Rising Inflation

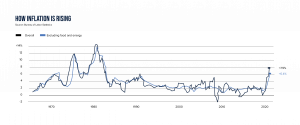

Rising inflation has skyrocketed to the forefront of consumers’ minds as the inflation rate hit a 40-year high of 7.9 percent in March 2022. Prices for goods and services have gone up significantly around the U.S. and globally, as pent-up demand and supply chain disruptions continue to cause issues for manufacturers, suppliers, retailers, and customers. Although real estate, both residential and commercial, has a proven track record of performing well in high inflationary periods, the industry is still seeing the effects of a strained economic environment, causing some investors to adapt their investment decisions.

What is Inflation?

Inflation is defined as the general increase in prices and a fall in the purchasing value of money. Although a steady increase in inflation rates over time is expected, a significant increase in a short amount of time can occur when supply and demand become unbalanced. Powered by government stimulus during the global pandemic, the U.S economy bounced back stronger than ever in 2021, with consumers spending more money on goods and services than they were pre-pandemic. This surge in spending resulted in a strong economy, but high inflation.

“High inflation is the dark side of an unusually strong economy.”- Wall Street Journal

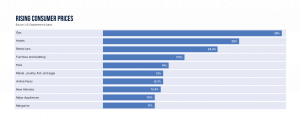

Some sectors have been hit harder than others when it comes to inflation, with used cars ranking number one for highest inflation rate. Certain foods, gas oil, household items, and services also saw a substantial increase over the past year.

How Long Will Inflation Last?

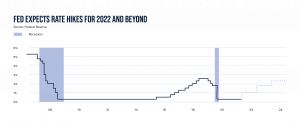

The U.S. Federal Reserve has two main jobs, to keep inflation in check and maximize employment. When inflation starts to rapidly increase, the Federal Reserve has a few options to try to decrease it but needs to act pragmatically to ensure that it does not stifle the booming economy or hinder employment rates.

To combat current inflation, the federal organization announced it would be utilizing quantitative tightening, the monetary policy applied to a central bank to decrease the liquidity within the economy. They are also expected to raise federal fund rates up to seven times throughout 2022, the first time an increase has been initiated since 2018. The federal fund rate is the target interest rate at which commercial banks lend and borrow excess reserves to each other. With this raise, banks adjust their interest rates for customers, which then influences business and consumer spending.

Although the Federal Reserve is taking action to combat high inflation, they have repeatedly stated that inflation is transitory and would eventually take care of itself as supply chain disruption from the pandemic decreases. Overall, high inflation is expected to stick around for the foreseeable future, but as the government raises federal fund rates, levels will moderate to normal levels.

Effect on Real Estate

Anytime the economy experiences historical ups or downs, landlords, tenants, developers, and investors are affected. Increased prices lead to erosion of principals on bonds, affecting asset values, and eventually affecting interest rates. Luckily, commercial real estate has a reputation of performing well during times of high inflation, due to the increase in rent and property values. Each asset class reacts differently, but this increase in performance is especially seen in multifamily, as landlords raise their rents to match inflation and gain higher returns.

“Real estate has the ability to weather inflationary pressures while preserving and building value.”- Forbes

Not only does multifamily reap the benefits of high inflation, but many sectors of the industry also see increased profit. As inflation rises, property values appreciate keeping pace with the economy. Inflation also increases the cost of labor, building materials, machinery, and appliances, which results in a decrease in development, driving pricing. High inflation also increases rent for tenants and reduces the value of money owed in the future, both benefiting investors.

In all, inflation is an ongoing occurrence but should stabilize as the government reacts accordingly and the U.S. continues to emerge from the pandemic. Investors, large or small, should keep an eye on the inflation rate and its effect on a national and local level to make informed and favorable decisions.