Insights

THE MATTHEWS PODCAST – Cultivating Success: A Look Inside the Matthews Culture

Multifamily Market Report | West Los Angeles, CA

Multifamily Market Overview West Los Angeles, CA The West Los Angeles submarkets mainly consist of Century City West L.A., Greater Culver City, and Mid-Wilshire. These submarkets include some of the most prestigious areas and cities in the Los Angeles metropolitan area. West Los Angeles’s prominent location, strong employment drivers, local attractions, and central location makes […]

Orlando Multifamily Market Report | 2023

Multifamily Market Overview Orlando, FL The multifamily market in Orlando is expanding quickly due to steady inbound migration and job growth. Even in the face of economic headwinds, it continues to rank among the top performers in the country. Rent growth through the beginning of 2022 was driven by solid renter demand from new residents […]

Adaptive Reuse: The Benefit for Investors

Why Adaptive Reuse Is the Right Choice for Repurposing Buildings There has been a notable increase in adaptive reuse throughout the real estate industry. Investors and buyers now see that adaptive reuse comes in several forms, and the possibilities of projects are endless. According to projections, 90 percent of real estate growth within the next […]

What Is a Good Cap Rate for an Investment Property?

Cap Rate for Investment Properties Cap rates are an excellent tool for assessing a property’s overall profitability. Although it may be difficult to pinpoint a perfect cap rate, there are ways investors can determine if the cap rate of a property meets their individual investment goals. Read on to see how investors can make the […]

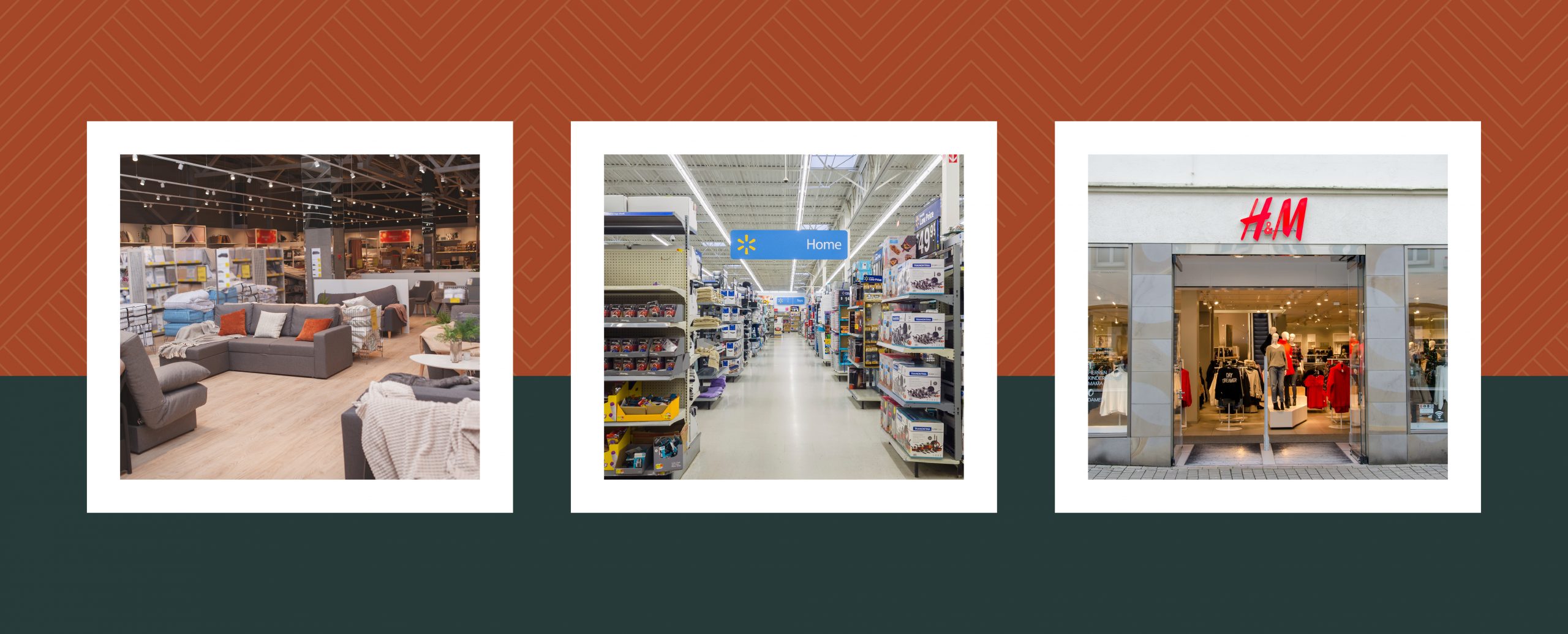

Direct to Consumer Vs. Wholesale

The Battle Between Retailers and Brands Over the past few decades, the surge in e-commerce has shifted many consumer brands from relying on wholesale retailers to direct-to-consumer (DTC) operations. Although some global brands have seen great success with DTC, research has shown that the business model may not be the “end-all, be-all” to business success. […]

The Value in a Dollar Store

The Value in a Dollar Store The net lease retail sector has continuously grown in popularity among investors due to passive income and minimal management responsibilities. One of the favored net lease segments is dollar stores, a popular discount retail sector that evolved during 2020 as consumers were shadowed with uncertainty. Dollar stores offer an […]

Multifamily Market Report | Gateway Cities, Los Angeles

Multifamily Market Overview Gateway Cities, Los Angeles The following cities, and some unincorporated areas of the Southeast Los Angeles submarket, comprise the Gateway Cities region: Artesia, Avalon, Bell, Bellflower, Bell Gardens, Cerritos, Commerce, Compton, Cudahy, Downey, Hawaiian Gardens, Huntington Park, La Habra Heights, Lakewood, La Mirada, Long Beach, Lynwood, Maywood, Norwalk, Paramount, Pico Rivera, […]

What Investors Can Learn From the History of Inflation

What Investors Can Learn From the History of Inflation Inflation has always been a natural component in our economic cycle, despite the fear it causes. The Federal Reserve continuously monitors inflation levels, and some levels can be favorable for the economy’s growth. However, a dramatic incline leads to adverse economic effects and national panic. The […]

Multifamily Market Report | San Gabriel Valley

Market Report San Gabriel Valley Multifamily The San Gabriel Valley submarket has seen modest growth in its market fundamentals, with vacancy rising from 2.1 percent to 3.6 percent as a result of new units being added. Additionally, the softening occupancy has come waning rent growth, which peaked in the summer of 2022, at roughly $2.35 […]