CLICK HERE TO DOWNLOAD THE ARTICLE

The pandemic has accelerated delivery trends, as restaurants were forced to comply with occupancy restrictions, limited operations, and in some cases, closed locations. Even before the virus, online delivery trends were revolutionizing the restaurant industry with an entirely new type of business. While some restaurants begin to reopen, customers are still cautious about returning to their favorite dine-in establishments. As a result, restaurants are looking for ways to capture more off-premise business, directing national chains and mom-and-pop restaurants to ghost kitchens, otherwise known as dark kitchens or virtual restaurants.

Recent Popularity

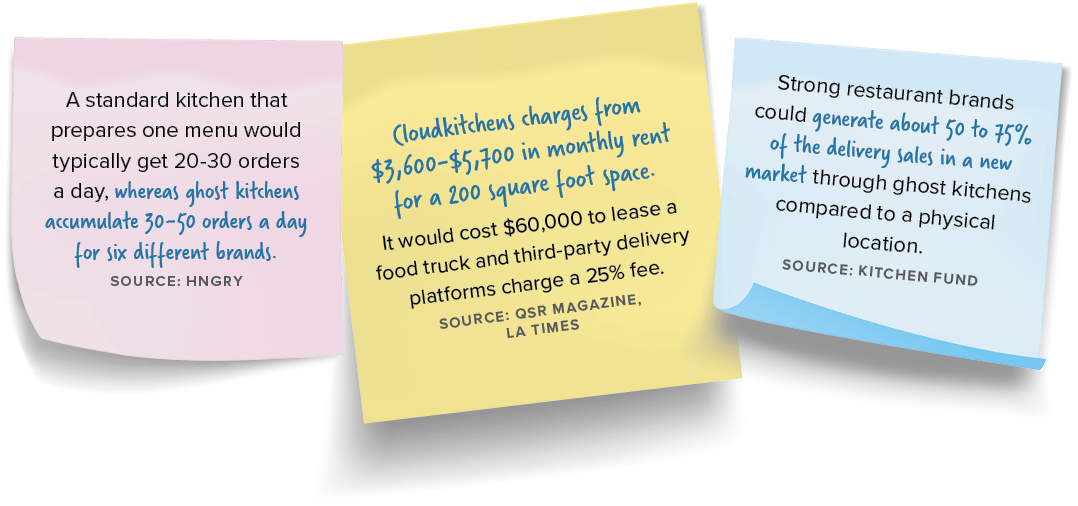

Restaurateurs view ghost kitchens as an incredible value-add that boosts sales and reach. Depending on the company that operates a ghost kitchen, they focus solely on fulfilling online orders and delivery. For the most part, virtual-only restaurants operate out of a space that consists of a single kitchen. Sometimes a restaurant serves an assortment of menus from different brands, but all the food is prepared in the same space. Ghost kitchen owners will work with various chains to optimize its use, boost sales, and hand over the order to their partnered third-party deliverer. More recently, tech companies have entered the food delivery market by partnering with food brands to create menus and branding.

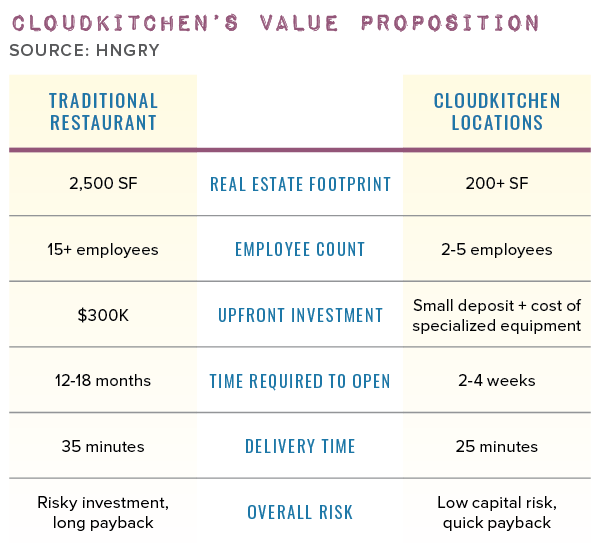

Ghost kitchens give restaurants the opportunity to deliver straight to customers at home that otherwise wouldn’t have the capability. They allow restaurateurs to focus on cooking and preparing food rather than dealing with the headaches associated with cost and management of opening and operating a restaurant business. In a sense, the restaurant wouldn’t even have to physically exist so long as a ghost kitchen is licensed with the restaurant brand. Brick-and-mortar landlords are eager to transform their vacancies into ghost kitchens as the demand from such tenants continues to increase, making them the perfect solution for struggling landlords looking to fill long-term vacancies. Ghost kitchens do not require an appealing storefront and do not need to be on a major retail corridor, so even a less desirable unit can be filled with ghost kitchen operations.

Food establishments that had to close during the peak of the pandemic referred to these virtual kitchens as a means to continue sales. Some dark kitchens lease out unused kitchen space in an existing restaurant. For fine dining establishments, ghost kitchens served as a lifeline as many decided to lease out their underutilized kitchen, running several menus in one location. Customers who order from these ghost kitchens are generally under the impression that they’re getting food from a restaurant with its own storefront.

Key Players

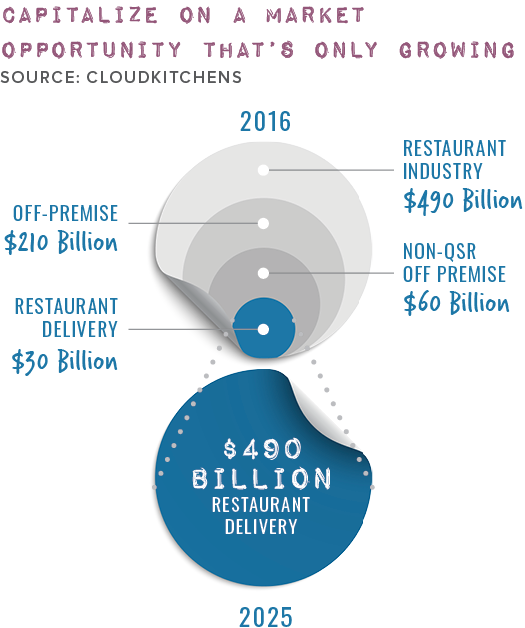

Tech entrepreneurs have pierced the food delivery industry, positioning dark kitchens as a digital marketing business. Already, an estimated 100,000 virtual kitchen concepts exist on third-party apps, according to the CEO of Chowly, Sterling Douglas. These tech-based delivery companies are equipped with valuable data that illustrate popular cuisine and target geographic areas with the most demand, operating similarly to Amazon or Netflix.

CloudKitchens

Partnered Chains: Tacos 1986, Joe’s Pizza, The Halal Guys, SweetGreen, CoolHaus, Fat Sal’s

Uber’s former CEO Travis Kalanick started CloudKitchens, which subleases delivery-only kitchens through monthly memberships. This concept avoids the upfront costs associated with equipment, monthly rent, and the lengthy ground-up construction process. According to the Wall Street Journal, the company has been quietly building an empire, buying more than 40 properties across the country over the last two years. Moreover, CloudKitchens is buying real estate strategically located in Opportunity Zones that offer tax benefits and employment to these neighborhoods. According to Technomic, the Los Angeles-based company could be the largest ghost kitchen network in the U.S. with at least 70 locations so far, providing menus and branding for virtual restaurants.

Postmates

Partnered Chains: N/A

New to the ghost kitchen game, Postmates launched its first dark kitchen concept in Los Angeles. Their model assembles a three-way partnership between top-performing food brands, caterers, and its marketplace. Postmates is responsible for hiring employees, managing inventory from the brand’s suppliers, operating the business, and the kitchen, while the brands receive a royalty of its sales. Dubbed as a virtual food hall, the kitchen offers five to six brands, which has picked up traction with locals.

Postmates has already expressed interest in opening another location in West Los Angeles. Their fast-track momentum and penetration in the virtual kitchen market has garnered so much interest that Uber bought Postmates for $2.65 billion in late 2020. The partnership allows Postmates to operate as a separate service and brand, while merging back-end logistics, such as drivers. This impressive acquisition indicates the shifted investor sentiment toward the value of delivery.

Kitchen United

Partnered Chains: Chick-fil-A, Wendy’s, The Halal Guys, Wetzel’s Pretzels

Aiming to help independent restaurants, Kitchen United offers shared kitchen space, back-of-house labor, and technology that works with delivery providers and ordering platforms. Kitchen United focuses on off-premise sales beyond delivery, so their locations allow customers to pick-up their orders. Their sites entail a healthy mix of local, regional, and national providers, determined by their geographical demand data. Garnering a lot of attention even before the pandemic, Kitchen United raised $50 million in investments. Kitchen United emphasizes ambiance and aims to create a food court experience with outdoor seating, onsite ordering, and drive-thru/pick-up windows.

DoorDash Kitchen

Partnered Chains: Chili’s, Cheesecake Factory, Italian Homemade, RT Rotisserie

DoorDash Kitchens debuted in the Bay Area in 2019 and operates out of a facility as a third-party deliverer. As the largest delivery provider in the U.S., it naturally transitioned into the virtual restaurant space. Pick-up options extended to 13 suburban markets and allows customers to mix-and-match menu offerings from different brands. Their goal is to help food merchants discover effective ways to reach customers more efficiently. Eliminating delivery fees to their DoorDash Kitchens until the end of the year, the delivery-only kitchen promotes new customer acquisition without the costs associated with opening a new store. DoorDash is responsible for logistics, marketing, and delivery. The third-party delivery service stays true to its dedication to empowering new restaurateurs through its platform.

Advantages & Disadvantages

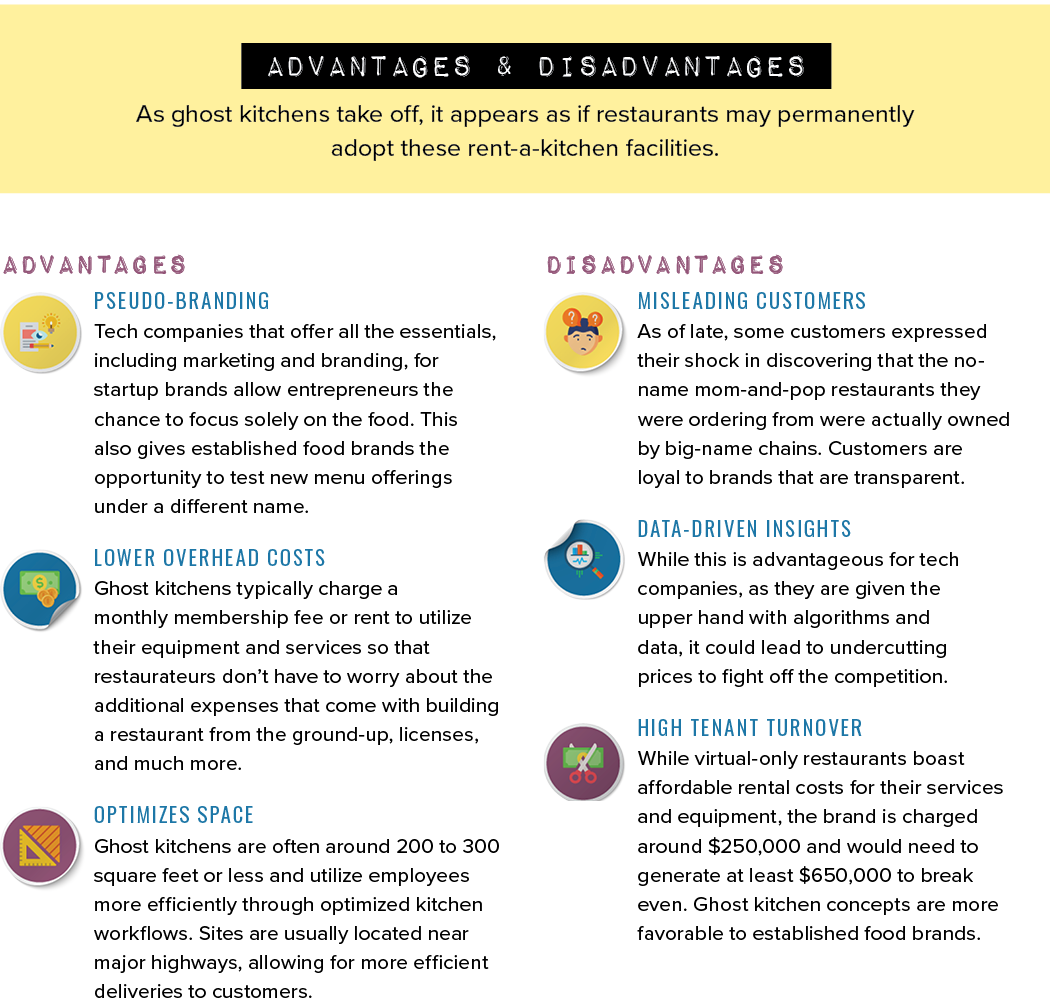

As ghost kitchens take off, it appears as if restaurants may permanently adopt these rent-a-kitchen facilities.

Outlook for Ghost Kitchens

Before the COVID-19 crisis, consumer habits were already changing. The demand for delivery reached all-time highs, illustrated by the various channels that people can order food from today. Ghost kitchens offer a one-stop-shop for restaurateurs. For quick-service and fast-casual restaurant brands, their focus is on leveraging lower-cost infrastructure to access demand in new markets. As restaurants reopen, we will likely see these brands remain in the ghost kitchen space.

Ghost kitchens were initially viewed as a short-lived trend when first introduced, but with the new demand for delivery, they are likely part of the post-pandemic life and beyond. As consumers shift priorities to accommodate the new norm, foodservice operators turn to new revenue sources, such as delivery-

only concepts. Offering all the amenities and labor, virtual restaurant concepts provide a helping hand to restaurateurs, both large and small. Ghost kitchens are helping revive the restaurant industry in navigating new consumer preferences that include delivery logistics, technology, and branding. Dark kitchens will affect how restaurants operate, redefine the leasing environment, and refresh restaurant concepts.