Navigating Capital Market Investments in Today’s Economy

As we enter mid-year 2023, uncertainty continues to swirl, prompting investors to continue to sit on the sidelines. This leaves the industry asking, where are the deals? What are investors buying? And what are lenders lending on? It is more likely that the economy will find more solid footing in the upcoming months. As inflation and other economic issues moderate, market conditions should improve, opening a window for more opportunistic issuance within Capital Markets.

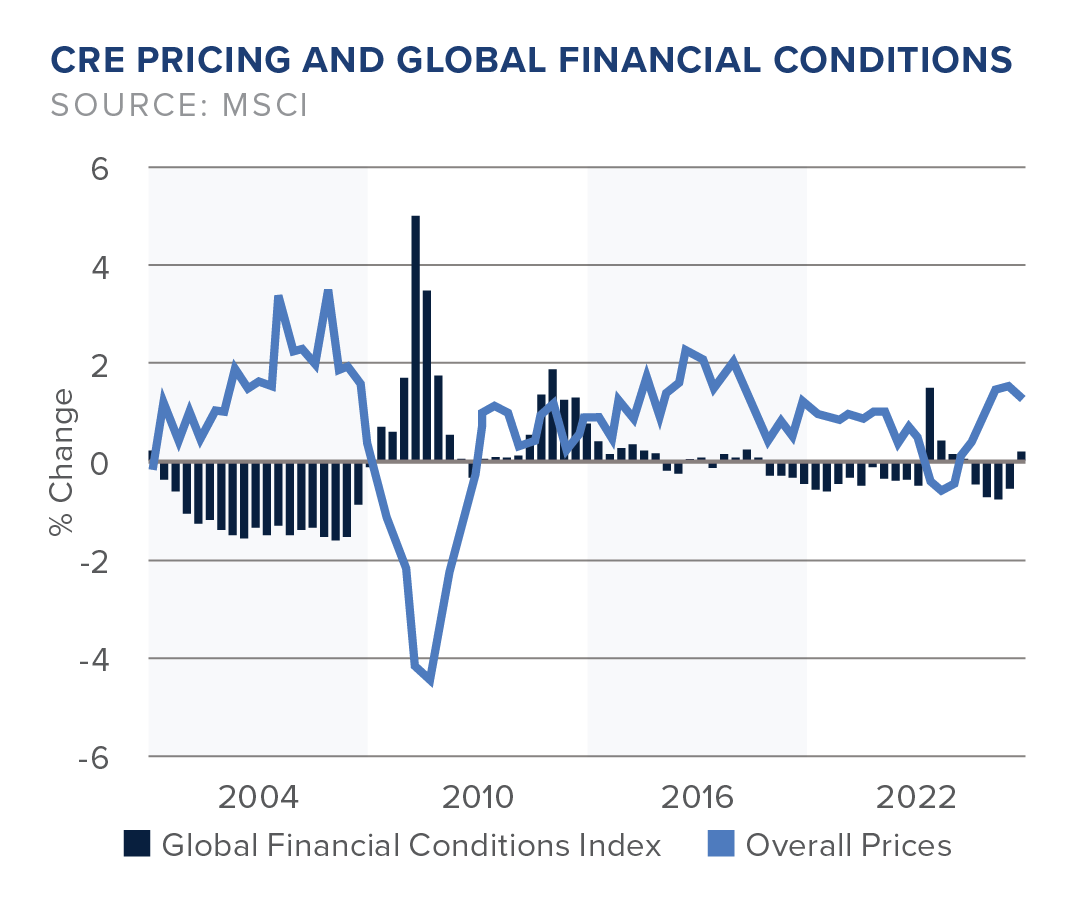

Global growth in commercial real estate prices has slowed down as financial conditions have tightened. – MSCI

Are Lenders Still Lending?

Throughout 2022, conducting sales activity became progressively more difficult, mainly due to the Federal Reserve’s actions. The central bank raised short-term interest rates by 400 basis points, which also included four consecutive months of 75-basis-point increases. As a result, commercial mortgage interest rates increased, causing a significant impact on pricing.

Bank loans for commercial real estate hit a record high in the last three months of 2022. And in Q1 2023, the industry experienced bank closures and tighter lending markets. The tightening financial conditions could worsen if lenders withdraw from the market and continue to limit lending liquidity. The CRE industry is already dealing with higher interest rates and lower valuations, and now underwriting, including credit facilities, which are expected to become more stringent. Real estate investors are expected to face more turmoil due to the dramatic implosions as debt availability becomes more challenging.

For all U.S. banks, fourth-quarter loans for commercial properties grew 1.8% to a record $1.78 trillion compared to the previous quarter, according to figures compiled by Dallas-based BankRegData.

However, it is important to note that there is still capital available to fund deals; investors just need to be able to find them. Two sources, in particular, include Fannie Mae and Freddie Mac, government-sponsored enterprises that play a significant role in the CRE multifamily sector. These agencies are a major source of financing for multifamily properties, and they remain active, offering a range of fixed and floating-rate nonrecourse loan products to multifamily owners and developers.

For other CRE property types, there is still plenty of lending liquidity; finding it has just become more challenging. Lenders that were active even just a quarter ago are now on the sidelines, but this has become an opportunity for previously less active lenders. This is where debt professionals can add value to your investment process. Capital Markets have their own way of reaching equilibrium if left to their own devices.

Where are Lenders Lending?

Most CRE sectors have remained relatively stable despite economic volatility. Highlighted are sectors continuing to excel during these uncertain times.

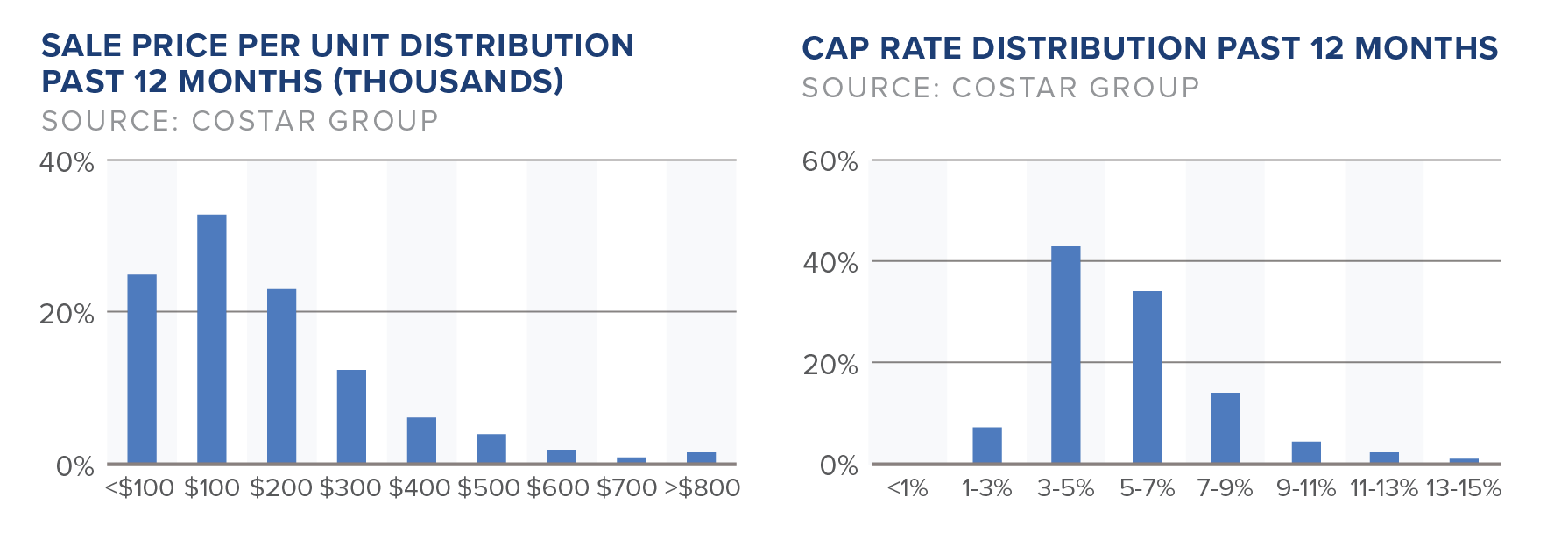

Multifamily

Due to their relatively strong fundamentals and positive long-term demand outlook, multifamily properties will remain one the most favored by investors. In 2022, multifamily assets experienced a slight pullback but continued to be the most sought-after asset type. According to a report by Yardi Matrix, San Jose, New York, Tampa, Miami, and Charlotte are the top five multifamily investment markets of 2023. According to the report, San Jose is expected to experience the largest increase in rental rates in 2023, with a growth rate of 4.9 percent.

New York, Atlanta, Los Angeles, Phoenix, and Washington, D.C. comprised the top five most-active investment markets in Q4 2022. Multifamily investors looking to deploy capital into newly built properties found ample opportunity to do so in these markets. Considering the uncertainty ahead, investors are issuing smaller check sizes and spreading their investments across assets and geographies to reduce concentration risk.

Industrial

The industrial sector continues its growth as buyer demand outpaces sellers. According to CoStar Group, investors have begun targeting fully leased properties with below-market rents in place and lease expirations coming due during the buyer’s projected hold period. These types of investments offer buyers the opportunity to significantly boost a property’s future net operating income.

As the end of each year approaches, transaction volumes usually increase as ongoing deals wrap up, and new investment prospects emerge in the first quarter. This pattern has remained constant since 2010, with 2022 being the second-best fourth quarter ever, with a total of $38.4 billion. However, sales velocity is now starting to slow, albeit from high levels, with a 28 percent year-over-year decrease as of Q4 2022.

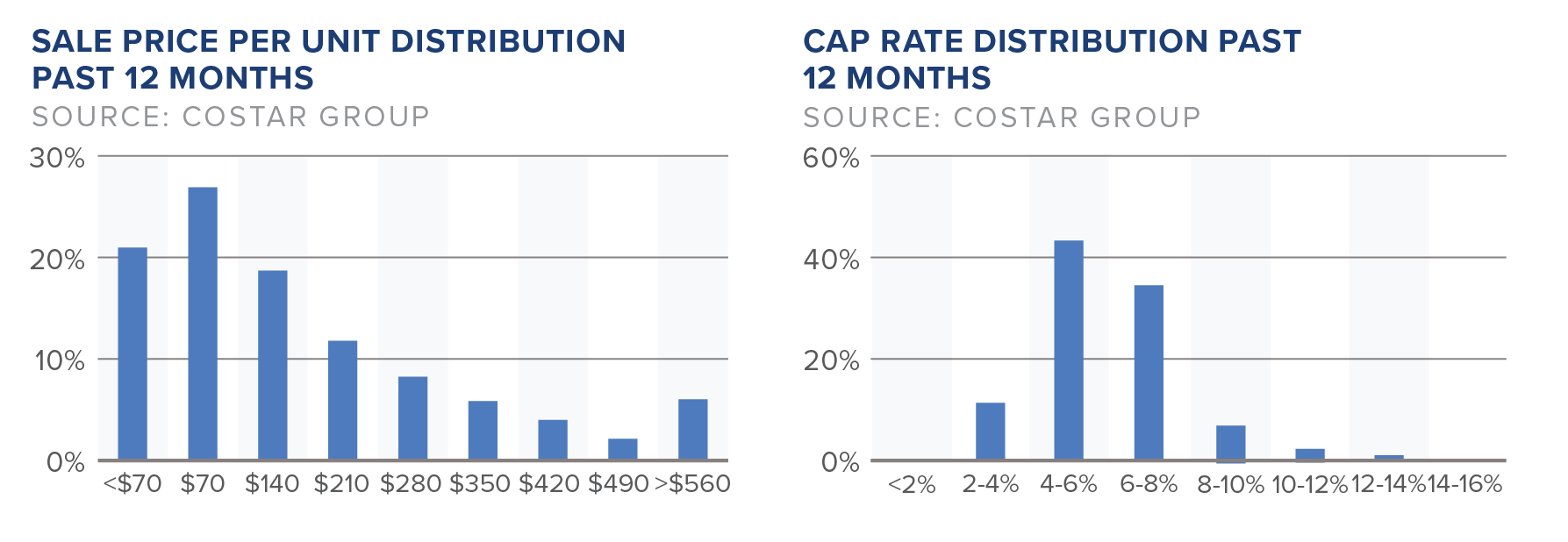

Self-Storage

The self-storage sector has notoriously been known as a hedge against inflation. Self-storage properties can provide stable income streams and attractive returns on investment, particularly in markets with high demand and limited supply. As a result, the self-storage sector has become an increasingly popular asset class for investors looking to diversify their portfolios and capitalize on the growing need for storage solutions. Investors are attracted to self-storage due to its stable income stream, low maintenance, and operating costs.

By the Numbers:

- Cap Rate: 6.1%

- Sale Price/SF: $146

- Average Sale Price: $6.6M

- Sales Volume: $9.7B

- Sale vs. Asking Price: -6.2%

- Average SF: 42.2K

- Average Months to Sale: 6.6

Retail

In 2022, retail tenants continued to expand despite concerns over inflation, increasing interest rates, and a possible recession. They were buoyed by a strong consumer base, which remained resilient and undeterred. According to Costar Group, investors are still showing interest in well-performing retail market segments, although they are being more cautious in their approach. Smaller investors, who are typically responsible for driving retail property sales, are focusing on smaller net-lease outparcels and freestanding assets. This interest in such properties contributed to a record-high of $57 billion in general retail sales in 2022.

Investment Forecast 2023

Despite uncertain times, investors still have a significant amount of optimism. In a recent 2023 CRE survey poll, 59 percent of investors indicated that they plan to remain active in the first half of this year. Another 17 percent indicated they plan to both buy and sell commercial real estate, while eight percent indicated they plan to only sell assets. Opportunistic buyers are circling as higher interest rates should increase the amount of available distressed inventory. Some of the top reasons given for buying are a search for yield, opportunistic acquisitions, new funds or syndication, or a tax-related decision. That said, the outlook on investments will in some cases be driven by the availability of financing, including the rates and terms influenced or set by Federal Reserve monetary policies.