2024 Industrial Trends

Over the last few years, the U.S. industrial segment has become one of investors’ most sought-after product types. However, given the current economic climate, the market is settling into what could be one of the sector’s more challenging times as interest rates are to remain ‘higher for longer’ and absorption decelerates. Despite this, vacancy rates are below the 20-year average, and rent growth is positive. With this in mind, there are a few trends industrial owners and tenants should keep an eye on in 2024.

Performance And Outlook

Source: Yardi Matrix December National Industrial Report

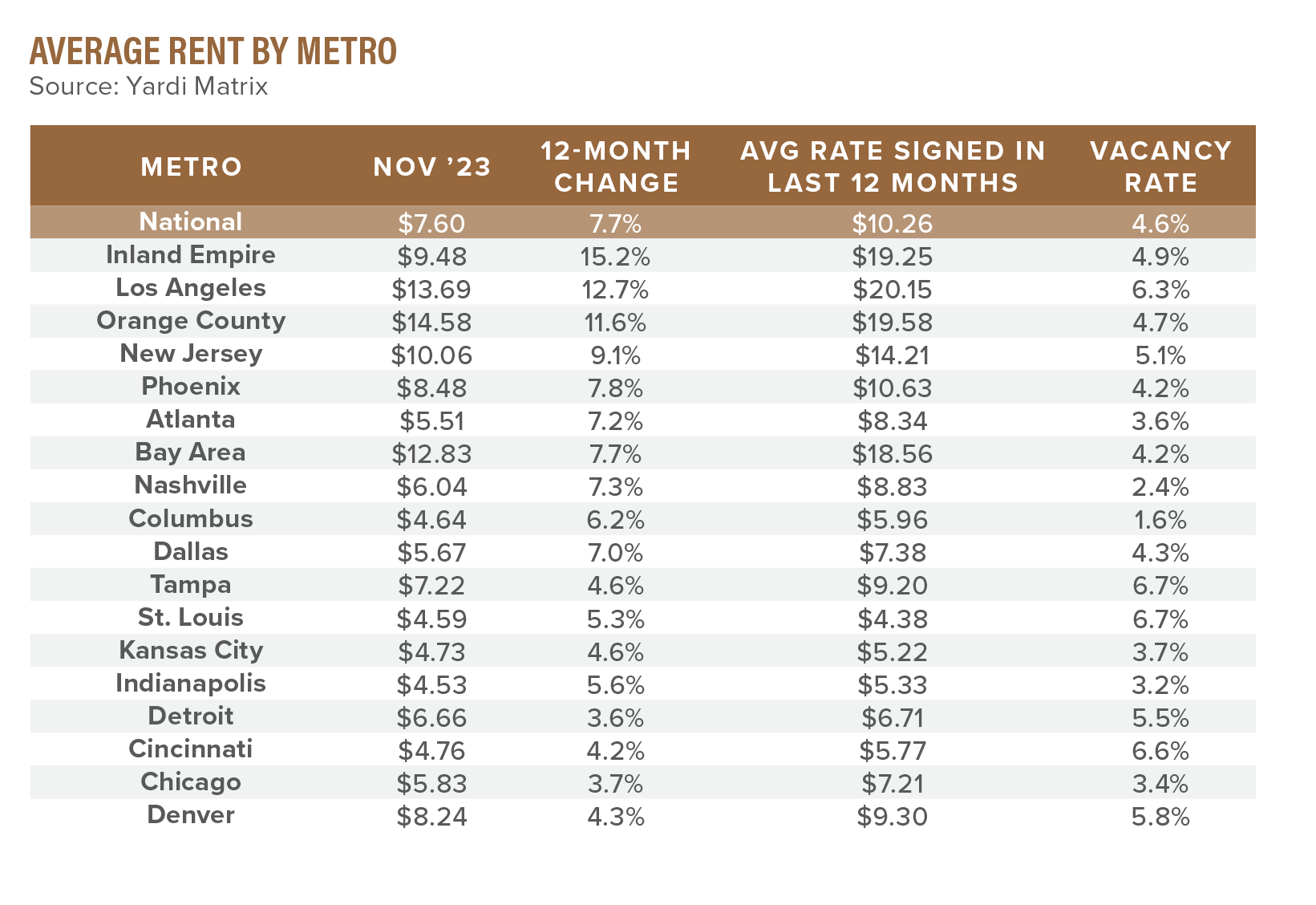

The average rental rate for industrial space nationally stood at $7.60 per square foot in November 2023. This reflects a slight uptick of four cents compared to October and a notable year-over-year (YOY) increase of 7.7%.

Southern California continued to outpace the rest of the nation for in-place rent growth, with the only three markets where rents grew by double digits in the last 12 months. In the Inland Empire, rents increased by 15.2%, 12.7% in Los Angeles, and 11.6% in Orange County.

The average rate for new leases signed in the past 12 months climbed to $10.26 per square foot, surpassing the overall average for all leases by $2.66. Premiums for new leases were most significant in port markets like the Inland Empire ($9.77 more per foot), Los Angeles ($6.46), and the Bay Area ($5.73). In contrast, midwestern markets such as Detroit, the Twin Cities, and Kansas City showed little to no premiums for new leases.

The Inland Empire maintained its position as the frontrunner in rental growth, experiencing an average YOY increase of 15.2% in November 2023.

Dallas and Phoenix have maintained their positions as leaders in new industrial development nationwide. Together, these two markets contribute to over 17% of all industrial starts nationwide, with Dallas initiating 26 million square feet of new projects and Phoenix starting 22.6 million. However, it’s important to note that even in these markets, the number of starts has significantly decreased compared to last year, where Dallas started at 49 million square feet and Phoenix at 41.3 million.

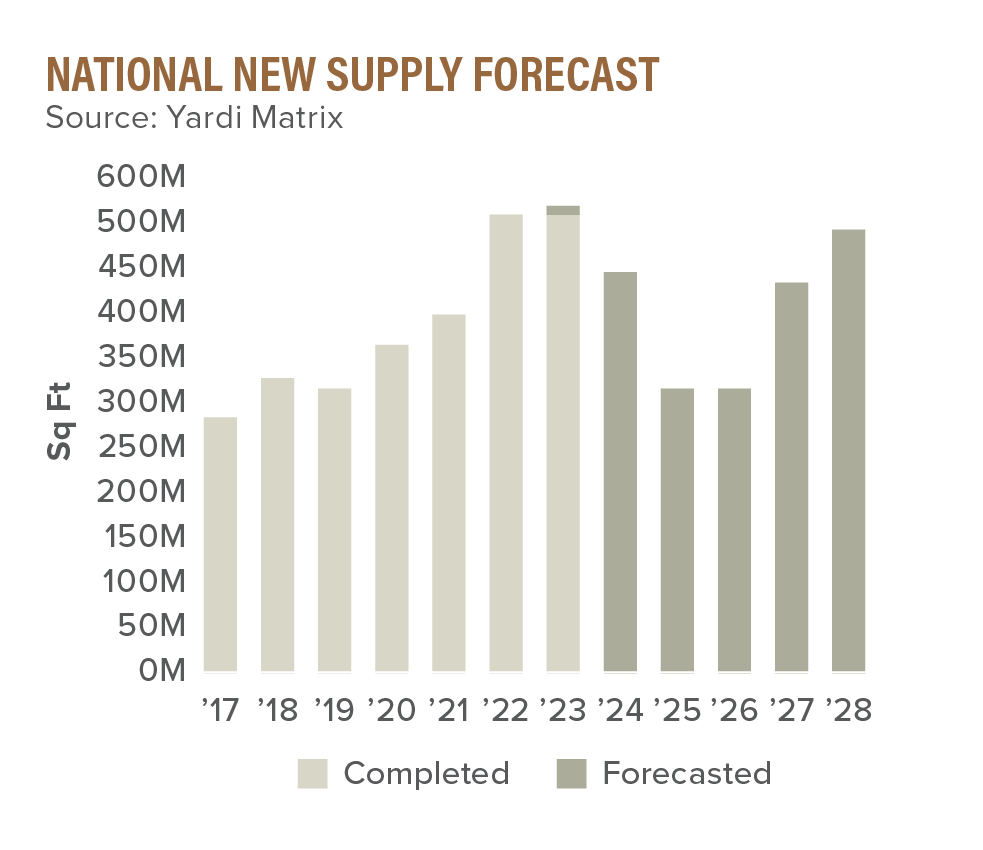

As of November 2023, the national vacancy rate was 4.6%, unchanged from the prior month. Record levels of new supply in recent years have helped alleviate the scarcity of available space for occupiers. There are currently 505.2 million square feet of industrial supply under construction.

Industrial sales totaled $48.6 billion through the end of November, with an average sale price of $130 per square foot. Denver experienced the most significant drop in average sale price, with a 24% decline in 2023.

Top Trends

Moderating E-Commerce

The surge in e-commerce during the early stages of the pandemic that elevated demand for industrial real estate to unprecedented levels stabilized in 2023.

Since Q1 2021, e-commerce sales volume has risen by 74%, with almost half of the increase occurring in the initial spike of Q2 2021. In Q2 2023, total e-commerce sales reached $277.6 billion, a 2.1% rise from Q1 and a 7.5% increase YOY. Although these figures appear to be robust, the full story paints a different picture. From 2010 to Q1 2020, e-commerce sales grew at an average quarterly rate of 3.6%. Following the initial COVID-19- induced spike, the average rate dropped to 2.2%. Additionally, the figures are not inflation-adjusted, with rising prices contributing to the growth.

Industrial pipelines in most markets continue to be historically significant, but there was a notable reduction in their size in 2023. This reduction is attributed to a substantial decline in project starts, driven by the adjustment to normalized e-commerce demand and the increased cost of capital.

While online sales growth has normalized, it continues to drive substantial demand for industrial space. The expectation is that e-commerce will remain a significant driver of industrial sector growth. Retailers will need both large-scale facilities and small-scale infill centers to ensure a quick and efficient omnichannel experience for customers. This trend will likely lead many existing retailers to consolidate brick-and-mortar operations, further fueling the demand for industrial space.

Nearshoring

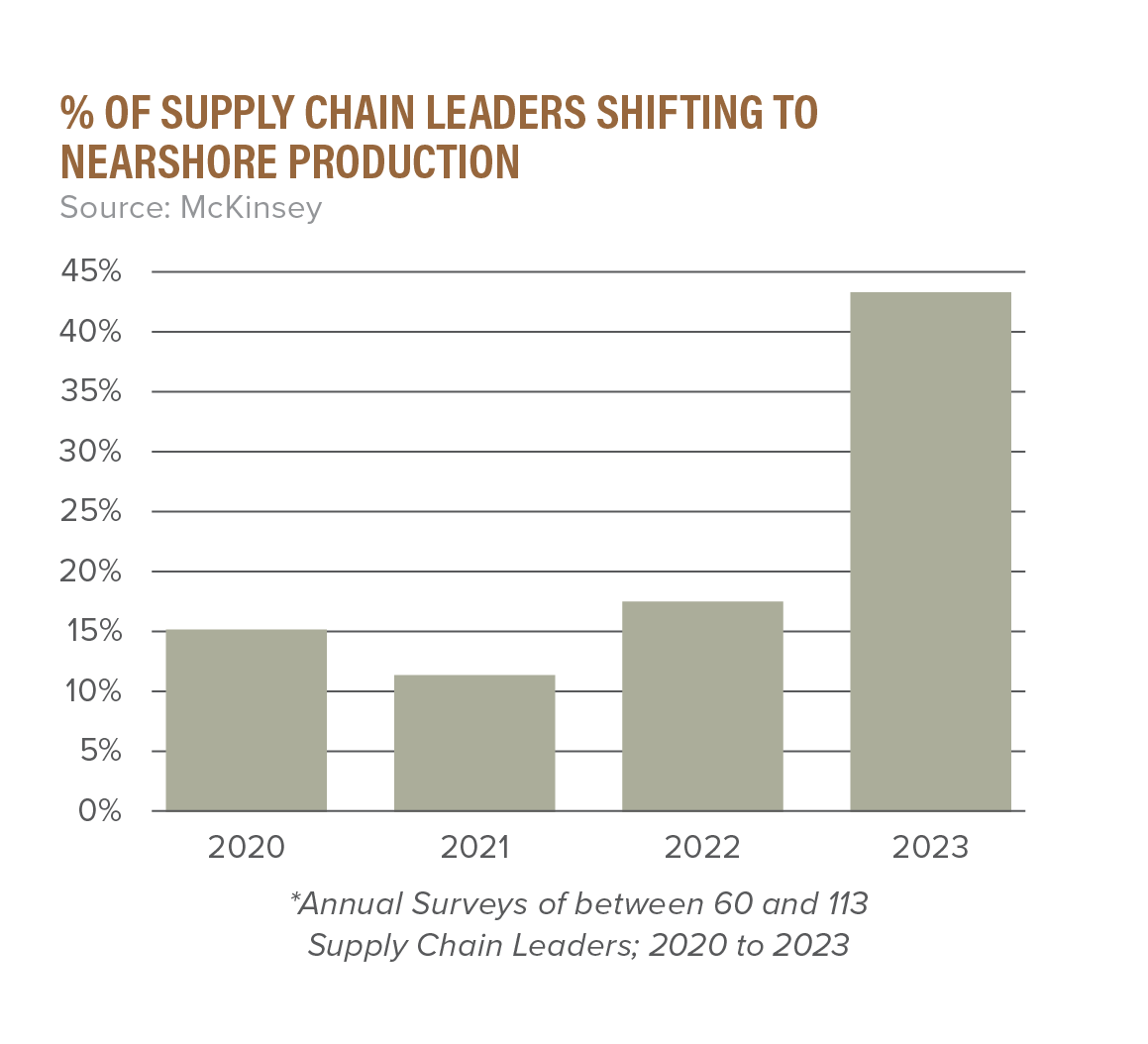

COVID-19 spurred a need for closer-to-home manufacturing, also referred to as nearshoring, and it will ultimately influence the industrial market in the upcoming years. Specifically for the U.S., the breakdown in the global supply chain encouraged supply chain companies to look at moving or expanding their manufacturing and distribution plants in North America instead of Asia. Empowered by the United States-Mexico-Canada Agreement (USMCA), these companies aim to enhance their oversight of production, facilities, labor expenses, transportation, and energy planning.

According to a recent survey conducted by McKinsey, the share of companies nearshoring their supply chains tripled in 2023.

As nearshoring becomes more of a priority, industrial investors can expect to see an increased demand for industrial real estate as companies seek larger spaces for their operations within the U.S.

Office To Industrial

There has been an increasing trend of converting underused office space to different commercial real estate asset types nationwide. According to GlobeSt., 100 office conversions were completed in 2023, more than double the annual average of 41 properties between 2016 and 2022.

As developers face increased development regulations and markets lack land availability, investors are finding creative ways to repurpose current spaces to fit their industrial needs. The newest trend is converting old office buildings into industrial spaces. There are specific needs for this type of rehab, including proximity to major highways, expansive acreage, and single-tenant occupancy. Still, if the property fits the requirements, it can present an excellent opportunity as an adaptive reuse project.

According to an article released earlier in 2023 by Commercial Observer, over 15.2 million square feet of office space nationwide had been converted to industrial use, a 33.7% increase in only two years. Additionally, the U.S. vacancy average for industrial properties is 4.6%, compared to 13.5% for office properties, further emphasizing the amount of unused office space.

In general, converting to industrial use typically comes at a lower cost per square foot compared to residential conversions. This is because industrial spaces, often referred to as a “giant box,” have simpler designs without the additional expenses associated with features like multiple bathrooms and other components found in residential properties.

Decelerating Rent Growth

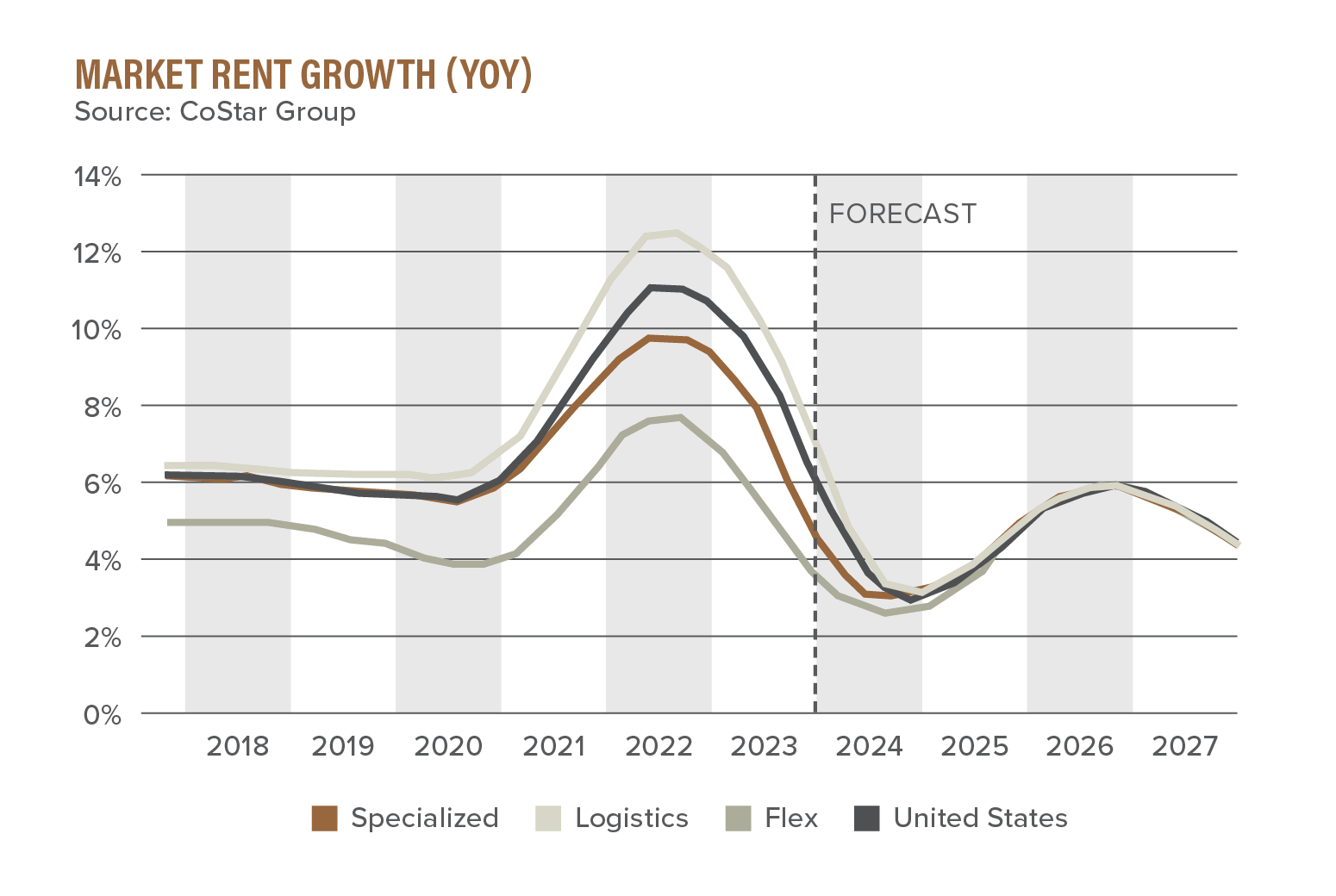

The growth in industrial rents in the U.S. has significantly slowed from the peak levels seen during the pandemic and is at risk of dropping below levels even seen before the pandemic in the coming months. Although the YOY national rent growth remains at a healthy 6.8% as of Q4 2023, it’s important to note that most of these gains occurred in early 2023, when the U.S. industrial vacancy rate was increasing at a much slower pace than it is currently. In Q3 2023 alone, rents increased by just under 1.1%, indicating an annualized growth rate of 4.6%.

Despite the current 10-year low in industrial construction starts and the U.S. industrial vacancy rates staying near pre-pandemic historic lows, CoStar Group suggests there’s a chance the national vacancy rate could peak at a relatively low level. This scenario could pave the way for a rapid increase in rent growth once the availability of space begins to tighten again.

Industrial Outdoor Storage

Despite the recent freight recession, the industrial outdoor storage sector is anticipated to sustain vigorous activity, gradually transitioning from the rapid growth seen in the past. With its resilient nature and favorable supply conditions, the industrial outdoor storage industry is poised to continue offering attractive investment opportunities and meeting the evolving needs of industrial users.

Industrial outdoor storage encompasses a wide range of functions and serves as a versatile solution for various industries. These storage facilities cater to diverse needs, including the maintenance and storage of rigs, trailers, containers, chassis, and the housing of bulk materials like roofing supplies, stone, and construction materials. Companies with extensive fleets, such as utility providers and field technician-based firms, often utilize these sites.

Typically occupying 5% to 20% of the land, industrial outdoor storage facilities are commonly situated in infill industrial areas near urban centers, ensuring convenient storage and access through proximity to freeways, railways, and ports. With their strategic location, these assets play a vital role in the last-mile supply chain, providing essential resources and facilitating efficient transportation to consumers, ports, and other hubs. The pandemic has further emphasized the critical nature of these assets, highlighting their significance in maintaining the speed and effectiveness of the global supply chain.

Formerly recognized as a subset within the broader industrial market, industrial outdoor storage has expanded over the past few years to become a market valued at least $200 billion. This growth has led to rising interest from institutional investors nationwide.

Industrial outdoor storage rents have increased by nearly 30% on average since the end of 2019 and have superior supply-demand fundamentals. Source: Commercial Search

Takeaways

While facing potential challenges in the current economic climate with higher interest rates and a deceleration in absorption, the U.S. industrial sector continues to exhibit resilience. The sector remains attractive, with vacancy rates below the 20-year average and positive rent growth. As the industrial landscape continues to evolve through moderating e-commerce, office conversions, nearshoring, and more, these trends will shape the sector’s overall trajectory in the coming years.