Multifamily Rents Hold Steady Amid Volatile Markets

Despite volatility and market uncertainty, the multifamily property market remains stable. Rents for both multifamily and single-family properties increased slightly in March, although the year-over-year growth rate continues to decelerate.

Rent Updates

The multifamily rental market produced no positive rent growth gains during Q1 2023 for the first time in a decade. However, experts are not concerned because of the strong demand due to the tight job market and high single-family home prices.

With high inflation and affordability concerns, rent growth in 2023 is expected to be modest.

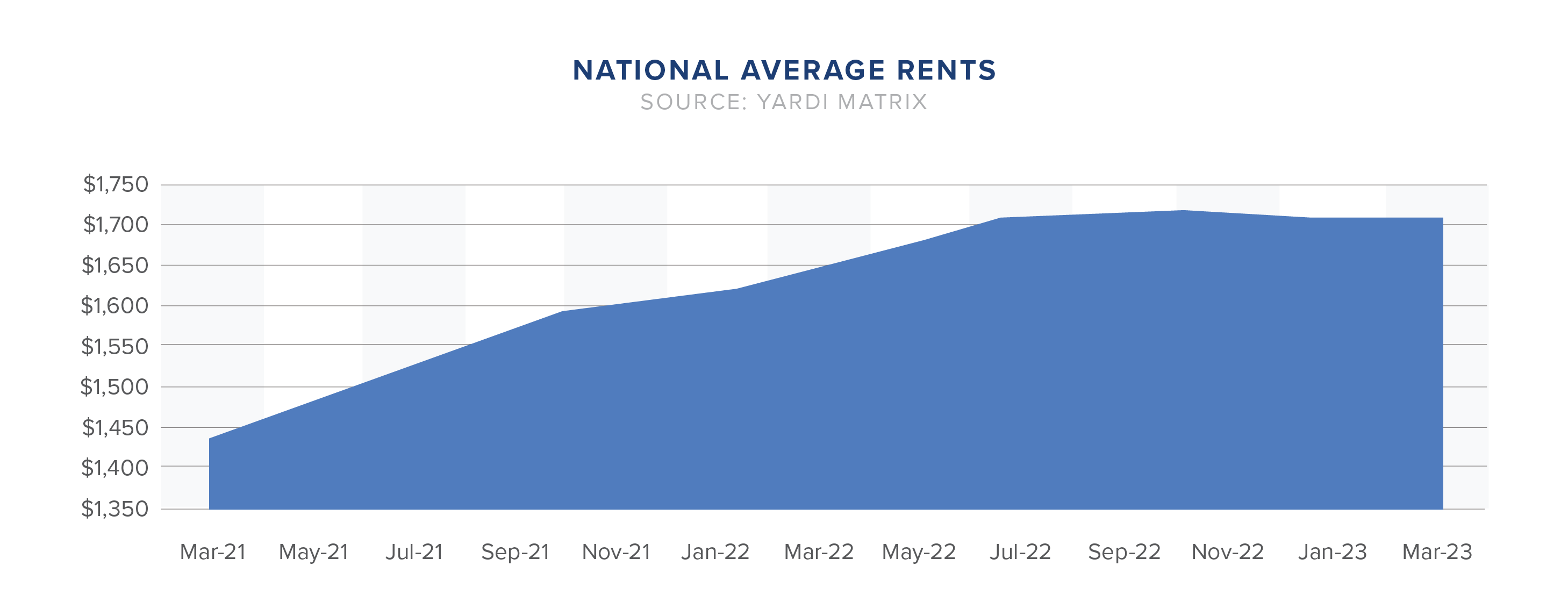

New data from Yardi Matrix reveals that the average rent for multifamily properties in the U.S. increased by $3 in March, reaching a total of $1,706. However, the year-over-year growth rate for multifamily rents decreased to four percent, which is a decline of 90 basis points compared to February and represents the lowest level since the unprecedented surge in rents beginning in April 2021. The average rental rate for single-family homes increased by $5 to $2,079 in March, with a year-over-year growth rate of 2.8 percent. Additionally, while the occupancy rate experienced a slight decline of 10 basis points in February, it remains at a strong 95.5 percent.

In March, asking rent growth in the U.S. turned positive after four months of overall drops. The Acela Corridor metros showed the highest monthly gains, and Indianapolis remains strong.

Renewal Rent Growth

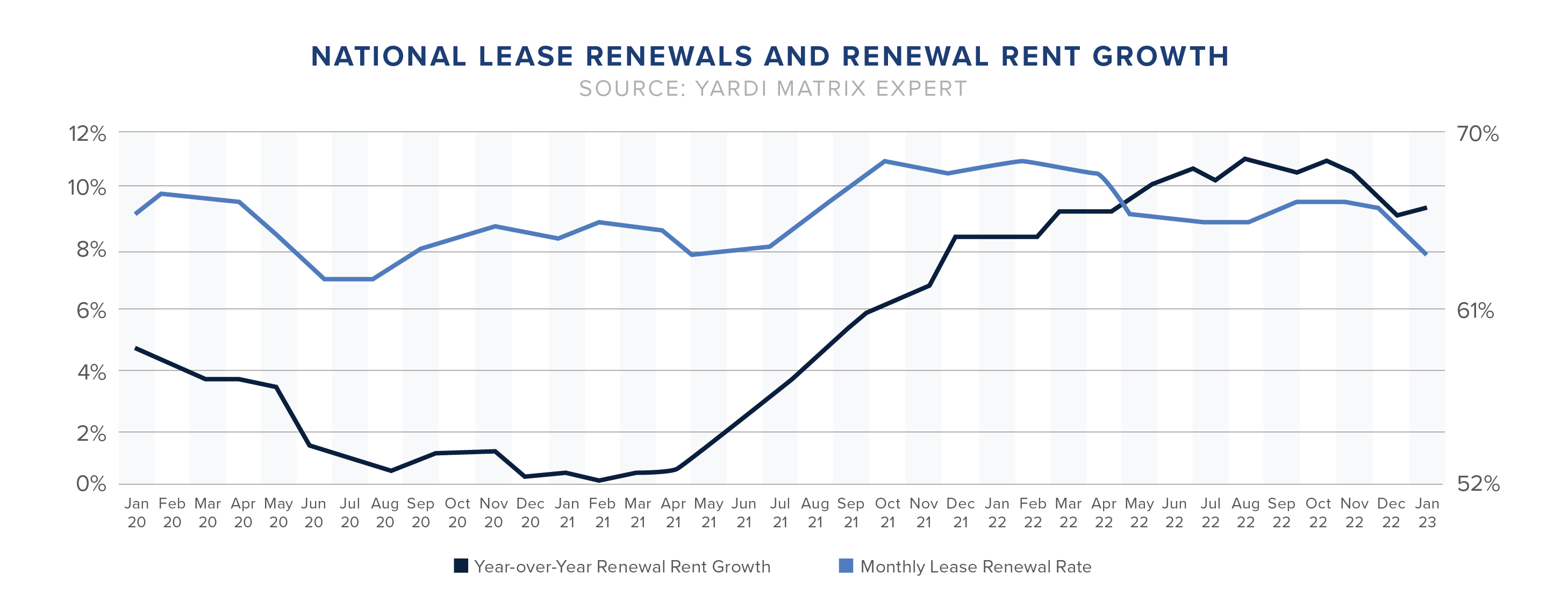

Renewal rent growth refers to the change in rental rates for tenants who renew their leases for the same property, as opposed to new tenants who sign up for a property at market rates. It is an important metric for understanding the trends in the rental market and the affordability of living in a particular area. According to Yardi Matrix, renewal rent growth for in-place tenants increased unexpectedly by 30 basis points to 9.3 percent year-over-year through January 2023, indicating that many renters can afford increases and demand is not decreasing significantly. However, national lease renewal rates decreased slightly from December to January. With a wave of supply expected to come online, absorption must stay positive to maintain consistent renewal rates.

Market Outlook

The Matrix top 30 metro rankings indicate that cities in the Midwest and Northeast regions continue to perform well, with Indianapolis, New York, and Kansas City showing the highest growth rates of 8.6 percent, 6.9 percent, and 6.9 percent, respectively. Boston and Chicago closely follow with 5.8 percent and 5.2 percent growth rates, respectively. Despite not being considered a high-growth market, Kansas City’s success is attributed to its strong economy, population growth, and a low number of new apartment deliveries. Although total employment has decreased recently, the unemployment rate remains low at 2.7 percent, with the leisure and hospitality, construction, and manufacturing industries showing the most gains over the last 12 months. In addition, new apartment deliveries only account for 1.6 percent of the total stock as of March.

Takeaways

Although asking rent growth turned positive last month after four months of overall drops, the multifamily market is likely to experience headwinds in the coming months due to the impact of the Federal Reserve’s policies and the collapse of several banks. However, a hard landing is not yet in the cards, and the market remains stable.