How Location Affects Apartment’s Overall Success

In this economy, investing in apartments might as well be considered a science. There is a myriad of factors that go into selecting the right investment to plant capital and receive the highest return. One of the most critical factors that can ultimately determine an investment’s success, profitability, or even failure is location. The asset’s location plays a substantial role in establishing its worth, demand, value increase potential, investment performance, and more.

The phrase “location, location, location” is a frequent saying in the real estate industry, and it’s valuable advice, especially when investing in apartment properties.

How Location Affects Value And Returns

Investors should prioritize increasing the demand for their investment property – high demand leads to higher occupancy rates, rental rate growth, and increased monthly rental income, making properties in desirable areas especially valuable. The location also influences rental prices, with high-demand areas in sought-out neighborhoods commanding higher rents, resulting in higher net operating income (NOI) and greater returns. Additionally, properties in highly coveted locations tend to appreciate faster, offering investors the potential for building equity and long-term value growth. However, it’s crucial to note that location choice can introduce risks, as properties in less desirable areas are more susceptible to market fluctuations and tenant demand, increasing the chances of delinquency or vacancy and negatively impacting investor returns.

An ideal occupancy rate against the national average is 96% or more, but this will vary based on locality.

Location Factors to Consider

- Proximity to Economic Hubs/CBDs

- Economic Growth Potential & Demographic Trends

- Nearby Amenities, including Grocery Stores, Schools, Parks, and Quality Infrastructure

- Access to Nearby Public Transportation

- Low Crime Rates & Robust Sense of Community

Best Cities For Renters

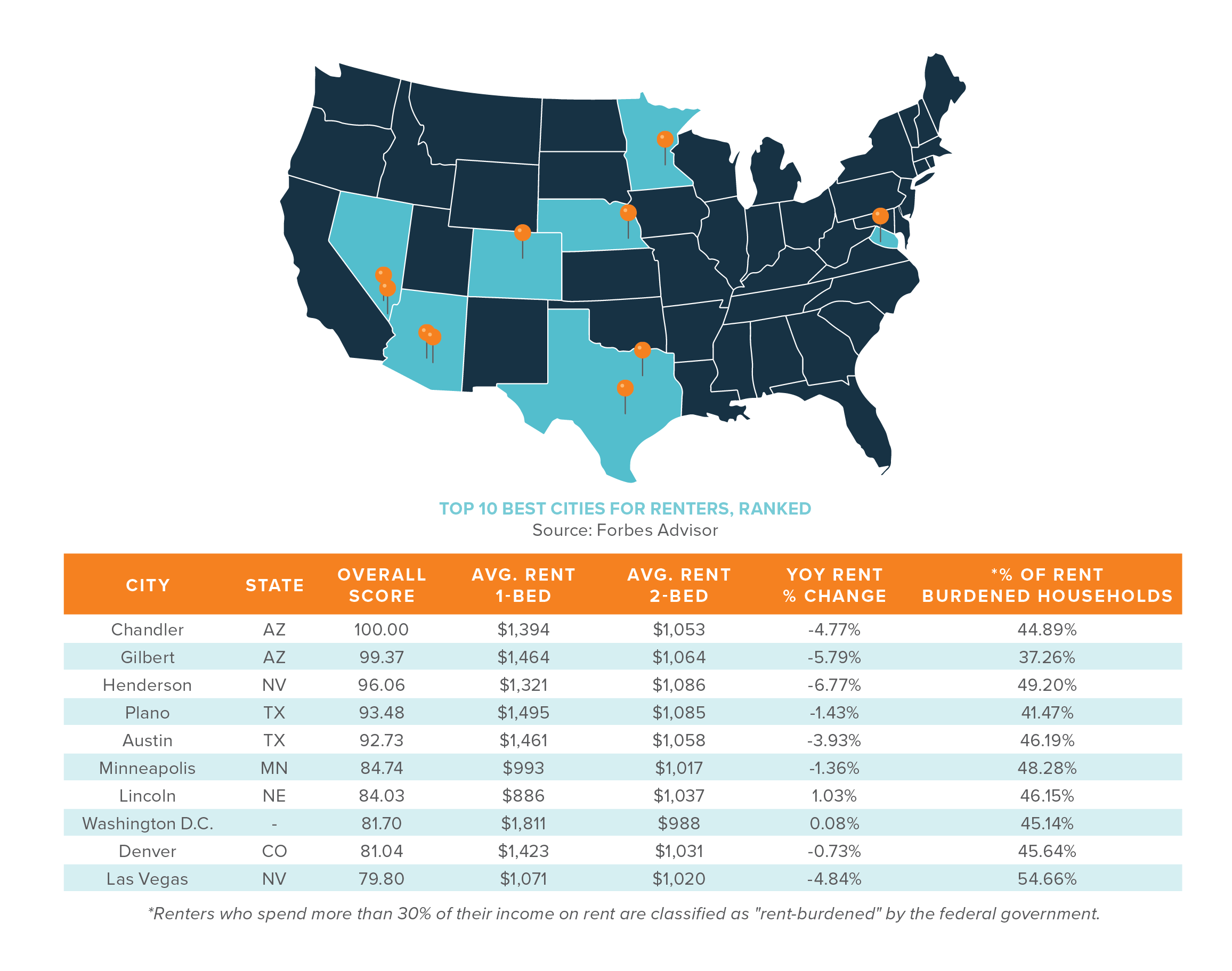

Forbes Advisor recently surveyed the 96 most-populated U.S. cities to find the top areas for apartment renters. The study assessed the best cities for renting by examining factors such as typical rental costs and the dimensions of one and two-bedroom rental units, the annual percentage shift in mean rental rates, the proportion of renters facing affordability challenges, levels of crime, the availability of pet-friendly rentals, the range of amenities, and various other metrics.

The average cost of renting a one-bedroom apartment in the 96 most densely populated U.S. cities stands at $1,301, while a two-bedroom apartment averages $1,590. In terms of size, a typical one-bedroom apartment spans 688 square feet, whereas a two-bedroom apartment covers an average of 979 square feet.

The list prominently features three metro areas in warmer climates. Chandler and Gilbert, AZ, secure the first and second positions on the ranking, with two other cities in Phoenix ranking in the top 25. Additionally, the study identified two cities in Las Vegas and two more in Washington D.C. Most of the cities listed among the top 15 for ideal renting conditions are accommodating to pets. For instance, Plano, TX, boasts the greatest number of pet-friendly rental options, while Boise, ID, offers the most dog parks.

Chandler, AZ’s top position is attributed to the substantial decrease in year-over-year average rent prices (a 4.77% deduction) and it’s higher-than-average median household income of $91,299.

Hotbeds of Multifamily Development: Top Zip Codes in Construction

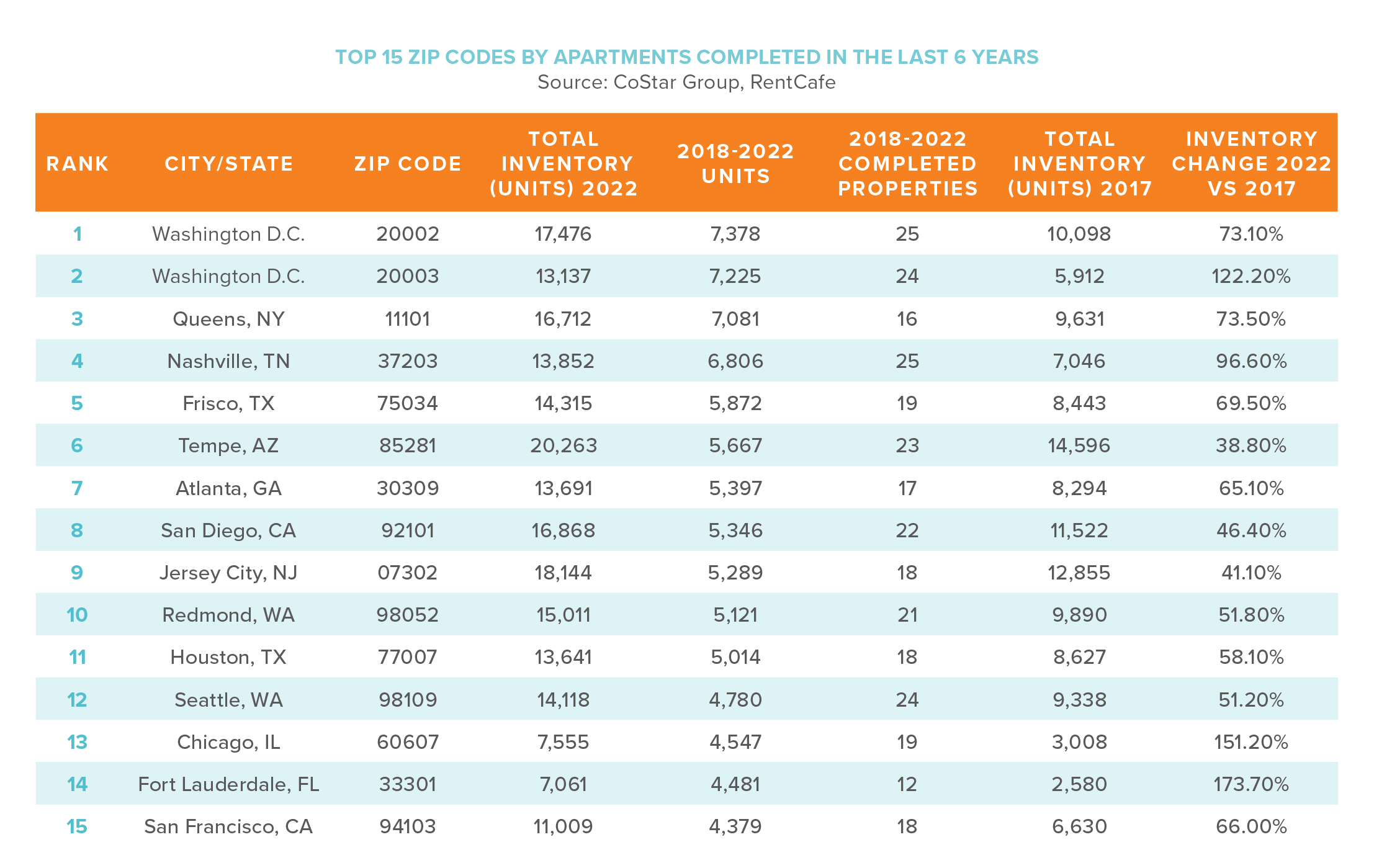

In central business districts (CBDs), there has been an influx of new multifamily construction within the last few years. An analysis by RentCafe reveals that approximately 1.2 million new rental units have been delivered since 2018, with specific zip codes showing remarkable growth. The zip codes with a higher percentage of a younger population and above-average incomes are at the top of this multifamily construction list.

The RentCafe report revealed that many renters prioritize newly built apartments with easy access to urban amenities when choosing their next place to live.

A significant number of neighborhoods that experienced a surge in construction activity over the past five years are situated either within city centers or in their vicinity.

The Washington D.C. zip code 20002, encompassing the U.S. Capitol and the H Street Corridor, leads the nation in construction, combined with a median income of $79,460 and a median age of 33.5. A notable feature of the 20002 zip code is its abundance of available land, making it an ideal choice for developers. This zip code has transformed into a top choice for city residents in search of a harmonious mix of historical significance and modern living. The neighboring zip code 20003, covering Capitol Hill and Capitol Riverfront, ranks second nationally with a median household income of $116,000 and a median age of 34.5.

Combined, these two zip codes have witnessed over 14,000 new units added over the last five years. Washington D.C., has made quite the comeback since the COVID-19 pandemic after losing a significant percentage of residents. The state has welcomed over 3,000 new residents in the last two years and is expected to continue growing, thus the need for more apartments.

New York’s zip code 11101 in Queens comes in third place, with 7,000 new apartments added in five years. The neighborhood’s easy access to Manhattan, several luxury and affordable housing options, as well as its strategic location along the East River have made it an excellent place for developers to build new apartment buildings.

Nashville’s Gulch/West End zip code 37203 ranks fourth, with 6,806 new apartments added. Frisco, TX, zip code 75034 secures the fifth spot, with a solid corporate presence and highly-rated schools attracting young professionals and families. This Frisco zip code added 5,872 units over the last five years, the majority being high-end rentals.

While all 50 analyzed zip codes more than doubled their multifamily inventories, notable percentage increases were seen in Miami, FL’s 33132 (354%), Maitland, FL’s 32751 (274%), Panama city, FL’s 32405 (190%), Virginia’s 23230 (235%), and Fuquay Varina, NC’s 27526 (216%).

Despite the strain on rents nationwide caused by the robust delivery pipeline, the positive demand and absorption persist. Occupancy rates have stabilized, and the market remains relatively steady. The rise in construction has the potential to result in higher rental rates, thereby increasing the overall value of investments. Moreover, an uptick in construction can foster economic growth in the area. This draws in more potential tenants and reduces vacancy rates, further emphasizing the importance of location when choosing an apartment investment.