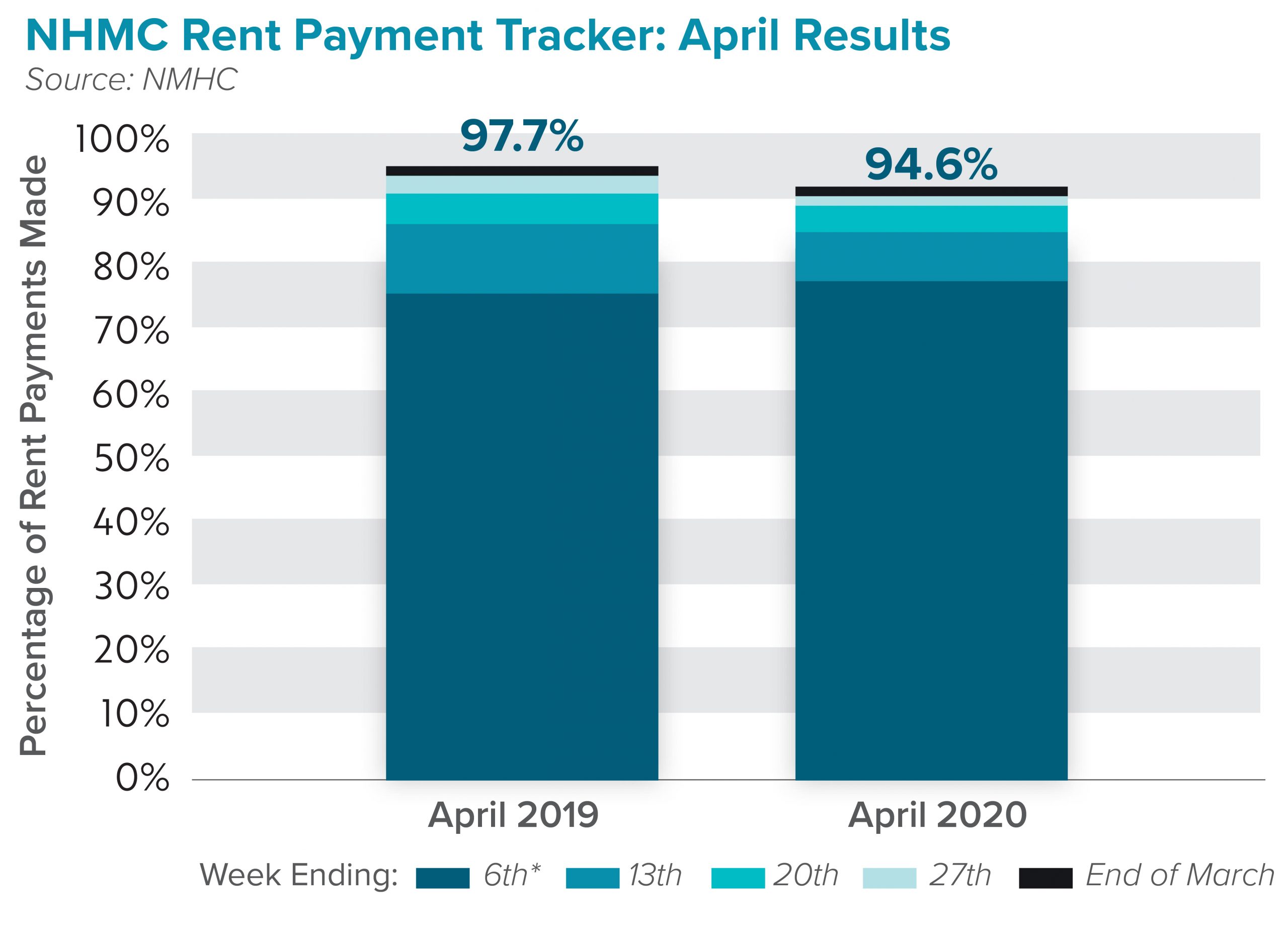

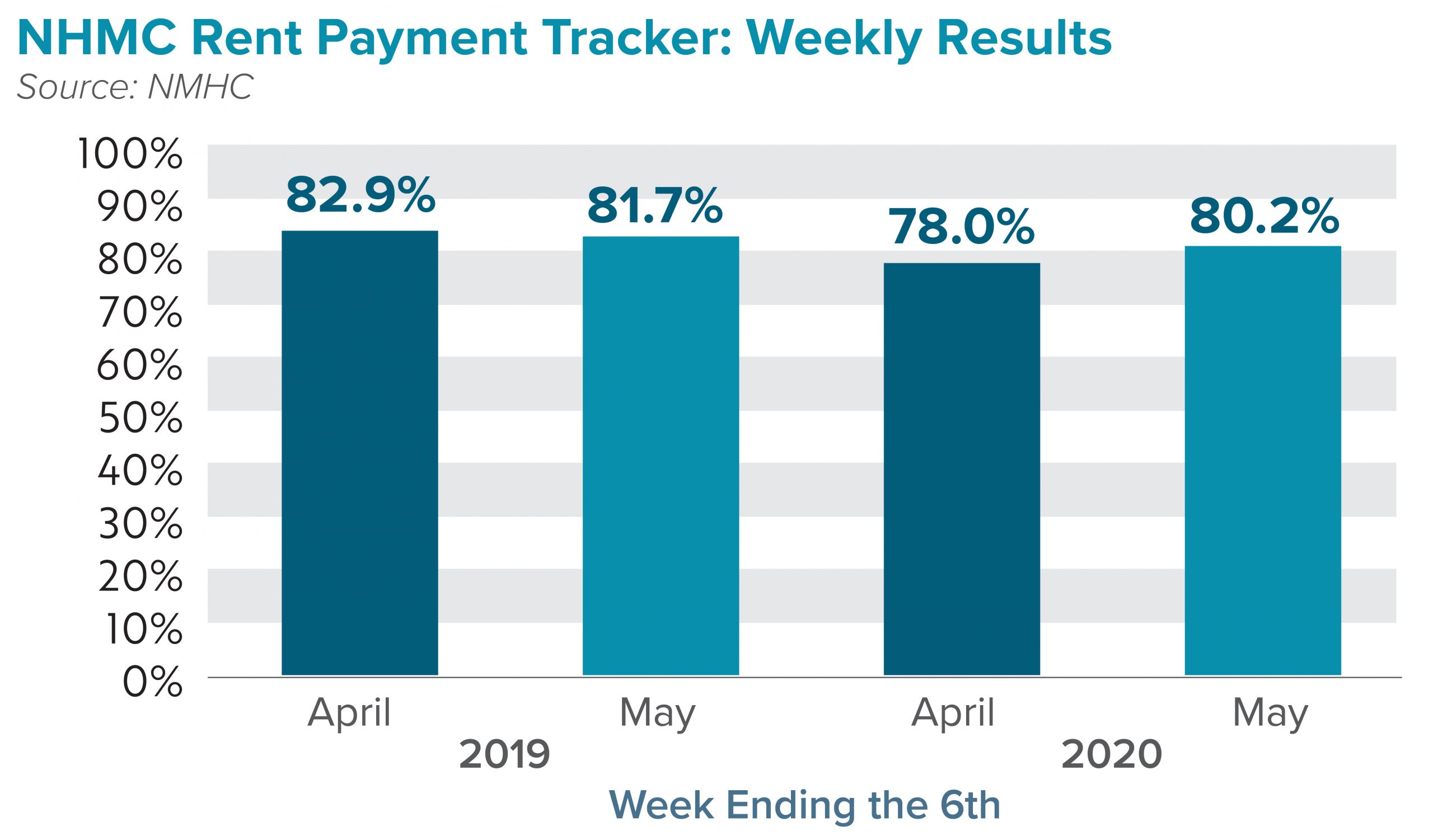

In recent weeks, we have released the National Multifamily Housing Council’s (NMHC) rent payment tracker data (Part 1, Part 2, and Part 3) in an effort to keep investors informed. In the fourth release, the data found that 80.2 percent of apartment households made full or partial payment by May 6th, 2020. This equates to a 1.5 percentage point decrease from the share of renters who made payment through May 6th, 2019, and compares to 78 percent of renters who completed payment by April 6th, 2020. The final rent payment for April 2020 was 94.6%. The data was pulled from 11.5 million rental units across the country that vary by size, type, and average rental price. This news comes after many industry experts feared rent collections would fall short in May in comparison to April.

These rent figures come on the same day as the release of the April job report from the U.S. Bureau of Labor Statistics, which revealed that a staggering 20.5 million Americans lost their jobs in April, increasing the unemployment rate to 14.7 percent. Despite these numbers, for two months in a row, we are seeing evidence that apartment renters are completing their rent payment obligations.

Overall, these results are solid for April and May, and rent sentiment is high. Between asset classes, Class A rent payments are higher, compared to Class C workforce housing, which is lower. Some markets, in comparison to others, are doing better than others. The markets that are lagging include New York, Las Vegas, New Orleans, and Los Angeles. Markets that came in below expectations include Seattle, San Francisco, Washington, D.C., and Atlanta. Florida and Houston performed better than expected.

While these numbers are a positive sign for the multifamily industry, NMHC continues to advocate for more legislation to provide relief for both renters and owners. Apartment owners have $1.6 trillion in outstanding mortgage debt, and if payment cannot be made, we may see a wave of multifamily foreclosures. As of May 7th, only a handful of owners from the 11,500 who have FHA insurance requested loan forbearance on their mortgage payments, according to a HUD official. NMHC is still calling on Congress to include a $100 billion in direct renter assistance in the next pandemic relief package.

As the industry enters uncharted waters, we are closing monitoring the events which unfold surrounding COVID-19 and the impact on the economy and commercial real estate. Information is sourced from NMHC, who will be monitoring and released updated Rent Payment Tracker data weekly. Please be on the lookout for reports with updated information.

Matthews™ is committed to keeping the commercial real estate community informed and continuing to offer our services during these market changes. With updates and challenges released daily, please contact a Matthews™ specialized agent for guidance during this uncertain time, and for more insights on COVID-19 and CRE, visit our dedicated coronavirus website.

The Centers for Disease Control and Prevention is offering information and updates on the novel coronavirus (COVID-19) outbreak, the World Health Organization is tracking the number and location of confirmed cases of the virus and Building Owners and Managers Association International has provided the following emergency preparedness guidelines for commercial and residential property managers and landlords.