Macro-Economic Outlook for 2023

As the Federal Reserve continues to increase interest rates in an effort to fight inflation, the U.S. is at risk of a mild recession for the 2023 fiscal year. This forecast is influenced by record-high inflation and the Fed’s more militant approach toward rates throughout the recent quarters. But as unemployment hits historic lows, economists are pessimistic that inflation will be reined in.

GDP and Interest Rates

J.P. Morgan data expects a modest 0.5-1.0 percent real GDP growth rate for the U.S. in 2023. Additionally, J.P. Morgan states that government spending, which accounts for 17 to 18 percent of GDP, should have a neutral impact in 2023. This impact is due to decreased pandemic-related spending offsetting increasing infrastructure and CHIPS and Science Act spending. A three percent increase in company investment in 2023 is expected, with substantial expenditures on machinery and technology partially offsetting lower spending on structures, including buildings, and plants.

Fed’s Impact on the Economy

J.P. Morgan expects the Fed to deliver another 100 basis points (bp) of rate raises before taking a pause next spring. This includes the 50 bp increase seen in December 2022, and the 25 bp increase in February. If the last raise in March goes through, the cumulative tightening would reach 475 bp, bringing the terminal fed funds to the target range of 4.75 to 5.00 percent.

According to J.P. Morgan, the Fed will continue reducing its balance sheet until 2023 at the current runoff rate of $95 billion monthly – $60 billion in Treasury bonds and $35 billion in mortgage-backed securities. As assets leave the Fed’s balance sheet, this essentially decreases liquidity in the economy because private investors absorb them.

These continuous rate raises mean the Fed is tightening monetary policy at the fastest rate it has ever done, affecting several other aspects of the economy. Although rate rises are intended to curb inflation, they also raise borrowing costs, negatively affect the stock market, and raise the cost of doing business for both public and private companies.

Investing in This Economy

Investors need to prepare themselves for a volatile trading year. According to Deutsche Bank AG, the S&P 500 Index will reach 4,500 in the first half, drop by 25 percent in the third quarter as a slump sets in, then rise to 4,500 by the end of 2023 as investors try to beat the recovery. A bright side in these inflationary times is the surge in popularity of savings bonds, which are now being seen as a top investment option for 2023. Series I savings bonds have seen the most action as of late. According to Forbes, The Series I bond rate reached a record high of 9.62 percent in April 2022, while the S&P had been down 15 percent year to date.

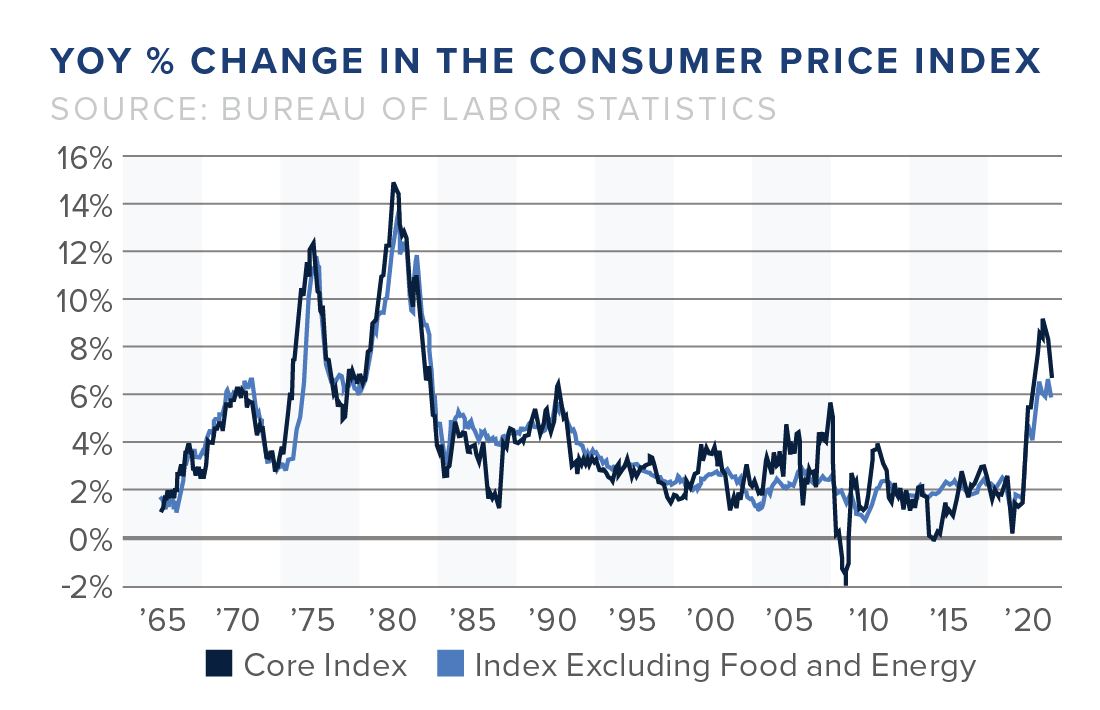

Consumer Price Index Report

The Consumer Price Index data released on February 14, 2023, revealed monthly price increases have been picking up quickly. This trend held for both indexes, including the one that accounts for gas and groceries and a “core” index that excludes these items since they have high month-to-month volatility, to better reflect underlying inflation trends.

According to the U.S. Bureau of Labor Statistics report, the Consumer Price Index for All Urban Consumers (CPI-U) increased 0.5 percent in January on a seasonally adjusted basis, following a 0.1 percent increase in December. Before seasonal adjustment, the all-items index climbed by 6.4 percent over the previous year. The food index rose 0.5 percent monthly, while the food at home index rose 0.4 percent. The energy index grew 2.0 percent month-over-month, as did all major energy component indexes. The report also stated that the all-items index grew by 6.4 percent from January 2022 to January 2023, with the smallest 12-month growth since October 2021. The index of all products except food and energy increased 5.6 percent in the last year, the weakest 12-month gain since December 2021. The energy index rose by 8.7 percent in the year ended January, while the food index increased by 10.1 percent.

This report has revealed prices are no longer relentlessly rising, as they were during much of 2021 and the first half of 2022, but the Fed is still wary of the volatility of inflation at this time.

Consumer Spending

Although job growth and pay increases have helped to support consumption, it is evident that individuals and families delved into retirement savings and purchased more on credit cards during 2022. In fact, a significant percentage of the surplus savings amassed in households from 2020 to 2021 was drained throughout 2022. The remaining funds could be emptied by the middle to end of 2023, depending on the course of inflation and the rate of consumer spending over the next several quarters. Data also suggests that real consumer spending will rise by two percent in the year, assuming wages grow by four to five percent and inflation declines to three to four percent.

Will Inflation Subside by the end of 2023?

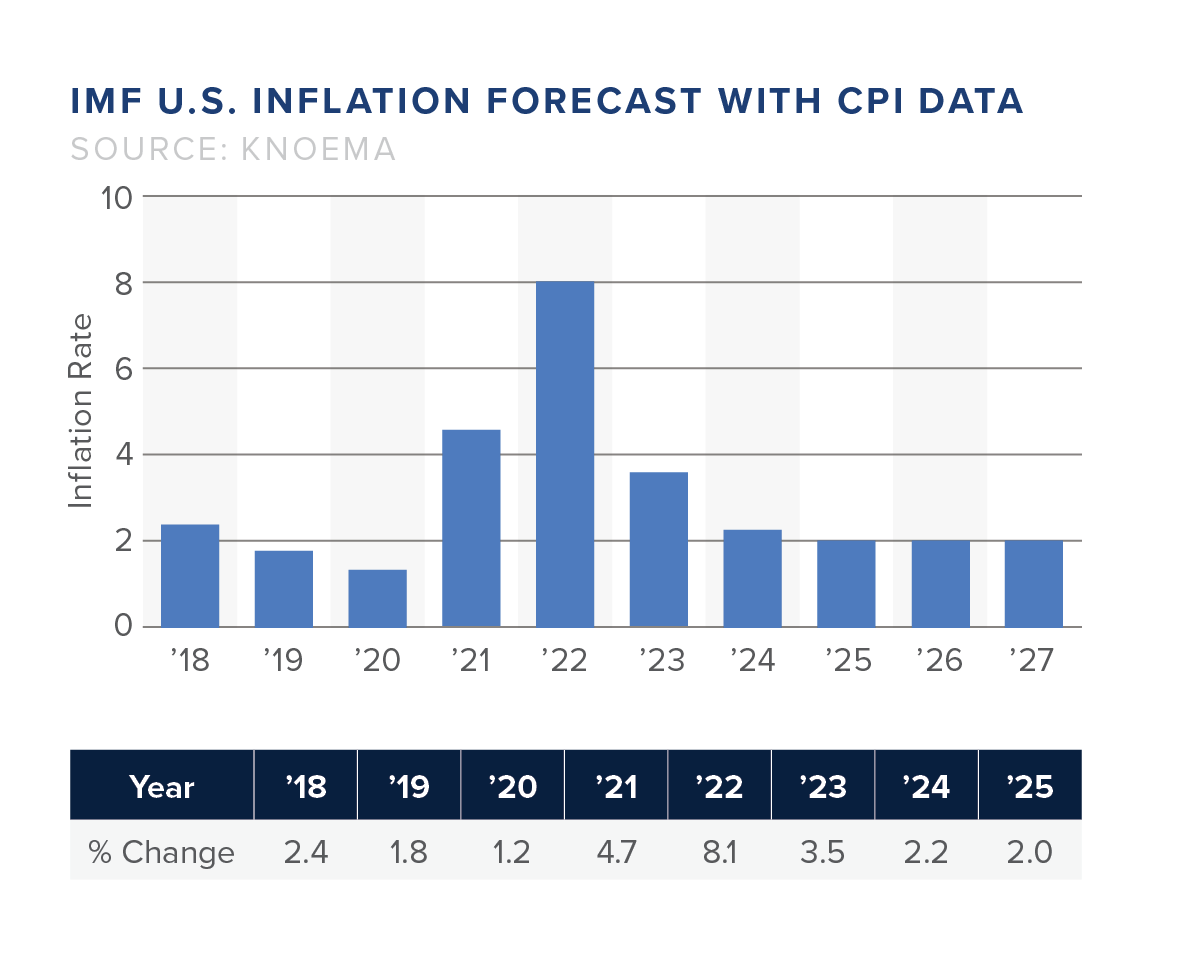

The federal funds rate has grown to a range of 4.25 to 4.58 percent; the highest rate in 15 years. With this in mind, it may be a while before the economy sees inflation back under control.

On average, it takes at least nine months for Fed rate hikes to take effect, meaning it may take until the end of 2023 to see inflation subside. It is not likely that the inflation rate will reach the Fed’s goal of two percent.

Labor Market

Demand continues to outpace supply throughout the labor market. The J.P. Morgan report stated that September 2022 recorded 10.7 million job openings, an elevated quit rate of 2.9 percent, and wage growth of five to six percent. However, recent job data from January 2023 reported 517,000 jobs added, making the unemployment rate fall to 3.4 percent, the lowest since 1969. Although low unemployment is a positive signal for the overall health of a country’s economy, a large influx of jobs increases consumer spending, hindering the Fed’s efforts to slow inflation.

Takeaways

While supply-side restraints are easing and monetary policy is under the watchful eye of the Federal Reserve, rising interest rates will tip the U.S. economy into a broad-based recession. Levels should begin to balance out by 2024 but prepare for a volatile economic year for now.