Monetizing Healthcare Real Estate Through a Unique REIT Structure

In a market where the demand for healthcare real estate is at an all-time high, many physician groups are being asked the question: Have you considered monetizing your real estate through a sale leaseback?

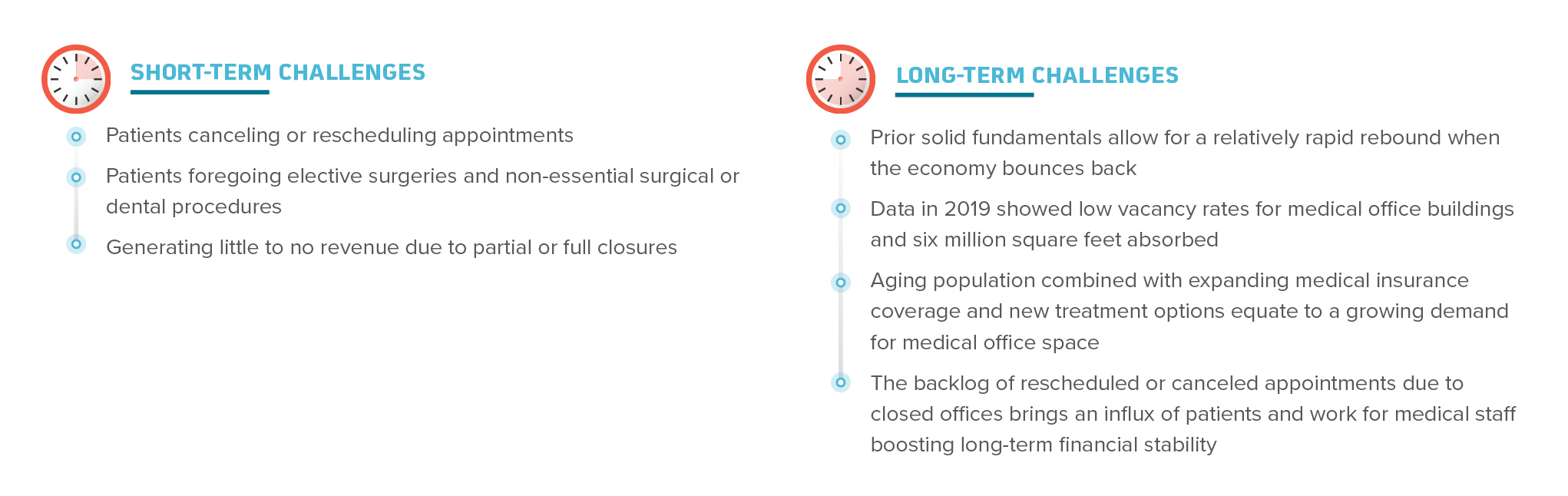

Short & Long-Term Challenges for Healthcare Real Estate

With more private and institutional capital flooding into the healthcare space than ever before, the industry has seen a significant increase in value and growth, and even more so, given the low interest-rate climate. An additional question comes to light after physicians are faced with the opportunity to monetize their assets through a sale leaseback: Although your building is worth a significant amount of money in today’s market, why would you pay capital gains taxes? Is there any way to minimize your tax burden without having to go through a 1031 Exchange?

In the following article, Matthews™ dives into the growing tax-deferral strategies in the healthcare space.