Key Inflation Metrics for Consideration

Inflation is the topic of discussion as a historic series of rate hikes by the Federal Reserve Open Market Committee (FOMC) have produced economic stagnation. Commercial real estate is heavily dependent on leverage and is negatively impacted during stagnant economic periods — property values decrease, and debt becomes increasingly expensive. Today’s landscape has investors trying to navigate this uncertain market, and understanding inflation is critical.

What trends or data should investors focus on when it appears that prices of consumer goods are rising and show no signs of slowing down? The three inflationary measures that accurately depict the market include the Consumer Price Index (CPI), Core CPI, and Shelter Costs. When investors dig into the data, they will see that there is light at the end of the tunnel.

CPI vs. Core CPI

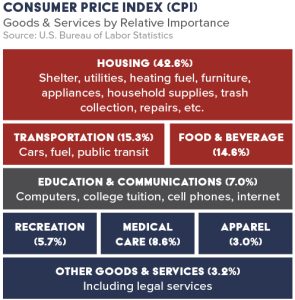

CPI is used to identify periods of inflation and deflation. Significant rises in CPI within a short time frame may suggest a period of inflation, whereas rapid declines in CPI may indicate a period of deflation. However, since CPI incorporates variable food and oil costs, it may not be the most accurate measure of inflationary and deflationary times.

Core CPI is frequently utilized for a more accurate identification. Core CPI excludes volatile items such as food and energy prices, focusing on an economy’s underlying and more stable inflation trends.

Recently released data from the BLS has shown that while CPI has significantly moderated, Core CPI has not. As of December 2023, CPI stands at 3.1%, down from 9.1% in July 2022. Core CPI is 3.99%, down from 5.9% in June 2022. The stubborn, largest weighted component of Core CPI is “shelter.” While all other commodities of Core CPI have significantly moderated, shelter costs are the reason why CPI has not dropped to the FOMC’s targeted inflation rate of 2.0%. This inflation target acknowledges the challenge of accurately measuring inflation, as there is often an inherent upward bias in inflation calculations. Having a slightly positive inflation target allows central banks like the Fed to lower interest rates to stimulate the economy during recessions and acts as a safeguard against harmful deflation.

Why do Multifamily Owners Need to Pay Attention to These Numbers & Their Impact on CRE?

Rent and Lease Agreements: Commercial leases often include provisions for rent adjustments based on changes in the CPI. Understanding CPI fluctuations is crucial for property owners as it can impact their rental income.

Market Conditions: This information is valuable for commercial property owners as it can help them anticipate significant market shifts such as rising cost of capital and cap rates. Understanding the complete picture and what to do when rising interest rates make borrowing more expensive helps investors make informed decisions regarding property management, leasing, and investment.

Financial Planning: Commercial property owners use CPI data to assess their financial planning. Understanding the rate of inflation, especially core CPI, can help owners make more accurate projections for their expenses and revenues.

Investment Decisions: Commercial real estate owners often invest in various financial instruments, including bonds and securities. CPI and Core CPI can impact the performance of these investments, so staying informed is essential for optimizing investment strategies.

The intricate economic landscape hinges on the trajectory of shelter inflation, which influences, overall inflation, interest rates, and financing dynamics.

Shelter Inflation

Shelter, which accounts for roughly one-third of CPI, is calculated by the BLS by examining changes in actual rents and owners’ equivalent rent. Owners’ equivalent rent is a survey-based estimate of how much homeowners believe they could earn by renting out their homes. The surge in shelter costs, encompassing housing and rental rates, significantly contributed to the rapid escalation of property values and rents from the start of the pandemic in 2020 to the present day. This has led to a notable increase in net operating income (NOI).

The BLS September CPI summary states that the index for shelter was the largest contributor to the monthly all-items increase (CPI), accounting for over half of the increase. Shelter was also the largest factor in the index for all items, less food, and energy. The shelter index increased 0.4% in November, after rising 0.3% the previous month.

Though increasing NOI can be highly beneficial to multifamily owners, the surge in shelter costs has been a prime contributor to the inflation that prompted the Federal Reserve to raise interest rates to cool the economy. The sequence of interest rate increases elevated mortgage rates to nearly 8.0%, abruptly halting the previously booming pandemic-driven housing market. Consequently, commercial real estate financing rates have climbed, making refinancing exceedingly tricky for many.

A Light at the End of the Tunnel

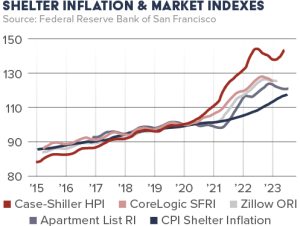

Several experts have predicted that the U.S. could experience the most severe reduction in housing inflation since the Global Financial Crisis of 2007 to 2009, according to a recent report by researchers at the San Francisco Fed. The report suggested that the shelter cost inflation peaked in April 2023 at around 10% on a year-over-year (YOY) basis. Though still high compared to historical norms, shelter costs are expected to decline at the beginning of 2024, and there’s a chance it could even dip into negative territory by mid-2024, positively impacting Core CPI. Such a development would signify a dramatic reversal in shelter inflation trends, with significant implications for the overall inflation landscape.

The Federal Reserve Bank of San Francisco forecasts that shelter inflation in 2024 can fall anywhere between -9% to about 2%.

The researchers’ models provide a broad spectrum of potential changes, predicting that YOY shelter inflation in late 2024 could range from -9.0% to the targeted 2.0% in their baseline model. It’s worth noting that even the highest estimate represents a deceleration of inflation. Keep in mind these projections assume that there won’t be any additional unexpected disruptions to the system.

Projections indicate that shelter costs will likely decrease to the target 2.0% by mid-2024 and may even turn negative by Q3 2024. As a result, the Fed will likely refrain from implementing an additional rate hike, and the burden of shelter inflation will soon significantly alleviate.

Overall, CPI and its components can notably impact commercial real estate by influencing inflation rates, loan rates, building prices, and a region’s general economic health.

Considerations for CRE

In certain commercial real estate leases, CPI serves as a mechanism to reasonably adjust a tenant’s rent by linking their base or additional rent to fluctuations in the national or regional CPI, effectively connecting rent to the corresponding inflation rates at national or regional levels. Although this practice is uncommon, it does occur, particularly in government leases. It’s important to note that not all leases with CPI adjustments experience an annual increase. Some leases may feature adjustments on a calendar year basis or at specified mid-term intervals, while others may include limits or minimum thresholds for CPI increases.

Commercial real estate investors rely heavily on debt to purchase properties. High-interest rates are making it harder to acquire or maintain properties at current prices. Recently, Guggenheim Investments, a global investment advisory firm, believes the FOMC could cut rates as much as 1.5% in 2024, with more cuts coming in 2025. If the San Francisco Fed and Guggenheim are correct in their predictions, debt rates could drop from the current 7s to somewhere in the 5s again. While ambitious, any relief would be welcome to lubricate this clogged market.