What Investors Can Learn From the History of Inflation

Inflation has always been a natural component in our economic cycle, despite the fear it causes. The Federal Reserve continuously monitors inflation levels, and some levels can be favorable for the economy’s growth. However, a dramatic incline leads to adverse economic effects and national panic. The most damaging is a quick surge in inflation because it takes corporations several quarters to pass on higher input costs to consumers. Similarly, buyers experience an unanticipated rough patch when goods and services become more expensive.

A Look Back in Time

It is no question that commercial real estate investments have historically outperformed during past inflationary times. For years, these assets have been an excellent way for investors to mitigate risk during a high-risk period. With this in mind, history, similar to commercial real estate, has a tendency to repeat itself; what occurred decades ago can provide insight into today’s market.

It is easy to see how the economy has reacted to past inflationary periods. Whether it was the post-war world II era, the dramatic 1970s rise, or the 2020 pandemic, in the end, all of those situations handled themselves accordingly. Inflation naturally declined to sustainable levels, and the economy continued moving forward. History has shown a predictable pattern when it comes to inflation, and experts believe that today’s high inflation rates are no different. Inflation may be on the rise, but the demand for consumer goods remains strong, an encouraging sign for investors.

Inflation’s Affect on Commercial Real Estate

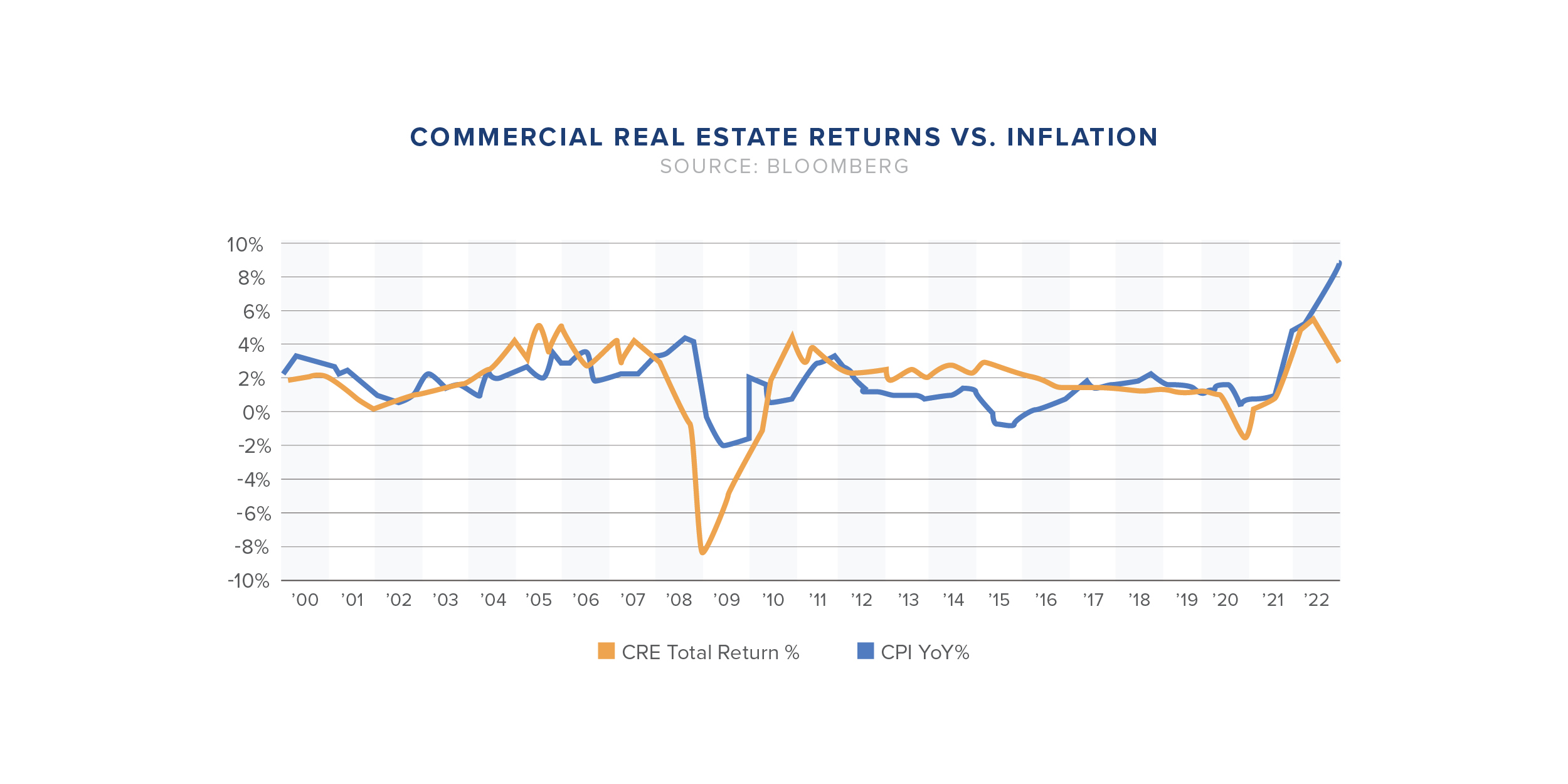

Commercial real estate has been a solid hedge against inflation for decades, and experts predict that pattern to stay the same. In fact, high inflationary periods have proven to impact commercial real estate positively. Commercial real estate returns have historically aligned with year-over-year changes in the inflation rate. This alignment can be attributed to the cash flow that commercial real estate investments produce. Real estate and other tangible assets typically increase in value proportionately to inflation. Rising consumer prices have a strong correlation with rising rents and property values. Commercial real estate loans with fixed lease terms enable rent increases to keep up with inflation.

Additionally, inflation is spurring industry innovation, and demand for space vastly outnumbers supply. Businesses are utilizing office space in radically different ways nowadays. There is a competition for better real estate to draw employees back to the workplace as calls to the office rise and new office lease agreements are signed – 13.8 million square feet in recent large-block transactions were negotiated last year.

Inflation is now forcing businesses and investors to look for more innovative and economical ways to implement the new normal. While prices are high, the economy as a whole is doing well. So next time you get worried about increasing inflation, remember, we’ve seen this before, and we can estimate how it will end. Stay patient and keep moving forward.