates that a national housing shortage will persist into the late 2020s, creating a seller’s market in many areas. The National Association of Home Builders also predicts this housing shortage will endure. This means that the self-storage industry can expect more stable occupancy rates and rental incomes for this year.

There’s an expectation of the typical February low point for the self-storage industry, with rental rates anticipated to increase from March through August. This could result in 2024 following a more conventional pattern in the operational landscape. Additionally, Yardi Matrix’s Q3 self-storage supply forecast shows an increase in projected deliveries for 2024 by 4.4%.

The state of the overall economy and geopolitical conditions can significantly impact self-storage owners by influencing customers’ demand for their services, the competitive landscape for acquisitions, pricing power, and the financial stability of their customer base. Remember, although self-storage assets have historically been resilient during recessionary periods, data has proven that this industry is not immune to the realities of the current economic environment. With this in mind, self-storage owners should pay close attention to the trends in their specific trade area and how the overall economy fairs in the coming months, potentially shifting how one operates their business.