Matthews™ Market Movers, Q&A

Uncertainty has plagued the real estate industry as increased interest rates loom. Fortunately, property fundamentals remain strong. In this Q&A, we asked our top agents to provide their specialized insight on what they see in the market and what discussions they are having with investors.

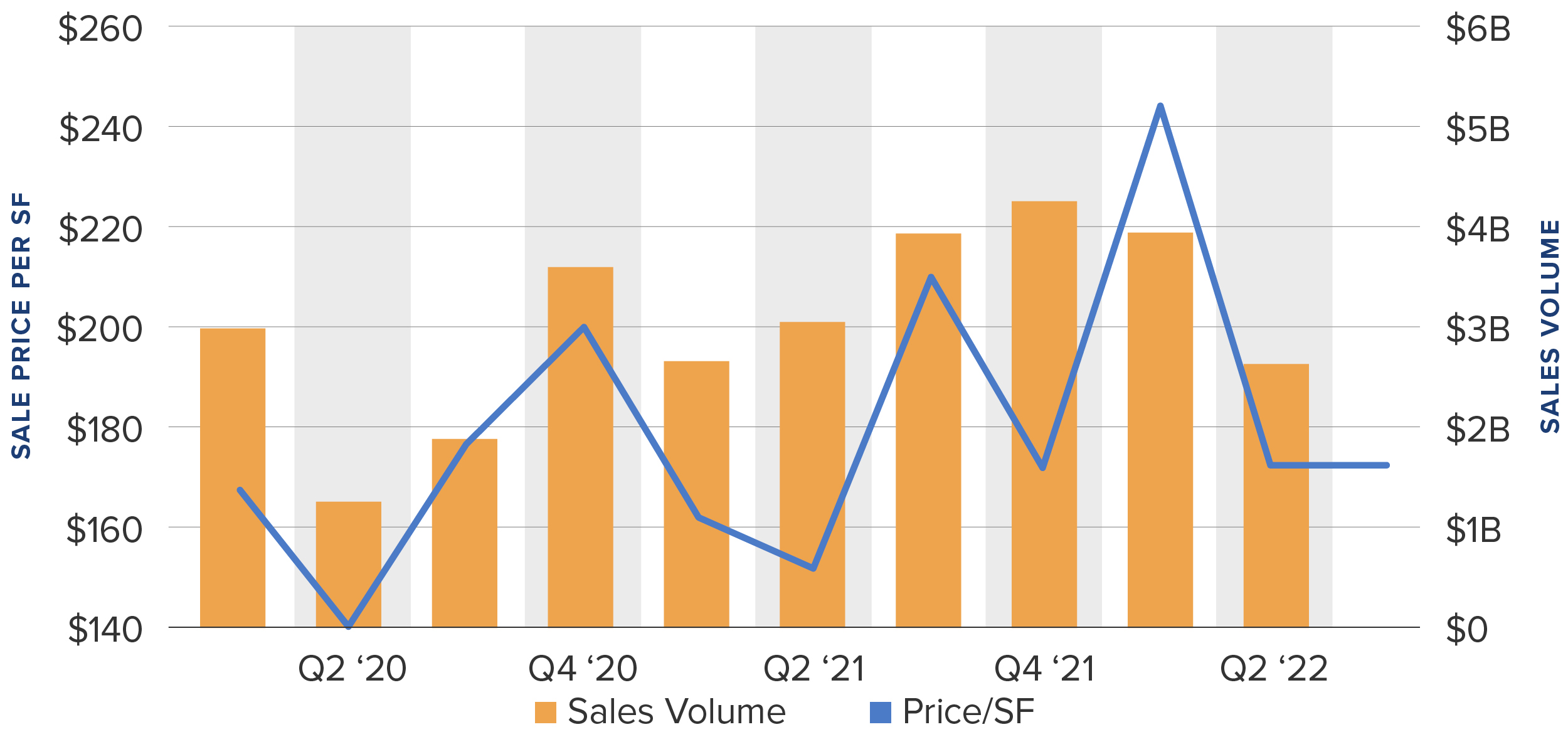

Alexander Harrold | Senior Vice President, Industrial

“There is uncertainty in the market, which causes investors to step back until there is a clear path on where the economy is heading. We expect transaction velocity to slow through the remainder of 2022 in the industrial market. However, many remain very bullish on industrial as rents continue to skyrocket exponentially. As interest rates continue to rise, the deals that are hurting the most are long-term locked-in leases with minimal rent increases throughout the term. The fundamentals behind the industrial market are still very healthy, and there is a ton of optimism in the market surrounding industrial assets. The main factors at play are interest rates and inflation. Luckily, rapidly rising industrial rents continue to battle inflation, which is why industrial still stands as one of the best places to put your money in 2022 and beyond.”

Austin Graham | Associate Vice President, Multifamily

“The last several weeks have presented a shock to the entire CRE industry with the rise in interest rates beginning to noticeably impact pricing. I expect this to slow down the red-hot velocity we have been seeing over the last 18 months as the bid/ask spread between buyers and sellers begins to expand. It is unclear exactly what the true impact these rate increases have had on pricing at this point, but the consensus seems to be about 10%. Looking forward 3-6 months from now, we will be able to see that sales data and where the market’s peak was.”

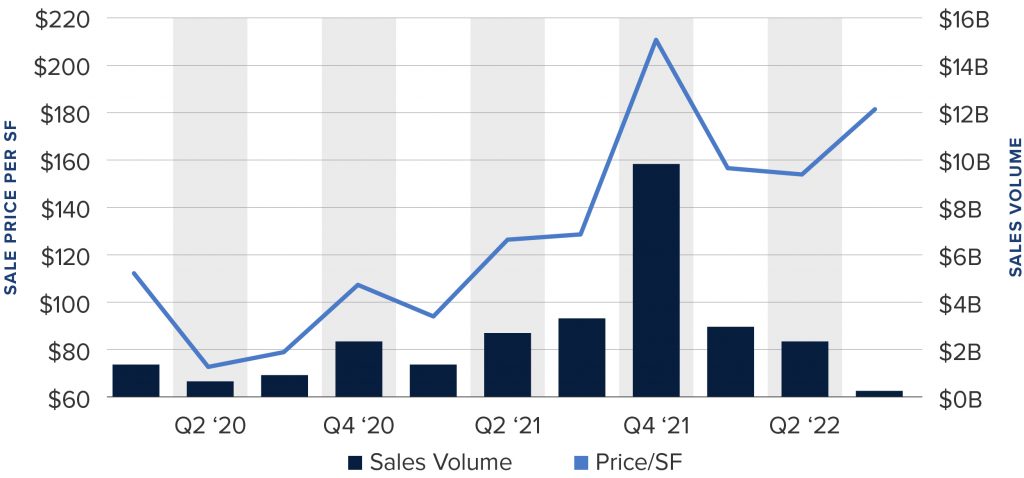

Austin McLeod | Associate Vice President, Self-Storage

“Self-Storage has a lot of liquidity in the market with more capital than ever chasing these deals. However, aggressiveness has cooled, and investors are being much more particular in what they offer and conservative in their assumptions for the years following the acquisition. Due to the uncertainty regarding interest rates, inflation, and a pending recession, I foresee investor sentiment remaining where it is at least until there is more clarity in the economy’s direction.”

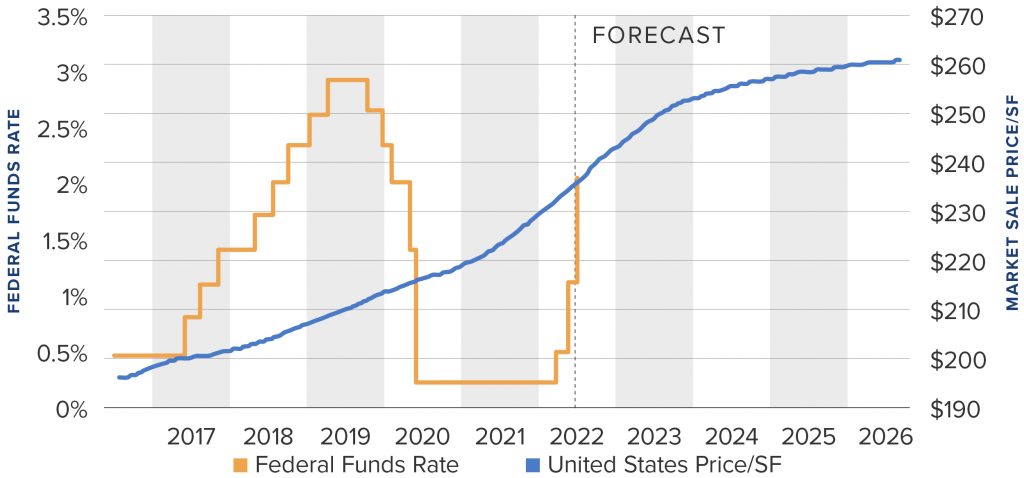

Chad Kurz | Executive Vice President, Net Lease Retail

“For investors who did not own net lease properties 50 years ago, they are experiencing something they have never experienced before, sustained rising interest rates. Many asset classes within the net lease industry have similar qualities to bonds which have experienced great benefit from not just the cash flow but a rise in value due to the steady decline in interest rates over the last 40 years. Most of our conversations with owners today involve helping them understand this correlation, the impact this could have for their investment, and ultimately, helping them decide which asset classes will perform the best for the future.”

Cliff Carnes | Executive Vice President, Capital Markets

“Not everyone wants to refinance right now, but some must. Owners who have maturing debt will need to refinance. With the rise in rates and uncertainty in the market, some needing to refinance will not want to because it means refinancing into current rates. But, most of these owners won’t have a choice.”

Finley Askin | Vice President, Multifamily

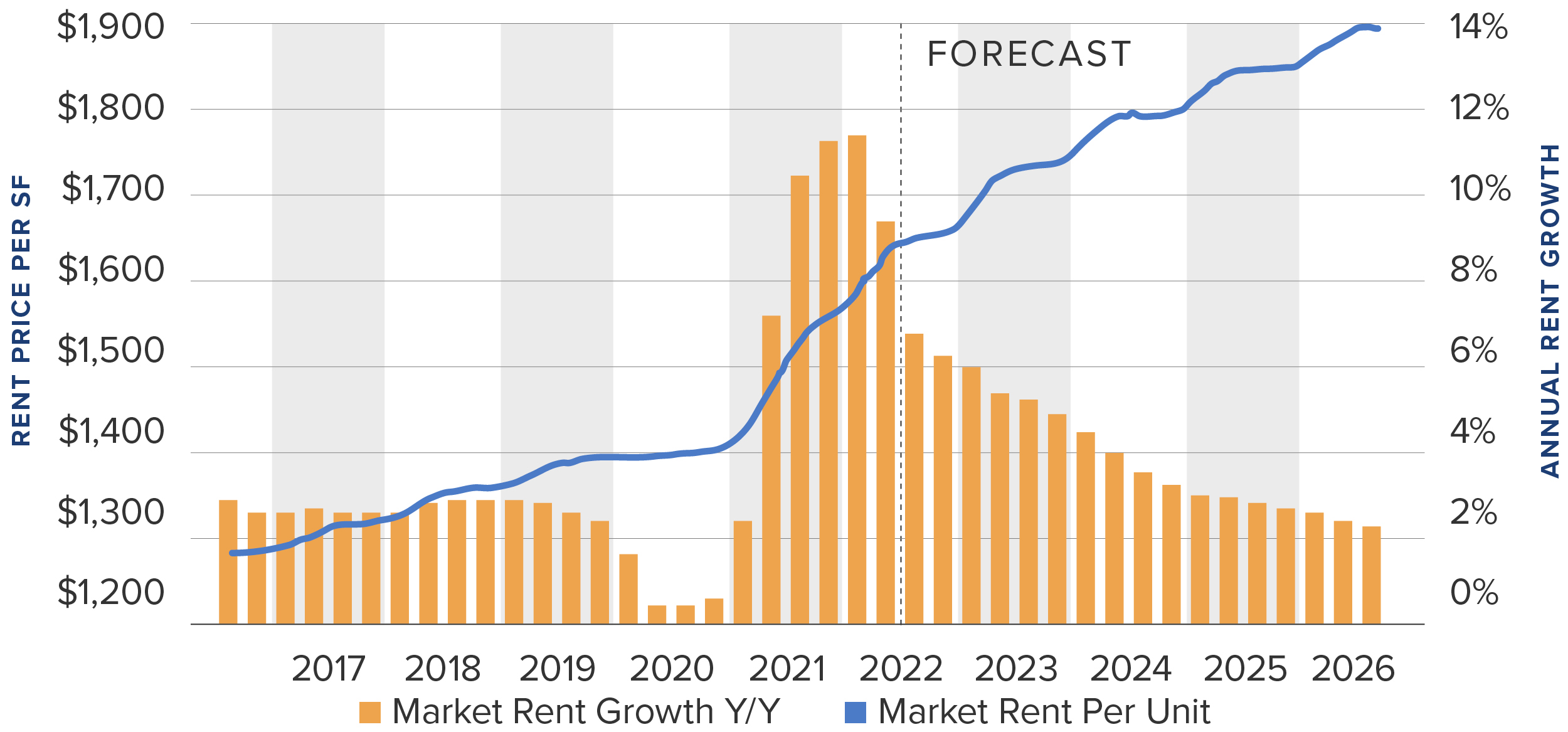

“Even with the increase in interest rates, the market has remained strong as multifamily assets have proven to be a strong hedge against inflation due to rental growth. I don’t anticipate rental growth to keep pace with the expected increase in interest rates, which will cause the market to cool as investors move to the sidelines. However, multifamily assets will remain coveted due to the national housing shortage, rising construction costs, and the track record of always appreciating over time.”

Josh Bishop | Senior Vice President, Net Lease Retail

“The past couple years of the “post-COVID-19 era” have been a real estate owner’s dream come true. Interest rates were at an all-time low, pricing was at an all-time high, and deals were moving with ease. With interest rates on the rise, we are starting to see the market settle out and come back down to “normal.” The next few months should tell us how the market will react long-term.”

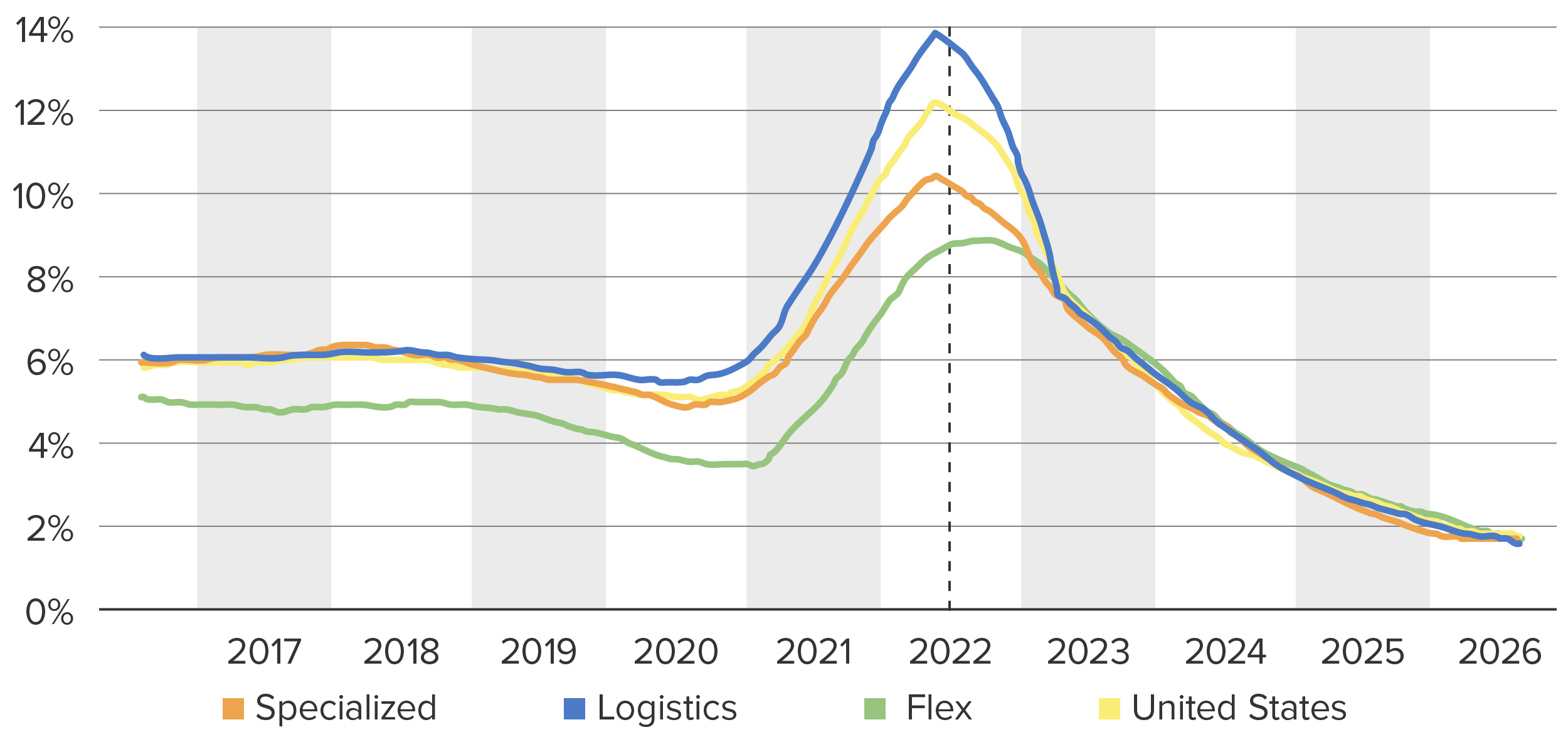

Michael Moreno | First Vice President & Senior Director, Healthcare

“We’re in a transitory period in CRE right now, which isn’t necessarily bad. The way I look at it is the market has been on cloud 9 for the past 18 months, and we’re now just moving to clouds 7 and 8. There are still a lot of opportunities out there, and prices are still at or near all-time highs when you compare it to the rest of this 10-year bull CRE market. The 2020 rate cuts shot steroids into the market, and now the market is figuring out how to balance itself without it. The good news is that quality real estate fundamentals haven’t changed, and this balancing of the market is necessary for the asset class long-term.”