The Decline in Apartment Rents

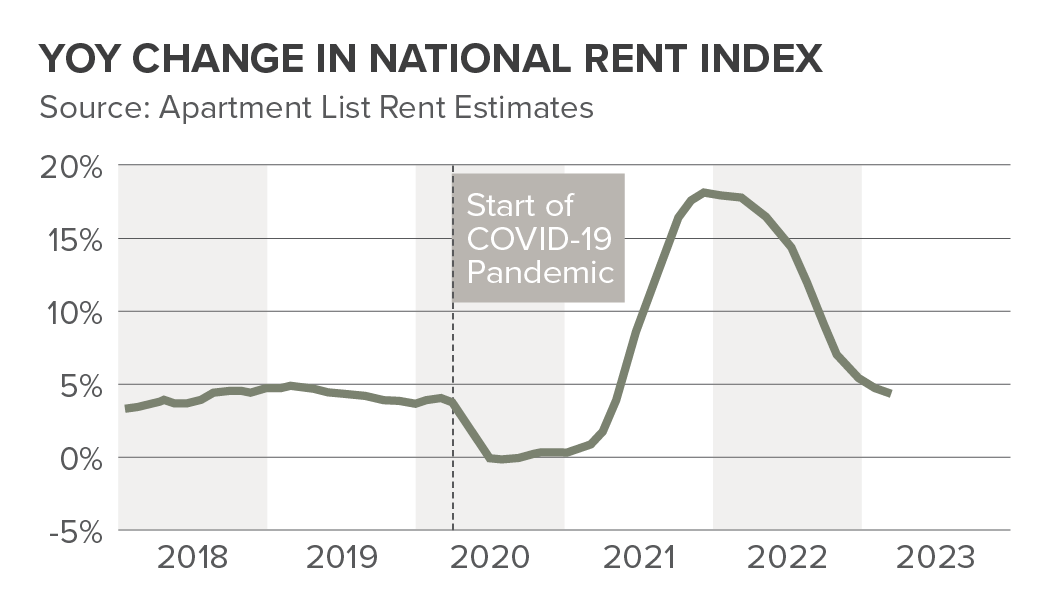

Rising interest rates, inflation, and recession worries have caused a dramatic shift throughout the multifamily market. After surging from mid-2021 through the first half of 2022, apartment rents are falling in almost every major U.S. metropolitan area. Experts predict this slowdown to continue until year-end 2023 due to supply additions outstripping mediocre demand. However, positive monthly rent growth during seasonality highs could reverse this year-over-year trend.

How Much Has Rent Fallen from Last Year?

According to recent data provided by Apartment List, renters with new leases in January 2023 paid a median rent that was 3.5% lower than the August 2022 rate, heavily attributed to the record number of multifamily units delivered.

National year-over-year rent growth has noticeably declined, standing at three percent as of March 2023, making it the lowest rent growth level since April 2021. Rents began dropping in September 2022 and proceeded to fall for the next five months until the slight increase seen in February 2023.

The national median rental rate for January 2023 was $1,942, slightly lower than December 2022’s median rental rate of $1,978 and the lowest since February 2022. Rental prices began rising in mid-2021, first surpassing $2,000 in May 2022 and peaking at $2,053 in August 2022.

The national rent index did experience an increase of 0.3 percent for February 2023, ending the five month decline in the rent growth period. However, this minuscule increase does not negate the fact that year-over-year rent growth is seeing a steady decline, and experts do not foresee any noteworthy rent increases in the following months.

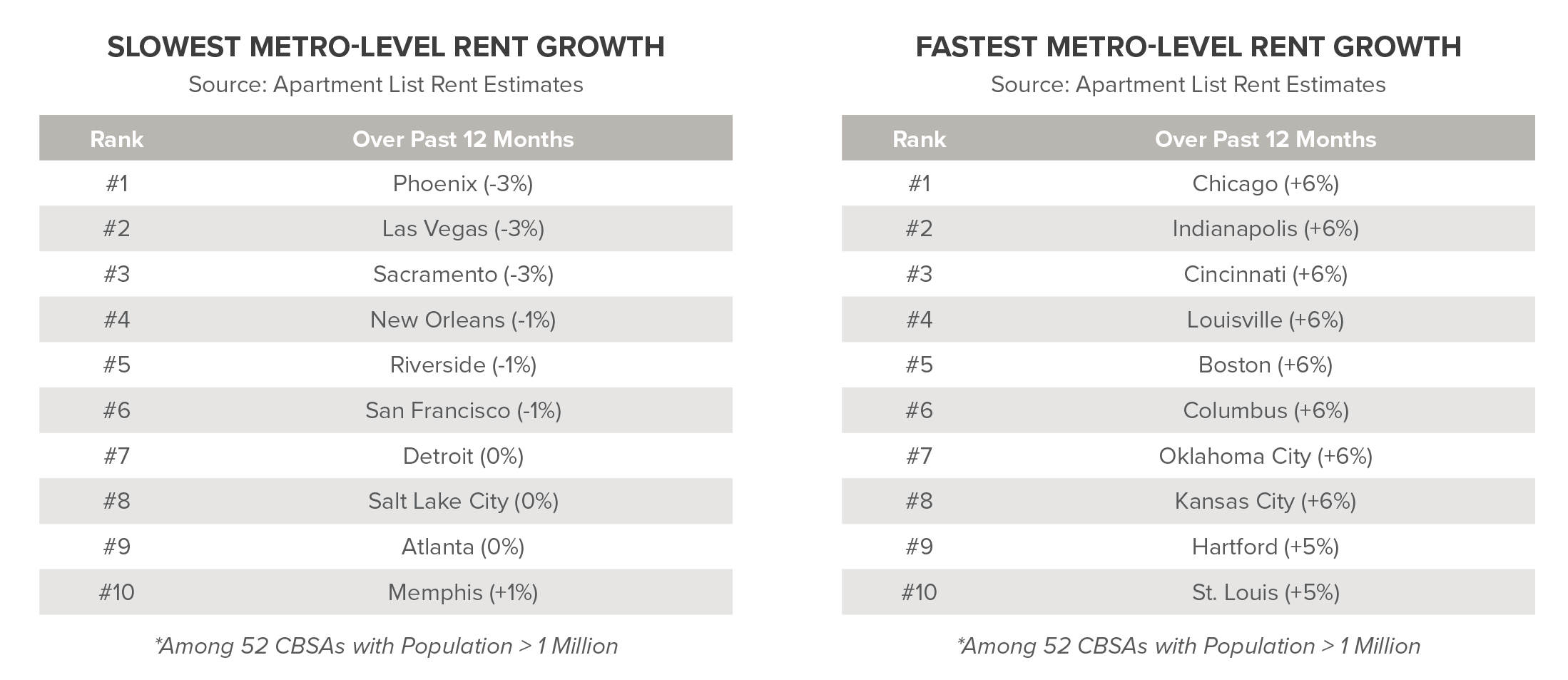

U.S. Metro Areas with Slowest Rent Growth

The vacancy index hit its highest level in two years in March 2023, standing at 6.4% – Source: Apartment List

The San Francisco metro saw the most significant rent reduction in the country during the first year of the pandemic and has been the slowest market to recover since then. San Jose and San Francisco are the only two major metro areas where the median rent is less than it was during the onset of COVID-19. Several urban, densely populated submarkets in the San Francisco Bay area are rebounding at an even slower rate.

Over the past 12 months, some markets that had been booming have now quickly cooled off, according to Apartment List data. Metros, including Las Vegas and Phoenix, have seen the sharpest rent declines despite both cities being among the top 10 in terms of pandemic-era rent growth.

U.S. Metro Areas with Highest Rent Growth

According to Apartment List, the Midwest region boasts the top three metros with the fastest year-over-year rent growth. Chicago takes the lead with a 6.3 percent increase, followed closely by Indianapolis at 6.2 percent and Cincinnati at six percent. The Sunbelt has experienced a surge in rental prices of over 30 percent in the last two and a half years, making the Midwest markets the last affordable option for renters. For coastal markets, Los Angeles is still drawing investors as it is one of the few California metros to see annual rent gains and is known for its resiliency.

Although some metros are performing well year-over-year, rent growth is moderate compared to 2021 and 2022 due to a cooldown in the rental market. For instance, no large metro has seen rental rates increase over the last six months.

Major Drivers Behind Rent Decreases

The cost of rent was 10.1 percent higher in 2021 compared to 2020. In 2022, rent increased five times the pace of 2020 rent growth. Overall, the last two years of rent growth were unprecedented and not expected to last long term. Essentially, the deceleration of rents was bound to happen as the rapid growth was unsustainable.

These decreasing rents are also a result of landlords succumbing to increased vacancy rates since renters cannot afford the higher rent. Landlords are realizing that having expensive rent limits the renter pool and hurts profitability as renters are priced out of the market, increasing the number of vacant units. Other factors within the apartment industry, including increased cost of living, new supply, and demand below seasonal averages, significantly contribute to these price slowdowns.

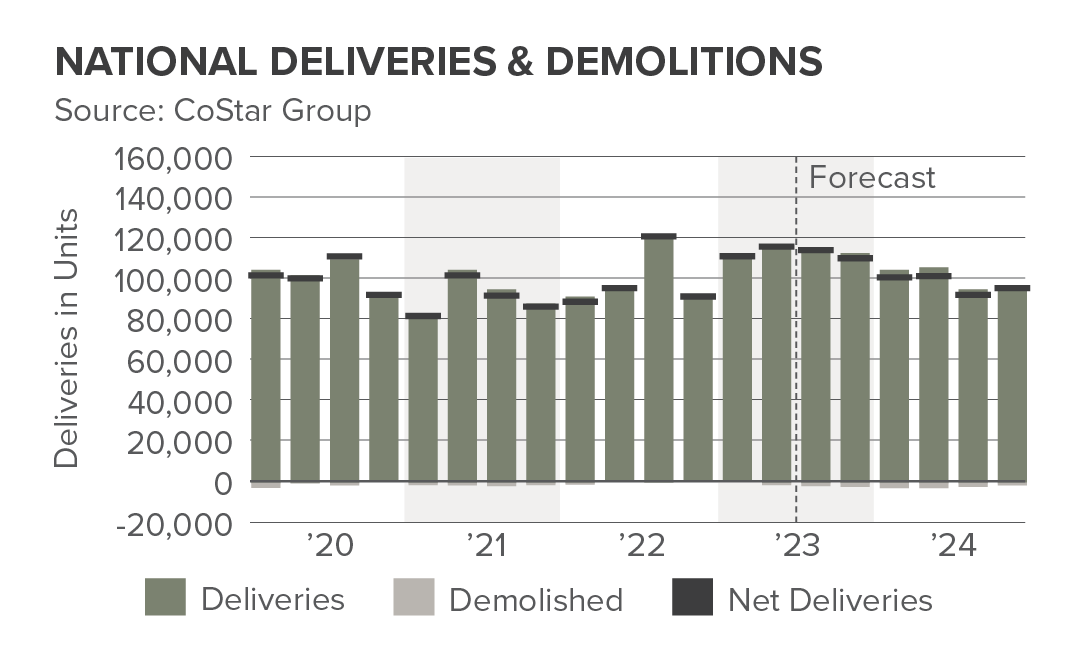

New Multifamily Supply

According to CoStar Group data, a record 959,000 multifamily units were under construction at the end of 2022, and projections for 2023 new deliveries are 507,000 units. In the fourth quarter of 2022, the top five most active investment multifamily markets were New York City, Atlanta, Los Angeles, Phoenix, and Washington, D.C. Each were among the top 10 in combined net deliveries in 2021 and 2022.

The new supply within the apartment sector will give renters more options, making it challenging for landlords to raise rents at the pace seen in early 2022. According to RealPage, the proportion of apartment residents who extended their leases fell to 52 percent in January, the lowest level for that month since January 2018. More and more renters are finding better options elsewhere, leading owners to head back to the drawing board.

The more units added and the stronger the construction pipeline, the slower rent will grow due to the supply and demand imbalance.

Multifamily Remains a Top Investment Pick

Multifamily continues to be a top asset type for investors, even with the fall in rent growth. With national sales volume of $197 billion from Q1 2022 to Q1 2023, trending above the historical average of $87.9 billion, the asset has proven resilient even in low-demand times. This increase in sales volume is from the record investment activity seen at the beginning of 2022. The influx of supply has weakened demand, but the need for housing will never cease. As some generations look to downsize and other generations are priced out of the housing market, demand and supply will balance.

February’s 0.3 percent hike has put an end to the five-month string of rent decreases. Nevertheless, even if demand keeps improving, the heavy development pipeline should restrain rent growth from surging. Rent growth is expected to moderate by the last two quarters of 2023. It is advised that investors look towards markets that are still seeing positive rent growth and growing populations.