CLICK HERE TO DOWNLOAD THE ARTICLE

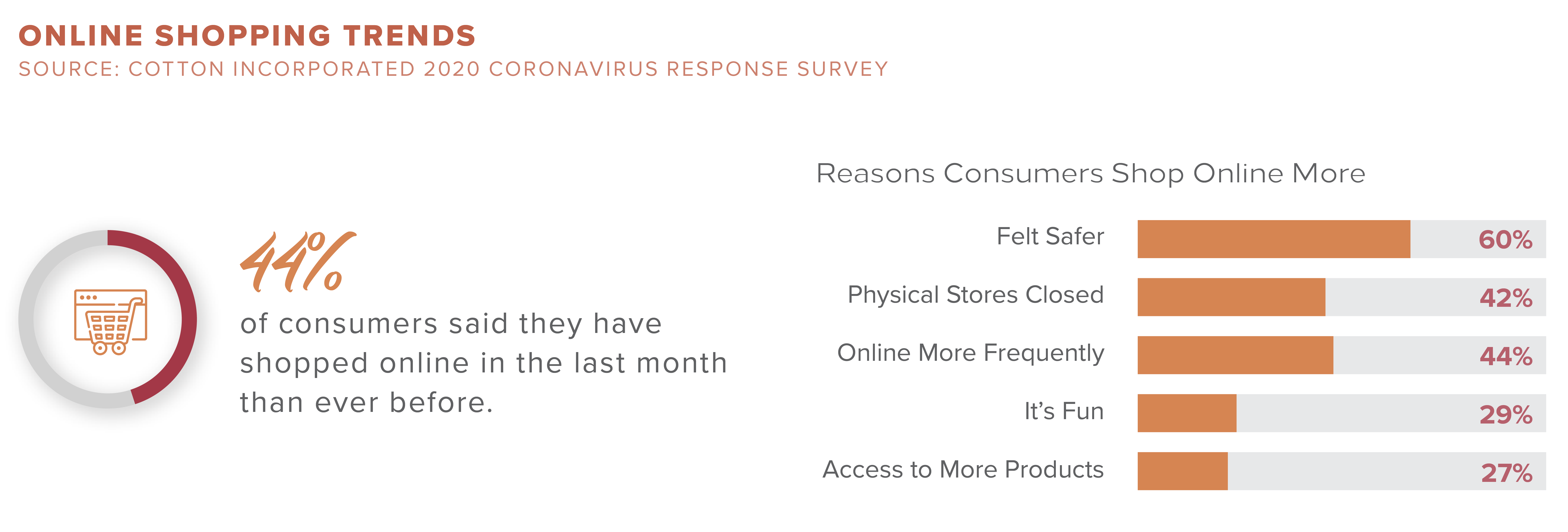

While the decline in the physical retail store began before the arrival of COVID-19, the pandemic served as the final nail in the coffin to struggling retailers. Chains that were falling behind on consumer trends and preferences, like online shopping, saw depleting sales during nationwide lockdowns. It’s not all bad news, though, as discount stores, home improvement stores, and grocery stores benefit from the coronavirus as a result of limited competition. Big-box retailers have converted their closed and unused store space into curbside pickup centers and warehouses that focus on online order fulfillment in the short-term.

Let’s take a look at the current shopping center conditions and the trends redefining the industry.

What Makes a Perfect Shopping Center?

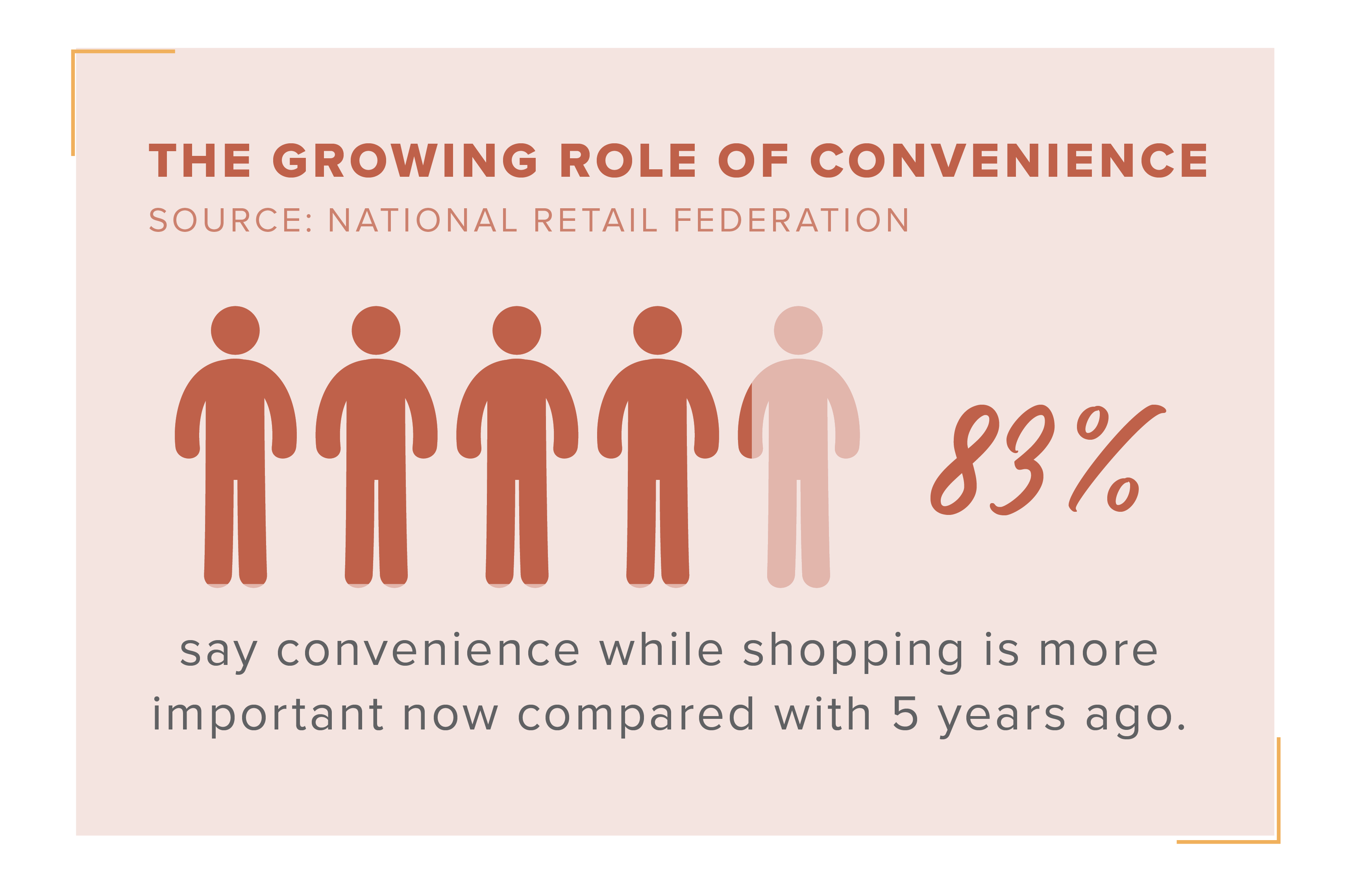

One of the most critical qualities in a successful shopping center is its physical location. A shopping center’s proximity to neighborhoods and interstates plays a vital role in a shopping center’s performance. If a shopping center is conveniently located nearby a customer’s home, work, or other stores they frequent, it can affect the traffic count and attractiveness. The coronavirus further proved the importance of location playing into convenience as people prefer to stay nearby home.

Another important attribute of a shopping center is its metropolitan statistical area. Shopping centers in markets that heavily rely on tourism will see a much slower rebound in the coming quarters. While markets with steady population growth see the most success in traffic count. Shopping centers in these markets will command higher rents. The coronavirus is also accelerating the value of shopping centers located in suburban markets, especially those with walkable areas and easy access points, as renters and businesses migrate to the suburbs.

Experts argue that the perfect shopping center will have a healthy tenant mix with shops that complement instead of compete with each other. A diversified shopping center with a financially strong anchor will continue to see returning customers. A perfect example is grocery stores or healthcare offices, in which they add value to a customer’s shopping experience by providing convenience. For owners, these tenants translate to long-term stability, a diversified tenant mix, and an increased loyal customer base.

General Merchandise Retailers

Serving as one-stop-shops, superstores remained open for the duration of lockdowns, providing daily essentials to households. These retailers, like Walmart and Target, have proven to be strong anchor tenants to shopping centers, as they blend elements of retail and industrial uses allowing for in-store shopping, online ordering, pick-up, and delivery.

Walmart was named one of the top-performing grocers in the U.S. by Ipsos, a global research firm. They credited Walmart to its in-store pickup, curbside pickup, and delivery. Its business model closely aligns with various coronavirus response forces, investing in curbside pickup practices and features, and home delivery. Measuring the strongest in its Buy Online, Pick-Up In-Store (BOPIS) service, Walmart exceeded in visible signage that navigated customers to the pickup designation in 86 percent of its stores. Walmart cited a 97 percent jump in e-commerce sales year-over-year.

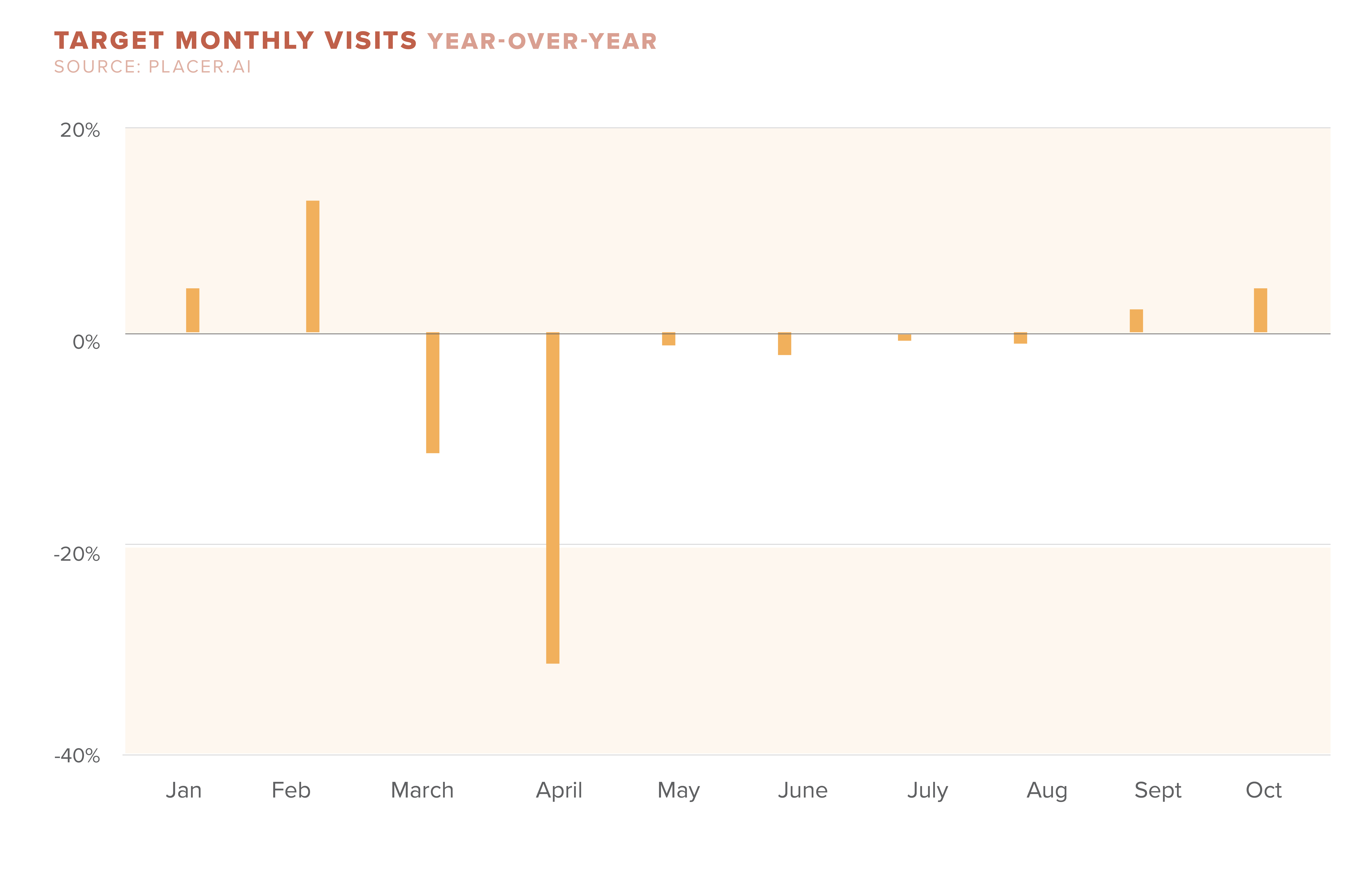

Target also measured exceptionally strong in its BOPIS service, with 98 of its locations having orders prepared on time. Target cited a 195 percent increase in online sales year-over-year. With Target consistently updating practices to prioritize safety and health, they have retained their loyal consumer base throughout the health crisis. Visit durations to Target are up five percent year-over-year in October, though the brand benefits more from online sales.

Grocery Store Performances

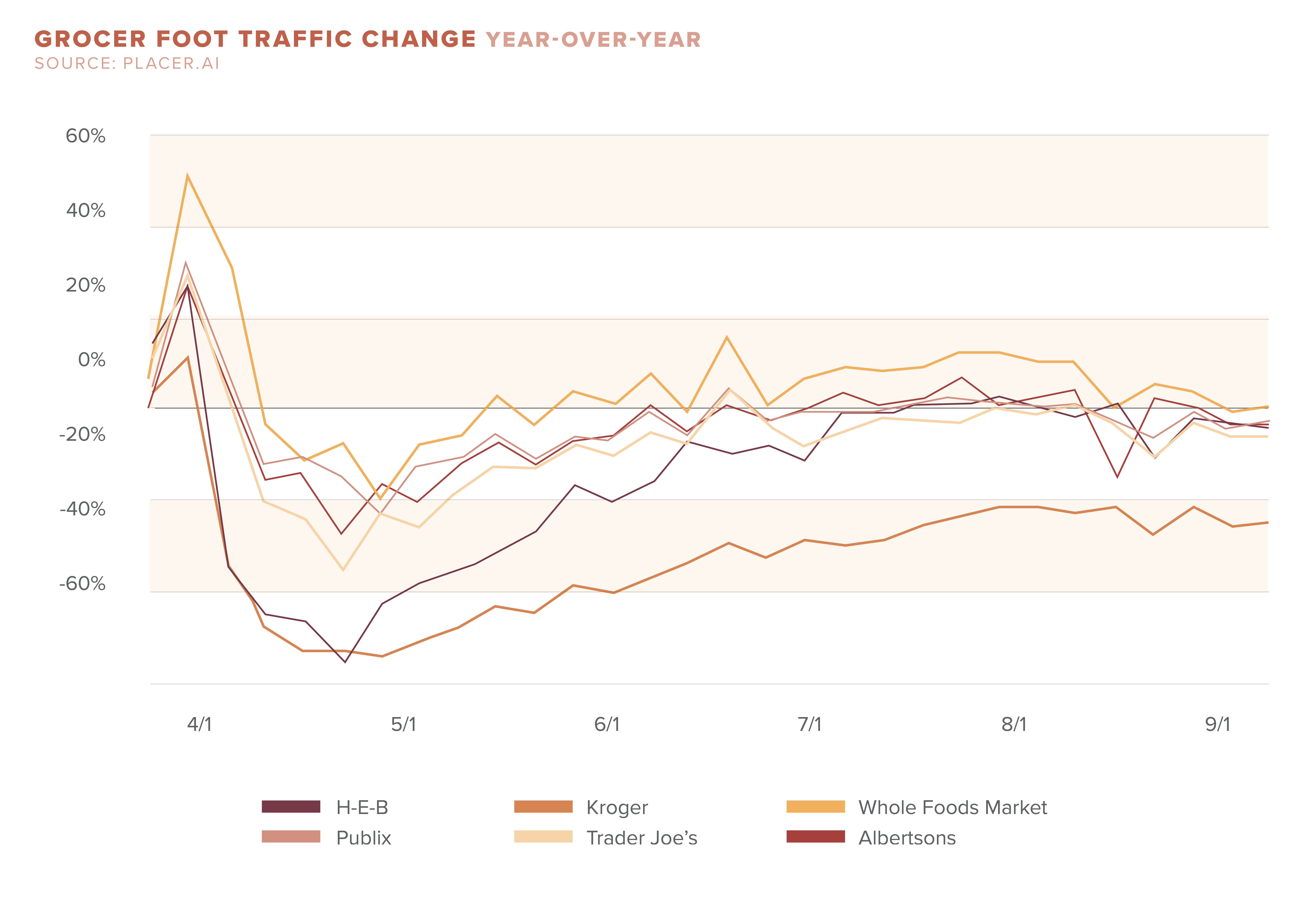

Grocery store sales were up 13 percent in Q2 2020, compared to last year, as American households stocked up on food and started preparing meals at home. Although an increase in grocery store sales is positive, it hasn’t been easy for grocers to accommodate massive shifts in consumer preferences and experience. Grocery stores are at a disadvantage in the current environment because they are enclosed spaces that traditionally are high-traffic. The coronavirus has increased the stakes to become the safest and most efficient grocer.

In the Ipsos Consumer Health & Safety Index, Trader Joe’s ranked third in COVID-19 health and safety measures. The health-focused grocer initially saw a dramatic decrease in visits at the peak of the pandemic but quickly picked back up in the summer. The research firm found that consumers heavily consider a store’s monitoring of foot traffic and customer occupancy when visiting a grocery store. 94 percent of Trader Joe’s stores actively managed the flow of traffic into the store. The grocer has been recognized for its safety efforts in combatting the coronavirus on both the inside and outside of stores.

High-end grocer, Whole Foods, is finding it especially difficult during the pandemic as they lose a large portion of their customer base. Due to their higher-quality products commanding higher prices, paired with the record high unemployment, customers are now turning to grocers with more affordable products. Additionally, Whole Foods lacks everyday essentials which has deterred their consistent customers. Numerator found that Whole Foods has lost an estimated 4.5 million households since March compared to last year. However, Ipsos’s E-Commerce Experience Report found Whole Foods’ Amazon delivery to have a 95 percent order accuracy rate. Online sales rose ten percent year-over-year but was less than half than its competitors, according to Earnest Research.

The Condition of Shopping Malls

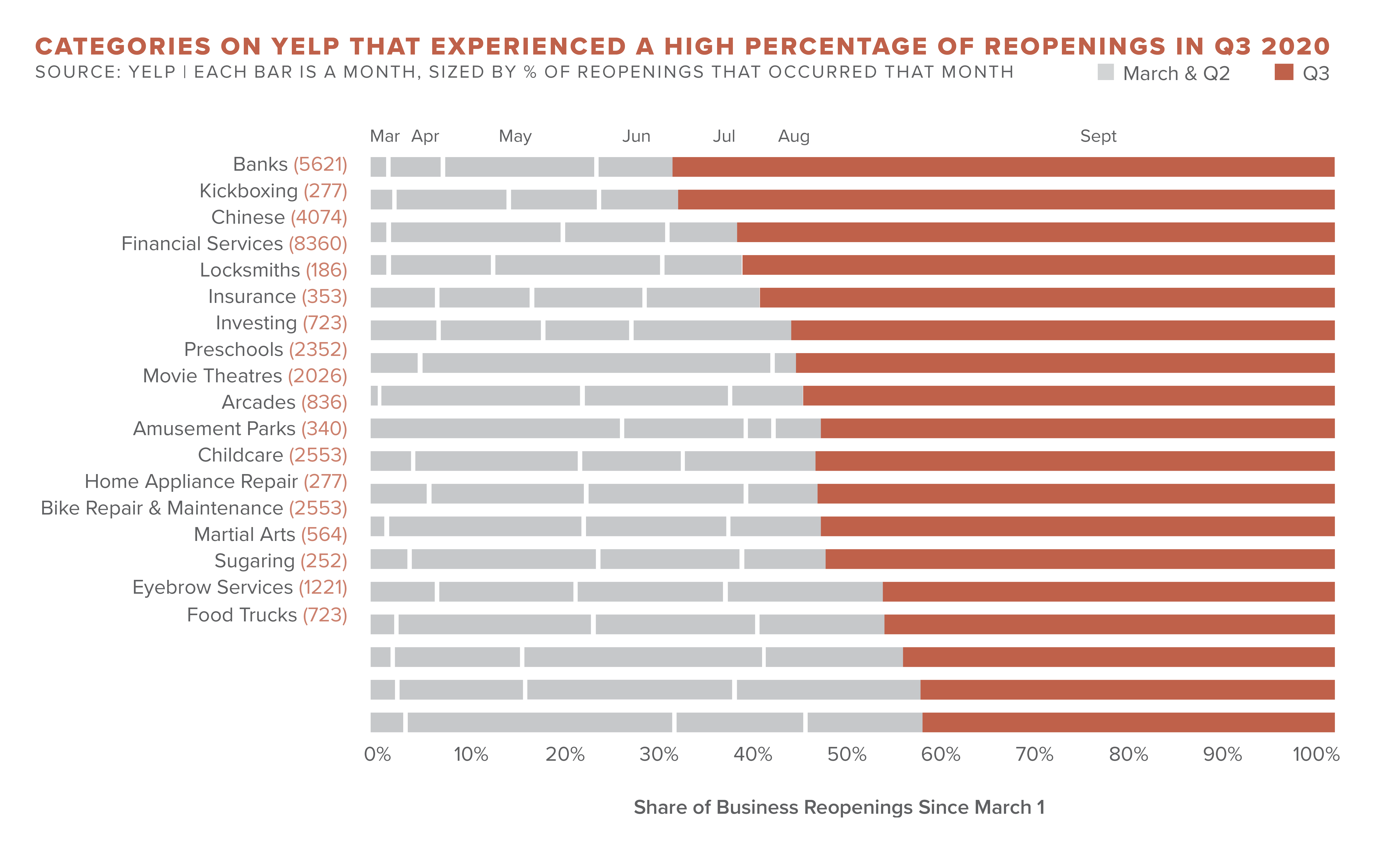

Shopping malls were already moving towards experienced-based tenants and amenities, like gyms, arcades, and even amusement park rides to attract shoppers. While COVID-19 derailed these plans, shopping malls are not quite finished yet. To survive in the post-pandemic world, mall operators have shifted focus to prioritize customer safety and social distancing.

It’s possible malls will convert parking lots and rooftops into restaurants that comply with social distancing. Additionally, brick-and-mortar stores could add kiosk windows on the outside and add curbside pickup lanes to facilitate fulfillment better. Retail dominated the market in square footage, but after calibrating operations to optimize convenience, safety, and order fulfillment, it’s likely stores will decrease in size in the coming years. While the conversion process may be complicated and lengthy, malls will undoubtedly come out looking different.

Tenant Infill

Consumers are still spending but have picked up new habits, mostly with specific retailers, such as Home Depot, Lowe’s, Michaels, Walmart, and Target. Spending has diverted from travel, entertainment, and restaurants to home improvement stores, grocery stores, and exercise equipment. As shopping center tenants look to fill vacant spaces, landlords are taking this opportunity to diversify their tenant mix and capitalize on shopping trends. Owners should review the fundamentals of a tenant and its consumer base. Having a diverse tenant roster in a shopping center will significantly increase the property’s value, boost consumer spending, and protect the property from industry fluctuations.

A study by Harris Group revealed that U.S. consumers aged 18 to 68 now value experiences over merchandise and service, with millennials leading the statistic by 72 percent. Not only will these vacant spaces be filled with tenants that can fulfill debt service and operating expenses but also experienced-based retailers. In the post-COVID-19 future, it’s likely shopping centers will function beyond their current purpose as they position themselves as a place to spend free-time with friends and family. Retailers must reintroduce their value-add to customers by ensuring the complete customer experience from online shopping to selection, convenience, and return policies.

When observing retailers who fared well, or even profited during the pandemic, it’s easy to see how they remained in business. For example, Michaels saw an 11.1 percent increase in sales during the second quarter and a 353 percent increase in e-commerce sales. The retailer responded to the wave of interest by launching a new incentive program for loyal customers and offering curbside pickup at their stores. Looking at how the do-it-yourself arts and crafts retailer adapted to the quickly-changing times illustrates the business’s strong fundamentals and the possibility that this shopping center staple is here to stay.

Brands that have been successful in rebranding have repositioned themselves as the destination of their category. Businesses that focused on digital growth and omnichannel solutions before the arrival of COVID-19 are finding themselves thriving in the pandemic. Retailers that focus on operational changes to accommodate customer needs are setting the pace for other shopping centers and their tenants.

Recent Activity

According to CoStar, the nation’s largest shopping center and mall landlord, Simon Property Group, negotiated to pay 18 percent less on a deal that involved purchasing 80 percent of their rival’s high- end shopping centers around the U.S. This purchase will combine the largest landlords in the nation into one, expanding Simon Property Group’s reach to dense urban markets.

Investor demand has put pressure on keeping values steady as the scarce supply of quality product remains an issue in the retail sector. Nationally recognized grocers like Kroger, Trader Joe’s, Sprouts, and Whole Foods that have impressive store sales are seeing the most interest from institutional buyers. This stems from the fact that institutional investors heavily favor geography and strong real estate fundamentals.

Shopping Centers Outlook

Shopping centers will evolve into an ecosystem that will offer a different tenant mix, giving consumers a reason to visit nearby tenants. Having long served as mall anchors, nonbankrupt department retailer Macy’s has announced plans to leave shopping malls. The short-term increase in vacancies is alarming but presents new opportunities to create a healthy tenant mix that can better prepare and survive future economic downturns.

Beyond the shopping experience, physical stores will serve a different purpose with an updated look.

Here are some current changes happening in the sector that are likely to stay:

In the near-term, essential businesses will likely dominate the shopping center sector as cautious investors look for safe and reliable companies. When researching companies that performed well during the economic and health crisis, investors will also find that nonessential retailers who meet key consumer needs will be sound investments. Overall, the perfect shopping center encompasses a healthy tenant mix that complements other tenants, a robust performing anchor or grocer, and is located near high-traffic points, like highways or job hubs.