Huntington Beach Market Overview

Huntington Beach’s vacancy rate has remained relatively stable over the past year, averaging 2.0 percent. Developers were active in the area several years ago, however, in recent years, nothing has been delivered to the submarket. This has caused the supply to remain minimal since no current submarket developments are underway. Rents have also increased extensively over the past year by 6.8 percent, a percentage that significantly exceeds the average annual growth of 4.5 percent over the past 10 years.

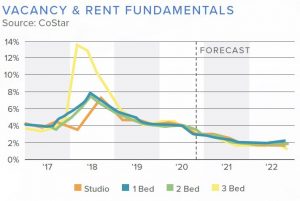

Vacancy & Rent Fundamentals

The graphs below display the consistent fall of vacancies by asset class and bedroom type and overall rent vacancies in the surrounding area. The percentage of vacancies has decreased tremendously, considering that an average of three bedrooms boasted almost 14% vacancies back in 2018. This is a positive sign for the area, setting the precedent that more people are migrating to the area and setting up residency.

The average rent for apartments in Huntington Beach is about $2,600/month. This average is right in line with that of the Orange County metro area. The rent growth rate of almost 7% also aligns well with the annualized rate over the past three years.

Huntington Beach has experienced exponential levels of rent growth over the past 10 years. The costs to rent an apartment in the area are currently 55.3% higher than they were a decade ago. The daily asking rent has also grown from approximately $2.30 in 2016 to about $3.00 in 2022. There was a noticeable change in growth in the middle of 2020 when the daily asking rent shot up from $2.50 to $2.80 within months.

Market rent reached a record high halfway through the 2021 fiscal year a little under $3,400. It has begun to slowly decline throughout 2022 and experts have forecasted that the market rent will continue to decrease over the next four years, back down to under $2,600.

Construction

Construction and new projects have come to a halt in recent years for the area. The lack of new deliveries and demolitions makes this a difficult market to forecast.

Sales

The Huntington Beach Submarket is a popular target among apartment investors within Orange County. Sales volume has averaged out to be $107 million over the past five years, and the 12-month high in investment volume hit $267 million during that same period. Also, $101 million worth of assets were sold in the last 12 months. Market pricing was $567,217 per unit during the third quarter of 2022. That average price per unit number is dramatically higher than it was compared to this time in 2021. The price itself also sits well above the average pricing for the Orange County region. The market cap rate has dropped to 3.5%, making it the lowest cap rate seen in the last five years. Experts have predicted that the Huntington Beach cap rate will rise slightly over the next year and then remain at a constant level for the next four years.