How the Great Financial Crisis Compares to Today’s Market

The Great Financial Crisis (GFC) of 2008 was a severe worldwide economic crisis that was triggered by the collapse of the U.S. housing market and the subprime mortgage industry. The crisis led to a global recession, with the U.S. stock market declining by more than 50 percent and many financial institutions and companies going bankrupt or needing government bailouts.

In contrast, the market in 2023 is experiencing a different set of challenges. On the heels of the COVID-19 pandemic, the stock market has seen extreme volatility. The economy experienced a sharp decline in March 2020, then quickly rebounded to reach new highs by mid-2022. But by 2023, the U.S. saw record inflation, causing concerns among investors and policymakers.

Overall, while there are some similarities between the GFC and the current market, there are also significant differences in the underlying causes and government responses.

Looking Back

The Great Financial Crisis was ultimately caused by the default of loans by subprime lenders, which caused the U.S. housing market to crash and global financial institutions to fail.

In an attempt to boost the economy after 9/11, the Federal Reserve slashed interest rates to as low as one percent in June 2003. This created a flood of liquidity as consumers with little credit or income could now afford a home. In turn, home prices increased, and banks began selling subprime loans to Wall Street. Issues arrived once interest rates shot back up, and those who had purchased a home at the adjustable rate of one percent could no longer afford the payments, forcing them to default. Home prices fell, and subprime lenders started filing for bankruptcy. The nail in the coffin was in September of 2008, when Lehman Brokers collapsed, marking the largest U.S. bankruptcy in history. Widespread panic ensued, and millions lost their savings, jobs, and homes. Although the GFC is said to have technically ended in 2009, it took years for the U.S. to fully recover.

When the bubble burst, financial institutions were holding trillions of dollars’ worth of near-worthless investments in subprime loans.

Moving Forward

Fast forward to 2023, and there isn’t a steep decline in the housing market, and employment is strong, but there is overarching fear and hesitation, conflicting views, and record-high inflation that is persisting despite the Fed’s best efforts. Supply chain disruptions caused by global shutdowns sprouted a deep supply and demand imbalance while government aid rapidly increased consumer spending. Inflation reached a record high of 9.1 percent in June 2022, and the stock market has been riding a rollercoaster since the fall of 2022, unable to exit a bear market.

In March 2023, the U.S. experienced the largest bank collapse since 2008 with the fall of Silicon Valley Bank (SVB). The lender had a booming business during the pandemic as start-up tech companies, their primary clients, flourished. Due to its success, the bank invested billions into long-term U.S. Treasury bonds, which quickly lost value once the Fed began to raise interest rates. The downfall began when tech companies started to struggle in the market and began withdrawing funds from SVB, which meant the lender needed to cash in on the purchased bonds that were now valued lower than their purchase price.

- In total, SVB lost $1.8 billion, which caused clients to panic and withdraw funds, ultimately leading the bank to fail. The bank failure injected fear into the U.S. banking system as lenders and borrowers flashed back to 2008.

- Federal agencies took immediate steps to help institutions shore up their cash reserves, a move that is setting the tone of urgency and awareness from the Fed, two characteristics often missing during the GFC.

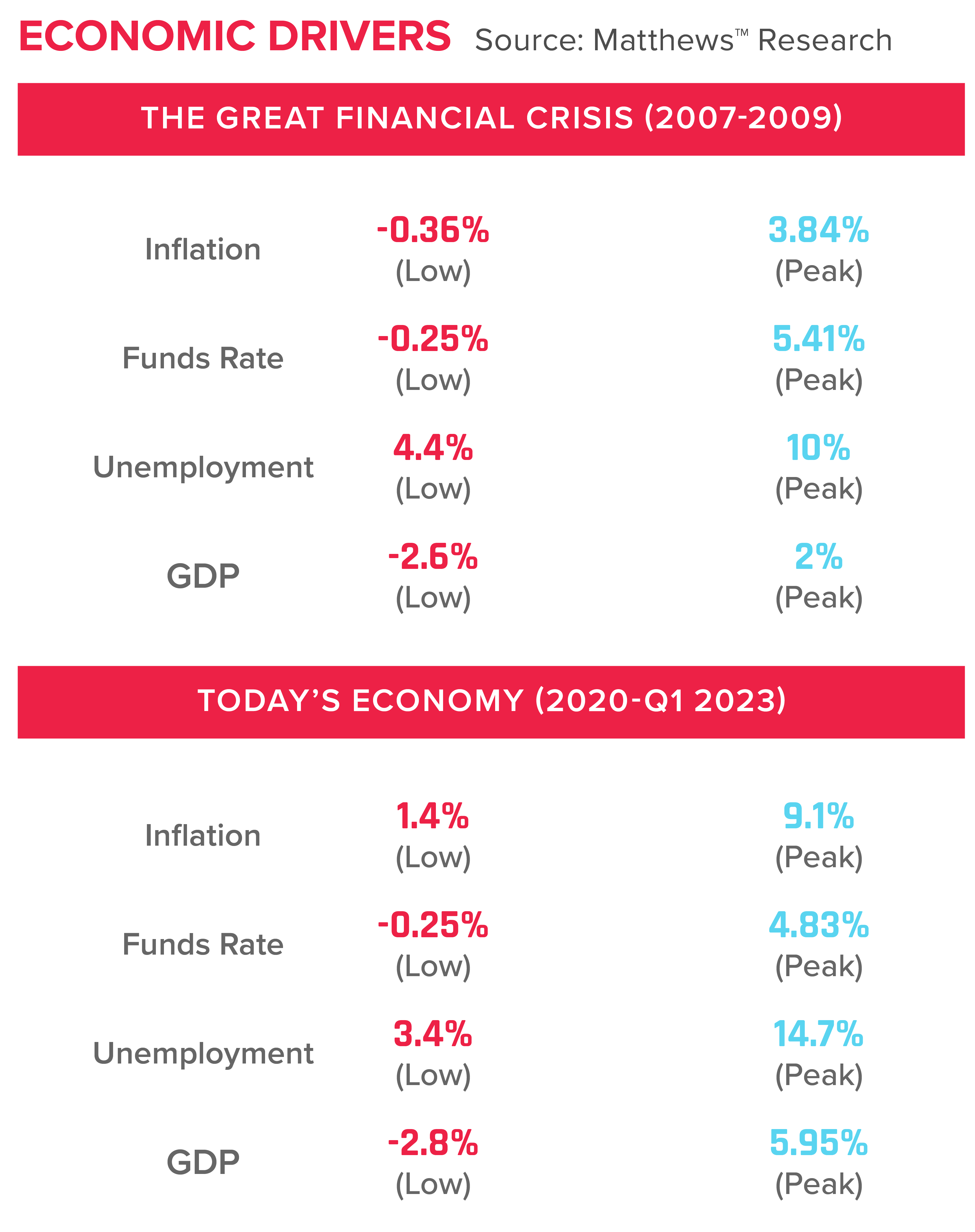

Although both are defined as recessionary periods, a significant difference between the GFC and today’s market is the nature of the underlying economic factors. Unemployment, inflation, and interest rates are all vastly different in each period’s highs and lows.

Beyond the numbers, the greatest difference between the two recessions is the government’s reaction. To combat the GFC, the U.S. government issued two major relief programs, the Troubled Asset Relief Program (TARP) in 2008 and the Recovery Act in 2009.

- TARP created $700 billion in government funds to stabilize the U.S. financial system. The fund amount was eventually brought down to $475 billion.

- The Recovery Act of 2009 was a stimulus package developed to create and save jobs. It also provided aid to citizens through temporary relief programs and invested billions into infrastructure, health, renewable energy, and education. In total, the estimated cost of the Recovery Act was $831 billion.

For years, the U.S. economy struggled to regain momentum, with GDP averaging two percent for four years following the recession. During this time, the Federal Reserve maintained low rates.

Policymakers’ fiscal response to the Great Financial Crisis, notably the Troubled Asset Relief Program (TARP) and the 2009 Recovery Act, was large for its time and effective at arresting an even sharper downturn. But it was neither large enough nor sustained long enough to promote a rapid recovery with stronger job growth. – Center on Budget & Policy Priorities

The government had a more aggressive approach to recovery from the COVID-19 crisis. The stimulus packages were much larger and enacted faster than during the GFC.

- The Federal Reserve cut rates to 0.0- 0.25 percent overnight.

- The government issued the CARES Act in March 2020, the Coronavirus Response and Relief Supplemental Appropriations Act of 2021, plus the American Rescue Plan in late 2021.

- The CARES Act is the largest economic stimulus package in U.S. history, reaching $2 trillion in total funding, with the majority of it spent on single payments to American families. It also included increased unemployment benefits and aid to small businesses, hospitals, airlines, and more.

- The U.S. paid an estimated $5 trillion in pandemic stimulus funds.

The aggressive strategy proved to stimulate the economy almost immediately once COVID-19 cases started declining and global restrictions weakened.

Federal policymakers enacted substantial relief and recovery measures in 2020 and 2021 to support the economy and relieve hardship. These measures helped fuel an economic recovery beginning in May 2020 that made the deepest recession in the post-World War II era also the shortest.- Center on Budget and Policy Priorities

The Effect on Investors and CRE

Real estate is often one of the hardest hit asset types during a recession as property values decrease and debt becomes more expensive. Being a cyclical market, the effects of a recession can take months to fully come to fruition in the industry.

A recession’s effect on residential real estate is straightforward; incomes fall, and homeowners get behind in mortgage payments and, in turn, try to sell or go into foreclosure. Commercial real estate is more complex as values are reflected by net operating income (NOI). If tenants stop paying due to a lack of business or occupancy rises, NOI decreases, pushing property value down. In addition, capital becomes more expensive, and lenders become more selective. The tightening of lending standards and increased costs can make it difficult for commercial real estate developers and investors to obtain the financing needed to plant capital. In the summer of 2007, the commercial real estate market was red hot, and CRE investors were franticly purchasing properties with skyrocketing value. Soon after the GFC, values plummeted, and many investors lost their assets to foreclosure or lost millions after selling way below what they purchased the property for.

A similar scenario to 2007 occurred in the late 2010s, a period that had a continual 10-year “up-seller’s-market.” Investors were rapidly buying and earning high yields until COVID-19 halted the economy in 2020. Once again, there was a vast difference between the recession’s effect on commercial real estate in 2008 versus 2020 – property values recovered quickly and fiercely through 2021. Commercial real estate had one of the best years on record in 2021 as consumers were eager to spend after months of lockdowns, and supply chain disruptions created an insurmountable need for industrial commercial space. In addition, the pandemic caused a large surge in migration which increased the value of homes and multifamily assets in secondary markets, self-storage, retail, and more. The incredible rebound continued throughout 2022 until year-end, when numbers started to moderate.

So why was there such a discrepancy in recovery in both recessions? It may go back to how the recession didn’t shock the economy as it did in 2007-2009. Investors had time to evaluate their portfolios and adjust accordingly in 2021-2022. In addition, the aftereffects of COVID-19 were unlike any other post-global phenomenon. It surged demand for almost every type of real estate asset, whereas it typically takes years to bring real estate values back to their prime.

Future Outlook

At the end of 2022, the Federal Reserve stated interest rates would most likely be higher than originally anticipated, as the current monetary tightening has not lowered inflation near the Fed’s two percent target rate. The Fed has been steadfast in its stance that it will not loosen policies until inflation is under control, regardless of the potential consequences.

- As of March 2023, the belief is the fund rate will reach 5.5 percent to 5.75 percent, a substantial increase from the once-stated 5.1 percent terminal rate. This change will reach all sectors of real estate.

For commercial real estate, early to mid-2023 will be a “realization” time, with sellers accepting lower prices as CRE enters the recession phase of the real estate market cycle.

- Pricing, rent growth, and occupancy are moderating while most markets are set to deliver large amounts of supply. This will encourage sellers to lower pricing.

The real estate market goes up and down according to four market cycles: Recession, Recovery, Expansion, and Hyper-Supply.

Overall, the fear and uncertainty tainting today’s economy are a long way from the agony caused by the Great Financial Crisis. Employment is strong, property values are stable, and bankruptcies are scarce. Investors should identify unique opportunities in the market to make the most of this soft-landing recession, leaning into those that hold demand even when consumers pinch pennies. The Great Financial Crisis was a devastating time in history, plagued by loss. Today’s economy was built on loss and came back stronger.